2Q analysis: All about Japan

Japan’s middle-market in fundraising flurry; Toshiba fails to make the second-quarter cut, but Asia buyouts still boom; public markets, particularly in Japan, deliver strong exits as trade sales stutter

1) Fundraising: Japan's attractive middle

KKR announced the much-anticipated final close of its third Asian fund in early June and the talk was all about Japan. The firm raised more than anyone else for a pan-regional vehicle, and did so within seven months, but attention soon switched to how this capital will be deployed. A glimpse at KKR's recent deal flow, not to mention statements about the fund, reveals a remarkable bullishness on corporate divestments in Japan.

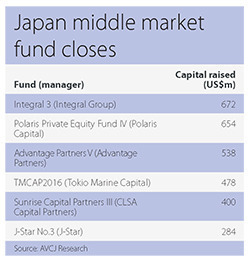

Three sizeable deals have been agreed in the past eight months, with KKR emerging victorious in each competitive process. Japan's middle-market managers, however, prefer to talk about the transactions below the radar: carve-out and succession-planning opportunities for which the auction is limited. Given Japan fundraising reached $2.14 billion in the second quarter – and the amount of capital entering local buyout vehicles was the most since before the global financial crisis – someone is clearly listening.

Seven middle-market players have announced final closes since the start of the year, and six came in April. It is no coincidence: April marks the start of Japan's financial year and various domestic LPs were keen to push their commitments into the next 12-month period. It meant Advantage Partners, CLSA Capital Partners, Integral Group, J-Star, Polaris Capital Group, and Tokio Marine Capital formally completed fundraising within days of one another.

The focus on the Japanese financial year underlines how prominent domestic investors have become in the latest round of fundraises, a turnaround largely attributed to negative interest rates and LPs looking further in search of returns. Financial institutions are the most conspicuous returnees. Insurance companies and the major banking groups are now committing relatively large sums to private equity, which they were reluctant to do five years ago . Regional banks are also active again, writing smaller checks than their national-level peers but in greater numbers.

Tokio Marine Capital is arguably the most extreme example. The GP raised JPY23.3 billion from 18 LPs for its fourth fund, which closed in 2013. Fundraising for the fifth vehicle, which was completed in six months, saw 34 investors contribute JPY51.7 billion between them, with one third of that coming from 17 regional banks. It is the only one of the six GPs mentioned above to raise capital from domestic investors only. However, all bar J-Star and CLSA relied on Japanese LPs for a majority of commitments.

The situation raises two questions. First, will the domestic money still be there at the same magnitude when these managers next come to market? Second, given the substantial jumps in fund size on the previous vintage, will the sweet spot and the competitive dynamics be the same?

Japan's middle market PE firms have forged a reputation out of buying at relatively low entry valuations and generating returns through leverage and operational improvement. It remains to be seen whether the influx of new capital will lead to more competition and increased entry multiples, putting more pressure on value creation capabilities. Similar questions are of course being asked of KKR and its peers at the top end of the market.

Post script: A total of $36.8 billion was raised for Asia-focused funds in the second quarter of 2017, the second-largest three-month figure ever recorded. While more fundraising activity is likely to be confirmed in the coming weeks, the $53.2 billion raised in the third quarter of last year is unlikely to be surpassed. More capital has been committed to Asian funds in the last 12 months than in the 18 preceding, but there is one unifying factor: state-sponsored Chinese funds.

For the second quarter of 2017, it was the State-Owned Enterprises China Innovation Fund, with a remit to reform the country's industrial laggards. It raised $16.5 billion towards an overall target of $21.7 billion, accounting for about 45% of the regional total. Yes, the number dwarfs KKR's latest pan-Asian vehicle, but these funds are not reflective of conventional institutional investor behavior, so comparisons are meaningless.

2) Investment: Nearly vs actually

This was supposed to be the quarter in which Asia's largest-ever private equity-backed buyout was agreed. Toshiba selected a consortium comprising Bain Capital, Innovation Network Corporation of Japan (INCJ) and Development Bank of Japan, among others, as the preferred bidder for its Nand flash memory business. A price tag of JPY2 trillion ($18 billion) was mooted.

However, plans to finalize an agreement for presentation at Toshiba's shareholder meeting on June 28 didn't come to fruition. There is also uncertainty over Western Digital's role in the process, either as a buyer or a spanner in the works due to veto rights it claims to have through an existing joint venture with Toshiba.

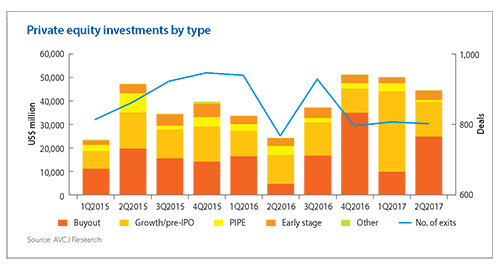

Toshiba needs to offload the asset by next March to avoid bankruptcy, so a transaction of some kind is likely to happen. In the meantime, it continues to swell the Asian PE pipeline alongside the impending privatization of Global Logistics Properties. In the absence of these mega deals, investment for April-June 2017 still came in at a relatively healthy $44.8 billion, lower than the previous two quarters, but comfortably above the quarterly average for the last three years.

At $24.9 billion, the amount committed to buyout deals is the second-highest quarterly total since before the global financial crisis. Buyouts worth $35.1 billion were announced in the final three months of 2016, led by the privatization of Ausgrid and KKR's purchase of Calsonic Kansei Corporation. There is a similar flavor to the second-quarter deal flow, with two sizeable infrastructure transactions in Australia – Endeavor Energy and the New South Wales land titles registry – as well as another Japan buyout for KKR in the form of Hitachi Kokusai Electric.

But arguably the two most striking transactions took place in China: one a growth capital play and the other a control deal; one involving a company that is a big advertisement for technology-enabled disruption in the country and the other a business that has been disrupted.

First, ride-hailing platform Didi Chuxing raised $5.5 billion from a group of investors including SoftBank and Silver Lake. This is the company's largest funding round in terms of equity, but more significant is the fact that SoftBank contributed $5 billion on its own, in what must rank as the largest commitment from a single investor to an Asia-based start-up. This is not a Vision Fund deal, which suggests that even with nearly $100 billion in third-party capital the firm is still willing to make big bets off its balance sheet.

Second, the board of shoe and apparel retailer Belle International accepted an offer from Hillhouse Capital and CDH Investments that values the Hong Kong-listed company at approximately $5.8 billion. This is not a transaction led by a chairman who holds a controlling stake. Rather the two senior executives have agreed to sell their interests and allow younger members of management to commit capital alongside the PE firms.

The announcement also came with an admission that Belle's recent poor performance is the result of a failure to integrate a traditional retail model into the digital world. Hillhouse and CDH are expected to help put this right.

It amounts to a very big bet on private equity's operational capabilities, online and on the shop floor. But should these efforts prove effective, with such a large business – Belle has more than 20,000 outlets nationwide – it would add a significant new element to the industry's China value proposition.

3) Exits: Public market payoff

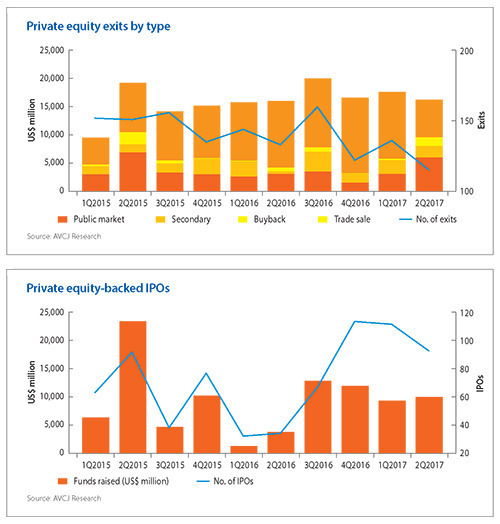

Public market exits by private equity investors in Asia reached a two-year high between April and June as positions worth $5.9 billion were sold at IPO or on the secondary market. There have only been two more prolific quarters in the past five years, but the bulk of the proceeds came from one transaction involving a non-traditional investor: Innovation Network Corporation of Japan exited a 19% stake in Renesas Electronics for $2.3 billion.

However, this wasn't the only activity in a robust Japanese market. Each of the four Japanese entries in the 15 largest exits for the quarter came via the public markets: Bain Capital and Cerberus both continued gradual sell-downs in Skylark and Seibu, respectively, while Baring Private Equity Asia sold its entire position in home improvement center operator Joyful Honda through a buyback. Further down the list, MBK Partners fully exited coffee chain Komeda Holdings, securing a 5x return.

Despite the strong public market showing, overall PE exits in Asia were down slightly on the previous quarter at $16.3 billion. This was due to weaker than usual trade sale numbers. At $6.8 billion, it was the lowest three-month total in more than two years; 49 transactions were announced between April and June, compared to 77 in the previous three months. Private equity-backed IPOs, meanwhile, showed greater consistency. A total of $10 billion was raised through about 90 offerings, which was roughly in line with the three quarters before that.

Guotai Junan Securities accounted for much of the proceeds, and the only PE representation is Apax Partners, which came in as a cornerstone investor in the IPO. However, ING Life Korea raised KRW1.1 billion ($972 million) in its offering, enabling MBK Partners to trim its holding, while WuXi Biologics went public in Hong Kong with a $588 million IPO. The valuation on listing represented a mark-up to the $3.3 billion a PE-backed consortium paid to privatize the then US-traded company in late 2015.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.