Portfolio: Partners Group and Guardian Early Learning

Now on its third PE owner, Guardian Early Learning Group is building its unique brand identity in Australia’s busy childcare sector. The key has been for each party to respect the strengths and needs of the other

A private equity takeover often brings a significant impact to a company – and after three such transitions in a row, one might expect to see the resulting business completely transformed.

Yet for Australia's Guardian Early Learning Group, the experience has shown that a PE investor can be a trusted, valuable partner without trying to leave an overt mark on a company. Founder and CEO Tom Hardwick, who has seen the business passed from Wolseley Private Equity to Navis Capital Partners and now to Partners Group, believes the key to success has been the partnership he established with each owner – with the current backer proving especially willing to respect his judgment.

"What I like about Partners Group is that they see this as a collaborative effort with the management team, with their corporate governance and experience helping businesses grow, and the founders' passion, skills and experience," says Hardwick. "I think as a founder, that's a really supportive environment."

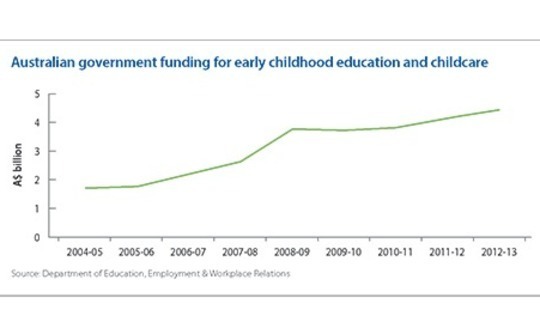

Australia's childcare industry offers many incentives for investors, thanks in no small part to eager and ongoing government backing. Lawmakers from across the political spectrum have long supported measures aimed at getting parents of young children out of the home and back in the workforce, and government rebates for childcare have reflected that desire, more than doubling from A$1.7 billion ($1.3 billion) in 2005 to A$4.4 billion in 2013.

In addition to the support from policymakers, demographic developments are also a key factor in the childcare investment thesis. Government statistics show that in 2014 there were nearly 250,000 children in Australia whose parents reported a need for more formal childcare options. In the majority of these cases the care was needed for work-related reasons, suggesting long-term and stable demand.

"They took a view that childcare was not just about parking children on the premises for a day while the parents worked; childcare was also very much about having the right curriculum that attracts the parent to put their child in this particular center rather than any other centers," says Philip Latham, a partner at Navis. "Guardian believed that if the industry slowed down, parents would make decisions based not just on price, but on how well their child would develop. We felt that approach was very good."

Brand identity

Navis took on the childcare remit in 2013 when Wolseley, which had bought a majority stake in Guardian in 2011, realized that the company's ambitious growth plans needed more resources than it could provide. The Australian private equity firm sold a 90% stake to Navis at a valuation of A$120 million, with management including Hardwick holding 10%.

The move to Navis signaled a shift in the company's expansion strategy. Guardian had earlier grown along parallel tracks, owning and operating around 30 own-branded centers while also managing 30 facilities owned by others. Navis saw the latter business, which only generated management fees, as a drag on the company with staff and resources that would be better utilized in Guardian's own locations.

With Navis' encouragement, Guardian shed its portfolio of managed centers and focused on growing and improving its own properties. This helped bring clarity to the brand, with the company able to offer a consistent level of quality in terms of both staff and facilities, and over the course of the firm's ownership, Guardian grew to 71 centers. About half of these additional facilities were newly constructed, while the rest were gained through acquisition of other childcare businesses.

Partners Group, which had bid against Navis for the asset but lost out, had never lost sight of Guardian during this transition. As the business developed, it only became more attractive to the firm. Seeing Guardian as a promising beneficiary of the GP's years of experience with the global childcare industry, Partners Group was quick to approach Navis when the firm began to feel that the company had grown past its ability to support it. Navis agreed to the takeover, selling its stake at a $440 million valuation.

"In all of our childcare investments globally there are different levels of development, but the one thing we like to see across the board is an increasing quality of service to the parents across quality of educators, quality of environments, and quality of curriculum," says Scott Dingle, a senior vice president at Partners Group. "That's something Guardian has been focused on, and we're keen to support them as best we can on that journey."

Having been drawn to Guardian by the competence and ambition of Hardwick and his management team, Partners Group had no desire to rein them in or replace them. The GP saw its role as a counsellor that could advise management based on its sector expertise, while helping to open doors that might be otherwise closed to a company of Guardian's size.

"We spent a lot of time ensuring that not only our individual perspectives helped to achieve the value creation plan, but also that we shared best practices from across our global portfolio," says Cyrus Driver, managing director and head of Asia private equity at Partners Group. "We are probably the private equity firm with the greatest experience in childcare investing around the world. We've made six investments in the space and they've all done well for us."

The change in ownership took some getting used to for Hardwick, who had previously dealt with a domestic, then a regional owner. Partners Group, on the other hand, was based in Switzerland, and though the GP had an Australia office it was still a more hands-off relationship than he had grown accustomed to.

This gave Hardwick, who felt he didn't need Partners Group to intervene in daily business, a welcome level of freedom. The GP's contribution to the company came in another way, through the independent directors that it appointed to Guardian's board. These individuals were selected for their experience in childcare and early education. They include a former executive with US-based KinderCare, one of the firm's portfolio companies and the world's biggest childcare operator.

"It used to be we'd turn up at the private equity firm once a month and tell them what we did for the month," Hardwick says. "Now, with this kind of board structure with independent directors, it's more how do we tap into their skills and experiences to help us achieve our goals. This concept of an advisory board means that the meetings are more than just reporting back to the PE owners."

While it leaves a portion of day-to-day interaction to its board appointees, Partners Group has made an impact on the business in a number of areas. The firm describes its approach as centered on "people and systems," with a focus on helping Guardian build out its staff while also installing the supporting infrastructure to help the new hires do their jobs. Notable hires include a new head of IT, who has implemented the networks through which teachers at the company's centers can communicate both with headquarters and with their charges' parents.

Curriculum curation

Partners Group has also contributed to Guardian's ongoing growth. Since its investment last year the company has continued to expand through acquisitions and new builds, and expects to pass 100 centers this month. Guardian aims to acquire 15 existing childcare businesses and construct 10 new locations each year in the central business districts (CBD) of major cities such as Sydney, Melbourne and Brisbane. Its target customers are upper-middle-class professionals for whom the CBD locations offer a convenient place to drop off their children on the way to work.

However, while these initiatives are vital to the company's continued success, the chief focus of Hardwick and Partners Group is the business's new curriculum, which management believes can become Guardian's killer app to differentiate itself from its competition.

The idea for a proprietary curriculum serves two purposes. For one, it helps to unify the approach of managers in each center, who had previously been largely left to develop their own techniques. Having a company-wide curriculum would help parents to see Guardian as a single brand rather than a collection of centers. In addition, the company felt it would reassure parents that this was a place where children would grow as individuals rather than marking time until being picked up.

"Children have been spending more and more time in childcare centers, and their brains develop so rapidly through those first five years," Hardwick says. "We need to be doing more than just caring for them; we need to be thinking about how we assist them in their development and learning, and get them ready for the journey of life."

Guardian's curriculum, which recently began to roll out across its centers, is based on the Reggio Emilia philosophy of childcare, developed in the Italian region of the same name. This approach is formulated for pre-school and primary education and encourages children to direct their own learning to an extent, through access to materials and objects that they can experience and observe for themselves. In the case of Guardian, this means providing children with donated materials from local companies, such as fabric samples from garment mills or offcuts from woodworking plants.

Guardian's management feels the Reggio philosophy, which emphasizes empowering children to form their own understanding of the world, is a perfect fit for their clientele. However, they acknowledge that its idiosyncrasy can make it difficult to roll out at scale. Currently about half of the company's centers have implemented the curriculum, with managers given wide latitude to determine the best approach. Gaining acceptance from parents of differing ethnic backgrounds may be difficult as well.

"When we were first looking at the business some of my colleagues, particularly from Asia, came down and were a little surprised to see the set-up of the centers: the lack of formal classrooms, mathematics tables, those sorts of things," says Dingle. "The Reggio approach is very much child-led learning, and there's a lot of documentation that's gone into that, but you're not walking into a classroom and seeing 20 kids at desks doing math recitals."

Domestic for now

Guardian's work on the new curriculum has kept its focus within Australia, despite its ownership by two international GPs in a row. While the company did take a preliminary look at entering Singapore while under Navis - buying the White Lodge childcare company as a sister to the Australian business - Guardian ultimately decided that trying to enter a new market with a completely different educational culture and business practices would be too much on top of its other goals.

This is not to say, however, that it has ruled out growing overseas. With Partners Group's international connections Guardian considers itself well-placed to continue researching the opportunities available. When it has reached at least 200 centers in Australia it may enter a country in Asia where its business model can gain traction.

By that time, Partners Group may have already made its exit. As the firm is still in the early stages of ownership, it is not actively exploring sale options yet. However, having already been through the process twice, Hardwick is optimistic that the business will continue to grow and find a buyer as eager as Navis and Partners Group were. While he believes that Guardian could have a successful IPO, he hopes that a private owner with a long horizon, such as a pension fund, will take an interest instead.

"I think an education business is better suited to being private, rather than having the public market breathing down your back about performance, and where' your growth is coming from," he explains. "This is a business that's about children and educators and doing the right thing by them, and that sometimes means you've got to take a slightly longer time frame."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.