Japan consumer: Beyond borders

Private equity investors see an opportunity in taking advantage of the popularity of Japanese brands in other Asian markets. Making these strategies work requires patience and a tolerance for risk

When CLSA Capital Partners (CLSA CP) supported a management buyout of Baroque Japan in 2007, the young women's apparel retailer had more than 100 stores in Japan and nothing overseas. The GP made initial steps to expand the business in mainland China and Hong Kong by leveraging the popularity of Japanese fashion in these markets.

"Consumer and retail in general is a very attractive sector for Japan-focused GPs, given the stable domestic economy. When it comes to cross-border, one theme for us is to follow the wave of Japanese cultural trend or lifestyle in overseas markets. Categories such as fashions and food have gathered very strong interests from Asian consumers," says Yasunori Maeda, a director with CLSA CP. "Once we win this type of deals, we're surely to pursue the cross-border opportunity."

Over the next six years, Baroque's footprint expanded to 357 stores, including 29 in mainland China and Hong Kong. In 2013, the business was sold to China-focused CDH Investments and local women's shoe retailer Belle International (the GP took Belle public in 2007 and is now backing a privatization of the company). They envisaged larger-scale growth in China than even Baroque itself was planning.

When Baroque listed in Tokyo last year, its domestic store count was little changed since the CDH and Belle acquisition, but the company's overseas exposure had grown to 143 locations. Seven are in Hong Kong and Macau, while the rest are in mainland China, operated through three joint ventures.

Baroque is a classic example of how private equity investors and foreign strategic players can create significant value for Japanese consumer brands – particularly in the middle-market space – beyond their home jurisdiction. Success is dependent on a deep understanding of both Japanese and overseas markets, as well as a willingness to put capital to work in relatively high-risk endeavors that might not deliver a short-term pay-off.

"For most of the Japanese companies, the actual financial capability is less of an issue because most of them have strong balance sheets and sizeable cash reserves. And if they want to borrow, they can do so cheaply in Japan," says James Robinson, a Tokyo-based partner at law firm Morrison & Foerster. "For these companies to partner with private equity firms when venturing overseas, it's more about the strategic know-how and management capabilities."

Finding an angle

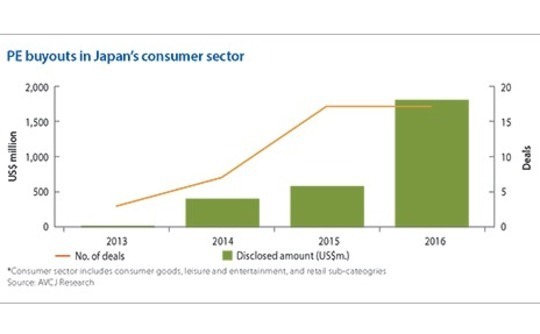

Over the four years to 2016, the amount of capital deployed in Japan consumer buyouts – across the sub-categories of consumer goods, leisure and entertainment, and retail – has grown from $21.43 million to $1.79 billion, according to AVCJ Research. Deal volume has also risen substantially, from three transactions in 2013 to 17 last year.

These investments, as with other sectors in Japan, tend to fall into two broad categories: founder-owners who are selling due to succession planning issues and corporates spinning out non-core business divisions. In both cases, a private equity buyer might see opportunities to drive growth by committing capital and resources to the newly independent businesses and taking them overseas.

From food and beverage business Pokka to toothbrush manufacturer Hukuba Dental, the private equity firm has helped in greenfield offline expansion, online distribution, securing partnerships with local firms, and completing bolt-on acquisitions.

"When you look 10 years back, Japan was certainly one of the most prevalent foreign providers of consumer products to Asian consumers, although more recently Korean brands have surpassed Japanese ones in a variety of categories. However, the appeal of these Japanese brands to Asian consumers is less faddish than for certain Korean consumer brands. Growth is therefore probably more sustainable in the long-term," says Emmett Thomas, head of Asia at Advantage Partners.

The Korean wave is unmistakable, with various PE and strategic investors seeking to monetize brands in overseas markets through the popularity of Korean music, TV dramas and beauty products, particularly in China. But Japan was actually an earlier mover in terms of leveraging its cultural appeal among Asian consumers. Assets such as sushi restaurant chains and skincare products have attracted interest from private equity players on this basis.

CITIC Capital Japan, which seeks to invest in Japanese businesses that have a China growth angle, expects to increase consumer sector exposure at the expense of manufacturing in its latest fund, which closed in February at $268 million. In this sense, the strategy is tracking the evolution of the Chinese economy itself. CITIC has already invested in Mark Styler and Akakura – both apparel retailers focused on the young females – and expects more deal flows in the restaurant and food and beverage segments.

"Clearly, our cross-border angle gives us many advantages," says Hironobu Nakano, head of CITIC Capital's Japan operation. "The competition is becoming more intense in Japan and the prices are getting higher. It's difficult to find exclusive deals currently as most are public auctions. Thanks to our cross-border capabilities, we can convince business owners about the opportunity outside Japan and how we can help them expand in China through our local networks."

Other GPs are looking to avoid mainstream segments like food and beverage and apparel altogether, citing the challenging environment for these companies. CLSA CP, for example, is targeting niche areas where Japan-made products could transfer to overseas markets. The idea is that the combination of high quality, high functionality and competitive pricing will prove more sustainable than relying on cultural appeal.

The private equity firm's portfolio includes Astro Products, a specialty tools retailer for the automotive industry, which has more than 160 outlets in Japan and is currently expanding in Thailand, China and India. Another cross-border growth candidate is make-up brush manufacturer Hakuhodo; the company has already opened stores in Singapore and Los Angeles.

"In overcoming the domestic economic downturn, a number of Japanese brands established strong ‘value for money' propositions that can be competitive even in emerging Asian markets," says CLSA CP's Maeda. "Despite limited brand recognition, this type of business can enjoy strong customer traffic overseas simply because customers feel that they can buy high-quality products for affordable prices."

Expansion risk

Even if a PE firm is able to identify a company with international expansion potential and devise an appropriate strategy, it can be difficult to realize the fruits of these labors within a five-year holding period. Penetrating overseas markets generally takes longer than building out a business domestically, and unfamiliar commercial environments often present uncertainties. Indeed, it took Baroque 10 years to build a substantial presence in China and that came on the back of strategic support from Belle.

"You must spend money on brand building and infrastructure. It can easily take two or three years, or perhaps even longer than the usual private equity holding period, for that to pay off," adds Advantage's Thomas.

Expansion – including capital structures and schedules for rolling out new offline stores – must, therefore, be planned well in advance. When The Longreach Group bought the bridal jewelry specialist Primo Japan in early 2015, it recognized mainland China as a long-term growth market for the company. Forming a China team led by Japanese management, the GP spent six months conducting market research on competitors and potential store locations to ensure pricing and marketing were correct.

Last year the company opened two flagship stores in Shanghai, and two more are planned this year. At present, around 90% of Primo's revenue comes from Japanese customers, but Longreach hopes the overseas contribution can reach 30% within three years. It is not rapid progress, but Mark Chiba, group chairman and partner at the firm, sees it as appropriate given the level of risk.

"We manage expansion at a good pace. We are making sure that we prove the profitability and cash generation of the business before we open new stores in China. That's very important – we don't need 20 stores in China to prove out Primo's clear growth path there. We might need 5-6 stores with strong EBITDA and profitability to show that the profitable and scalable growth path is established," he says.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.