Portfolio: Samara Capital and Cogencis

Cogencis’ market data terminals have made a strong showing in India against Bloomberg and Thomson Reuters. Now the Samara Capital-backed company is looking to repeat that success worldwide

The finance industry lives on data, and providers like Bloomberg and Thomson Reuters have made themselves industry fixtures by delivering it. Through the Bloomberg terminal and Thomson Reuters' Eikon platform, customers across the financial spectrum receive a never-ending stream of information – from earnings reports to reports on earnings – that is factored into their investment decisions.

But for Indian entrepreneur Pankaj Aher, customers are losing out as a result of this virtual duopoly: Bloomberg and Reuters set the rules and users are forced to pay for everything regardless of what they actually need.

"They have one product and one price point, and they sell that globally to everybody, irrespective of whether you are a foreign exchange trader in New York, or a commodities trader in Hong Kong or Singapore, or an equities trader in London," says Aher. "You get the same Bloomberg, same Reuters-Eikon, at the same price."

Cogencis, the company founded by Aher in 2007, is trying to prove that financial data can live outside the box defined by Thomson Reuters and Bloomberg. With support from Samara Capital, it now aims to become as indispensable in emerging markets as the dominant players are in the developed world.

When Samara was first approached to buy Newswire18, the forerunner of Cogencis, in 2012, the firm knew immediately it was looking at a remarkable story.

"This particular player had successfully challenged the duopoly of Reuters and Bloomberg, and from a volume perspective garnered 25% of the Indian market, which was critical. We couldn't find such a case study anywhere else in the world," recalls Anchit Gupta, a director at Samara.

Early frustrations

The company's bid to unseat the global majors had its roots in founder Aher's first career as a journalist. While reporting for Dow Jones Newswires in the 1990s he had seen earlier iterations of the Eikon and Bloomberg products, and like many observers he marveled at the depth and range of information available. But he also suspected most users would quickly become overwhelmed.

The problem with both products was essentially a matter of focus. Bloomberg and Reuters both aimed their services at customers in the US or Europe, and made no effort at geographical variation. For users in developed markets, looking for investment opportunities worldwide, this model made sense. But Aher believed customers in emerging regions such as India needed a different kind of product – one that fit their need to focus on the internal market and filtered out extraneous data that didn't apply to them.

"If your capital is being put to work in the same country, then you need more information about the market in which you're operating," says Aher. "There's no point to getting 20,000 news items a day, 99% of which have nothing to do with the asset class or the geography that I'm operating in."

The downfall of Bridge left a vacuum for a company that could provide relevant local data to India's financial services sector, and Aher spent the next five years looking for a media partner that could make this a reality.

He first teamed up with Indian ratings firm CRISIL to launch Marketwire, a news service focused on Indian financial data. While Aher and CRISIL's plans included a terminal product, this idea stayed on the shelf due to concerns about competing with Bloomberg and Reuters. After CRISIL was acquired by Standard & Poor's the terminal plan was scuttled for good, and Aher looked for a new backer.

Media company Network18 proved to be more receptive to his pitch. The firm, which ran the Indian franchise of CNBC, was looking for a way to expand its influence in the financial sector. Seeing an India-focused market terminal as a way to set its brand apart, Network18 tapped Aher and his Marketwire management team to launch Newswire18 in 2007.

Rather than a division of the parent company as Marketwire had been, Aher had Newswire18 incorporated as a separate entity with about 20% of the equity in the hands of management. Network18 held a 70% stake and the remainder was set aside for an employee stock option plan (ESOP). This was the result of lessons learned at Aher's previous employers.

"At Bridge we were doing quite well and business was booming in India, but when the company shut down globally we were at the mercy of factors beyond our control," says Aher. "So we wanted some say in management, but while we became management in Marketwire we didn't have an equity stake to reflect that. So when we created Newswire18 we were very clear that we needed equity participation."

Network18 was receptive to Aher's argument and gave his team space to grow the business the way they saw fit. Their hands-off approach paid off quickly as Newswire18 showed a profit for the first time in 2010. The company has remained profitable in most years since.

Moving house

But despite Newswire18's success, it remained a small part of Network18's operations. This made it vulnerable when the overleveraged parent decided to put some of its assets on the auction block in 2012, particularly since Thomson Reuters was already showing interest in buying out the service that had given it such a strong challenge.

Remembering how Thomson Reuters had immediately shut down Bridge after taking over, and fearing the same fate for their company, the management at Newswire18 sought the parent's permission to look for an alternative buyer. Their search brought them to Samara, which at the time had never done a control deal. While initially hesitant, Newswire18's prior success combined with the vigor of the management convinced Samara it couldn't let the opportunity pass.

"Pankaj is one of the most passionate entrepreneurs we've ever come across. He's great at idea generation and had a lot of ideas about what new things we can do to grow beyond the one niche that they had," says Samara's Gupta. "It was really Pankaj and his core team that gave us the comfort to try and do a buyout here."

Having bought Network18's 70% stake for INR900 million (then $16.5 million), Samara set about reviewing the newly rechristened Cogencis' business and identifying ways to enable Aher's ambitions. It attributed two key strengths to Cogencis that set it apart from Bloomberg and Thomson Reuters. First was its local focus, with 100 reporters focused purely on Indian news stories providing a level of information that global competitors couldn't hope to reach.

An even more important differentiator was the level of customization available to users. Rather than charging a single price point for a single, unvaried set of information, Cogencis offered products aimed at different market segments – principally foreign exchange, equities and commodities – with varying pricing tiers reflecting different levels of coverage. Within those products the company allows further customization through mixing and matching of modules, so that a commodities trader, for instance, can add foreign exchange coverage if he feels it is relevant to his business.

"For a value-conscious market like India, that was a big selling point, and it was very difficult for their competition to follow those differentiators," says Gupta. "The global market is over 300,000 terminals for Bloomberg, and to do something for a market that is probably about 7,000 terminals would have had large repercussions."

Throughout its holding period Samara has aimed to reinforce these strengths by investing capital and offering fresh ideas. Early on the firm pointed out that despite its 25% share of the terminal market overall, Cogencis had a negligible presence in the equities market, where Bloomberg continued to dominate. Samara launched a two-year initiative to develop a new equities module for the software side and to collect and process more data to make it useful for customers. It says there has been considerable interest since the module launched last year.

Another significant new software product is aimed at banks' credit desks. This initiative is in the early stages of roll-out and is intended to spread Cogencis' service beyond the treasury desks, which account for most of the product's current users. The credit module will provide credit assessment, risk management and monitoring functions for Cogencis' existing financial institution customers as well as the hundreds of banks that are as yet unreached by the company or its competitors.

Going global

Beyond these projects, the biggest opportunity that Samara and Cogencis hope to crack is outside India. The company is focused on challenging the market leaders on a global scale.

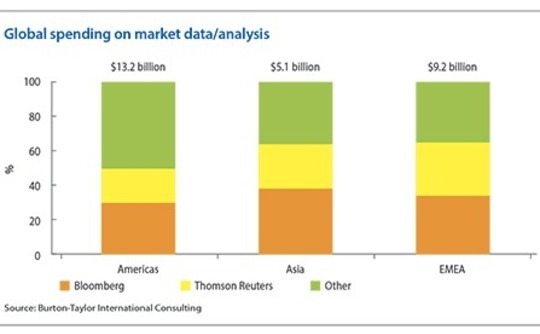

Breaking Bloomberg and Thomson Reuters' hold on this market is a daunting task: according to Burton-Taylor International Consulting, more than 60% of the $5.1 billion spent on market data in Asia last year went to these two providers, with a similar percentage in Europe, the Middle East, and Africa. Even in the Americas, where other vendors have a larger foothold, Bloomberg and Thomson Reuters accounted for nearly half the $13.2 billion spent.

But Samara and Cogencis are optimistic about their chances because of the similarities they see between India and other emerging markets. Investors in these areas are likely to share with their Indian counterparts a focus on their own markets and frustration with the oversupply of data by other providers. Cogencis expects to make inroads among these customers through the value it offers.

"There are a lot of countries in Africa and Latin America that they can go after," says Gupta. "Except for the really developed global trading hubs like the US and Western Europe, in addition to Hong Kong, Singapore and Japan, everything else is very much like India."

Cogencis has already started its international expansion in Indonesia, where it launched last year. Since the business model, the customer-facing software and the back end can be replicated across territories with minor tweaks, the only major investment needed is to hire reporters for local coverage. In Indonesia the company now has 16 reporters and expects to break even by next March. Once the first international market is cracked Cogencis plans to enter more regions, starting with Malaysia.

The company might start that next phase with another backer, as Samara has begun to explore exit options. The firm is looking for a buyer that can benefit from the wealth of proprietary data that Cogencis has built up over the years and its relationships with some of India's most prominent banks, along with the collective experience of the management team. In addition, having proven that the international expansion thesis is valid, Cogenics wants backers that are aligned with these plans as well.

Aher is confident that any new investor will see the company's success as an indication of the pent-up demand for a flexible product that users can customize the way they want. He believes market data providers of the future will need to take their cues from Cogencis' model as customers become more sophisticated and value-conscious.

"This may not be a mass-market product, but globally, there may be a million users of these products," says Aher. "It is a big market, and you will need to cater to the market in the way and manner in which the customer is happy. If he wants only the forex data and nothing else, who am I to sit in judgment? I can only sit in judgment of whether we want to serve that need or not."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.