Alternative exits: Tricks of the trade

Trade sales can provide investors in underperforming companies with an opportunity to reshape their investments, but they must be willing to let go of previous expectations and show flexibility

A year ago Snapdeal was riding high. The online marketplace had secured a new round of investment at a reported valuation of $6.5 billion, cementing its status as a preeminent unicorn and a force to be reckoned with in India's fiercely competitive e-commerce industry. As domestic rival Flipkart faced increased media and investor scrutiny amid a wave of markdowns from US hedge funds including Fidelity, Morgan Stanley and T. Rowe Price, Snapdeal remained largely free from such doubts.

But this year the company's fortunes have reversed. The start-up hasn't raised a new round in over a year and its investors, SoftBank among them, are said to be agitating for a trade sale. The most likely buyer is Flipkart, revitalized after a fresh infusion of $1.4 billion – albeit at a lower valuation than before – and an agreement to buy the India business of US-based online marketplace eBay.

Such an outcome would obviously be less than ideal for Snapdeal's venture capital backers, who may still harbor hopes of a sizeable IPO or other more lucrative exit. However, industry professionals hope the sale will demonstrate to the VC community that it is possible to get something out of an investment even if the original thesis has become unworkable rather than looking for an immediate escape hatch. GPs that are able to compromise may find their exit options are greater than was previously apparent.

"In transactions that are motivated by salvation mode, it's all about damage control and bringing enough sanity to ensure that there is some kind of return that the investor can showcase to its LPs," says Vinayak Burman, managing partner at boutique law firm Vertices Partners. "With the right mindset, one can construct a deal that minimizes the bleed and provides an exit for the existing investors and perhaps a delta in terms of a stock swap of the acquiring entity. The idea at these moments is to try and find a halfway that hopefully is a balanced act."

Another way

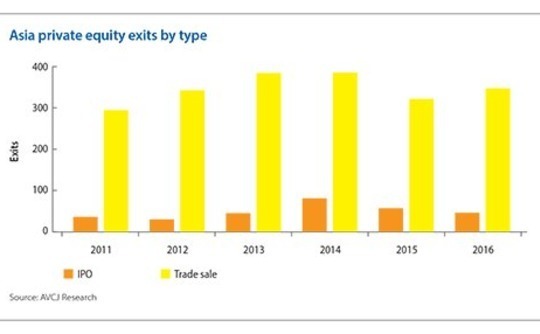

Trade sales have always been the dominant form of exit for private equity and venture capital investors, although the historical proliferation of minority investments in markets like India and China mean an IPO is often the desired – if not the actual – outcome. AVCJ Research shows nearly 2,200 trade sale exits from 2011 to 2016, as opposed to 308 IPOs. Fluctuations on a year-by-year basis tend to be the result of public market volatility that puts the brakes on IPO activity.

Despite the prevalence of trade sales in overall PE figures, convincing founders who are majority owners that a public market exit is not the best option is difficult. In most cases, they would have agreed to take third-party investment in anticipation of an IPO at some point, and reevaluating these expectations involves reconfiguring an alignment of interest between founder and private equity backer.

Indeed, trade sales in the venture capital space are a relatively recent phenomenon, driven by the willingness of local internet companies to make acquisitions as much as investors' needs for alternative exit routes. India is a case in point. While the country has seen some highly visible trade sales featuring VC investors, including the acquisition of taxi-booking service TaxiForSure by rival Ola in 2015 and Flipkart's purchase of Myntra in 2014, such deals are still relatively rare.

"If it's a two-way tussle between founders and investors it's still manageable," says Nandini Chopra, managing director at consultancy firm Alvarez and Marsal (A&M). "But when it's a multi-way tussle between one founder and several blocks of shareholders, who have come in at different times and have different return expectations, these contracts prove difficult to enforce, and it's all about renegotiating and working out the best possible scenario."

Complicating the situation further is the haste with which many inexperienced start-up founders sign investment agreements with downside protection provisions they do not fully understand or haven't even read. Actually holding entrepreneurs to these requirements might require a court battle, which can take years to resolve – and in the meantime the likely already fraught relationship between investor and investee will almost certainly become damaged beyond repair.

"When things go wrong and investors want to enforce draconian clauses, founders may raise their hands and say look, I didn't know what I signed up for, this is too much. If this is how things are going to be I would rather not have done the deal," says Pankaj Naik, director at Avendus Capital.

Investment professionals feel many of these difficulties are connected to the relative youth of India's VC ecosystem. The challenges seen here, including concerns about enforceability of contract provisions and ability of investors to get leverage over their portfolio companies, are similar to those seen previously in China, and China-focused investors have been obliged to find their own ways to handle them.

For some GPs, despite continued concerns about the effectiveness of enforceability, going through official channels has become more effective than in previous years. China New Enterprise Investment (CNEI), for example, had considerable success forcing a recalcitrant entrepreneur to honor the redemption clause in the investment agreement by taking him to court, where he was held to the guarantees that he had originally provided, including his personal assets.

"Whenever we hit the next milestone in enforcement procedures, he made some more payments," says Johannes Schoeter, a founding partner at CNEI. "By now we've gotten about 70% of our investment back. The next step of our enforcement procedure is to have one of his private accounts frozen, and I guess we will receive the last 30% just before that happens."

Engineering an exit

However, even if courts are willing to back up a GP's claim, this approach may not be practical if it is one of several investors in a portfolio company. Stringently enforcing multiple contracts may take more resources than the company has, and in any case investors that still hold out hope for the company are unlikely to lend support to exit attempts that will probably cause it considerable operational difficulties.

In such cases investors in struggling companies may instead try the strategy allegedly pursued by SoftBank with Snapdeal and arrange a sale to a rival. A number of similar deals in China may provide a model: last year shopping and social networking platform Mogujie, which counts Qiming Venture Partners and IDG Capital Partners among its backers, agreed to acquire its rival Meilishuo. The latter had received support from Sequoia Capital, Tencent Holdings and GGV Capital but had failed to raise capital since its last funding round in 2012.

China has also seen several transactions that are more like mergers of equals, such as the unification of ride-hailing app operators Didi Dache and Kuadi Dache, and of online local services platforms Dianping and Meituan. These deals have helped the companies involved simplify and streamline their operations, along with reducing competition and consolidating a crowded market. But for investors, the resulting alliances can be uneasy.

"When it comes to those big-stake investments, invariably people start to draw lines – I'm in this camp, you're in that camp – and in competitive markets, people get pretty passionate about their investment picks," says James Lu, a partner at law firm Cooley. "So when it comes time for a marriage, you have those two camps of investors who may have different investment philosophies, because they were backing different players in the past."

Conflict can arise not just between the two investor camps, but within them as well, as different players aim to secure the best position for themselves in the new structure. Difficulties at this stage are usually the result of differing priorities for each investor based on both the size of their stakes as well as their time of entry: early-stage investors will likely see exiting as their highest concern, while later-stage backers might want to hang on to their stakes in hopes of selling them for a better value down the road.

Firms have various means of triggering a sale process, even in situations where they lack a controlling stake. A GP might have an option in its investment agreement that requires an entrepreneur to pursue certain exit options, including a trade sale, after a certain period of time, thereby guaranteeing that the company will at least have to consider an offer that has been made.

Drag-along powers can give weight to these provisions by obligating all stakeholders to go along with a decision once it has been agreed by a certain number of investors, negating the veto powers that are otherwise a standard part of the investment agreement. Though they may not often be formally invoked, these provisions usually prove vital in pushing through a desired measure without getting the otherwise-required assent of all stakeholders.

"Whether they looked at that clause first, or they just went to the most influential investors and then put it through, drag-along does get exercised all the time," says Cooley's Lu. "From a logistics perspective it takes a lot of time and energy to reach out to every single small investor."

Some form of leverage can also be helpful. In the case of Snapdeal, SoftBank reportedly has a liquidation preference agreement that gives it priority for repayment in case the company declares bankruptcy. That could be instrumental in persuading Kalaari and Nexus to go along with the sale despite reservations about the proposed valuation of Snapdeal.

Founder favor?

Missing from these calculations are the companies' founders, who may be sidelined by this stage. This can be a result of the company raising too many equity rounds and diluting its capital to the point that the founders no longer hold a controlling stake, or of investors exercising a clause in their contract. Either way, when investors try to work out a solution on their own it indicates they have lost faith in an entrepreneur's ability to turn things around.

Industry participants say that even if this step is necessary, it should not be taken lightly. A founder can often help investors exercise their plans for the company, even if that plan involves simply selling it to a competitor. Moreover, an investor who takes an antagonistic relationship with the entrepreneur risks pushing him away at the moment that they need each other most.

"If the company hasn't done well, you can't go back to the entrepreneur and say, ‘By the way, I had a 25% IRR to IPO, and I know the company hasn't performed well but you have guaranteed me this IRR,'" says Gaurav Ahuja, managing director at ChrysCapital. "The entrepreneur's going to come back and tell you, ‘You took an equity risk, and that risk didn't pan out. If the company hasn't performed well, why should I be the only one who suffers?'"

For this reason, many investors say naïveté can be just as damaging on both sides of the table. While an inexperienced entrepreneur can damage his reputation by agreeing to terms that he doesn't understand that lead to obligations he cannot meet, an investor who tries to force obedience to those terms can damage his prospects for achieving desired returns just as much. GPs that can preserve their partnership with an entrepreneur may find there is more life in the start-up than they had thought.

"The minute the contract is bigger than the relationship, everything falls apart," says A&M's Chopra. "The relationship has to be bigger for the investors to exit with some grace and some level of returns, if not the returns they expected."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.