Portfolio: Archer Capital and Australia's Allity

During its ownership of Allity, Archer Capital has focused on putting the aged care company a cut above the competition. Now the GP believes its premium care bet is poised to pay off

Decisions on caring for aged loved ones can be difficult even at the best of times – and in most cases the times are far from the best. "Usually when someone needs to go into aged care it's not planned," says Ben Frewin, managing director at Archer Capital. "Someone's had a fall, someone's not coming home from hospital, someone's had a mental or physical illness, and all of a sudden the family's gone from no planning to within a week having to figure out where are we putting this loved one."

With little preparation and circumstances dictating haste, family members often feel rushed when choosing a home and guilty afterwards as they wonder if they made the right decision. Since nobody wants to taint an aged relative's final years with regret, Archer knew a clearly superior option would be very attractive to families facing this choice.

"They want to actually feel proud and excited that they've found a lovely place where their loved ones can live in great comfort and be well looked after," Frewin says.

This realization has underpinned the firm's investment in Allity, an Australian aged care provider that targets a premium experience for customers. In the years since its acquisition of the company, Archer has worked hard to provide a path forward based on differentiating Allity from the competition and the resources to execute it. Now it believes Allity is uniquely placed to benefit from the country's coming demographic explosion.

New territory

When Archer approached property group Lend Lease in 2013 about buying its aged care unit, the industry was almost unknown to the country's private equity community. Indeed, up to that point AVCJ Research had no record of PE transactions in the space at all.

Investor reticence was due largely to cultural factors. Aged care in Australia has historically been dominated by non-profit agencies, which have a mandate to care for all regardless of their resources and hence face pressure to keep fees low. In addition, aged care is still widely viewed primarily as a public service than an area for private operators to make a profit.

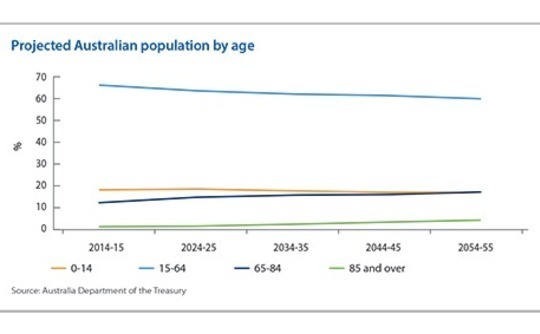

However, Frewin could also see that the industry faced growing pressure from increased life expectancies. Australia's Department of Treasury has projected the over-65 share of the population to grow from 15% in 2014 to 23% in 2055, while life expectancy at age 70 is expected to increase over the same period from 17 years to 21 years for men and from 19 years to 23 years for women.

"The thesis with the private hospital group was very similar, in that it's playing to the ageing population," Frewin explains. "Private hospitals are full of people in their 50s and 60s getting work done on their knees, eyes, hearts, and so on. The aged care sector is already operating near capacity and needs to cater for this growing cohort over the next several decades."

Many players in the healthcare space had begun to suspect that the non-profit sector – and the government, which at the time still accounted for 11% of the beds in the aged care industry – would not be able to cope with the predicted explosion in demand. Private sector providers were seen as the most likely source of the aggressive expansion needed to add an estimated 82,000 additional beds by 2025 and to refurbish or replace another 50,000 old units.

What Archer required was a private aged care business with a good operating record and an owner that wanted to sell for other reasons. Lend Lease seemed to be the perfect answer: its aged care homes, which numbered fewer than 30 at the time, had come along with a portfolio of retirement villages that the company bought from Babcock & Brown and had never fit well with the property developer's other business lines.

"They didn't want to own the operating risk of an aged care business, they only really wanted the property development piece," Frewin says. "They had been looking to sell for a number of years, and it was difficult to buy because it was hard to diligence, but we stuck at it and eventually we bought it."

David Armstrong, a co-founder of aged care business Amity (now part of BUPA), was brought in to help with due diligence and became CEO after the takeover. He was struck by the patience and caution that Archer showed in choosing a takeover target, compared to many of the other investors he met at the time, who saw aged care as the latest hot industry.

"A lot of other people I caught up with seemed to be in a hurry," Armstrong remembers. "But one thing I know is that you have to buy well, particularly in a sector that's undergoing progressive deregulation. You need to get the right assets at the right price, and a business you can build out over time."

Private practice

Having bought the business for A$270 million (then $276 million), Archer set about implementing its thesis for the company. As the GP saw it, there was an opportunity in the market for a private operator backed up by an experienced capital provider, and not beholden to the limitations seen in the non-profit or public sector, to build a unique and exciting alternative in the aged care industry.

Archer decided to concentrate its capital in two areas. The most obvious bet was in consolidating Australia's highly fragmented aged care industry, in which 189,000 beds were spread across over 1,000 providers, mostly small independent owners with a few homes and fewer than 200 beds.

In this area as well, however, the private equity firm recognized patience as the best policy. After the bolt-on of a portfolio of aged care homes and a retirement village owned by ECH the year after the Allity acquisition, there have been no other major purchases of competing businesses, though the company has pursued greenfield expansion by building new homes on its own.

Partly this slow approach is due to both Archer and Allity's desire to maintain the Allity brand, necessitating careful attention to the location of potential acquisitions. In addition, achieving traditional economies of scale has proven challenging in the industry.

"Scale in many industries means purchasing power, synergies, or the ability to defray costs over a bigger network. But in aged care, ultimately it's a fairly decentralized business model. Each of the homes is a micro business," Frewin says. "A huge portion of the cost base is labor, and labor isn't something you can scale just because you buy more homes."

Consolidation can still deliver economy through eliminating duplication in supporting services and technology. But as Archer sees it, increasing the company's presence across Australia mainly helps to spread awareness of the Allity approach to aged care along with acceptance of the concept of paying additional fees for services over and above the standard levels of care.

This is the second area of Archer's concentration in developing the company, and one where the GP has been able to make more headway. Allity is focused on providing a level of care and service for which residents and their families will be willing to pay a premium, and that means making its homes visibly a step above what customers can get from other providers.

"There's a lot of steel and glass places being built for which the architects might win awards, but I don't think that it's a great experience for residents necessarily. I don't think they walk in the front door and feel a sense of welcome, feel they've come home," says Armstrong. Under his watch Allity is seeking to create a comfortable environment both for potential residents and their family members, a process that starts before they even walk in the door.

"Our design brief is very specific about tracking the residents' experience from the moment they pull up outside, walking in the entry and having a line of sight to the town center, and then the experience from there as they move past our private courtyards along a beautiful corridor to their bedrooms," he says.

Beyond the design of the grounds and rooms, the Allity experience involves providing clientele with activities to keep them busy and productive. These include regular bus trips for those who are unable to drive, along with exercise, art and music classes to engage residents and keep their minds occupied. Libraries and media resources are also at their disposal, as well as online communication and media devices specially set up for accessibility by elderly users.

Though these services are used by the aged, Allity has an eye to building its brand among future clients as well. The company believes as Australia's population ages and end-of-life planning becomes more accepted, Allity can capitalize on that awareness.

"People are getting better at planning for their retirement and planning for their old age. You plan for what happens when you stop work and you've built your superannuation or your pension up, and hopefully your savings to be able to look after yourself. But traditionally it's not gone past that," says Frewin. "I think if we're successful in positioning this as a product that people are less resistant to, then it can be part of that overall plan."

Expansion options

While management focuses on repositioning Allity in the consumer market, it is also looking beyond the short term to future transformations. One possible development is expansion into China, where the population dynamics are similar to Australia – even magnified to an extent by the one child policy.

In addition, Allity and Archer have not abandoned their plans for acquisitions. Although both still see the aged care market as crying out for consolidation plays, they feel more time is needed for their desired assets to return to the right price points.

"We picked up ECH when the market wasn't quite as hot, and subsequent to that we felt that the pricing got out of hand and the market was overheated, so we've just been focused on developments until we feel that the market's back offering reasonable value," explains Armstrong. "We're trying to build out our existing networks, high quality homes in fantastic locations where we can buy adjacent properties and expand them, and there's a very attractive IRR on those sort of projects."

For its part, Archer faces several possibilities in finding an exit. However, past experience suggests the firm will need to tread carefully. While several aged care operators have gone public in recent years, including private equity-backed Estia in 2014, their pumped-up valuations have all subsided since, with Estia recording the biggest drop since its debut.

Some investors have come to see public markets as less than ideal holders of such assets, since the regulatory environment and the importance of government funding of aged care services means short-term performance will be hard to predict. Longer-term private investors such as superannuation funds might be more suited because they have the patience to wait out short-term fluctuations in the market – New Zealand Superannuation Fund, which bought RetireAustralia in 2014, is seen as a possible harbinger of future developments.

Regardless of the exit route, Archer is confident that Allity will continue to execute its plan under different ownership. And whoever that owner is, it will inherit a business with a strong independent identity and a solid basis for moving forward.

"I believe we've done the early hard work in creating a really good platform to go forward with great systems and process and management, so that the business knows exactly what it does, it knows how to do it, and it has a sustainability about it," says Frewin.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.