1Q analysis: Whale watching

KKR’s first close dominates fundraising activity, but mid-market showing still impresses; Japan leads the way as Asia exits remain reasonably strong; investment slows, if China state-backed deals are ignored

1) Fundraising: Big beast

Minnesota State Board of Investment has $82.7 billion under management, of which about 5% is deployed in private equity. Earlier this year, the pension plan approved an allocation of up to $150 million to KKR's third pan-Asian fund – its first commitment to any vehicle dedicated to the region as a whole.

KKR achieved a first close of $5.8 billion on the fund at the end of March, having earlier set an institutional hard cap of $8.5 billion. Including contributions from the firm's balance sheet and management team, the total is expected to reach $9.2 billion. It is the largest single close – partial or final – for an Asia-focused private equity fund, and the largest such vehicle ever, comfortably surpassing the $6 billion KKR accumulated for its second regional fund, which closed in 2013.

Appetite for the fund – KKR is said to have cut some LP allocations by 50%, such is the level of demand – speaks volumes for the way in which institutional investors are addressing the Asia private equity opportunity. Capital is flooding into the asset class globally as these groups look for returns in a low interest rate environment. Meanwhile, commitments to Asia are increasing because the region represents a small portion of most portfolios and it is expected to deliver growth.

These investors write large checks, they want co-investment, and there is a general desire for diversification; Minnesota State Board of Investment was hardly going to make its first investment in a mid-market China fund. This means they gravitate towards the larger pan-regional players, which explains the rapid fundraises that have characterized the current cycle, from Baring Private Equity Asia to Bain Capital and from MBK Partners to KKR.

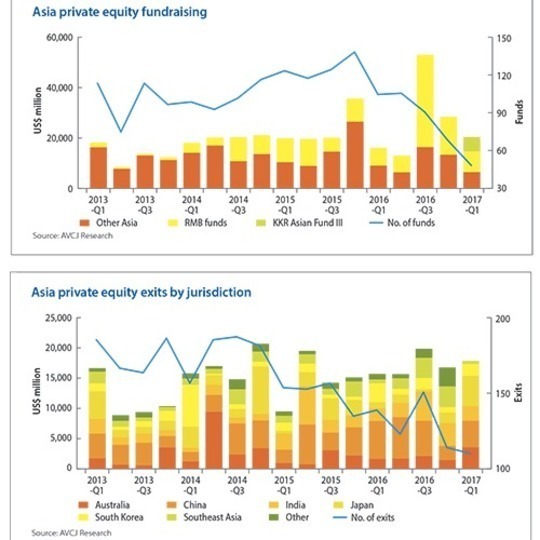

As ever, fundraising seems easy for a select few and harder for the rest. A total of $20.4 billion was committed to approximately 50 Asia-focused private equity vehicles in the first quarter of 2017, including full and partial closes, according to preliminary data from AVCJ Research. It represents a drop from $28.5 billion across about 70 funds in the last three months of 2016, but the headline number is still the fifth highest in the last two years.

Remove KKR Asian Fund III and the Reform Central Enterprise Operation Investment Fund from consideration, though, and the total plummets to $7.4 billion. The latter fund is a renminbi-denominated vehicle backed by the Guangzhou government, intended to drive state-owned enterprise reform. A first close of RMB50 billion ($7.2 billion) came in March and the full target is RMB150 billion. It is the third state-sponsored mega fund launched in the past year; the other two helped China PE fundraising reach a record $79.7 billion in 2016, with 80% of commitments going into renminbi-denominated vehicles.

The distortion continued into the first three months of 2017: China accounted for just under half of overall Asia private equity fundraising; 90% of the China total was on the renminbi side; and 90% of the renminbi total came from the Reform Central Enterprise Operation Investment Fund. The amount of capital entering China-focused US dollar funds slipped below $1 billion, the lowest quarterly figure since the last three months of 2012.

In the final three months of 2016, 10 of the 20 largest partial or final closes in Asia involved Chinese funds, including US dollar and renminbi vehicles. This fell to just four in the first three months of 2017. If anything, the rankings offer a snapshot of middle-market strategies that have won favor in a challenging fundraising environment.

ChrysCapital – one of five India representatives – closed its seventh fund at $600 million, in part due to a steady track record: more than $4.2 billion realized across 55 complete exits, representing all of the capital from its first four funds and over 100% of committed capital from its fifth. Meanwhile, South Korea's VIG Partners hit the hard cap of $600 million, making a meaningful breakthrough with foreign LPs who were convinced by the strategy on the back of the performance of Fund II.

There were also the first signs of what is expected to be an uptick in Japan fundraising this year, with Tokio Marine Capital and CITIC Capital Partners announcing final closes on their latest vehicles of JPY51.7 billion ($466 million) and JPY30 billion. In addition, The Longreach Group reached a first close of around $200 million on its third North Asia-focused fund, which has a particular focus on Japan.

Although there is foreign LP interest in Japan's mid-market space – CITIC and Longreach both attracted offshore money – Tokio Marine's investor base is purely domestic. This reflects the growing interest in private equity among Japanese institutional players. Of the 34 LPs in the fund, 17 are regional banks and they account for one third of the total corpus.

2) Exits: Japan shows its strength

Universal Studios Japan (USJ) has been a fun ride for PE. MBK Partners, which privatized the business in 2009 with existing backer Goldman Sachs and Owl Creek Asset Management, was on course for a 4.95x return at the end of 2015 based on the sale of a 51% interest to Comcast NBCUniversal earlier that year plus distributions already made and the value of the unrealized stake. In February, Comcast completed the acquisition, paying JPY254.8 billion ($2.3 billion) in a deal that valued USJ at JPY840 billion, including debt. PAG Asia Capital, which invested in 2013, also exited.

Infrequent big ticket trade sales tend to skew the exit numbers in Japan. With proceeds of $5 billion, the first three months of 2017 represented the country's best quarterly showing since Permira sold Arysta LifeSciences in 2014. However, USJ was not the only contributor. Japan accounted for six of the 15 largest exits across the region as Bain Capital made partial exits from Macromill and Skylark, Cerberus Capital pared its holding in Seibu, and a PE consortium sold Peach Aviation.

Australia, China and South Korea also posted quarter-on-quarter gains in aggregate exit value. While activity in China was reasonably widespread, Australia and Korea – like Japan – relied on a single stand-out transaction: TPG Capital's $3 billion sale of Alinta Energy Group to Hong Kong's Chow Tai Fook; and the $1.74 billion exit of Daesung Industrial Gases by a Goldman Sachs-led consortium to MBK Partners.

These deals helped drive overall Asia private equity exits to $17.1 billion in the first quarter, up from $16.5 billion in the last three months of 2016. It represents the fifth-highest quarterly total in five years, even though the actual number of exits, at just over 100, was well below the average. Trade sale activity continues to be strong, with proceeds of $12.5 billion ensuring that Asia cleared $10 billion for the fifth quarter in a row. The average for the 20 quarters preceding this period is $6.5 billion. Sales to other financial sponsors were also relatively robust, coming in at $2.4 billion.

On the other hand, public market exits continued to disappoint. After $1.4 billion was realized in the last three months of 2016 – the second-lowest quarterly total since 2011 – the first three months of 2017 delivered only a modest improvement. GPs came away with $1.9 billion from about 25 deals, a showing that would no doubt be blamed on market volatility.

The recent rebound in private equity-backed IPO activity also appears to be short-lived. A total of 59 offerings generated proceeds of $5.8 billion, down from $11.9 billion from 114 offerings in the last three months of 2016 and $12.8 billion from 67 in the quarter before that. However, the IPO markets are very much a China-driven phenomenon and Chinese New Year shortens the window of opportunity for new offerings.

3) Investment: Unigroup the outlier

Tsinghua Unigroup has risen to prominence as China's agent-of-choice for establishing a meaningful market share in global semiconductor manufacturing. Spreadtrum Communication and H3C Technologies are among its international M&A scalps, while Western Digital, ChipMOS Technologies and Silicon Precision Industries are high-profile failures. More recently Unigroup, which is controlled by an investment arm of Tsinghua University, has turned its attention to greenfield projects at home.

Last month, Unigroup received more fuel for its ambitions as China Development Bank and Sino IC Capital – manager of the state-backed China Integrated Circuit Industry Investment Fund – committed RMB150 billion ($22 billion) in funding. As a result, private equity investment in China hit a record $36.6 billion in the first three months of the year, but the Unigroup deal cannot be seen as representative of purely commercially driven activity. Exclude it, and the China total falls to $14.6 billion, largely in keeping with previous quarters.

Continued robust deal flow in China flies in the face of mounting concerns about private market valuations – although early-stage investment came to just $2 billion, the lowest quarterly total since early 2015, suggesting that reality might be starting to bite in certain segments of the market.

Areas of interest remain largely the same: consumer and technology. Notably, The Carlyle Group teamed up with CITIC Group's Hong Kong-listed unit and CITIC Capital Partners to buy the McDonald's China and Hong Kong business for $2 billion, while internet start-ups such as Alibaba Group's local services platform Koubei, chauffeured car service Ucar, online used car auction business Uxin Group, and bicycle-sharing player Ofo raised sizeable growth equity rounds.

Asia-wide PE investment came to $50.1 billion across approximately 700 transactions, falling to $28 billion if Unigroup is ignored. This compares to $43.6 billion, from the same number of deals, in the last three months of 2016. Australia and Japan both saw substantial drops in capital committed – a result of one unusually large deal in each market during October-December. Investment in South Korea and India rose, the latter rebounding from a weak previous quarter to continue its recent strong showing.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.