Dual currency fundraising: Servant of two masters

A resurgence in renminbi fundraising has prompted GPs best known for US dollar funds to enter the local currency market. Addressing conflicts of interest in an increasingly complex industry will prove difficult

SAIF Partners launched its fifth Greater China fund more than 12 months ago, seeking $800 million. There has been no word of a first close. Several sources in the LP community say there was little appetite for the vehicle and that the GP has been forced to regroup. But that's not to say SAIF has no capital to deploy: it has more than RMB6 billion ($870 million) under management across a dozen renminbi-denominated funds.

SAIF made its name in the US dollar space. Having begun life as the $404 million SoftBank Asia Infrastructure Fund in 2001 – SoftBank Group was the GP and Cisco Systems the sole LP – the firm went independent in 2004 and prospered, largely on the back of pre-IPO technology deals. Fund IV closed at $1.3 billion in 2010, with commitments from the likes of California Public Employees' Retirement System (CalPERS). The India team spun out in 2011 and has since raised two funds.

When the Chinese government started making concerted efforts to develop a domestic private equity industry in 2006, SAIF was a willing partner. Between 2008 and 2009, it launched three renminbi funds in conjunction with the Tianjin, Heilongjiang and Changzhou governments, raising a combined RMB3 billion. Performance is cited as one reason why LPs are reluctant to support another US dollar fundraise; the risk that SAIF might be distracted by the scope of its local currency interests is another.

A number of GPs essentially went native in 2006-2008, riding on a wave of capital from government-backed guidance funds. The phenomenon is now being repeated, particularly in the VC segment, as an even greater quantum of state-driven capital enters the asset class. Raising renminbi has arguably never been so easy, and several traditionally US dollar managers are enlarging their local currency pools. Offshore LPs are inevitably asking questions about conflicts of interest – is there a reasonable answer?

"Of more than 15,000 PE funds in China, the majority are renminbi-denominated," says Jun Qian, head of China for Swiss asset manager Adveq. "For the time being, renminbi funds and US dollar funds are competing in different parts of the market, but one day – maybe in the next 3-5 years – the two pools of capital will merge and there will be no currency convertibility issues any more. If you believe that, you should look closely at renminbi activity when evaluating the entire Chinese GP landscape."

Deeper pockets

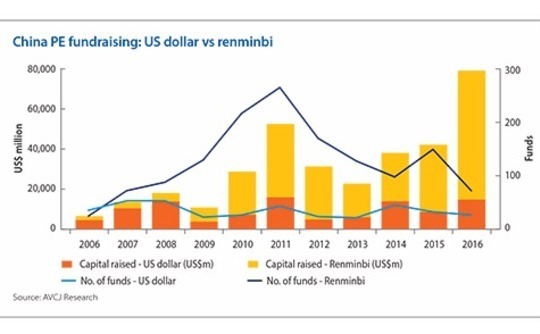

China private equity fundraising has seen two peaks. The first came in 2011, when $52.8 billion poured into the asset class, 70% of it entering renminbi funds as high net worth individuals (HNWIs) pursued pre-IPO opportunities. The second arrived last year: $79.7 billion was raised, 80% of it going into renminbi funds. In the absence of meaningful HNWI activity, the government role has been magnified. Three state-sponsored renminbi funds together received around $39 billion, including RMB40 billion for the National Venture Investment Guiding Fund for Emerging Industries launched by the State Council.

Following a fund-of-funds model, the vehicle will provide seed capital to professional managers which will then raise more money from independent sources. It sits at the top end of burgeoning segment that is estimated to contain around 1,000 renminbi fund-of-funds with total assets of RMB1.5 trillion. About 60% of them have central or local government support. The net impact is that more capital is available from an increasingly sophisticated set of LPs – and this is not lost on GPs best known for US dollar funds.

"For a GP that has not raised a renminbi fund before but is raising one now, a natural question to ask is: ‘Why now?' It could be about navigating a competitive VC environment: we have seen US dollar GPs commit renminbi to lock in a deal and convert to US dollars later on for timing reasons," says Jireh Li, chief Asia representative at Commonfund Capital. "Other questions would include: How do you manage your time across the two vehicles? What differences are there in strategy or return expectations? How will you manage potential conflicts? It would be a major concern if a GP has not thought through such issues and is looking to raise a renminbi fund only because their neighbors are doing so."

The restrictions placed by the Chinese government on foreign investors, streamlined approvals processes for local currency deals, and higher valuations when listing companies onshore rather than offshore have long been cited as justification for simultaneously managing US dollar and renminbi funds.

In 2009, when for the first time more capital entered renminbi funds than China-focused US dollar vehicles, the Limited Partners Association of China (LPACN) published a study on the potential conflicts arising from such an operational model. Although GPs have employed different mechanisms to try and minimize the risks, some remain.

The biggest concern is that a majority of Chinese GPs use the same team to manage both currencies. When individual investments vary – for example, renminbi funds tend to invest in growth and later-stage deals, while dollar funds go earlier with longer time horizons – or investment allocations diverge between the two funds, the amount of time spent by senior partners on each vehicle is diluted. For GPs that raise new renminbi funds during the investment period of an existing dollar fund, additional challenges arise.

With greater amounts of renminbi capital flowing into the system from increasingly sophisticated LPs, GPs could become even more distracted. "What has changed in the renminbi market is the maturation of the LPs," says Niklas Amundsson, managing director at placement agent Monument Group. "Five years ago they were passive. Today, renminbi LPs are more institutionalized and they are also hungry to co-invest into deals, just like international LPs. Structuring this type of deal will take up more of a GP's time, and so they may become more focused on the renminbi vehicles. International LPs might start worrying about that."

James Wang, investment funds partner at Han Kun Law Office, echoes this view. He adds that some renminbi LPs are conducting even deeper due diligence on GPs than their foreign counterparts, investigating carried interest plans, allocation of the responsibility within management teams, and GP succession planning. In certain cases, requests have been made for a share of carried interest at the GP management company level.

"If renminbi LPs find that some current status of a GP isn't consistent with what they see as the ideal arrangement, they will ask for further assessment, which is really aggressive and almost unheard from the US dollar LP community," Wang adds.

It is also not unusual for private equity firms to feel obliged to make larger GP commitments to renminbi funds than to their US dollar vehicles in order to convince big name domestic LPs to invest. This kind of arrangement can make offshore LPs feel uncomfortable. If the economic terms are structured differently between the two funds, or one vehicle is performing considerably better than the other, the GP will be incentivized to allocate better deals and more resources to the fund that can generate earlier and larger carried interest payments.

To assuage these concerns, some GPs are constructing diversified investor bases that includes different independent LPs, so as to avoid perceptions of overdependence on government-guided funds. They might also be conservative in increasing their renminbi fund size despite the large amount of capital flowing to the market. Qiming Venture Partners has deliberately kept its US dollar funds three times larger than its renminbi funds over the past three vintages. The firm's latest US dollar fund closed at $648 million in 2016, followed by RMB1.5 billion for a local currency fund one month later.

"We won't push entrepreneurs to accept either pool of capital. Often they choose which currency to take. Some have already established offshore vehicles so they prefer US dollar funds with a long holding period," says Janet Yu, a partner at Qiming. "When a deal can be accommodated by both funds, with the entrepreneur's permission, we commit capital from the renminbi fund and US dollar fund on a proportional basis."

Parallel plans

But there is still an issue if dollar and renminbi funds operated by the same managers have invested in different sets of deals, resulting in different performance. As such, larger managers such as CITIC Capital and Hony Capital have devised parallel fund structures in an attempt to invest in the same assets on a pro rata basis. There is some skepticism as to whether this can work in practice.

When CDH Investments launched its mid-market fund in the summer of 2015, it wanted to have the two currency tranches operating in tandem. However, China then tightened controls on capital outflows while proposals to relax the approvals process for foreign investment have yet to come to fruition as originally envisaged. CDH ended up with $800 million, split 60-40 between renminbi and dollars, but co-investment in every single deal was no longer seen as a practical goal.

If a GP does want to build an overlapping portfolio, it is essential that communication with offshore LPs is transparent and that processes are in place to ensure different pools of capital are treated equally. "For example, for investments where both currencies can invest, the GP will invest from both. For deals which are appropriate for one pool of capital only, the best approach is for the GP to share information on the legal or structuring reasons behind the decision," says Haide Lui, a principal at HarbourVest Partners.

While troublesome, this may be regarded as essential to deploying capital effectively in a market where high quality deals are said to be relatively few in number. Just as traditional US dollar GPs are looking to raise renminbi funds, GPs that made their name with local currency vehicles want dollar-denominated pools of capital as well. Less than half of the approximately 4,000 independent renminbi managers have proven track records with institutional investors, so offshore commitments are hard to win.

Principle Capital and Maison Capital have both managed to attract international LPs into their debut dollar funds, although they have yet to achieve final closes. Principle is targeting a $300 million parallel fund that will only invest in areas where foreign capital is permitted, so as to maximize the overlap. The dollar portion is intended to be three times the size of the renminbi portion because Principle wants to build long-term relationships with offshore investors and ensure they have exposure to deals.

In the absence of full currency convertibility, this balance is likely to become ever more difficult to strike, regardless of whether a GP has made its name on the dollar side or the renminbi side. As the market matures and Chinese LPs grow in sophistication, their demands will begin to match those of their foreign counterparts, making it harder to please all parties concerned. Caught in this bind, private equity firms would have to make careful strategic decisions about which path to take.

"Going forward, more US dollar GPs will focus on the renminbi market, making investments through increasingly streamlined procedures and establishing relationships with emerging Chinese institutional LPs," says Chun Zeng, a partner at Gopher Asset Management. "But every US dollar GP is developing its renminbi fund strategy at a different pace, depending on individual strategies that are in part driven by what kind of Chinese LPs they want to capture."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.