Portfolio: EQT Partners and Australia's I-Med

When EQT Partners acquired Australia-based I-Med Radiology Network, the company had spent years in the hands of different creditors. The GP had to restore confidence internally and drive long-term growth

Sydney-based I-Med Radiology Network was the third-largest Australia buyout of 2006, a year in which PE investors deployed a record $16.7 billion in the country as aggressively priced leveraged buyouts dominated the global private markets landscape. This total wasn't surpassed until 2015 on the back of several large infrastructure privatizations.

CVC Capital Partners acquired the business as part of a A$2.7 billion (then $2.1 billion) buyout of its parent, DCA Group. A year later, DCA's aged care business was sold to BUPA for A$1.23 billion, leaving the diagnostic imaging business and a A$900 million debt load.

In 2011, a 25-strong group of investors led by US hedge funds Anchorage Capital and Fortis Investment took control of the near bankrupt I-Med through a debt-for-equity swap. Paul McClintock, a former cabinet secretary, and Steven Rubic, previously head of Sydney's St Vincent's & Mater Health, were named chairman and CEO. The appointments were part of a management overhaul as the company looked to make a fresh start.

Allegro Funds then led a A$240 million corporate restructuring and refinancing of I-Med's debt in November 2014 in a deal with a local bank consortium and Morgan Stanley. At that point the company was approached by EQT Partners.

The Swedish private equity firm acquired the company alongside co-investors Caisse de dépôt et placement du Québec of Canada (CDPQ) and Singapore's GIC Private. The value of the transaction was not disclosed but it was said to be around A$400 million. It was EQT's first investment in Australia, made from the EUR1.1 billion ($1.48 billion) EQT Mid-Market Fund. The buyout resulted in I-Med's debt being slashed to just under A$300 million.

"The shareholders who hired us were never long-term holders of the business. They were there to fix the capital structure and then move on. So they did that. EQT obviously is taking a much long term view in terms of the performance of the business," says Clare Battellino, CFO at I-Med.

Growth agenda

Established in 2000, I-Med is the largest medical diagnostic imaging clinic network in Australia. It has operations in Queensland, New South Wales (NSW), Victoria, Tasmania and South Australia and the Northern Territories, trading under a variety of regionally based brand names not only through self-operated business but also joint venture (JVs). With 200 clinics covering metropolitan areas and significant parts of rural and regional of Australia, I-Med offers various diagnostic imaging services including X-rays, ultrasound, cardiac imaging and interventional procedures. When EQT made its acquisition, the company was performing four million procedures per year.

Although the business had returned to reasonably healthy shape, it bore the emotional scars of being handled by a number of different financial investors. A network of doctors is essential to I-Med consistently delivering quality service and McClintock and Rubic's deep relationships in the medical community were instrumental in holding this group together during the difficult times. One of EQT's priorities was winning the doctors' trust.

"When a healthcare company runs into troubles and needs restructuring, it's very hurtful for the doctors – the most important asset for I-Med. So a lot of focus has been on building a strong company culture and working environment together with the management team," says Carl Kistenmacher, a Singapore-based director at EQT. "Transparency is very important and we have spent a lot of time explaining to doctors and employees who EQT is, how it operates as an owner and what we want to achieve. Ultimately that is the same thing: to provide world-class services to I-Med's customers."

The PE firm had already made a number of similar healthcare investments in other jurisdictions, such as Finland-based Terveystalo and Europe-focused Atos Medical. Moreover, the industry operating model is similar to what the GP has seen in Europe. Diagnostic imaging services – over 90% of which are provided by private clinics – is a stable and growing business in Australia, driven by an ageing population, higher incidence of chronic disease, greater focus on early detection and preventative treatments, and more spending on complex diagnostic procedures that deliver better patient outcomes.

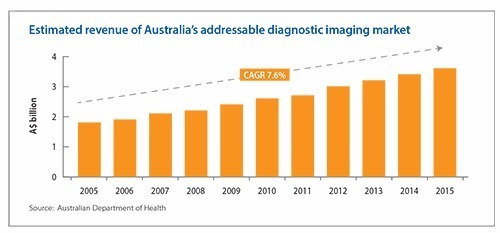

Between 2005 and 2015, the number of diagnostic imaging services undertaken in the country grew at a compound annual rate of 5.4%. The addressable market for private providers generated total revenue of about A$3.6 billion in 2015, according to Australia's Department of Health, with the five largest players accounting for more than 40% of the market. I-Med's share is about 16%.

"It is an industry with relatively low entry barriers for setting up a single clinic, but a single clinic lacks a number of the benefits of scale that I-Med has. A large business like I-Med can afford the capital expenditure to buy all the advanced equipment and the latest IT systems. It is also able to attract high quality radiologists to work in the clinics," says Fredrik Atting, a partner at EQT. "Most importantly, with scale you can be a good partner to the larger hospital chains and you can be at the forefront of the clinical development."

Three buckets

As such, the company is seeking to expand its market share by attracting more hospital contracts rather than launch large-scale takeovers of its competitors. Alongside the management, EQT has initiated a strategic growth plan comprising "three buckets," explains Atting. First, there is a pledge to improve I-Med's existing platform through organic growth, with EQT investing more than A$30 million a year to upgrade equipment and IT systems in each clinic, as well as to roll out new facilities.

The number of clinics has been reduced to around 180 clinics over the last two years, with 250 radiologists employed nationwide. Victoria is so far the largest part of I-Med's network, with 70 clinics. While the state has performed well, EQT has concentrated its efforts on NSW, an underperforming area but with potential to grow. Several centers were closed down and reopened in more accessible locations, taking the total number in the state to 40. Meanwhile, new clinics have been opened in Queensland and Tasmania as part of an ongoing effort to strengthen the company's market position.

The second bucket involves EQT assisting I-Med in the pursuit of small-scale add-on acquisitions to further expand its national footprint, and the third is working on operational improvement initiatives intended to make the business more united and efficient.

"I-Med initially had numerous local brands and small joint ventures. Over recent years it has been consolidating branding to a small number of core brands and rationalizing those joint venture relationships. I-Med today retains three core joint ventures and while it is not adverse to such partnerships, the preference is to own 100% of each clinic. If a patient goes anywhere in Australia, they will see the same logo and be offered the same high-quality service. That's how we are building an even stronger brand," says Kistenmacher.

Scale is particularly important in winning nationwide referral contracts from large medical centers and hospital chains because there is a requirement not only to provide comprehensive services including high-end modalities, but to do so 24 hours a day, seven days a week. In addition, private diagnostic imaging providers must comply with certain standards in terms of billing and financial transparency.

"I-Med is the leading provider of hospital-based radiology services in Australia and has strong relationships with the private hospitals and state health departments. It also has a reputation for providing high quality, comprehensive, value for money services and has the largest tele-radiology business in Australia that supports all hospital relationships by providing essential after-hours remote reporting," says Battellino.

I-Med currently provides services to more than 75 different public and private hospitals across the country, up by almost 10% since EQT's investment. These contracts are responsible for half of the company's overall revenue – 45% from public hospital and private hospital-based services clinics, and 5% from tele-radiology. The remaining 50% is generated through its stand-alone clinic services.

Careful decision

Australia's diagnostic imaging industry remains highly fragmented with thousands of providers, ranging from single clinics run by families to small chains with 5-10 facilities to a handful of scale players. Two companies are listed, Integral Diagnostics and Capitol Health, and although they are direct competitors to I-Med, neither can match it for size, with 57 and 50 clinics respectively. Integral and Capitol Health generated revenue of A$167.8 million and A$158.3 million last year; I-Med's came to approximately A$650 million.

Larger rivals come in the form of Sonic Healthcare and Primary Health Care, which also trade on the Australian Securities Exchange, but in each case diagnostic imaging is a small part of a broader business. Sonic, for example, had 100 radiology centers and diagnostics contributed A$420.7 million to an overall revenue base of A$5 billion.

This general fragmentation presents opportunities for I-Med to further consolidate the market. The company has completed seven acquisitions in NSW, Queensland and Victoria, with each business reporting annual turnover of A$2-20 million. More deals will come but they will be carefully selected: targets must either I-Med to expand its network geographically or help fill a hole in its established network. They must also meet stringent quality standards. The typical approach has been to takeover high-performing family-owned businesses and integrate them into the I-Med platform.

"Often we're buying businesses from practitioners who have built them from the ground up but are looking to retire over the next five years. They want a way to transition the ownership of the business prior to their retirement – which suits us. It gives us a plenty of time to plan the succession of the clinical staff in that business, while at the same time growing our geographic footprint," says Battellino.

Expansion has nevertheless been prudent, given the continued emphasis on improving the existing business. There has been a degree of service diversification, with specialist primary care services provided on a small scale in partnership with local cardiologists and neurologists. But there are no plans for a more comprehensive shift in commercial focus.

In 2015, EQT reportedly sought to sell a 50% stake in I-Med through an IPO, getting as far as the road show before the offering was pulled in response to market volatility. Kistenmacher says the GP at present has no plan to exit the business because there is still potential for growth. Asia's rapidly growing emerging markets are an obvious target on the periphery, where the penetration of diagnostic services is increasing and the same demographic and healthcare trends present in developed economics are gradually beginning to kick in. EQT is therefore considering cross-border expansion opportunities.

"High-quality service providers like I-Med can export a lot of industry know-how into China and developing countries in Southeast Asia," adds Kistenmacher. "We are all working on expanding into Asia. The value proposition for all parties is good and we expect to achieve that in a few years."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.