4Q analysis: Big ticket bias

Ausgrid deal obscures weak investment environment; fundraising returns to normal after state-backed blitz; China’s IPO market is on the mend, but public market problems undermine Asia exits

1) Investment: Final quarter flurry?

The fourth quarter has traditionally been when Asian private equity made up lost ground. Divestments of government-controlled assets in Korea are perhaps the best known examples of deals squeezed into the final weeks of December in order to secure completion within a particular calendar year, but it is not unusual for PE firms to try and get their business done ahead of the Lunar New Year quiet period.

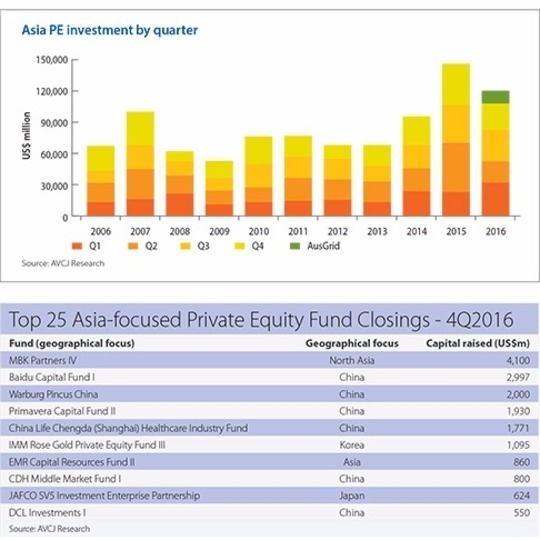

In six of the last 11 years, the final quarter has been the most active of the four - and 2016 was no exception. Total private equity investment for the three-month period came to $38.1 billion compared to $29.8 billion, $20.4 billion and $32.1 billion in each of the three preceding quarters, but the headline number should be viewed in the appropriate context.

In October, the New South Wales government sold a 50.4% interest in Ausgrid, its electricity distribution network, to IFM Investors and AustralianSuper for A$16.2 billion ($12.3 billion). Remove this deal from consideration and the fourth quarter looks a lot more ordinary.

This trend of increasing amounts of capital entering a small number of transactions - the 595 deals announced is the lowest quarterly total since 2013 - played out across 2016. Private markets investment for the year came to $120.4 billion, the second-highest total on record. But three Australian infrastructure deals accounted for 22% of all capital deployed. Include the five largest late-stage rounds for Chinese internet companies and logistics players with ties to e-commerce and the share rises to 30%.

Large rounds for the bastions of China's sharing economy were conspicuous by their absence in the fourth quarter. Nevertheless, private equity investment in the country during this period reached $12.2 billion, bettering the $9.4 billion posted for the previous three months. The $4.4 billion take-private bid from Ocean Link for travel website Qunar helped mask what hasn't been a vintage quarter for China. On annual basis, investment was down by one third at $47 billion.

As the largest buyout even seen in Australia - albeit one driven by the appeal of predictable, long-term yield and therefore at odds with traditional PE - Ausgrid helped Australia to its largest-ever quarterly total. The annual figure for the country of $33.1 billion is also a record. Only two other markets posted quarter-on-quarter increases in investment: Japan, which posted $6.5 billion in deals, its second-largest three-month total; and Hong Kong, which saw $2.4 billion committed, the third-highest on record.

In Japan, an argument can be made for this rising investment flow being part of a broader trend. The marquee deal from the fourth quarter is KKR's agreement to buy Nissan Motor's 41% holding in automotive components supplier Calsonic Kansei Corporation and subsequent tender offer to acquire the company in full at a valuation of JPY498.3 billion ($4.5 billion). Assuming it goes through, the transaction would represent a significant step in industry efforts to carve out assets from Japanese conglomerates.

Intermittent big check situations like Calsonic and MBK Partners' JPY102.5 billion offer for Accordia Golf, plus a surge in activity in the lower mid-market, helped total private equity investment for 2016 to $10.2 billion, the most since 2007. At close to 630, the number of deals announced is a record for the market.

Hong Kong, by contrast, remains more opportunistic. AVCJ Research only has information on seven PE buyouts worth $500 million or more in the past 15 years, and two happened to fall in the same week in October. First, The Wharf Holdings announced it would sell telecom services provider Wharf T&T to MBK and TPG Capital for HK$9.5 billion ($1.2 billion). Then Permira agreed to buy business, corporate and investor services provider Tricor Holdings from Bank of East Asia for HK$6.47 billion.

The last time a Hong Kong conglomerate sold a business to private equity was CVC Capital Partners' acquisition of Hong Kong Broadband, another internet service provider, in 2012.

2) Fundraising: Back to the norm

Asia private equity fundraising $18.4 billion in the final three months of 2016, an improvement on each of the first two quarters of the year, but trailing the third quarter total by a substantial margin. This is no surprise. Between July and September, three state-backed renminbi-denominated funds together received around RMB271 billion ($39 billion), taking region-wide fundraising to a record high of $59.1 billion.

As a result, the yearly fundraising total has been thoroughly skewed. More capital entered Asia-focused private equity vehicles than ever before, but of the $104.7 billion committed, 60% of it went into renminbi funds.

Yet only 69 renminbi funds achieved partial or final closes during the year, down from 145 in 2015. This phenomenon of ever larger sums of capital going to a small number of managers is a longstanding characteristic of the US dollar space - in China and outside of it. About 320 GPs reached a close of some kind across the region, down from 480 in 2015. It is the lowest annual total since before the global financial crisis.

A glance at the leading fund closes in the fourth quarter says much about the bifurcated nature of the market. Of the $6.1 billion that went to buyout managers, MBK Partners accounted for $4.1 billion. It is claimed the GP took approximately two months to raise this sum for its fourth North Asia-focused fund, although the line between launch, soft launch and general indication of future plans in response to inbound inquiries seems increasingly blurred these days.

MBK said it delivered a record $2.7 billion in realizations in 2015, but expectations for co-investment were likely equally instrumental in the GP making a substantial jump up from $2.7 billion for its previous fund. Sizeable commitments came from Canada Pension Plan Investment Board (CPPIB), Ontario Teachers' Pension Plan, China Investment Corp, and Temasek Holdings, all active co-investors.

If MBK's fundraise reflects the importance of co-investment to the LPs, Warburg Pincus' $2 billion China vehicle underlines the value of a strong brand. It will invest alongside the firm's $13.4 billion global flagship fund, offering LPs also present in that vehicle the opportunity to double down on their China exposure.

However, there was also evidence in the fourth quarter of GPs establishing themselves as part of the industry with encouraging second and third fundraises. Primavera Capital closed its second fund at $1.93 billion, nearly twice the size of Fund I, while Korea's IMM Private Equity upsized from $720 million to $1.15 billion for Fund III.

In Southeast Asia, Creador and Falcon House Partners both earned sufficient confidence from LPs to warrant re-ups. The former closed its third fund at $415 million, and the latter secured $400 million for its second Indonesia vehicle, a big increase on the $212 million secured for Fund I.

3) Exits: China IPOs rebound

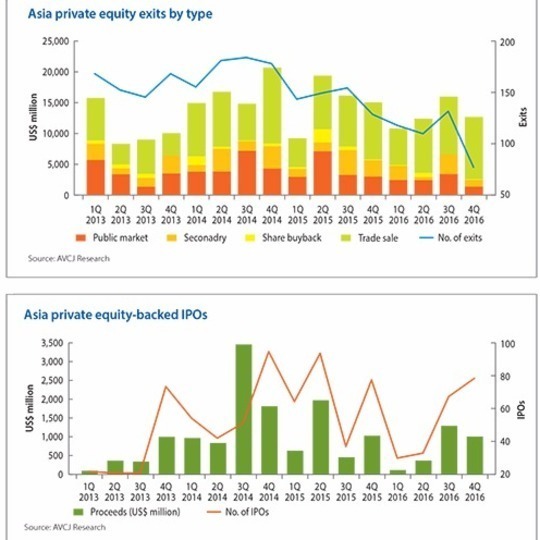

For those concerned about liquidity for China-based investments, the second half of 2016 should have offered a snippet of optimism. Having seen just 19 PE-backed IPOs in Shanghai and Shenzhen in the first six months of the year, 34 were completed in the third quarter and then 52 in the fourth. Proceeds reached $4.8 billion in the final three months, the highest quarterly total since the boom period of 2011.

China was the mainstay as PE-backed IPOs across the region generated $10 billion from 78 offerings, compared to $12.9 billion from 67 the previous quarter. For 2016 as a whole, the total was $27.8 billion, down from $40.7 billion in 2015.

The fourth quarter also featured two milestones for Chinese companies listing outside of their domestic markets. Logistics operator ZTO Express, raised $1.4 billion in New York Stock Exchange, the most by a Chinese group on a US bourse since Alibaba Group in 2014. This was followed by app provider Meitu raising $629 million in Hong Kong, the biggest IPO by an internet company on that exchange since Tencent Holdings in 2004.

The broader exits picture was less encouraging, with proceeds of $12.7 billion, trailing the $16.1 billion posted in the third quarter. It contributed to an annual total of $52.1 billion from approximately 430 exits, well short of the $67.6 billion and $60.2 billion from 2014 and 2015, respectively, although roughly in line with the average for 2010-2013.

Public markets exits were the major weak point in 2016 as volatility played havoc with exit timing. This was particularly true of the fourth quarter, which saw just $1.3 billion generated from primary and secondary share sales, the lowest three-month total since 2011. Trade sales made up all but two of the 15 largest exits, and the $10.2 billion generated from all trade sales is the most in two years, even though it came from a relatively small 45 transactions.

They include the oddity of The Abraaj Group's agreed sale of K-Electric to Shanghai Electric Power for $1.77 billion - by some distance the largest private equity investment in Pakistan and now the leading exit as well.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.