Portfolio: The Longreach Group and Primo Japan

The Longreach Group bought Primo Japan last year to bring its bridal jewelry focus region-wide. China expansion is the first step toward the company’s Asian leadership

For young couples preparing to get married, the number of decisions they need to make can seem overwhelming. Bridal jewelry specialist Primo Japan believes that in these times, a sympathetic ear has the power to become a couple's best friend.

"For most of our customers, it's their first time to buy a wedding band and engagement ring, so they don't really know what to buy," says Yuichi Hayashi, chief sales officer at Primo. "We spend on average one-and-a-half hours per customer, just listening to their needs and wants. And at the end, the conversion rate of our customers is more than 60%."

This performance has helped Primo stand out in Japan's moribund jewelry market, to the considerable satisfaction of The Longreach Group. The North Asia-focused buyout firm, which took a controlling stake last year, believes Primo's unique business model and high-quality service offer a crucial edge in both remaining the market leader domestically and positioning for overseas expansion. The GP has also made it a priority to bring its own abilities to bear in order to enhance Primo's innate strengths.

Mark Chiba, group chairman and partner at Longreach, had had his eye on Primo for some time before making a move. Baring Private Equity Asia, which had acquired the company from Goldman Sachs and Risa Partners in 2011, was preparing to exit, and Chiba had made it a point to cultivate relationships with the owner and with the company's management, with a view to positioning his firm to make the best case in the bidding process.

"What attracted us was that this is not a general jewelry business, subject to fashion trends or wider flows," says Chiba. "It's very focused on bridal jewelry, and it's got a very strong track record of gradually increasing its market share. So we evaluated the business as having growth opportunity within Japan, even though the overall market is shrinking, because it still has room to improve market share and it's got a terrific product offering."

Bucking the trend

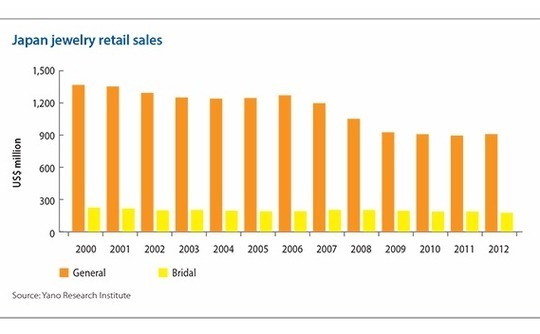

At first glance, investing in Japan's jewelry industry would seem like a risky bet. The market was still the third-largest in the world, behind the US and China, but it had reached historic lows just a few years earlier - a report by the Yano Research Institute shows retail jewelry sales dropping to JPY895 billion ($7.8 billion) in 2011, and rebounding only slightly the following year to JPY911 billion.

Bridal jewelry in particular looked little better. Despite being the biggest segment of the overall market, bridal jewelry had fallen along with it, reaching JPY187 billion in retail sales in 2011. Researchers attributed the fall in revenues to declining marriage rates, resulting in decreased demand, along with increasingly price-conscious consumers deciding not to buy separate engagement and wedding bands.

Amid these depressing statistics, Primo, founded in 1999, stood out: the company had bucked the market trend, with sales rising steadily every year, going from JPY 12.2 billion in 2011 to JPY 16.4 billion in 2014. Outperforming a growing market would have been impressive enough, but Primo's ability to increase its take while the rest of its peers stumbled made it a must-have for Longreach.

Upon completing the takeover, the first challenge for Longreach was simply to avoid changing too much. It had bought Primo for its performance, and had identified the company's business model as an inseparable element of that revenue-generating ability. Unlike other jewelry retailers, Primo does not sell fully finished pieces in store: instead, it offers a semi-customized approach. Customers are presented with a range of options for fittings and stones that they can choose from to create jewelry that is suited to their particular tastes - the company claims to offer up to 150 different combinations of rings and gems.

This focus on customizable products at an affordable price point - the company aims at a market segment below premium foreign names like Cartier and Tiffany - had helped Primo achieve considerable domestic success, with its main brand I-Primo ranked eighth in sales among both domestic and foreign brands in 2015. Longreach had no intention of disturbing this winning approach. However, it had also identified some blind spots in the company's strategy that it knew had to be overcome.

One of the chief areas for improvement was advertising, of which the company had basically none at the time of the purchase. Primo's method of spreading brand awareness, up to this point, had consisted of placing promotional advertisements in one of Japan's leading bridal magazines. Due to its uninterrupted growth the company had never felt that it needed more promotional efforts - but Longreach saw the value in increasing awareness of the brand among potential customers before they even looked at a bridal catalog.

"We've launched a team to focus on brand building, and we've put in significant resources in terms of human capital and financial capital to launch TV commercials nationwide, which started about a year ago," says Jun Suzuki, a principal at Longreach. "We have higher recognition now and a better branding position, and as a result, despite the declining Japanese market, we have not been put into a situation where we need to lower prices. In fact, we're increasing prices."

Regional ambitions

As important as Primo's brand building efforts were, however, Longreach was saving its biggest push for the company's international expansion. The GP had pursued this strategy with several of its other Japanese portfolio companies, and saw Primo, with its high standards of service, as a perfect candidate for such a move.

Primo had already taken its first steps toward expanding outside Japan prior to Longreach's takeover. Its first Taiwan store opened in 2007, with a Hong Kong presence established shortly after Baring's acquisition. By the time Baring exited, the company had 10 stores in Taiwan and two in Hong Kong. But Longreach saw these locations as introductions to the main attraction: mainland China, which, with its 12% share of the world jewelry market and rapidly growing middle class, would be a prime target for the company.

Longreach's team made the China move its highest priority. Within a week of the acquisition being finalized, the GP had formed a China team with Hayashi at its head, and by July of this year it had opened a first store in Shanghai. Another followed in November, and two more are planned for the coming year.

Despite Primo's history as a brand primarily focused on Japan, Longreach was confident in the company's ability to translate to a Chinese audience. The experience of Taiwan and Hong Kong had taught the firm that increasingly westernized middle-class consumers would respond to product flexibility and attentive, accommodating sales staff. This positive impression could be started even before the customers entered the shop, as consumers would associate the company's Japanese origins with high quality and outstanding service.

"We are selling a Japan-style product, because there's no Japanese bridal jewelry-focused player in China," says Suzuki. "That's how we succeeded in Taiwan and Hong Kong, and while the China market is not exactly the same as Taiwan and Hong Kong, in Shanghai specifically, we can sell Japanese quality and style."

The company's history in Taiwan and Hong Kong has also proved useful for ironing out some of the difficulties associated with moving into a new market. Even such early steps as finding retail space turned out to be easier than expected, because mall owners recognized the company from its presence in the other two Chinese markets. The precedent has also made language and cultural issues less difficult.

"The challenge in Shanghai was training the sales staff, but we could use some of our human resources in Taiwan, where we are the top brand in the bridal jewelry market," Hayashi says. "So we brought our Taiwan store manager and some sales trainers who speak Chinese to Shanghai, and that made it a lot easier to train our new hires."

So far the firm and the company have been highly satisfied with the performance of the China project, and in the coming years Primo plans to continue its growth in China and elsewhere. The company expects to open a branch in Beijing as an extension of the Shanghai stores, in addition to growing the Hong Kong branch into Guangzhou. A move into Southeast Asia is also under consideration, though market research is needed first.

Despite the financial outlay required for these expansions, Longreach considers the investment to be worthwhile as it builds the company toward its own exit. The GP is looking to leave Primo transformed from a leader in the sleepy Japanese jewelry industry to a significant regional player. It is confident that any potential buyer will see the value in its highly service-oriented nature and consider the staff that makes it happen a valuable resource rather than an expense to be streamlined.

"I don't think we're any more labor intensive in terms of head count. But we are very service-intensive. So what we want to bring to the stores and the customer experience is more of a counseling and caring way of selling the product," Chiba says. "The more time we spend with the customers in store, the better we're going to do in terms of the customer experience and, probably, the price point."

Offline to online

Though the China expansion is taking the majority of Longreach's focus, the GP has other initiatives underway. It has identified a number of further enhancements to the company's business, which it hopes to implement during the course of its holding.

One of the most important goals is to overcome one of the inherent limitations of the bridal jewelry market: customers intend never to visit more than once or twice. Rather than hoping for a rise in the divorce rate, the company plans to use the customer data it collects to build longer-term relationships and market more products to its clients for special occasions such as anniversaries.

"We sell to one-time customers, and unless people get married many times, we only sell once to each customer," says Suzuki. "We think we can do better. We are trying to build a repeat customer business model, and anniversary jewelry addresses that."

Primo's anniversary jewelry initiative is also intended to serve as a test bed for its e-commerce capabilities, which are still mostly a work in progress. Longreach plans for the company's website to eventually enhance its in-store service offering, and is exploring some of its options, such as sending alerts to clients whose anniversaries or other special occasions are coming up, or allowing customers to browse the product options and make a choice before they come into the shop.

However, as it explores the possibilities offered by e-commerce, the private equity firm is also committed to preserving the culture of Primo and its hard-earned reputation. To this end it is wary of the consequences of moving to an online-first model or otherwise radically changing the business model, which it feels would remove one of the main sources of its appeal to consumers.

"We're not a cheap commoditized internet sales or services business, and we never will be. We want to complement our core business," says Chiba. "So we're going to test that carefully, because what we do not want to do is in devalue our brand and our service proposition."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.