2016 in review: Uncertainty reigns

Infrastructure and late-stage technology among the few investment bright spots; renminbi vehicles dominate the fundraising landscape; public market instability undermines exit plans

INVESTMENT: FLATTERING TO DECEIVE

Australian infrastructure deals and China tech transactions paper over the cracks in a weak market

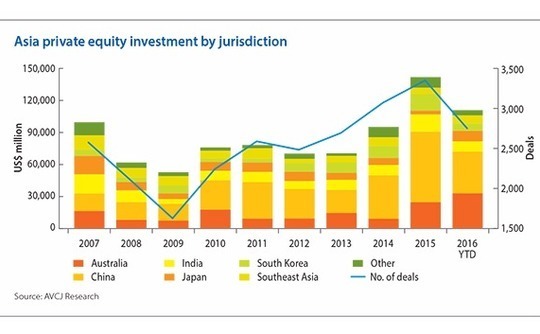

Of the $111.7 billion in private equity capital committed in Asia over the course of 2016, approximately one third went into seven deals: three Australian infrastructure privatizations and four late-stage China technology investments.

This statistic amounts to a startling caveat to an annual investment total that is the second-largest on record. The $142.9 billion deployed across 3,300 deals in 2015 was never likely to be bettered, but one of the themes of last year appears to have intensified this year: increasing amounts of capital entering a small number of transactions. Exclude these outliers from consideration and 2016 is more accurately characterized as a period in which many Asian markets flat-lined in the face of economic uncertainty.

The uptick in Australian infrastructure investment was widely signaled. A succession of port deals in recent years have added credence to the strategy of privatizing brownfield assets - that appeal to institutional investors because of a proven ability to generate predictable, long-term yield - in order to finance much-needed greenfield projects. The obstacles are primarily political. At what speed and to what extent are state governments willing to pursue this course of action? And how fussy will the central government be about who buys them?

The latter question was answered in unequivocal yet controversial fashion regarding the sale of a 50.4% interest in a 99-year lease of Ausgrid, New South Wales' electricity distribution network. When Hong Kong-based Cheung Kong Infrastructure and State Grid Corp. of China submitted bids for the assets, they were rebuffed on grounds of national security. This left a clear path for an all-Australian consortium comprising IFM Investors and AustralianSuper, which agreed a A$16.2 billion ($12.3 billion) deal.

A year earlier, Transgrid was offloaded - without objection - to a consortium that included several foreign investors. However, they were acting in partnership with other groups, a characteristic of several successful deals in the space. Qube Holdings and Brookfield Asset Management led the A$9 billion purchase of Asciano Group, with Canada Pension Plan Investment Board, China Investment Corporation and Qatar Investment Authority as minority partners. Similarly, the A$9.7 billion acquisition of Port of Melbourne featured locals QIC and Future Fund as well as the likes of Ontario Municipal Employees Retirement System.

Two aspects of the China data set are worth particular consideration. First, the venture capital sub-total is larger than for 2015 - $11.9 billion versus $10.2 billion - but the market is becoming more skewed towards bigger ticket investments. While there were sizeable falls for transactions in the $5-19 million and $20-99 million brackets in terms of capital committed and deals announced, the $100-499 million category doubled on both counts, with $5.6 billion across more than 30 investments. The implication is clear: the VC squeeze is being felt most keenly at the bottom of the food chain, with investors preferring to re-up in companies they think can be winners rather than gamble on new arrivals.

Second, the amount of capital deployed in growth-stage deals has fallen to $11.1 billion from $18.5 billion in 2015, with the number of transactions dropping by half, but the top-end of the scale appears to be immune to pressure. Three investments of $1 billion or more were announced, just like last year. The aggregate value of those deals was down on 2015, but much of the $4.5 billion in equity funding that went to ride-hailing platform Didi Chuxing in June doesn't appear in the AVCJ numbers because it came from strategic rather than financial players.

Even within this upper echelon, there is evidence of investors being selective in terms of where they commit capital: there is a preference for established leaders or start-ups that have substantial local strategic backing. Of the largest recipients in 2016, Ant Financial Services and Cainiao Network Technology are the financial services and logistics affiliates of Alibaba Group; JD Finance is the equivalent of Ant Financial within the JD.com family; and electric car pioneer LeEco is part of a wider group - although recent developments underline that success in this space is not guaranteed.

It is also worth noting the evolution in the kinds of investors backing these companies. Foreign capital still plays a role but local institutions are more prominent. And investor rosters not only feature Chinese internet companies but also, and increasingly, insurers, corporates and vehicles managed by banks and asset managers that likely contain a mixture of corporate and high net worth individual clients. These are long-term or opportunistic players, often willing to take whatever terms are handed down to them.

In the absence of more late-stage tech deals and PE-backed privatizations of US-listed Chinese companies, overall private markets activity in the country has slowed over the past 12 months. The $39.4 billion committed since the start of the year is the third-largest on record but the 2015 total of $66.8 billion remains far in the distance. With growth equity transactions in particular falling year-on-year throughout the region only three jurisdictions saw a meaningful uptick in deal flow on a US dollar basis (the decline is almost universal in terms of deals announced).

The first is Australia, rising from $24.4 billion to $32.9 billion, for the reasons outlined above. The second is Vietnam, up from $149.7 million to $738.9 million, largely due to two sizeable investments by GIC Private in Vietcombank and Masan Group, respectively. The third is Japan, where investment has increased nearly threefold to reach $9.7 billion, the highest since 2007.

A single, large-ticket transaction has played a role here too, with KKR prevailing in an auction for Nissan Motor's 41% holding in automotive components supplier Calsonic Kansei Corporation and launching a tender offer to acquire the whole company at a valuation of JPY498.3 billion ($4.5 billion). It represents a significant step in the industry's efforts to secure carve-outs from Japanese conglomerates, but also reflects an improvement in private equity investor sentiment that stretches from big buyouts all the way down into the lower mid-market.

From CVC Capital Partners' purchase of a controlling stake in assisted living, nursery school and cleaning services provider Hasegawa Holdings to the clutch of buyouts reported by the likes of J-Star and NSSK, the combination of succession planning challenges and tougher commercial conditions appear to be encouraging founders to sell to private equity in greater numbers than before.

FUNDRAISING: RENMINBI REVIVAL

In a difficult fundraising environment, local currency China vehicles come to the fore

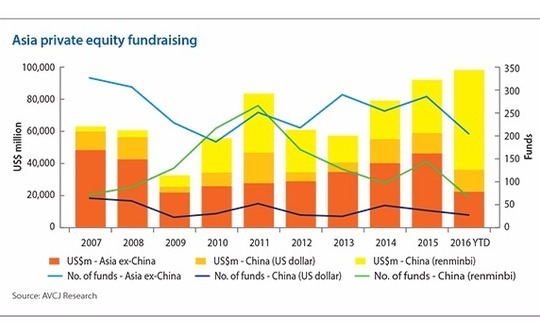

For an explanation of Asia private equity fundraising in 2016, look to 2011. Back then, a record total of $84.1 billion was raised for funds targeting the region; $0.66 of every $1 committed went into a China-focused vehicle, with renminbi-denominated funds alone accounting for $0.44. That mark was bettered last year when $92.8 billion was raised, split roughly equally between China and non-China funds. With nearly three weeks of 2016 still to come, a new record has been set: $98.9 billion raised for Asia, a disturbingly large 77% of it going to China, and 63% to renminbi funds specifically.

While the two vintages have both seen an unusually large amount of renminbi fundraising, they represent different phenomena. In 2011, the industry saw an explosion of local interest in Chinese private equity as high net worth individuals piled into the asset class, eyeing the lofty multiples on offer through IPOs in Shenzhen. Much of this fundraising was legally dubious, with many investors not really understanding the commitments they were making. When multiples started falling and the regulator barred new listings for a year, many investors defaulted on commitments or wrote off their losses.

Fast forward to the present and the renminbi market is better regulated; there is more institutional money available and high net worth individuals participate in a relatively orderly way. In 2011, 268 local currency funds achieved an incremental or final close; in 2016, there have only been 66. The year is only record-breaking thanks to a handful of very large state-backed vehicles that say a lot about the Chinese government's thinking on state-owned enterprise (SOE) reform and driving innovation, but very little about genuine institutional appetite for private equity in Asia.

The headline fundraising data offer a skewed picture of a market that remains incredibly challenging and increasingly bifurcated. Commitments to US dollar China funds came to $13.9 billion, an improvement on 2015, but elsewhere in Asia fundraising is down more than 50% at $22.3 billion. It is the lowest total since 2009, although as yet unannounced fundraising activity may emerge over the coming weeks. Approximately 300 funds have achieved incremental or final closes - the lowest in 12 years - with non-China managers accounting for two thirds of these.

Next comes the China State-owned Venture Capital Fund, which raised RMB100 billion towards an overall target of RMB200 billion. It has similar backers and a similar strategic objective to the restructuring fund but the focus will be on technology companies. Finally, the National Venture Investment Guiding Fund for Emerging Industries achieved a final close of RMB40 billion. Technology is once again the priority, but allocations will be made to several managers.

While these three vehicles cast a long shadow, activity in the renminbi space is more nuanced than Beijing simply throwing money at policy initiatives. First, the government is said to be increasingly open to having professionals manage these pools of capital - although it remains to be seen how savvy the selection is, for the funds mentioned above and others. Second, a growing number of institutional investors are entering the system. And third, traditional US dollar managers are raising renminbi vehicles so they can invest in areas where foreign capital is unwelcome or an onshore listing is desired.

From Sinovation Ventures (formerly known as Innovation Works) in the venture capital space to private equity players like Hony Capital, dual-currency funds are increasingly common. Given the differing regulatory regimes for US dollars and renminbi, it is unclear to what extent the two tranches act in tandem or are simply raised in parallel but follow individual investment remits.

There remain managers on the US dollar side - or predominantly US dollar side - who can raise large sums at short order. Hony took longer than it expected to close its latest vehicle at $2.7 billion, but the process was completed within nine months. FountainVest Partners and Boyu Capital, each in the market with their third funds, took a fraction of that time to achieve final closes of $2.1 billion and $2 billion, respectively. While LPs are arguably more cautious on China than they were before, this does not extend to all managers.

Indeed, the dynamic of "haves" and "have nots" continues to play out across the region as investors seek to reduce their GP relationships and commit more capital to private equity firms that meet two or more of the following criteria: strong track record, experienced team, compelling investment narrative. Depending on strategy, ability to offer co-investment is another key factor, maybe even a deal-breaker.

MBK Partners is an obvious beneficiary of this trend, closing its fourth North Asia buyout fund at $4.1 billion, 50% larger than the predecessor vehicle. Sizeable commitments came from the likes of Canada Pension Plan Investment Board, Ontario Teachers' Pension Plan, China Investment Corp, and Temasek Holdings, all of which are known as keen co-investors. However, bifurcation is not limited to the pan-regional players - from venture capital through mid-market buyout, a minority of firms build up a following and can close quickly on favorable terms. The majority face a hard slog fundraising.

Quadrant Private Equity is the stand-out example in Australia this year, taking just six weeks to close its eighth fund at A$980 million ($728 million). Among the VCs, GGV Capital led the way, raising $1.2 billion across multiple vehicles that will back US and Chinese start-ups from seed through late-stage rounds. IDG Capital Partners also hit the $1 billion mark in China, working in conjunction with Breyer Capital, and then Sequoia Capital now has a larger fund than any manager in India - PE or VC, after securing $920 million for its fifth vehicle, which also invests in Southeast Asia.

Venture capital fundraising has dropped off slightly from 2015, coming in at $13.5 billion once the distorting impact of the China State-owned Venture Capital Fund is removed. However, in keeping with the rest of the industry, money is increasingly flowing to select bunch of managers.

EXITS: REVERT TO THE NORM?

Public market pains outmatch robust trade sale activity, as the slide from the 2014 peak continues

Just under $2 billion in private markets capital has been deployed in Pakistan over the last two decades, according to AVCJ Research. Cumulative proceeds of $2.6 billion have been realized from barely a handful of deals - and $1.77 billion alone coming from The Abraaj Group's agreed sale of a majority stake in K-Electric to Shanghai Electric Power. The seven-year turnaround of an historically unprofitable business, which came to a conclusion in October, is one of the three-largest exits of 2016, a year notable for its relative paucity of big-ticket realizations.

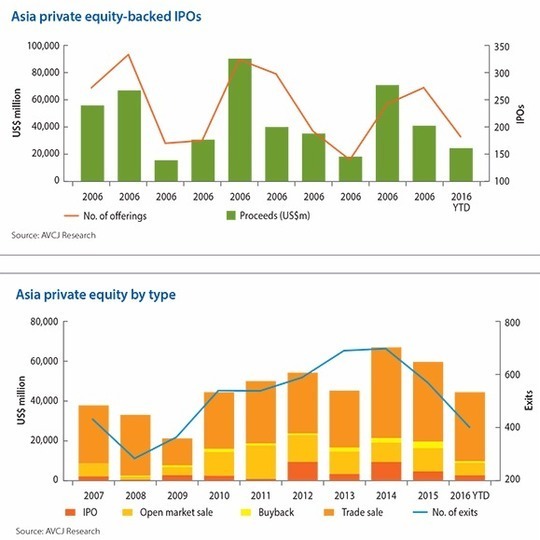

The high point for Asia private equity exits remains 2014, with $67.4 billion in proceeds from around 700 transactions. In 2015, the figure fell to $60 billion and 570 transactions, and for 2016 it stands at $44.7 billion, generated from 400 deals. This total is not dissimilar to those of 2010-2013 - even including 2014 and 2015, the annual average over the past seven years is $52.4 billion. While it is tempting to suggest that Asia might be reverting to the norm, there are some idiosyncrasies in the data worth noting.

China also features prominently in numerous outbound deals as companies look to diversify their business and acquire technology and expertise that can be brought into the domestic market. In addition to Shanghai Electric's purchase of K-Electric, Hony Capital sold its stake in Australia-listed energy business Santos to ENN Ecological; while KKR exited healthcare companies in two different markets - Gland Pharma in India and GenesisCare in Australia - to Shanghai Fosun Pharmaceuticals and China Resources Holdings, respectively. Macquarie Capital was a minority participant in the latter deal.

Continuing the theme of Australasian health and wellness, a consortium comprising Shanghai Pharmaceuticals and Primavera Capital agreed to buy New Zealand-based Vitaco, barely 12 months after Next Capital listed the business in Australia.

Assuming the deal goes through, it will add to the growing list of secondary exits in Asia. Broadly speaking, these fall into two categories: pan-regional GPs buying businesses from country managers that have reached a certain scale, and new GPs picking up minority positions from existing backers who need to generate liquidity.

Second, public market volatility was of little help to private equity firms seeking exits. The year started badly as the "circuit breaker" mechanism introduced by Chinese regulators to limit stock market losses prompted massive sell-offs, with the shockwaves felt on bourses across the region. It has only been in the final months of the year that most indices have returned to the levels at which they started 2016, and net result is relatively little activity in terms of IPOs and open market sales.

A total of 182 IPOs have so far delivered proceeds of $24.4 billion, just over half the 2015 figure and putting Asia on course for its weakest year since 2013. Actual exited equity amounts to just $2.5 billion, the least since 2008. At $6.3 billion, open market sales are at a seven-year low - and much of that coming from CDH Investments' two block trades of Chinese pork producer WH Group.

On a market-by-market basis, only two major jurisdictions have seen an increase in exit activity compared to 2015. Hong Kong is one of them, largely thanks to the $2 billion CDH generated from its WH Group sales. The other is South Korea, where proceeds nearly doubled to reach $6.1 billion, even though the number of full or partial exits dropped sharply.

Three investments that originated as corporate carve-outs were the major contributors: Affinity Equity Partners received KRW1.5 trillion ($1.3 billion) when Kakao Corp. took a majority stake in Loen Entertainment, 30 months after the GP bought the business from SK Planet; Glenwood Private Equity and NH Private Equity are set to receive KRW619 billion from SK Networks for Tongyang Magic, about 30 months after acquiring it from Tongyang Group; and IMM Private Equity and Mirae Asset Private Equity got KRW695 billion for Doosan Defense Systems & Technology following a seven-year hold.

India also continues to impress, suggesting that some private equity firms at least are capable of moving beyond the overhang of yet-to-be-realized investments from 2006-2008. The exit total of $9.5 billion is less than the record $13.3 billion posted for 2015, but it compares favorably to the annual average of $4.7 billion for 2011-2014. The country has also seen a record year for IPOs, with proceeds of $3.4 billion from 19 offerings. KKR was responsible for much of this liquidity, with the sales of Gland Pharma and Alliance Tire Group alone generating more than $1.5 billion for the firm.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.