India infrastructure: Finding on-ramps

As capital patterns in the Indian infrastructure space evolve, the opportunity sets for private equity are being reshaped. Precisely calculated entry strategies will be the key to success

When government-backed sectors in large emerging economies experience a sustained period of internationalization and maturation, it tends to open doors for private equity - although these doors are not always immediately evident. This has been the case in India's infrastructure sector, where increasing attention from long-term overseas investors is signaling a change in the private capital equation.

One recent example involves Canadian pension plan Caisse de depot et placement du Quebec (CDPQ) and Kuwait Investment Authority (KIA) backing an $850 million platform launched by ICICI Venture and Tata Power that will invest in domestic power projects. For CDPQ, the commitment follows the opening of an Indian office in March. GIC Private and Canada Pension Plan Investment Board (CPPIB) have also established a local presence in recent years, and the latter has been active in infrastructure with a $322 million investment in local engineering and construction company L&T Infrastructure Development.

These moves punctuate a wave of interest from foreign LPs and sovereign wealth funds. They also signify a shift toward more patient capital expecting lower yields, and hence a reduced role for traditional PE plays seeking faster turnarounds and larger multiples. At the same time, GPs currently active in the sector have yet to see many returns on a flurry of investment in the sector about five years ago due to systemic headwinds.

"We had a policy paralysis, a complete underestimation of the execution risks and number of delays. And with changes in the policy and regulated environment under the new regime, returns have been recalibrated and the traditional private equity model no longer holds," says Manish Aggarwal, head of infrastructure and corporate finance for KPMG in India. "It's not about believing the Indian growth story or being skeptical about it, but the past has a baggage without many success stories which investors can't just ignore - and rightfully so."

However, there is still room for PE investors to gain exposure to the macro drivers behind infrastructure development if they are suitably selective. As such, sub-sectors, business models and partnering entities must be targeted with a heightened understanding of the bureaucratic entanglements that color the overall industry.

Original interest

Private equity started getting involved in Indian infrastructure in a significant way 7-8 years ago when there was a significant need for new capacity and greenfield projects. As these projects became operational and the influx of direct investment from longer-term players betrayed a new risk-return dynamic, GPs demonstrated increased wariness around finding the right policy framework and getting the right revenue models in place.

Meanwhile, a stagnant exit market has contributed to investor hesitancy. According to AVCJ Research, PE divestment activity in the sector has been erratic and muted across the past decade, with only three exits transacted this year for a total value of $36.8 million. This followed an even weaker 2015, which saw two infrastructure exits worth $18.5 million.

"The return expectations have moderated, but if you're able to work within the lower return spectrum, there are deals here in the marketplace," says Suman Saha, head of the infrastructure advisory team at Kotak infrastructure funds. "We're pretty selective in what we do, and focus on core infrastructure, basically storage, power and transport."

This more concentrated approach has been influenced by other events redirecting deal flow. For example, government policy roll-outs have created "plug-and-play" investment opportunities in assets constructed by national authorities, such as toll roads. This scenario - in combination with encouraging macro drivers such as India's consistent economic growth across recent years - has helped maintain private equity sentiment.

"Investments in the infrastructure new build/brownfield asset space are still generating returns of 20%-plus, so they do have a PE return flavor," says Archana Hingorani, CEO and executive director of IL&FS Investment Managers, the private equity arm of India's Infrastructure Leasing & Financial Services. "Private equity has played an important role in the past, and I don't see that changing because the government goals require a huge level of participation from the private sector. The scarcity of equity available for the infrastructure space is so significant that any amount of capital that can come in would be most welcome."

Finance Minister Arun Jaitley has said that India will need more than $1.5 trillion of investment over the next 10 years to bridge this gap as a number of government programs come to light. These programs include some substantial commitments, such as the Smart Cities Mission, Power For All and Housing For All urban development initiatives, which are slated to receive $8 billion, $12 billion and $7.5 billion in financing from New Delhi, respectively.

Such policies are underpinning PE opportunities across waste management, logistics and power, with renewables expected to be one of the fastest moving growth areas on the back of a $90 billion plan to install 175 gigawatts of capacity by 2022. Transportation, meanwhile, remains the most prospective opening for GPs overall, with some $100 billion in government funding earmarked to expand rail networks and a $25 billion hybrid annuity program set to drive private investment in highways.

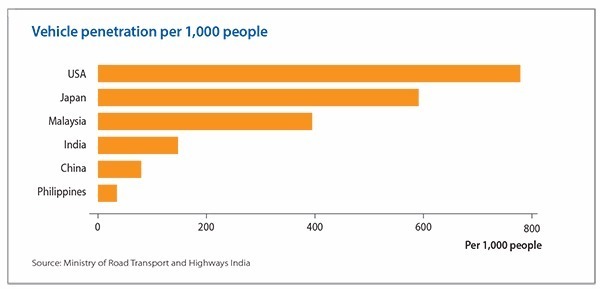

Upside for road investment is also highlighted by India's sparse vehicle penetration, which is less than half of Malaysia's rate at about 150 cars per 1,000 people. The low base has fueled one of the fastest uptake rates globally, with car use rising 11% between 1996 and 2013, according to Euromonitor International.

"With fairly low to moderate risk for long-term concessions, you're able to pick up growth rates in the roads sector that you're not able to get in other developed and growth economies," says Gautam Bhandari, a partner at I Squared Capital. "From a risk-reward perspective, it's an area that has done quite well both in terms of performance of assets as well as in terms of future potential."

Distress opportunities

Indian infrastructure strategies have traditionally aimed to diversify risk by acquiring stakes in holding companies instead of investing at the project level. This has been the primary PE approach over the past 6-7 years and has allowed for exposure to a targeted company's brownfield assets as well as its possible greenfield plans. However, as projects invested during this period have matured, GPs have increasingly eschewed preassembled portfolios to focus on later-stage value-add plans at the project level.

Deal flow in this context has been driven by widespread financial distress, ultimately tied to an overload of bad debts and non-performing loans from the local banking industry. In infrastructure, this market has been characterized mostly by projects for which commissioning has been delayed or where challenges to equipment supply have resulted in cost overruns.

The emergence of distress as the primary pool of acquisition opportunities has narrowed the playing field for private equity but it has also opened up a chance to reap returns in the 20% range despite the fact that the brownfield market normally offers lower yields. But success is contingent on a careful approach to deal targeting that prioritizes projects with solvable problems.

"There are a lot of assets stuck because most of the EPC [engineering, procurement and construction] players are under financial stress," I Squared's Bhandari explains. "Our approach has been to find construction companies with stretched balance sheets and buy them out outright. The key lies in making sure the construction companies do what they are most capable of, which is to construct - that allows operational value-add investors like us, to play a pivotal role in optimizing assets."

I Squared has also built up tailored technical expertise by teaming up with the IFC to create a new platform of some 100 engineering professionals rather than absorbing offshoots of conglomerates or families. In the roads segment, a key application of this talent is data collection and analysis - a diligence process that is lacking even among experienced domestic players but essential for building traffic network models that allow for the identification of prospective assets. As toll businesses take payments predominantly in cash, GPs must also establish monitoring frameworks to plug leaks in revenue streams.

Value-add strategies with EPC acquisitions otherwise focus largely on understanding the sector's often opaque accounting methodology, improving governance, scaling the client base and helping secure long-term bank financing at a reasonable price. Paragon Partners followed this method with Mumbai construction contractor Capacite Infraprojects after investing an initial $15 million in the company across two rounds earlier this year.

"For us, it's more a play on the business and the industry dynamics than a macro infrastructure thesis," says Siddharth Parekh, a senior partner at Paragon. "Since Capacite remained focused on their specialization - and as a new company, didn't have any legacy issues - they were able to grow from essentially zero four years ago to around $250 million of revenue this year."

Investment in EPC players can also give GPs exposure to infrastructure segments where direct ownership of assets is blocked by entrenched government monopolies such as Indian Railways. Tata Capital followed this playbook with its acquisition of Tata Projects, a contractor specializing in the delivery of industrial freight corridors and metro passenger train systems. Furthermore, this approach has also allowed Tata Capital to moderate its exposure to government-connected properties.

"These large infrastructure projects tend to play out across multiple political cycles, and we're looking for predictability in execution across such cycles before we take a view on whether we back public or private entities owning those assets," says Bobby Pauly, a partner at Tata Opportunities Fund. "We would prefer to underwrite entities that are not putting capital at the mercy of various approvals, land availability, changes in regulation or taxation."

Policy permutations

Since Prime Minister Narendra Modi took office in mid-2014, a deterioration in global commodity prices has given India's import-dependent government the ability to dominate the infrastructure push with direct financing of construction and a policy framing role that has been embraced by investors. In addition to the persistent distress amid volatile interest rates and low capital availability from banks, this has kept PE activity sporadic.

Regulatory moves to reverse this inertia include allowing an extension on the maturity period for infrastructure-related loans from around 10-15 years to 25 years. This has provided equity investors with a more sensible means of realizing cash flow on long-life concessions.

In the roads space, the government has also imposed rules that require 90% of a concession to be issued up front, with compensation guaranteed if red tape issues delay delivery of the remaining 10%. Under the previous system, only 70-75% of a project would be handed over to a developer up front, and the remainder could get caught up in procedural cobwebs causing construction delays without government accountability.

It is expected to take time for such reforms to improve clarity around infrastructure investment sufficently to recharge private equity confidence in the sector, although more patient government and LP investors are likely to continue piling in. This is because tightening up concession agreement implementation protocols cannot deliver India's infrastructure boom alone - investor experience in realizing turnarounds must also improve.

"Private sector investments are yet to pick up. The bottom line is, investors need cash to come back from existing assets before really investing in new capacity," KPMG's Aggarwal says. "But I definitely think that in the next one to one and a half years, we are going to see a very large pick-up of investment activity in brownfields by strategic investors, sovereign funds and pension funds."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.