India fundraising: Bifurcation point

Only a handful of India-focused private equity firms have shown they are able to raise funds $500 million or more. With LPs still wavering on India, however, membership of this select group is not guaranteed

The International Finance Corporation (IFC) has 19 active GP relationships in India, including a fair number of first and second-time managers with funds in the sub-$250 million range. However, two of the development finance institution's (DFI) most recent commitments do not fit this profile: it backed Everstone Capital's third fund and Multiples Alternative Asset Management's second vehicle, which closed at $730 million and $690 million, respectively.

"What we have done in the last three years is evaluate the market and say there is more of an opportunity to back experienced fund managers and help them get to the next level rather than backing first time managers," says Nupur Garg, head of South Asia private equity funds at IFC. "Our more recent investments have served to diversify the portfolio, introducing new relationships and different strategies."

IFC is not alone in gravitating towards managers that are known quantities. The Indian GP landscape has bifurcated to such an extent that only a handful of groups are capable of raising $500-750 million; the rest of the market is below $250 million. Even for those with a strong LP following, the jury is still out as to how effectively they can differentiate themselves and deliver returns.

"If you don't have a strong 10-year track record, it is really hard to justify your case," says Praneet Garg, a managing director with fund-of-funds Asia Alternatives. "Until now, if you were raising Fund II you could say you learned your lessons in Fund I, and even on Fund III you can say the macro was bad and India can get over it. Now we see GPs who have been in the market for 7-10 years and only a handful have met LPs' return expectations."

Concentration factor

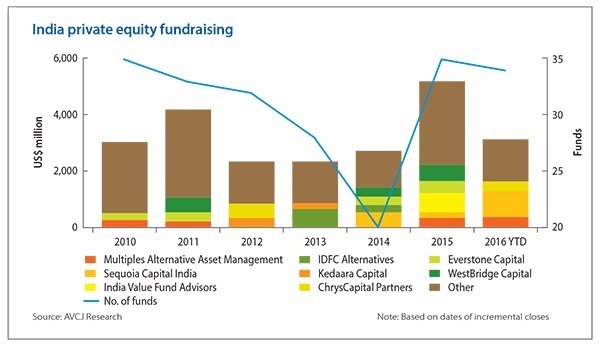

After coming close to an annual average of $8 billion in 2006, 2007 and 2008, private equity fundraising has slumped to an average of around $3.4 billion - and an increasing proportion of the capital has gone to a select group of managers.

Of the $3.1 billion raised so far in 2016, just over half has gone to three firms: Multiples, Sequoia Capital India and ChrysCapital Partners. Sequoia and Multiples - bear in mind AVCJ Research separates out incremental closes from final closes - are also two of five GPs, alongside India Value Fund Advisors (IVFA), Everstone Capital and WestBridge Capital, that accounted for 42% of the $5.2 billion raised in 2015. Swap out IVFA for IDFC Alternatives, and the same firms received 52% of the $2.7 billion committed to India-focused funds the year before that.

These numbers are symptomatic of a market that has underperformed. Much of the capital invested in 2006-2008 has failed to deliver a satisfactory return and so LPs are concentrating their resources on the handful that have historical track records, strategies and teams that imbue the most confidence. This means reducing the overall number of GP relationships, or at least seldom adding any new ones.

"We added a name last year, we might add another name this year. We dropped one name this year, we will probably drop another next year. It's net flat with some churn, but overall happy with the portfolio," one LP observes. However, this investor also claims to be wearied by the India market, saying that he rarely enjoys meeting with local GPs because on the most part the narratives are not very compelling.

Thinking ahead

Some existing PE firms have responded by reducing their fund sizes from the previous vintage - CX Partners is an example of this - while it is a difficult environment for new managers. Amicus Capital, founded by executives from IVFA and The Carlyle Group, and Sealink Capital Partners, which was set up by KKR's former head of India PE, are among those groups that have been in the market for some time now.

PE firms are also increasingly focusing on particular sectors and control transactions, so they can in theory bring more value to portfolio companies and have a greater say on the timing of exit. "We are seeing funds that are sector agnostic having a bias towards three or four sectors and not going beyond those," says Alagappan Murugappan, head of Asia funds at CDC Group.

The problem, as Asia Alternatives' Garg notes, is that most managers have gravitated towards the same three sectors - pharmaceuticals, financial services, consumer and IT services - which makes it harder for firms to differentiate themselves. He suggests that GPs pursue differentiation by being more thoughtful in deal execution and portfolio management, and proactively thinking about creating liquidity.

The bifurcation dynamic is likely to remain in place until a few PE firms are able to demonstrate strong net fund-level returns. Even if this happens, it does not necessarily mean the current upper echelon will remain the same. "The interesting question is can that group all perform well in this cycle," says Doug Coulter, a partner at LGT Capital Partners. "I highly doubt it."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.