Portfolio: IVFA and India's HiCare

IVFA bought HiCare with an eye to cornering India’s nascent pest control market, but the firm’s ambitions for the company are much greater

When India Value Fund Advisors (IVFA) looked at India's pest control market in 2014, the industry offered little to recommend itself at first glance. Low interest levels, particularly on the consumer side, meant that the space was dominated by small businesses, mainly operating on a local scale, with few organized players to appeal to consumers.

But the market's sluggishness was precisely where the firm saw opportunity. When A. Mahendran, a former executive at the Godrej conglomerate, asked IVFA to partner with him on buying its onetime insect control services division, it needed little prodding.

"What we realized was that there is extremely low penetration for these kind of services in India, and with urbanization increasing the problems related to pests are only going to increase," recalls Ashish Bargava, a partner at IVFA. "Also, as per capita income goes up we are likely to see more and more people become more hygiene-aware, and therefore the need for such services is going to increase."

Now two years into its investment, the private equity firm continues to see pest control's growth theme as a winning bet. However, it is also setting the company's sights higher by expanding into new verticals and attempting to build a more diverse brand identity among consumers. As India's middle class continues to grow, HiCare's owners hope to take a major chunk of this burgeoning customer base.

Pest problems

Pest control would seem like a natural fit for India, a tropical country long infamous for its swarms of mosquitoes, flies and other animal annoyances. But in 2014 the country's extermination and pest prevention industry had so far shown few signs of growth, particularly on the consumer side, where most of the revenue came through products such as traps and sprays, rather than services - more than three times as much. This distribution was the opposite of that found in Western countries, where services account for five times the revenue of products.

HiCare had pursued this market in a haphazard way when IVFA first encountered it. The company was founded in 2003 as part of the Godrej conglomerate under the auspices of Mahendran, who was then managing director of Godrej Consumer Products. In its original incarnation Mahendran intended HiCare to operate alongside the company's insecticide business and provide insect control services to residential and business customers.

However, that business model morphed upon HiCare's acquisition by Danish facility management company ISS Global in 2009. Like Godrej, ISS saw HiCare's services as a useful adjunct to its core business, and offered pest control as an add-on to the customers who purchased its management service. But this focus on enterprises came at the expense of the company's potential success among consumers.

"Their core business was really facility management, and the B2B [business to business] pest control kind of fit into that business, so there was a natural tendency to focus on the B2B part," says Bhargava. "It's not that they ignored the B2C [business to consumer] side of things, but there was less emphasis on it."

Under ISS, HiCare did a brisk trade servicing the parent company's corporate clients. Its consumer side, on the other hand, saw little development. HiCare continued to serve its existing residential customers, but ISS made little investment in marketing and brand building to acquire new ones.

At this point Mahendran, who had left Godrej before HiCare's sale to ISS, re-entered the picture. He approached IVFA proposing to partner with them to buy the business back from ISS, which was looking to divest its non-core assets. The firm agreed, and the two pursued a deal that ultimately saw HiCare change hands for INR2.5 billion ($39.7 million), with IVFA taking an 80% stake and Mahendran holding the rest.

Despite the historically sleepy nature of India's pest control space, IVFA saw HiCare as a hidden opportunity. The firm believed the growth of India's middle class would boost interest in hygiene issues and pest control as consumers sought to emulate Western lifestyles. Once that occurred, having one of the few organized players in the industry would be a major benefit.

"Our own understanding of the growth of the market is that it has been more of a supply-side challenge than a demand-side challenge," says Himanshu Chakrawarti, who joined HiCare as CEO in 2015. "We feel that in this market, supply will create the demand if you have good-quality service providers."

Recruitment issues

One of the first challenges facing the new owners was to beef up the company's management team. As a division within larger conglomerates, there had been no need for HiCare to build up a complete corporate structure of its own. While a competent staff of technicians was already in place, many departments such as human resources and payroll had not been established.

"On the residential side, the business had grown very little over the last four years before the acquisition," Chakrawarti says. "Even the team that was there already was almost entirely operational in nature. So one of the key challenges they had was to create a set of highly talented people which would drive and fuel a much larger independent business over a period of time."

Adding Chakrawarti to the team satisfied one of the new owners' key concerns, since finding a head for the newly carved out company had presented a considerable challenge. IVFA and Mahendran had few options within India's still largely undeveloped pest control space, and executives from the existing, underperforming players in the market held little appeal.

Eventually the owners decided that a CEO unencumbered by experience in pest control might actually be able to pursue a bolder course than a veteran of the weak performers. Discussing their ideal candidate, they decided on some essential qualities for the new head: he should have considerable experience in retail, in order to help build out the residential service business; he should have experience in a high-growth industry; and he should have a good understanding of technology, in order to implement the efficiency measures that they were planning to introduce.

Chakrawarti met both of these requirements. He had 10 years of retail experience, first as the COO of the Landmark Limited department store chain and then as CEO of The Mobile Store, India's largest mobile phone retailer. The second of these also helped him meet the high-growth and technology industry qualifications.

"We thought retail was probably the closest business to something like this, because it is distributed, it has huge manpower requirements, and it caters to consumers, so there was a consumer orientation that was important," says Bhargava. "It has a big service element, so the CEO needed to understand the service part."

Another challenge for IVFA was finding the right business model to rebuild HiCare's atrophied consumer arm. The firm was determined to find cost savings and streamline the company as much as possible to make scaling the business easier and give it an advantage over its competitors.

One of the first steps was to move to a franchise model for expanding the business. At the early stage of their ownership this removed some of the burden of day-to-day operations from the in-house staff. In the long term it will help to keep the company asset-light and give local operators more flexibility in how they run their franchises on the ground.

The owners were also determined to introduce new technology solutions across the company that could both boost efficiency and create a more engaging customer experience. IVFA was inspired by the changes wrought by new communications technologies in India and other markets in industries such as taxis and home services. It wanted to catapult HiCare ahead of its competitors, which were mostly still tied to old-fashioned pencil and paper methods.

"The way things work in pest control services is that you call up some operator, and he then gives you a quote and schedules an appointment based on the convenience of both parties, and comes to your home to deliver the service," says Bhargava. "It's a multi-step process, and because it's a multi-step process, the access friction is extremely high."

Rather than stick with this model, HiCare wished to transition to an on-demand system, whereby customers can make appointments with service providers through a single nationwide platform via the web or a mobile app. The request is then sent to a computerized routing system that assigns the task to an available technician in the customer's area, and plans out the technician's rounds for greatest efficiency.

The goal is to replace as many of the fallible human layers between customers and service providers with technology solutions that will hopefully be more precise. The company expects productivity to improve by as much as 25% when its new systems have been fully pushed out to its franchisees nationwide.

HiCare has found IVFA a willing partner in pushing these changes. The firm sees the benefits of such technological enhancements as well worth the initial investment required. "We haven't had to sell them on why or how we need to do this. In fact they've been a great help along the way," says Chakrawarti. "They themselves want to be at the forefront of adding technology as a key enabler for their portfolio companies."

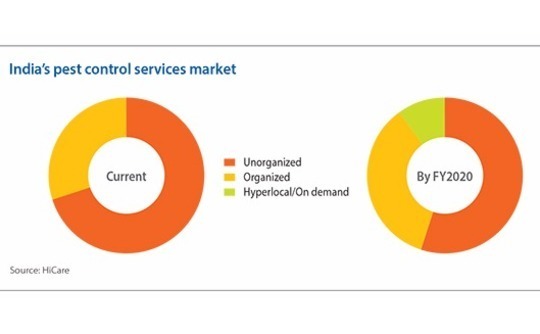

There is a certain urgency to the company's push for change, due to expected future shifts in the industry. Currently the pest control services industry, in addition to its small size, is dominated by unorganized players - only 30% of the market is made up of organized companies like HiCare. The company expects the unorganized part of the market to shrink to 55% by 2020.

However, the organized services slice is only slated to grow 5%. The remainder will be taken by on-demand services, a category not currently represented. HiCare's mandate is to grab as much of this as yet unrealized category that it can, in expectations of greater growth to come.

Big ambitions

While all of these initiatives are helpful for HiCare's core pest control business, their real purpose is to lay the groundwork for a much more ambitious goal. IVFA plans to transform the company into a broader home hygiene solution that can offer customers a range of services, from house cleaning to air purification.

The jump from pest control to house cleaning may seem incongruous, but HiCare and IVFA feel that the step is not only logical, but inspired. With a booking and routing system already in place, adding more services is only a matter of tweaking the existing infrastructure. In addition, HiCare's existing customer base has already demonstrated an interest in cleanliness and a willingness to pay an outside company to provide it. By becoming a one-stop shop for multiple hygiene categories the company hopes to take a bigger part of its customers' attention and build its reputation.

"There was consumer tailwind that we felt toward this category, both in terms of increasing urbanization and higher per capita income, which will get more and more people to buy these kinds of services," says Bhargava. "Therefore with the low penetration to date, one of the big growth stories was that as penetration improves, we are likely to corner greater share."

HiCare has pursued its expansion deliberately, first researching the segments it was interested in and then slowly adding them to its service portfolio over the past 18 months. Currently it offers eight house cleaning services, with plans to add two more by the end of the year. It wants to add air purification in the near future, but is moving more slowly on this because of the higher level of training required.

IVFA hopes its new initiatives will help HiCare become a force in the home hygiene industry. Before the acquisition the company had shown anemic growth, with a constant annual growth rate of 3% between 2011 and 2015. However, as India's consumers strive for higher standards of living, the firm expects business to take off, with a CAGR of 36% projected from 2015-2019.

As HiCare grows into its own, IVFA will consider its exit options. Despite the positive growth expectations, the company will remain too small and niche for an IPO. A sale to another Indian service provider - or a multinational looking to enter the country - is more likely. The GP believes the innovative technology solutions that it is putting in place will be the attractive feature for a buyer when it does decide to sell, even more than the size or market share.

"We are aspiring to be number one in the area where we operate, but even if we are not number one, then we would definitely like to be the most profitable tech-driven company," says Bhargava.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.