Hong Kong tax policy: An unfortunate first

Hong Kong is the only major international center openly seeking to treat carried interest as income rather than capital gain for tax purposes. The private equity industry wants to know where it stands

"To strengthen its position as a premier international asset management center, Hong Kong will provide relevant legal and regulatory frameworks, and a clear and competitive tax environment with a view to attracting more funds of various types to base in Hong Kong to broaden the variety and scope of our fund business," said John Tsang, the territory's financial secretary, in his 2013-2014 budget statement.

These were words Hong Kong's PE industry had been waiting a long time to hear. Adding substance to these ambitions for clarity, Tsang went on to say that PE investors would qualify for the local profits tax exemption to offshore funds, while consideration would be given to introducing fund structures to Hong Kong that were popular with the industry in other markets.

The extension of the tax exemption alone was significant: It meant that Cayman Islands-incorporated funds would no longer have to set up complicated structures designed to avoid triggering permanent establishment in Hong Kong and thereby becoming liable for local tax. Beyond that, the open-ended investment company (OEIC) structure aimed at mutual funds and hedge funds could serve as a stalking horse for adjustments to the limited partnership legislation. This would enable PE managers to bring their entire structure onshore instead of keeping the fund entity in Cayman.

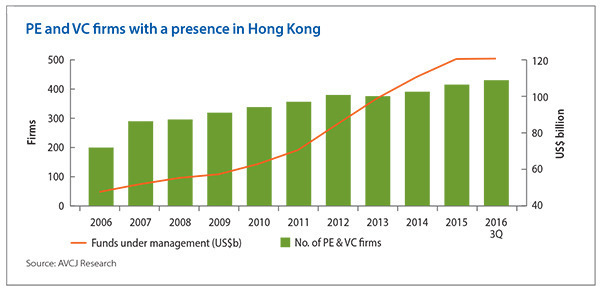

The exemption extension came into force in 2015 and the OEIC ordinance is in development. But Hong Kong threatened to derail its ambitions earlier this year when the Inland Revenue Department (IRD) published practice notes relating to the profits tax exemption. While several provisions are seen as incredibly limiting, another came out of leftfield: the IRD announced it would tax carried interest as income rather than capital gain. Several months and various lobbying efforts later, the uncertainty remains.

"The HKVCA [Hong Kong Venture Capital and Private Equity Association] was a little surprised the IRD would issue a practice note on this complex subject without some consultation," says John Levack, managing director of Electra Partners Asia and chairman of the HKVCA's technical committee. "Hong Kong now has the unwelcome distinction of being the only major private equity center that has emphatically declared that carried interest will be treated as income for tax purposes."

Specifically, two-and-a-half pages out of the 37-page Departmental Interpretation and Practice Notes No. 51 (DIPN 51) address taxation of the investment manager. It states that carried interest received by the investment manager outside of Hong Kong could be targeted under anti-avoidance provisions and taxed as income onshore, at the corporate or individual level.

Out of the audits

The origins of the IRD's policy approach lie in audits carried out of assorted Hong Kong-based alternative asset managers, dating from 2013. More than 50 audits were completed, targeting a wide range of entities, and the focal point was transfer pricing.

Most Asian PE firms establish an investment manager in Cayman, which in turn incorporates a GP and sets up a fund in the same jurisdiction. Advisory entities are then created in Hong Kong and other relevant locations, where much of the activity takes place. The 2% management fee accrues to the holding company and it remits sufficient cash to the advisory entities to cover their costs plus 5-10% extra, and that relatively small slice of profit is taxed locally.

"These are transactions between affiliates - not arm's length transactions - so you have to use a transfer pricing concept to figure out how to price those services," says John Fadely, a partner at Weil. "The IRD looked at where the value was being generated and decided that considerably more of the fees should be left onshore and taxed. But the focus of those audits was not carried interest."

Carried interest came into the equation over the course of these audits, notably when some PE firms disclosed their carried interest payments to the regulator. Working from the hedge fund model, which features performance fees that are taxed as income, the IRD concluded that these payments made to the employees of advisory entities constituted a disguised management fee. It deemed they should in fact be treated as a service fee and taxed locally.

DIPN 51 may represent the first time carried interest has appeared alongside the tax exemption extension in document form, but the IRD had already hinted at its views in earlier forums. Anthony Lau, a tax partner at Deloitte, recalls the matter being raised at the 2014 annual meeting of the IRD and the Hong Kong Institute of Certified Public Accountants (HKICPA).

"The IRD did mention it, though indirectly. They did not use the term carried interest, but if you look at the minutes, the interpretation is that the IRD cited an example where management fees and performance fees payable in the form of dividends or distributions would be considered as sourced in Hong Kong and subject to local tax if they were derived from asset management services rendered in Hong Kong," he says.

Given the relatively small amount of space in DIPN 51 devoted to the complicated and often contentious issue, numerous questions have yet to be answered. In particular, the document says that anti-avoidance provisions will not be applied "to arm's length return on genuine investment in the fund," with an arm's length return defined as one that is comparable in size to those accruing to third-party LPs. No further detail is given on what qualifies as a genuine investment or how one quantifies an acceptable return.

Nor is it clear how the IRD would apportion carry if, for example, a pan-Asian manager with a presence in multiple jurisdictions made the argument that most of the value in its investments was being produced outside of Hong Kong. "That's when you scare an entire industry - when you say you have the right to potentially tax every dollar of profits but you don't say how you're going to do it, or even give the industry much of a clue," says Weil's Fadely.

Principals and principles

The context of the IRD's approach, which flies in the face of international norms, is also somewhat confusing. Hong Kong runs budget surpluses so there is no imperative to introduce a capital gains tax to boost revenue, but at the same time there is political sensitivity around a small portion of the financial services community paying no local tax on a large amount of their income.

The IRD may have considered that even with a 16.5% corporate income tax, covering fees and carry, levied on advisory entities, the overall rate would still be lower than in Europe and the US, where capital gains are taxed. It therefore may not be seen by the IRD as detrimental to Hong Kong's competitive position. (In addition, it is worth noting that the legislation has different implications for individuals, based on whether their home country has a global taxation policy and the extent to which it is enforced.)

However, these factors are arguably secondary to how the IRD justifies treating carried interest as income in the first place. "The overall tax rate may still be lower than in China and the US, but that's not the point - it is a matter of principle," says Lorna Chen, a partner at Shearman & Sterling. "There is a fundamental difference between ordinary income and capital gain; one is your salary and bonus, the other is your investment return."

As Electra's Levack observes, other jurisdictions have recognized that "principals" in PE firms who make substantial financial commitments to new funds every 3-4 years are not just employees; they are given a "promote" on their equity commitment in the same way that entrepreneurs receive value for the knowledge they bring to a new venture. In trying to accommodate the IRD's approach, though, treatment may vary based on the nature of this commitment.

The founders of a private equity firm who have accounted for the bulk of the GP commitment across multiple funds - and have put a lot of labor into building up the firm - have grounds to claim that the distributions they receive back represent a capital gain. For more junior employees it can be harder to make the distinction between capital gain and a performance bonus paid to an investment banker, which would be taxed as income.

For example, in cases where team members do not contribute to the GP commitment, any carried interest they receive from an unallocated pool is more likely to be considered income. Attitudes towards carried interest vary among PE firms in Asia. While some global players already report distributions from unallocated pools in returns filed with the IRD - on the basis that it is a discretionary bonus controlled by the manager - smaller firms are said to have been lax in their approach, dolling out carried interest on a deal-by-deal basis without supporting paperwork.

"I would suggest all groups review their own cases. Some arrangements are very solid, and definitely not a tax avoidance mechanism. People put in money, it is properly documented and there is no reference to employment status in the document," says Florence Yip, Asia Pacific tax leader for financial services at PwC. "Others have no documentation at all. A person might have been supposed to contribute capital several years ago but didn't - maybe the founder didn't want to impose the requirement on junior team members - and so when the windfall comes it looks like a bonus."

Suggestions have been made as to how carried interest arrangements for more junior employees could be placed in a structure that is acceptable to regulators and offers clarity to the industry. One is to plug existing carried interest plans into employee stock ownership plans (ESOP). Participants would be taxed based on the value of carried interest units when they receive them. For those who join early, valuations would be low because at that point no one knows how much return is likely to be generated. Once the investment period begins, the value of these rights would rise.

"When granted the carried interest unit, an investment professional offers tax based on the fair market value of the unit at the time. It will be on the low side because the fund has not made any investments. Any subsequent distribution from the carried interest unit would be considered personal investment, because tax was paid when the unit was granted," Deloitte's Lau explains.

Best-case scenario?

A climb-down on DIPN 51 is seen as unlikely but most advisors are hopeful of some kind of compromise solution. This doesn't necessarily mean further guidance is required, rather that the IRD does not enforce as aggressively as the document suggests it might. According to several industry participants, the rhetoric is already being dialed back, with the IRD saying it will prioritize cases in which managers are abusing the system by reclassifying management fees as carried interest in order to avoid tax. However, criteria for such actions are unknown.

"I am not confident we will get any further guidance on this issue and some are questioning whether we need it. If we continue to push for further guidance we may not be happy with the guidance we receive," says Darren Bowdern, a Hong Kong-based tax partner with KPMG. "We don't want to see anything that might really jeopardize the funds industry and make Hong Kong less competitive vis-à-vis Singapore."

Any debate about policy uncertainty in Hong Kong inevitably turns to Singapore - which at present does not tax carried interest, although no definitive statement has been released on the issue - and the chances of PE firms relocated their staff from the former to the latter. While there might be some leakage, the consensus view is that Hong Kong still has enough to recommend itself in terms of geography and human capital.

However, the situation does not inspire confidence in Hong Kong's professed ambition to create a domestic funds industry. It asks questions of the regulatory and political will to make the changes to the limited partnership legislation and accompanying onshore exemption required to make the system work. Moreover, in seeking to re-characterize carried interest as management fees, the territory has deviated from the international norm.

"The question is whether or not this is a good idea in terms of the image that Hong Kong is trying to present," adds Shearman & Sterling's Chen.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.