Portfolio: VIG Partners and Samyang Optics

When VIG Partners acquired Korea-based Samyang Optics, the company was a camera lens manufacturer with untapped potential. It is now looking to challenge the global elite

Feedback on Samyang Optics' first foray into the auto-focus camera lens market has been positive: from Amazon to B&H Photo Video to the handful of blogs that offered detailed reviews of the AF 50/1.4 FE in July, all bestowed it with at least four stars out of a possible five. The company has since released two more auto-focus lenses, all designed for Sony cameras, and plans to follow up with customized Canon and Nikon products in 2017 and 2018, respectively.

It represents an ambitious push into a new market for Korea-based Samyang, which built its reputation on manual-focus lenses, but the move is seen as essential to the company's long-term growth. Less than one third of photographers who use cameras with interchangeable lenses opt for manual focus - and they are by necessity the most experienced and able practitioners. The question is whether Samyang can find the right balance between quality and affordability (the AF 50/1.4 FE sells for $699; a comparable Sony product with a Carl Zeiss lens is listed at $1,500) to appeal to a broader market.

"We want to go from being a niche player well known among serious photographers to a brand used widely among weekend, amateurs and family photographers," says Jason Shin, managing partner at VIG Partners, which has owned Samyang since 2013. "When we took over the company its global market share was about 2%, and now it is 3-3.5%. By the time we exit we want to be at 5%, and we will have achieved a great deal if we get that."

Missed opportunities

Canon and Nikon are the dominant players in the DSLR camera segment, with the likes of Sony, Olympus and Pentax trailing some distance behind. These are also the major lens manufacturers - with an estimated more than 60% market share - because users buy native lenses alongside their cameras.

The remaining 40% is divided up between specialty players; brands photographers might turn to when they want specifications beyond those offered by camera makers. This group is led by Sigma, Tamron and Tokina in Japan, Carl Zeiss in Germany, and Samyang in Korea. Samyang and Carl Zeiss are alone in having thus far specialized in manual-focus lenses.

Samsung Electronics' gradual withdrawal from the camera market, which began in 2013 when the digital imaging division merged with the mobile phone business, should have been a boon for Samyang. However, the company wasn't set up to take advantage of the opportunity.

Founded in 1972, Samyang started out producing interchangeable lenses for film cameras. With the advent of digital devices, which didn't require interchangeable lenses, the company diversified into manufacturing lenses for CCTV cameras. When that area also became challenging, chiefly because the barriers to entry are low and dozens of Chinese players flooded the market, Samyang should have refocused its efforts on interchangeable lenses, capitalizing on how technological improvements was driving demand for DSLR cameras.

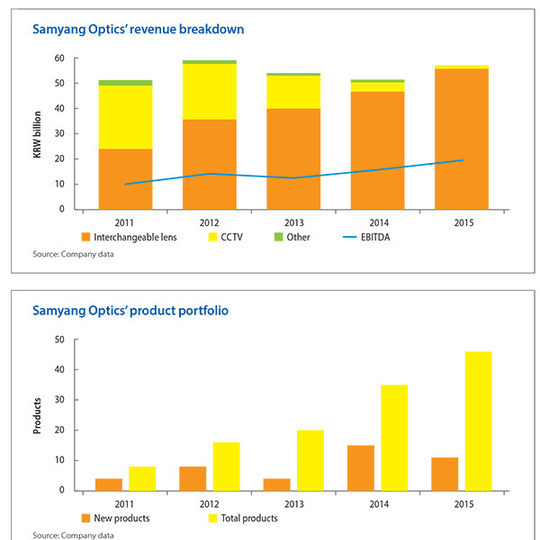

But the opportunity was largely missed. Although the CCTV lens business was low margin and in decline, with most of the EBITDA coming from interchangeable lenses, as recently as 2011 the latter accounted for a smaller portion of the revenue than the former. It didn't help that, for years, earnings generated by Samyang had been used to support the owner's attempts to branch out into other industries, ranging from biotechnology to electric car batteries.

"The owner was sitting on a business but didn't figure out exactly what type of business he had," says Shin. "This is because he and his associates saw the company as a piggy bank and they didn't really pay attention to operations."

When the owner ran into financial difficulty as a result of these other ventures underperforming, VIG suggested that Samyang be carved out and the proceeds used to pay off creditors and pay out minority shareholders. The PE firm also put forward an expedited timeframe for achieving this, and duly won exclusivity. It acquired 100% of Samyang in August 2013, paying KRW68 billion, including KRW25 billion in debt. This equated to a relatively low multiple of 4.8x trailing EBITDA, in part because of an agreement to make an additional payment to the founder on exit, should the IRR clear a certain threshold.

On taking up ownership, VIG moved swiftly to wind down the CCTV business and concentrate on interchangeable lenses. Revenue has been flat during the ownership period thus far, reaching KRW57.2 billion in 2015. However, the CCTV contribution fell from KRW13 billion in 2013 to KRW3.7 billion in 2014 and will be zero this year now the inventory has been cleared. Revenue from interchangeable lenses, meanwhile, has risen nearly 40% to KRW55.8 billion. EBITDA has jumped 57% to KRW19.5 billion.

"It was clear the company should discard the CCTV lens business and focus on expanding the manual lens product groups and also enter into the much larger auto-focus lens market, which accounts for roughly 95% of industry revenue globally," says Choong-Hyun Hwang, CEO of Samyang.

Changing of the guard

A veteran of Samsung's camera division, Hwang was well positioned to know. He had left the company as the division was scaled back and VIG recruited him to support the Samyang due diligence process. For five out of the six control investments in its second fund, the PE firm has brought in industry advisors to complement work carried out by the investment team and external consulting firms. In most of those cases, the industry advisor has gone on to lead or hold a senior position in the new management.

With Hwang in place, VIG also hired a CFO who had previously worked for another of its portfolio companies and a CTO who was formerly head of camera R&D at Samsung. Replacing entire management teams is not unusual for the GP.

"We tend to buy $100-200 million companies from chaebols or family owners. If it's a small asset within a chaebol group, you won't find the best management talent there. And when you have family owners running a business it tends to be family members or family members' long-time associates in the management positions. They aren't going to be the industry best either," says Shin. "If we find people who are good within a company we don't mind retaining them, but more often than not we end up replacing them with the best management we can source in the respective industry."

It was also necessary to make changes in Samyang's distribution network. About 40% of the company's products are exported to the US and VIG switched to a single distributor rather than the previous arrangement of two players that tried to undercut one another. In Europe - which accounts for another 40% of sales - the situation was even worse: a single, small-scale group in Poland was responsible for every market. Samyang now has 17 distributors across Europe, with established relationships in each major country.

Beyond that, substantial modifications were required to the product portfolio itself. In 2013, the company only offered 20 different types of lens, compared to the 50-plus ranges of most global players. With 15 new products rolled out in 2014 and 11 in 2015, the launch of the auto-focus lenses alongside other products this year has taken Samyang to the industry standard level.

Much of the initial focus was on video lenses, leveraging the fact that more people now shoot video on interchangeable lens cameras. Revenue from video lenses has more than doubled during VIG's ownership period, reaching KRW24.2 billion in 2015. The product line includes a set of six cine lenses that cater to professional filmmakers.

"With six cine lenses and three auto-focus lenses, new segments account for one third of the new products launched since 2013," says Hwang. "Samyang is the only manual focus lens player that also specializes in video lenses, capturing a sizeable market share in that area. With our knowhow and competitive advantages, we can expand our product categories into much more high-end complex lenses."

Even within the auto-focus lenses, the company is pursuing an element of differentiation, choosing to focus on single-lens products whereas many of its competitors mainly offer zoom lenses.

Talent spotting

If Samyang is to replicate its success with manual-focus lenses in the auto-focus segment, securing a reputation for producing high-quality products at affordable prices, it has to stay ahead of the game in terms of technology. In this sense, Samsung's withdrawal from the camera market is beneficial because it freed up a lot of local talent, much of which has already been recruited by Samyang. Nevertheless, recruiting staff is often a long and frustrating process, particularly when trying to tempt professionals from the DSLR powerhouses of Japan and Germany.

"Getting R&D talent in an industry where there are few players and few people, that is the biggest challenge," says Shin, who notes that Samyang has managed to recruit several experienced industry professionals from Samsung and from Japan.

As such, Hwang is somewhat guarded about the company's prospects in auto-focus lenses, pointing out that so far only three products have been released for a single brand of camera (while most manual-focus lenses will work on any DSLR device, auto-focus products will not). The reviews have been strong, but much rests on Samyang delivering quality products for Canon and Nikon devices as well. He describes the company's strategy as "eating away at the market share that larger players enjoy," with an increase from zero to 1% considered a significant win.

Hwang does, however, believe in Samyang's longstanding competency and the fact that this resonates with users. Indeed, when Samsung entered the camera space 20 or so years ago, it received technical assistance from Samyang.

From a VIG perspective, the most likely exit is a trade sale. This could be an international company that sees Samyang's R&D abilities and global brand as complementary to its own product line-up; a Chinese player seeking to climb the value chain; or even a second or third-tier Korean conglomerate that already distributes products to some of the same markets.

Shin has confidence in Samyang's enduring value for two main reasons. First, unlike CCTV lenses, there are substantial barriers to entry in the exchangeable lens market. Samyang and its peers have a strong hegemony and most industry observers do not expect to see them challenged by new arrivals for a decade or more. Second, the company is sufficiently well-regarded in the manual-focus segment that it should be able to retain some momentum when rolling out more auto-focus lenses.

"If the due diligence process had led us to conclude that these guys were completely unknown and would need to get themselves known as a quality manufacturer, we would never have invested," Shin says. "Brand awareness is the hardest obstacle to overcome. Fortunately, the Samyang brand - known as Rokinon in the US - is well known. We looked at hundreds if not thousands of reviews and there was uniformly positive feedback."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.