3Q analysis: Deep pockets of the state

Fundraising hits a record quarterly high, thanks entirely to Chinese government-backed vehicles; Australia, Southeast Asia compensate for investment slowdown in China; India shines on exits

1) Fundraising: An anomaly in China

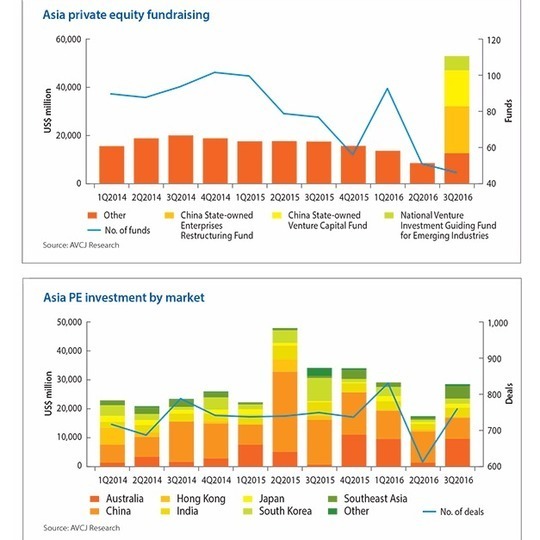

At $53.3 billion, the amount committed to Asia-focused private equity funds during the third quarter of 2016 represents a record high - and by some distance. However, the results do not indicate a surge in conventional institutional interest in the asset class. What is happening is government-fueled Chinese fundraising on a scale never seen before.

To put the statistics for the July-September period in context, the total is roughly equal to the sum raised across the full 12 months of 2014, according to provisional data from AVCJ Research. It is also more than double the second-highest quarterly total on record, which came in 2011 when renminbi-denominated fundraising - on a commercial as well as a government-driven level - was at its peak.

Three funds account for $0.75 of every $1 raised in the third quarter. First, the China State-owned Enterprises Restructuring Fund, which launched in September with a target of RMB350 billion ($52.5 billion) and initial contributions of RMB131 billion provided by nine state-owned enterprises (SOEs). The State-owned Assets Supervision & Administration Commission (SASAC) will appoint a professional manager to operate the vehicle, with a remit to drive industrial upgrades and structural reform.

Second, the China State-owned Venture Capital Fund raised RMB100 billion towards an overall target of RMB200 billion. It has similar backers and a similar strategic objective to the restructuring fund - and will also be operated by a SASAC-backed manager - but the focus will be on technology companies. Third, the National Venture Investment Guiding Fund for Emerging Industries, which was launched last year, achieved a final close of RMB40 billion. Technology is again the priority but the format seems somewhat different: the fund will make allocations to several managers based on an open tendering process.

Given the level of state involvement, the significance of the first two vehicles is not their impact on private equity fundraising, but the insights they offer into the government's approach to SOE reform - which may have implications for broader private equity deal flow. China has experimented with mixed ownership as a means of introducing private sector best practice to SOEs without ceding government control. Early indications are that it will largely remain a game for local players, although strategies will vary, depending on the size of the asset, the sensitivity of the sector, and political expediency.

Restructuring funds appear to offer flexibility in reform, whether it means leading consolidation efforts in highly fragmented industries, supporting established businesses that are introducing mixed ownership, or serving as the parent of holding entities for assets that require considerable restructuring. If they are to be successful, much rests on the quality of management.

Discount these three government behemoths and the third quarter fundraising statistics look more familiar: a total of $12.6 billion was committed, which is approximately $1 billion lower than the average for the previous four quarters. The general trend of fewer closes - the AVCJ data include incremental and final closes - continues, with the total slipping below 50, although more fundraising activity may subsequently become apparent.

Even without the big three, appetite for China exposure appears to be robust as capital entering country-focused, US dollar-denominated vehicles reached $5.6 billion. The $5 billion threshold hasn't been passed since the second quarter of 2014. It helps when there are high-quality sponsors in the market, and China doesn't have that many.

Leading the way in the third quarter was FountainVest Partners, which closed its third fund at $2.1 billion in September (although the bulk of this counted towards the second-quarter total, when the GP made a substantial first close). Boyu Capital also completed fundraising for its third vehicle, with $2 billion in commitments, while IDG Capital Partners chipped in with $1 billion for a venture capital fund raised in conjunction with Breyer Capital.

The quarter was also notable for the showing made by managers with specialist strategies. Hong Kong-based Kerogen Capital closed its second energy fund - a global vehicle with an Asia angle - at $830 million and CDH Investments received commitments of $526 million for its latest local currency China mezzanine vehicle. Other China specialists include Ocean Link, a private equity firm focused on travel and tourism that received $400 million in seed capital, and CMC Capital Partners, which reached a first close of $350 million on its second US dollar media fund.

2) Investment: Australia, SE Asia to the fore

Large rounds for Chinese technology companies have been a key driving force of private equity investment activity - in terms of headline numbers - in recent quarters. Between July and September there was nothing of significant size, which was in part responsible for investment in China falling to $7.3 billion, the lowest quarterly total since the first three months of 2015. Usually a ubiquitous presence in the ranking of largest deals, the country was responsible for just four of the 15 largest transactions.

Private markets investment in Asia as a whole did manage to improve on the weak showing in April-June as $28.6 billion was deployed. Buyout deal value increased more than five-fold quarter-on-quarter, largely thanks to the A$9.7 billion ($7.3 billion) paid by a consortium comprising China Investment Corp, Future Fund, Global Infrastructure Partners, Ontario Municipal Employees Retirement System and QIC for a 50-year lease on Port of Melbourne.

However, ample support came from Southeast Asia, which saw its most active quarter in nine years: a total of $4.3 billion was deployed. While this included Temasek Holdings' portfolio management exercise involving its telecom assets, there were also sizeable deals such as CVC Capital Partners' privatization of Malaysia-listed funeral services business Nirvana Asia and funding rounds for Southeast Asian taxi-booking app Grab and its Indonesian near-counterpart Go-Jek.

3) Exits: India delivers

The mismatch between the amount of capital entering Indian private equity between 2006 and 2008 and the amount that came out over the ensuring five years has been the source of great LP dissatisfaction. In recent years, though, exits have picked up, rising from an annual average of $4.7 billion for 2011-2014 to $13.2 billion last year and $8.8 billion so far in 2016.

Each quarter of the year has delivered a trade sale of $1 billion or more, with Welspun Renewables, Alliance Tire Group and most recently Gland Pharma. KKR is responsible for the latter two, realizing estimated proceeds for investors in excess of $1.5 billion.

The sale of Gland Pharma, which will see the private equity firm exit its 38.4% interest as Shanghai Fosun Pharmaceutical acquires a majority position in the injectable drugs manufacturer for up to $1.26 billion, was announced in July. It contributed to India delivering a third consecutive increase in quarterly exit value, with $3.9 billion transacted. The number of disclosed transactions - 40 - was the most recorded since April-June 2014.

Of the 25 largest private equity exits in the third quarter, based on overall deal size, India accounted for nine, an unusually large share. They include several middle-market success stories. First, Capital Square Partners and CX Partners agreed to sell business process outsourcing firm The Minacs Group to US-based Synnex for $420 million, having bought the asset for $260 million in 2014. This was followed by Kedaara Capital receiving a combination of cash and stock as Mahindra CIE Automotive acquired Bill Forge for INR13.1 billion ($200 million). The GP paid INR3 billion for its 46.9% stake in early 2015.

There were also exits on the venture capital side, with Netherlands-based PayU acquiring Citrus Pay for $130 million - generating cash returns for Sequoia Capital, Ascent Capital and Beenos - and Matrix Partners selling its interest in TCNS Clothing to TA Associates as part of a larger $140 million investment.

Private equity exits in Asia as a whole reversed the downward trend of recent quarters, coming in at $12.6 billion, up from $7.9 billion for the previous three months. There was an uptick in open market sales, secondary exits and trade sales in terms of overall proceeds and transactions announced. Open market sales included CDH Investments offloading $1.2 billion worth of shares in WH Group - a much-needed liquidity event involving a company that CDH has backed across four funds, starting in 2006.

There was more good news for private equity-backed IPOs as proceeds reached $12.8 billion for the July-September period, following two quarters of relative weakness. India was again well-represented with five of the 20 largest offerings completed in the region, including ICICI Prudential Life Insurance, L&T Infotech and RBL Bank.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.