China regulation: Low-gear revolution

A nationwide extension of the relaxed foreign investment policies available in China's free trade zones should simplify a cumbersome deal-making environment. Wider sector openings, however, remain on hold

A spate of foreign investment reforms in China has given investors a lot to speculate about but not much more to do. One of the standout developments in recent weeks has been a decision to adopt a nationwide negative list scheme. This system - already used in the country's free trade zones (FTZ) - allows foreign investors to sidestep significant filing protocols in any target industry that is not on the list.

The administrative easing - along with an expansion of the number of FTZs and ongoing bilateral investment treaty negotiations with the US - suggests a sincere and concerted government initiative to reduce bureaucracy that restricts inbound deal flow. In the broad arc of Chinese foreign investment reform, these moves represent part of a logical progression toward a streamlined regulatory environment based more on corporate governance rules than a web of redundant oversights.

However, all these efforts have been kept in check by a consistent conservatism over allowing foreign investors to take controlling stakes in domestic companies, as well as what appears to be an ominous sense that any major overhaul would be irreversible. "China's door, once open, is unlikely to be closed," Chinese Premier Li Keqiang recently told business leaders at a roundtable discussion in New York.

While investors will certainly benefit from the latest round of liberalizations, they must remain conscious that the opening up of Asia's largest economy is set to tick along at two different speeds. Under the new rules, currently realistic inbound M&A strategies will benefit from a substantial step toward international approval process standards - but onshore M&A plans in some of China's most sought-after investment areas will have to remain in long-term limbo.

Policy breakthrough

Given four FTZs have been established over the last three years, the announcement of seven new zones - including a number of inland locations such as Chongqing, Hubei and Sichuan - is significant. But the policy development that drew most attention is how a project piloted in these zones, which serve as test beds for relaxed legal frameworks for international trade, will roll out nationwide.

One of the primary attractions of the FTZs is negative lists for foreign investment, which replaces the Foreign Investment Industry Guidance Catalogue, a policy document used nationally since the 1980s. What the FTZs essentially offer is lighter touch regulation: investments in sectors excluded from the negative list do not require approval from the Ministry of Commerce (MofCom), which speeds up the transaction process.

Implementing an FTZ-style negative list throughout China will not make the zones irrelevant. They will continue to offer enhanced foreign ownership limits such as in the human resources sector, where foreign control of up to 70% is permitted; outside the FTZs overseas players should remain limited to minority investments. Special dispensations will also remain in the zones for local companies looking to invest overseas. Only about 10% of companies operating in the FTZs are based outside of China.

"What's going to happen with this new regulation is still a bit vague, but hopefully it will be more harmonized between markets, and foreign investors will get a clearer picture of what they can do in China," says Thibaud Andre, senior consultant for Daxue Consulting in Beijing. "That would really change a lot of things because that's been the problem for many years."

Although the nationwide negative list was set to come into force on October 1, this date coincided with the week-long National Day holiday, and details remain scarce. The list is expected to essentially reflect that of the Shanghai FTZ, with about 120 items subject to various levels of scrutiny.

Full prohibitions will continue in certain types of mineral exploitation and a wide range of telecommunication services. Many cultural industries are completely off limits as well, including Chinese traditional arts, gambling and even golf course operation. Foreign ownership of car manufacturing joint ventures under Shanghai zone rules is limited to 50%, as is outside investment in life insurance companies.

Low expectations for a broad relaxation of these foreign ownership caps have highlighted likely shortcomings in the near-term investment picture - especially for those already accustomed to maneuvering the red tape with dependable legal workarounds.

"I hear people say there might be certain instances in which the required time it takes to get an approval can be a deal-breaker, but in terms of foreign investment approvals, it's never been seen as a problem - except for some specific deals with unique circumstances - because people just get used to the old regime over time and run with the procedure," says John Gu, head of China deal advisory and M&A tax at KPMG. "But that's also why there are more offshore transactions doing indirect acquisitions of onshore companies in China. You don't need to go through the specific MofCom approval or changes in the corporate licensing required for onshore M&A transactions."

Investors encouraged to pursue these indirect investments have become comfortable with the necessary alternative deal structures. But as the new rules are yet to be fully confirmed, new untested deal structures may eventually become necessary, creating additional uncertainty.

More disappointment could surface as details emerge about an apparent broadening of the definition of control beyond equity percentages to encompass investors with any material interest in a company's operations. Shanghai FTZ investors have so far been considered to have control at a participation rate of 51%, but under the nationwide negative list terms, foreign firms with minority stakes could be subject to additional, still unspecified rules.

"It's curious because what they've done with these amendments is kind of halfway between the old regime and the new regime that is contemplated by the draft Foreign Investment Law," says Paul McKenzie, Beijing-based managing partner at Morrison & Foerster. "But it's not yet clear how this will work."

Silver linings

Despite this cloudiness, insights about the practical roll-out and repercussions of negative list plans on a national level may still be gleaned from recent evolutions in the FTZs. A 2014 revision of the Shanghai list, for example, demonstrated a willingness to expand entry opportunities in sectors prioritized for growth, including printing technologies and automobile electronics. The same year, a pending boom in domestic healthcare needs inspired the elimination of a RMB20 million ($3 million) minimum investment threshold for health sector deals along with a 20-year limit on operating medical institutions.

Cracks have also begun to appear in the normally impenetrable media space, as exemplified by the recent lifting of bans in the cybercafé and video game console industries. Foreign ownership in e-commerce joint ventures, meanwhile, has been opened up slightly from 50% to 55%.

"From the kinds of requests we're getting right now and what's already going on in the free trade zones, anything related to healthcare and education will probably see more foreign investment in the near future," says Daxue's Andre. "If you look at it case-by-case and market-by-market, there could also be some impact from the new regulations in cross-border consumer."

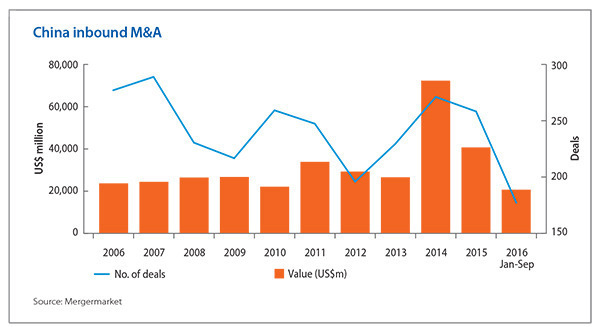

These reforms have largely been driven by concerns that insufficient support for foreign investment will hamper access to crucial long-term growth inputs such as technology and talent. The sense of urgency has been heightened with new data indicating that overall outbound investment has eclipsed inbound investment for the first time in China's history. In M&A terms, these diverging trajectories are exacerbating an already lopsided picture, with the value of outbound deals last year amounting to $87.7 billion versus only $25.2 billion for inbound.

"You hear from some members of the Chamber of Commerce that have concerns about certain industries not being opened up fast enough or wide enough to accommodate their companies getting into the China market," says KPMG's Gu. "The international community wants China to open up more, but I don't know if it's the case that the negative list regime is trying to achieve that objective."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.