China sports M&A: They shoot, they score?

China wants to develop its sports industry, with football a priority, prompting numerous investors to look for overseas assets in the name of government policy. Their rationale is often divorced from reality

Five years ago, Chinese President Xi Jinping shared his three wishes for the men's national football team: qualify for another world cup, host a world cup, and win a world cup. These ambitions have gradually crystallized into concrete policy, with the government announcing earlier this year that it wanted China to become a "world football superpower" by 2050, with a squad capable of challenging for the top prizes.

This grand ambition is in keeping with the emergence of sport as a national strategic priority. The industry is expected to be worth RMB5 trillion ($750 billion) by 2025, up from the $62 billion last year, according to a State Council blueprint published in 2014. Football will spearhead this development. Over the next 10 years, the number of adults and children participating in the sport will is intended to reach 500 million, with at least 20,000 soccer training centers and 70,000 pitches at their disposal by 2020.

Corporate and financial investors are keen to leverage this trend. Huge sums of money is being poured into the domestic league and attention has now turned to overseas assets. In the past 12 months, nearly 20 European football clubs have received Chinese capital. Several buyers have set out clear agendas: to help monetize growing Chinese interest in the world's most popular leagues (with the English Premier League front and center), and almost as a by-product, strengthen the sport domestically by bringing in the best management expertise, training techniques and players.

However, some of the investors - typically high net worth individuals or consortiums - are as mysterious as the 2050 ambition is bold. They are entering an industry far removed from their core businesses, and while they may profit from a general appreciation in the value of these assets, it is unclear whether the China angle can be fully realized. Football therefore represents an extreme example of the outbound investment story in a sporting context, but the same question can be asked of Chinese buyers across the industry: Do you have a realistic end-game or are you simply holding a trophy asset?

"China's sports industry is in the infant stage, having previously been operated by the government. The foundation is almost zero. If you want to grow the market to RMB5 trillion, you need to bring in new content and different assets. Therefore, sport-related investments and acquisitions will continue in the short-to-medium term," says Stella Yuan, China central leader at EY's transaction advisory services practice.

Opening up

Sport contributes 0.7% of China's GDP compared to 3% in the US. The expectation is that China will follow a similar path to developed markets and witness a blossoming in consumer demand for health and lifestyle activities as household incomes rise. Government policy is also playing a role, offering tax cuts for companies operating in the sports industry and minimizing the regulatory bureaucracy surrounding domestic and foreign investment.

Shenzhen Tianrong Investment, which was founded in 2005, focuses on water sports events; it holds the domestic rights to the Formula One Powerboat World Championship. Haobo Zhao, an investment director with the firm, has been encouraged by the government's commitment to sport since 2012, including investment in infrastructure, cultivating sporting activities beyond football, and insisting that physical education is taught in schools.

"The government will further open up the sports industry to private capital over the next 10-15 years," he adds. "We can now invest in local stadium projects, sports events and coach recruitments. Those opportunities didn't exist before."

Policy support is one of the reasons why investors are targeting domestic football. Alibaba Group bought a 50% stake in Guangzhou Evergrande, one of the leading local teams, in 2014 and then last year broadcast rights the Chinese Super League were sold for RMB8 billion. This was the first time the rights were put up for sale through a free auction, and it was won by Tiao Power, a company backed by CMC Capital Partners. It will air 30 matches a season over five years, starting from 2016.

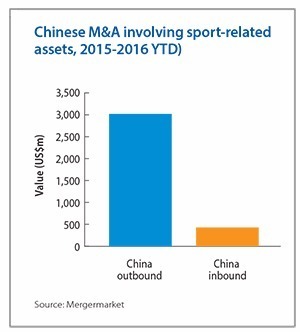

However, investments in domestic sport are dwarfed by those overseas. Mergermarket has records of 23 announced overseas sport-related M&A transactions involving Chinese groups since the start of 2015, worth a combined $3.3 billion. Football accounts for eight of these and for $1.07 billion of the capital committed. Over the same period, the domestic industry has seen six deals totaling $432 million.

Dalian Wanda Group became the first Chinese investor in a European football club in January of last year, buying a 20% stake in Atletico Madrid - ranked among the top three clubs in Spain alongside Barcelona and Real Madrid - for EUR45 million ($50 million). Electronics retailer Suning then acquired a 70% interest in Italy's Inter Milan for EUR270 million.

CMC Holdings - an investment platform set up by CMC Capital Partners - and CITIC Capital were the first financial players to find their way into the English Premier League (EPL), paying $400 million for a 13% stake in Abu Dhabi-based City Football Group, which owns the Manchester City and other related businesses. Aston Villa and West Bromwich Albion in England and AC Milan in Italy now have Chinese owners as well.

For all the talk about monetizing these assets in China, the opportunity to flaunt one's wealth in a high-profile arena is also a motivating factor in these deals, as has been the case in other sports. "People don't do it for the financial returns alone, some of them love football so they want to own it - just like when former Microsoft CEO Steve Ballmer bought the LA Clippers for $2 billion," says a Chinese investor who owns a basketball franchise in China. "It's hard to say how much these assets could be worth at some point. It's a bit like buying real estate; you know how much you get when you sell it."

Wanda has also made acquisitions beyond football clubs, in keeping with its strategy to transition from a property developer to a service-oriented company with a competency in sports and entertainment. These include World Triathlon Corporation (WTC), the leading global operator of Ironman events, which was bought from Providence Equity Partners for $650 million, and Infront Sports & Media, a marketing specialist picked up from BridgePoint Private Equity for $1.19 billion.

Killer content

As a major player in the distribution of television and media rights to sporting events, Infront represents a different - perhaps more clear-cut - approach to monetizing the industry in China. Beijing Baofeng Technology, an A-share listed internet and technology company, and Everbright Securities followed up by acquiring MP & Silva, a rival to Infront with a strong interest in European football. The deal is significant given Baofeng recently launched an online sports media and social networking division.

"Our purpose is different from other traditional strategic investors when it comes to outbound acquisitions of sport assets," says Shijun Bi, CFO at Baofeng Technology. "Developing a strong internet platform, not only it requires technology, but also to provide meaningful content in order to engage with online users. We want to capture as many viewers as possible on our platform by offering different kinds of matches."

Baofeng is not alone in pursuing content. The size of CMC's Chinese Super League deal - the previous rights holder, national broadcaster CCTV, paid about RMB45 million a year - indicates the perceived potential in domestic coverage, given the recent influx of internationally renowned players and coaches to the league. In addition, several Chinese internet companies have struck deals to broadcast international events in China. Tencent Holdings has an exclusive digital partnership with the NBA, while PPTV, an online video platform owned by Suning, holds the broadcast rights for Spain's La Liga.

Yao Capital, a sport-focused firm set up by China retired NBA star Yao Ming and David Han, formerly CIO at Wanda and managing director at The Carlyle Group, is also targeting broadcast rights, though not the EPL or the NBA. The objective is to build a portfolio of more specialized sporting assets and then participate in the full value chain, from marketing and promotion to the devices through which media coverage is consumed.

"There are still a lot of segments within sport that have yet to be explored, such as the lottery business, hardware devices, games, nutrition, big data, and broadcasting technology for both traditional TV and internet platforms," says Han. "The market for European football clubs is definitely over-heated and over-invested by Chinese groups. It is not a priority for us."

Certainly, the EPL broadcast rights, which are put up for tender every three years, are seen as a bellwether for strategic interest in English football clubs. At the start of the year, a contract worth GBP8.3 billion ($10 billion) was agreed for the three 2016-2019 seasons, up from GBP5.5 billion in the previous cycle. The foreign rights, which cover 80 different geographic contracts, jumped from GBP2.2 billion to GBP3.3 billion.

Several industry participants link this substantial increase in value to growing interest from Chinese investors - and consequently activity is expected to drop off as the next contract negotiation draws nearer. However, it is not the only reason why the current wave of acquisitions may not last. Of the clubs up for sale, many are heavily in debt and require turnaround capital. While investors like the idea of getting a bargain on entry, the reality is these transactions are difficult to execute.

"During the due diligence process, Chinese investors often ask about football clubs that are in debt or loss-making - their rationale is that the clubs need to find a buyer and so might be worth it," one transaction advisor explains. "But owning a football club requires continued investment, perhaps more than many Chinese groups expect. There are a cultural gaps between the buyers and the club management team. That is why a lot of deals don't get transacted or fall apart."

The sale process can also be lengthy, particularly when the buyers are high net worth individuals. According to industry participants, they often form a consortium and the lead investor negotiates deals without all the financing in place. Once an agreement is signed, the lead investor returns to China and raises capital from third-party investors, and there is no guarantee they will generate sufficient interest. According to Bloomberg, the Chinese investors that bought AC Milan provided a false bank statement during the initial negotiations.

For transactions that are completed, the focus soon switches to how the new owner can help the club expand in China, but often little thought has gone into this. As such, owners are becoming more circumspect when dealing with prospective Chinese buyers.

On the ground

Operational expertise and local networks are the key considerations when building a footprint for foreign brands in China. Yao Capital seeks to deliver this in a sporting context through a combination of Yao Ming's name and the team's industry experience. It recently invested in overseas kickboxing programmer Glory Sports International. As part of the deal, a China joint venture is expected to receive external funding from Yao's industry network, including Le Sports, Tencent-backed online ticketing operator Weiying Times, and World Land, an A-share listed theme park operator.

World Land, which is also known as Songcheng Group, makes for an interesting partner. The company is keen to stage overseas events at its main tourist attractions located in Hangzhou, Sanya and Sichuan, which receive more than 20 million visitors every year. Although the company has formed a sport and entertainment-focused fund to invest in related projects, it opted to back Yao Capital as an LP due to the uncertainties presented by a sports industry that is only just taking off.

"Yao Capital has a strong track record in overseas sports investments. Through their fund, we can source high quality projects from them and identify potential partners to collaborate in China," says Yaowen Xi, an investment director at the firm. "More Chinese investors are now focusing on target companies' operations and profitability; they are not speculating, but looking for good long-term investments."

These investments will likely continue to be primarily overseas, given the lack of quality assets available domestically and the years required to redress this balance, government policy notwithstanding. Indeed, the expectation is that Chinese investors will widen their scope, looking beyond football to other projects that are perhaps more niche but also more strategically sustainable.

"Football clubs are just the beginning, the tip of an iceberg. Often the first wave of Chinese investment is driven by trophy-type assets. Experienced investors will then find better opportunities by digging one level deeper, especially in Europe," says Olivier Glauser, co-founder of China sports management firm Shankai Sports and previously a managing director at Steamboat Ventures. "Football is the most sought after sector, but there are many other sports. I think golf will see a revival in China."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.