Outbound M&A finance: The safer bets

China’s outbound M&A market has taken off in recent years, but many are skeptical that purchasing companies will be able to handle the financial and operational burdens they have taken on

On the face of it, Biostime International's decision to acquire Australian vitamin maker Swisse Wellness was a bold step. Through the buyout the Hong Kong-listed baby formula maker could add a whole new product category and a brand already popular in China through online sales. However, Biostime's subsequent stumbles in executing the transaction have fueled concerns about the ability of Chinese companies to follow through in such ambitious deals.

The seed for Biostime's troubles was laid in the agreement that secured a $450 million bridge loan from HSBC and ANZ last year to complete the transaction. It contained an overlooked equity go-to-market right for the two banks in the event that Biostime failed to refinance the loan, a clause that was tripped in March of this year as the company dragged out negotiations with the banks. It potentially allowed HSBC and ANZ to forced Biostime to issue shares at any time to pay down its debt.

In the event, the banks chose to keep renegotiating the refinancing rather than put the clause into effect; Biostime went on to secure a credit facility from Goldman Sachs of up to $845 million in April to cover the original loan. But the possibility of being forced onto the market meant Biostime was under pressure to conclude the deal with Goldman quickly. In addition, the delay in refinancing the loan meant that by the time it was repaid, the margin on the bridge had risen substantially - and also that the new bridge loan provided by Goldman started with a significantly higher margin than the original.

While the worst-case scenario was avoided, these difficulties highlight the risks of the recent wave of Chinese large-cap outbound acquisitions. Rising demand for offshore assets has created lucrative opportunities, both for sellers of increasingly highly valued targets and for financiers, but Biostime's needless delay in refinancing its debt points up the lack of experience on the part of managers. Observers warn that these borrowers should be kept in check, and that safety valves must be employed in case of mishaps - as proved reassuring for lenders in the Biostime situation.

Outbound awakening

Swisse Wellness represented the first in a flurry of Chinese healthcare-related deals in Australia. Within the last 10 months alone, two transactions involving healthcare providers have been announced: a subsidiary of Luye Pharma bought Healthe Care, Australia's third-largest private hospital group, and China Resources Group agreed to acquire a majority stake in cancer and cardiac care specialist GenesisCare. Then Shanghai Pharmaceuticals teamed up with Primavera Capital on a deal for nutrition and healthcare products provider Vitaco, which listed less than 12 months ago.

Chinese outbound investment in the pharmaceuticals, medical and biotechnology space globally has already reached a record $5.4 billion for 2016, beating the full-year total for 2015 of $3.3 billion, according to Mergermarket. Over the preceding nine years combined, $3.5 billion was deployed in the sector across about 30 deals. There have been more than 40 transactions since 2015.

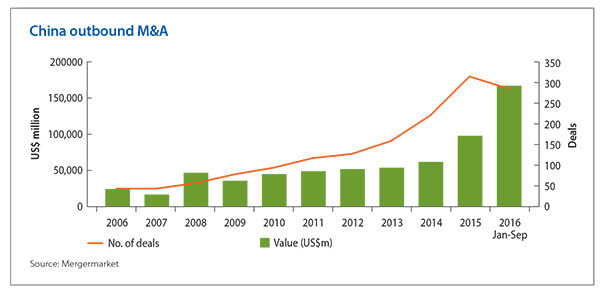

It is a similar story in any sector apart from resources and financial services, where Chinese interest - primarily driven by state-owned enterprises (SOEs) - is relatively longstanding. Led by sharp increases in activity in technology, industrials and consumer, outbound investment has grown more than three-fold over the last three years, while the number of deals has doubled. The 2015 total of $97.4 billion has already been surpassed, reaching $165.8 billion in the first nine months of the year. China National Chemical Corp's (ChemChina) proposed $45.9 billion acquisition of seeds and agrochemicals producer Syngenta accounts for a large portion of this.

Junwei Chen was responsible for six outbound deals completed by ChemChina before moving to Harvest Fund Management where he is now CEO of Harvest Technology Investment, a cross-border private equity unit. He sees no evidence of the outbound trend abating. "In the past six months, of all the chairmen and CEOs of leading companies in China that I have spoken to, no one has told me they don't need internationalization, no one has told me they are not on the path to becoming more internationalized," Chen says.

The rationale behind these deals varies as much as the sectors they encompass. In most cases there is a strategic agenda: the acquisition of scarce resources; getting access to technology or management expertise that can be deployed in domestic operations to make them more efficient; and the possibility for diversification through rolling out foreign brands in China using existing distribution networks. To these can be added more cyclical factors such as policy support, currency arbitrage, and buying growth to support a heady domestic stock market valuation.

The potential upside of transforming a foreign company's performance by tapping into Chinese demand is considerable, and it contributes to a willingness to pay up for the right asset. However, the line between strategic rationale and uninformed opportunism is often blurred, particularly when a buyer - or buyers - have little experience engaging in overseas M&A.

"Some recent deals have been at crazy valuations - we saw one go for 20x EBITDA and it's a European manufacturing business, not healthcare or the internet where you might see rapid growth," says Zhou Yan, a partner at domestic law firm Zhong Lun. "The buyer doesn't even come from that industry; it has paid a high valuation for an asset that is not related to its main business."

Structural issues

This rapid rise in pricing for outbound M&A deals has created an obvious need for financing and considerable opportunities for banks in the region; however, concerns persist about the risk of these transactions and the lack of transparency of the buyers. Efforts to mitigate the uncertainty in this space have generally met with approval, though most industry sources believe the market is still in transition and more changes are on the way.

Structuring on the largest recent deals has tended to consist of at least two tranches: a recourse loan provided to the buyer, usually by Chinese or international banks, requiring the buyer to pledge its assets to repay the loan in case of default; and on the seller side a non-recourse loan, which is raised from the domestic LBO market of the target company and does not involve such a pledge. In ChemChina's purchase of Syngenta, for example, the onshore recourse financing was arranged by China CITIC International, with HSBC handling the offshore non-recourse loan.

Selling shareholders and their backers are not always comfortable accepting a Chinese buyer's commitment to pay its share with a recourse loan, however; due to the difficulty in obtaining Chinese companies' financial information, a seller has no assurance that the asset pledged will be available.

In some cases, a Chinese company's other overseas holdings might be considered sufficient guarantee. If not, to address this concern purchasers will often deposit break fees or other assurance money in an escrow account with a bank located in the target country. This can be a major challenge if a company wins a bid but does not have the cash on hand right away. "You're having to put in a lot of cash upfront for a deal that may not close for months. It's a huge disadvantage," says Soo-Jin Shim, a partner at Weil.

On the other hand, obtaining financing on the buying side has become much easier, thanks to regulatory changes. For instance, companies are no longer required to obtain approval from the State Administration of Foreign Exchange (SAFE) for a foreign acquisition; now they only need to register the transaction. With regulatory approval virtually guaranteed, banks feel much more comfortable lending to companies pursuing these deals.

While international banks saw considerable growth in business when these changes were first put in place, China's domestic lenders have taken on a far more active role after building their familiarity with the transactions. Bank of China (BOC) and China Merchants Bank (CMB) in particular have provided considerable support to domestic companies for overseas buyouts, with international participants finding themselves increasingly outmaneuvered on this front.

"A whole lot of international banks are being crowded out of those financing opportunities, with big, large checks done on very loose, aggressive, flexible terms, with pricing that is very difficult to match," says a source who has worked on a number of outbound M&A deals. He points to the recent acquisition of Finland-based mobile game developer Supercell by Tencent Holdings as an example.

Tencent is a regular and popular player in Asian loans markets, and has borrowed around $10.4 billion since December of last year. Until its purchase of Supercell, those loans were dominated by international banks looking to build relationships that can be leveraged to generate ancillary business, including capital markets deals. But on the Supercell acquisition, while allocations are not final, a handful of international banks have been allocated around $300 million each, while Bank of China (BOC) is expected to receive a $1 billion allocation from a $3.5 billion total facility.

The buyout is non-recourse to Tencent, with the buyer providing a letter of comfort, and as bankers have noted, Supercell is a mobile games creator, and rapid technological changes and a fickle and evolving target audience are risk factors in the industry.

National flag

BOC similarly has been aggressive on deals such as Go Scale Capital's proposed acquisition of the Lumileds LED business from electronics giant Philips, which was nixed by US regulators. The bank scooped a mandate away from Morgan Stanley to underwrite a $1.93 billion loan, and only sold down around $250 million to $350 million of the deal to the broader market through a syndication.

Western bankers have dubbed these practices as "patriotic lending," amid suggestions that the banks have been encouraged to support Chinese companies in their efforts to acquire overseas. Other industry participants, however, believe that domestic banks' advantage comes from their greater understanding of the Chinese business environment, particularly SOEs, with which they tend to have established relationships. This familiarity with the companies and their businesses means lenders can take on opportunities that international banks might have to pass on due to risk concerns.

"The risk profile that the Chinese banks look at is different than the international banks," says Baldwin Cheng, a partner with White & Case. "A lot of people looking at Chinese SOEs will put some country risk on there, but for the Chinese banks that's kind of mitigated, because they know the SOE, they've banked with them for a long time, they know the type of business relationships that the SOEs have, and that risk premium is lowered."

In addition, lending to SOEs is seen as a safe bet since it is widely assumed that the government will provide support in the event of a downturn. This is often not based on an explicit guarantee, but rather on the understanding that these companies are considered important to the provincial or national economy and therefore worth rescuing by the state.

In the case of privately owned enterprises (POEs), this calculus is different; though some private companies have connections to the state, banks do not see them as receiving government backing the same way that SOEs do. Financing can still be available, but only in the largest cases, as with Tencent's purchase of Supercell; for these companies the strength is seen more in terms of sheer size rather than their relationship with the government.

Though industry observers believe current financing models are viable in the short term, many feel that the industry is heading for another turning point. One of the main concerns is the amount of leverage in the system. Purchasing companies already tend to have unusually high debt loads - ChemChina's debt was recently reported to be 9.5x EBITDA - and many lenders are coming to doubt the wisdom of continuing to fuel their debt expansion.

"The bankers in Hong Kong, whether they are international banks or Chinese banks or just regional Asian banks, they already want to pull back, and they already see that the debt is too high for these companies," says Owen Chan, a partner at Hogan Lovells. "But the banks here are assisting the parent banks in China to do the deal. They're not in the driving seat."

Some observers see further danger signs in the weakening of lending structures for Chinese buyers, with traditional covenants such as interest coverage ratios - used to determine how easily a company can pay interest on outstanding debt - being stripped away from loans. Because SOEs can access capital markets to take out bridge loans quickly, terms on these bridge facilities are being watered down, but the same watered down bridge terms are now showing up on regular term loans, potentially weakening the overall market. Pricing is being pushed down too, adding to an overall aggressive loan market.

Value proposition

These risk factors dissipate somewhat if the buyer can deliver growth through its strategic agenda. While there are often broad-brush plans for post-deal integration, companies' ability to offer granular detail on realizing additional value is patchy. Much rests on the ease with which a product or technology can transition into the China market.

Biostime once again makes for an instructive example. Even as it steered through rocky financial waters in the first six months of 2016, the company saw its revenue climb 53.3% year-on-year to RMB3 billion following the inclusion of Swisse Wellness in its financial statements. The infant formula contribution to sales, which stood at more than 80% 12 months ago, fell to 50% as adult nutrition and care products were factored in.

Having diversified its revenue base, the next challenge for Biostime is activating direct sales of Swisse Wellness products in mainland China. Given the company has an existing network of 3,300 staff in 200 sales offices nationwide - and Swisse Wellness already has some brand recognition within China - there is believed to be a good chance of success although stricter regulations on health food products entering the country has created some near-term uncertainty.

Of the healthcare-focused acquisitions in Australia, Luye Pharma and China Resources Group arguably face a more daunting challenge, taking primary care providers into China where they have no pre-existing footprint. Luye, for example, announced a 20-year plan with Healthe Care to roll-out a high-end medical services business in tier-one to tier-three cities. The company will likely leverage its healthcare industry network much as China Resources can tap into its various real estate and retail interests.

While most industry participants accept that valuations have become swollen to almost unsustainable levels, sustainability hinges on internal considerations - such as detailed China expansion plan and the recruitment of talent capable of managing acquired assets - that might not be apparent to the watching world. And even if some investments do fail, they will not necessarily hinder an outbound movement that many describe as only being in its early stages.

"Whenever there is an uptick in any activity you see some burn-ups. That happens everywhere, not just in China," says Michael Weiss, vice president for investments at Sanpower Group, a Chinese conglomerate that has completed a number of outbound deals. "When you do something for the first time and you are competing against others that are more experienced, as many newcomers are, it is particularly challenging. There will be some bumps on the road for Chinese M&A, but everyone has to get their feet wet - and it's not the type of risk that is going to be majorly detrimental."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.