India logistics: Wheels within wheels

A confluence of macro influences is driving demand for modernized logistics in India. Private equity is likely to benefit in a number of areas, but informed targeting and value-add approaches will be key

Warburg Pincus' $125 million commitment to Stellar Value Chain Solutions last month punctuated a string of recent deals by the firm that have crystallized increasing investor confidence in the depth of the Indian logistics sector. Having already formed a $250 million warehousing joint venture with Embassy Group and backed door-to-door delivery specialist Ecom Express, the GP has interests that span the supply chain.

Indeed, the two ends of logistics spectrum represented by Embassy and Ecom Express were brought together in the Stellar deal with an aim to address the needs of both asset-heavy industrial park operators and asset-light trucking companies. The plan is to grow the start-up's capacities in storage, primary and secondary distribution with technological integrations and practical supply chain network optimizations.

"We believe there is a shortage of high-quality providers of outsourced logistics services such as warehouse management and distribution to a wide range of sectors in India," Viraj Sawhney, a managing director at Warburg, said upon confirmation of the deal.

These diverse investment opportunities in India's $130 billion logistics sector are driven by the same macroeconomic forces, especially those relating to the country's gradual modernization and improvement of living standards. However, private equity investors must acknowledge that this commonality belies a complex network of nuanced sub-markets that demand a case-by-case sense of tact.

Macro to micro

The basic investment case for the sector is grounded in the integration of global value chains into the local economy. This is because becoming part of global supply chains requires domestic operators to conform to higher international logistics standards - usually by seeking outside investment.

Furthermore, there is a positive correlation between participation in global value chains and standard of living development rates, which are in turn tied to interesting PE opportunities such as the growth of e-commerce. According to the UN, the countries with the fastest growing participation in global value chains have GDP per capita growth rates some 2% above otherwise comparable jurisdictions.

After decades of zigzagging dramatically, between 2-9%, India's per capita GDP settled on a modest but steady upward trajectory from around 5.5% in 2012. Meanwhile, in nominal terms, India was the world's fastest growing economy in the first half of 2016, expanding 7.5%. The International Monetary Fund predicts it will retain this leadership position until 2020.

The traction has precipitated a major turnaround in logistics. Last month, India jumped 19 places in the World Bank's logistics performance index, reaching a rank of 35 out of 160 countries. Property consultant Knight Frank has forecast that warehousing demand will grow at an average annual rate of 9% to 2019. And in the trucking segment, vehicle sales increased 32% during the 2016 financial year and are expected to expand 13-15% in 2017.

Private equity activity against this backdrop so far has reflected the zero-to-one nature of the industry's growth opportunity. For example, Bain & Company tracked a spike in the number of PE funds participating in logistics for e-commerce in 2015 from zero to 10.

"It is clear that India is coming from a low base in terms of logistics formalization and is thought to be considerably behind other major emerging markets such as China or Brazil," says David Buckby, an economist at research group Transport Intelligence. "That said, we expect it to catch up considerably over the next 10 years or so and be one of the fastest formalizing countries in the world over that period."

The sudden rise of PE interest is largely related to the only recent evolution of warehouses as facilities measuring more than one million square feet. Now that construction plans are starting to reach this threshold, the asset class is increasingly being regarded as a natural fit for providing the growth capital needed to take the industry to its next phase of development.

"In the last 12 months, we've seen a boom in private equity investments in warehousing with Warburg Pincus and others, but before that there was almost no one," says Nirav Kothary, industrial head and a senior vice president at Jones Lang Lasalle (JLL) in India. "In the last six months, I have met up with no fewer than 12 private equity professionals who were actively considering investing in this area."

Enthusiasm has also been underpinned by a range of government support initiatives. From a PE perspective, the most inspiring of these has been the approval of a reformed goods and services tax (GST) regime that will take effect next year.

In trucking, the new GST is hoped to reduce red tape around interstate compliance, resulting in faster turnaround times. In warehousing, expectations that the reform will result in a unified, nationwide taxation system have been tied to the spike in investment activity, including Singapore-based real estate firm Ascendas-Singbridge setting up a fund especially for Indian logistics parks.

"With the GST in place, the logistics and supply chain expenses will be regarded as value add, and manufacturers will get tax credit for such services availed," says Rubi Arya, executive chair at Milestone Capital Advisors, a Mumbai-based firm that began investing in warehousing in 2008. "We expect more participation of PE firms and NRIs [non-resident Indians] in this sector since the business models can now be made more robust, with control on land costs, especially in large-format logistics parks."

Room at the top

Although firms such as Milestone have invested at the land level, the PE thesis in Indian warehousing typically entails servicing third-party owners in an emerging supply-demand gap for grade-A units. According to National Bulk Handling Corporation (NBHC), about 80% of warehousing facilities use non-mechanized methods of loading and handling, with most of the remainder using technology no more advanced than forklifts and hydraulic hand pallet trucks. Fully modernized warehouses represent only about 3% of sector.

"Private sector initiatives are small and sporadic in this sector," says Hanish Kumar Sinha, head of research and development at NBHC. "Most of the private sector warehousing capacities available in the country are of poor quality, small, fragmented and do not meet the requisite infrastructure standards."

Some of the strongest potential for operational value-add has been identified in the refrigerated food segment, where the National Center for Cold-Chain Development counts only 250 modern pack-houses versus a requirement of more than 70,000. Traditional manufacturing is otherwise expected to dominate demand, with fast-moving consumer goods, white goods, cars, textiles and industrials commonly cited as important growth areas over the next 5-7 years.

The government's "Make In India" export initiative is also seen as driving demand for grade-A warehousing since an increase in products sent overseas will necessitate more stringent, internationally standardized storage protocols. This is set to be compounded by a rising presence of global brands.

"Global brands are unlikely to utilize the capacity built up in the unorganized segment" says Vikram Goel, CEO at HDFC Realty. "They would pursue global practices requiring stringent quality in warehouse developments to service their needs. Since sustainable business practice is prerequisite for most MNCs, environmental safety norms would be adopted rigorously and more specifically in case of chemical and heavy engineering sectors."

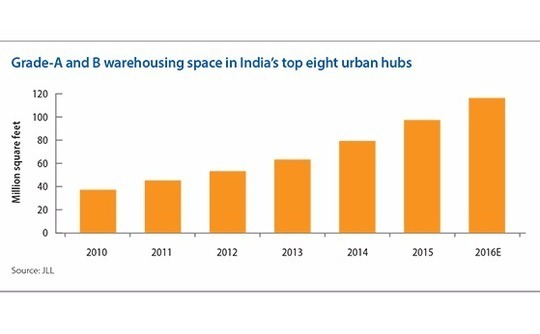

While the manufacturing and agriculture sectors are leading warehouse usage nationally, e-commerce has emerged as the fastest growing source of pressure on the supply-demand dynamics for modernized facilities. Across India's eight largest urban hubs, online retailers now occupy the largest inventory footprint of grade-A and B warehousing space, which grew at a compound annual rate of 21% between 2010 and 2015 to reach 97 million square feet.

JLL estimates that e-commerce companies currently occupy about 25% of India's total in-use warehousing and will more than double their space requirements by 2020. Flipkart has helped validate this view with the opening of its 18th warehouse this month. Ecom Express, meanwhile, is tipped to set up seven large warehouses over the next two years.

Ready to roll

Such anecdotes have stimulated expectations that the trucking sector will see a similar surge. There is speculation that China's Alibaba Group is entering a string of e-commerce agreements alongside DHL and Delhivery, and that Flipkart will invest $500 million in an effort to achieve one billion shipments in 2017-18, or 10 times its current annual throughput.

The e-commerce angle drawing attention to trucking is distinctly concentrated in the consumption-driven cities and the niche delivery markets therein. PE-style plays in this space often involve a spoke-and-hub model about 30 miles outside of city limits, where land prices are more competitive and short-run deliveries into congested urban areas are too impractical for intercity operators like DHL.

"Intercity logistics in India has been developed for years at the same level as other countries, so I don't see any opportunity for venture capital there," says Ebihara Takeshi, founding general partner at Rebright Partners, a Singapore-based firm which has invested $1.3 million in Bangalore last-mile logistics company LetsTransport. "The beauty of last-mile logistics in India is that there is not any existing strong player, so start-ups can get a dominant position relatively easily."

LetsTransport, like most of its direct competitors, receives the largest portion its business from large e-commerce and internet on-demand clients, including Amazon, Big Basket and Snapdeal. While the rise of such operators over the past three years has been the main driver of last-mile investment opportunity, cold chain distribution in standard food retail remains arguably the most prospective entry point. It is said that around 9,000 refrigerated trucks currently service Indian roads although more than 60,000 are still needed due to congestion delays causing perishable goods to spoil.

More broadly, the initial private investment activity in last-mile has targeted a consolidate-and-upgrade strategy comparable to the approach now gaining momentum in warehousing. While intercity fleet sizes can range up to 800,000 trucks, unorganized intra-city fleets commonly number less than five, often comprising ramshackle trailers and three-wheeled tempos. Independently employed drivers set quotes off-handedly and service failure rates are high.

Further last-mile incentives for PE can be found in reduced barriers to entry due to a customer and industry education period experienced during the proliferation of app-hailed taxi services. The success of companies like Ola and Uber has created an opening for organized last-mile plays by establishing English skills among drivers as well as savviness with mobile devices and GPS technology.

"Intra-city logistics is far more broken than the taxi market, so we see an opportunity for someone to come in and fix it," says Navin Honagudi, an investment director at Kae Capital, which made a $5.5 million investment in logistics service provider Porter last year alongside Sequoia Capital. "What we're really trying to solve is availability, convenience and strong transparency around pricing."

In this respect, investment strategies in the last-mile space are based on providing these service improvements through disruptive technology, rather than increasing fleet sizes. Indeed, both Porter and LetsTransport - two of the few remaining survivors in this quickly consolidating space - operate technology-based service models with no physical vehicle assets.

Broadband connectivity, task-courier matching software, geolocation and routing algorithms are considered key focus areas for outcome optimization. The PE opportunity is in providing these technologies in order to aggregate and organize entrepreneurs with small personal fleets - a block still said to represent two-thirds of all truckers nationwide.

"Here, you're a small piece in a large game, with strong headroom for growth in the next five years that is nowhere close to peaking out," Honagudi adds. "There are about one million trips in the intra-city in India a year and its growing at 10-15%, so we've barely scratched the surface, with probably a sub-0.5% penetration in this space."

Despite this depth of upside, competition in last-mile has been fierce. A number of players including TruckSumo, PepperTap and TinyOwl have reportedly shut down in recent months, following the example of the overheated and rapidly contracting taxi-app space a few years before. Some investors have braced for this fallout through diversification, with Sequoia notably having spread its last-mile risk across Porter, PepperTap, TinyOwl and Grofers.

In this context, the Warburg Pincus approach of building exposure across various storage and delivery models can be viewed as a broader logistics sector hedge, hoping to ride out the early stages of a massive, multifaceted expansion trend. Although operational pitfalls are plentiful in areas such as hyper-local trucking, and risks remain in warehousing related to landowners gravitating toward more lucrative office rentals, the long-term logistics picture appears set to offer a worthwhile endgame for investors that manage to find the survivors.

"Of course, anything that causes a divergence in price between modern and traditional facilities in India will impact supply and demand, which in turn will have an impact on logistics formalization in the short run," Transport Intelligence's Buckby says. "But it really is the macro factors that we should be concerned about in the long run. That is what will really drive demand for modern facilities."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.