Portfolio: L Capital Asia and Seafolly

Beachwear maker Seafolly was already a leader in Australia when L Capital Asia acquired it in 2014. Now the founding family and the GP plan to build it into a global lifestyle brand

When L Capital Asia approached Australian swimwear manufacturer Seafolly about a partnership in 2013, the company was already disenchanted with private equity. CEO Anthony Halas of the founding Halas family, seeking support for his global expansion plans, had explored the possibility of selling a controlling stake to several GPs the previous year. But even though several investors had shown interest, Halas and his team were not satisfied they had what the brand needed.

"We had quite a number of offers on the table but nothing that I really felt was going to add true value to the business, and so we actually withdrew from the process and decided not to go ahead," says Halas.

But in L Capital, the PE firm sponsored by French luxury goods conglomerate LVMH, Halas saw a different kind of GP: one that was designed fundamentally to reach out to companies like his and help them benefit from LVMH's experience and connections in the global fashion industry. Further meetings confirmed this impression, and the acquisition went ahead in December 2014, with L Capital paying A$70 million ($74.9 million) for a 70% stake.

Now Halas sees the company's progress under the private equity firm's ownership as a vindication of his prudence. L Capital is focused on transforming Seafolly from a family-run business focused almost exclusively on Australia into a modern, efficient organization that will be more than a match for its global rivals, and it has found the company's leaders to be more than willing partners.

"We realized that Australians, first of all, have a great fitness culture; I think it certainly, if not equal to America, in many ways could be seen as better than America," says Ravi Thakran, chairman and managing partner of L Capital. "Secondly was the outdoor culture: people are practically on the beach whenever it's warm. So anything related to these two segments became our focus."

Expansion agenda

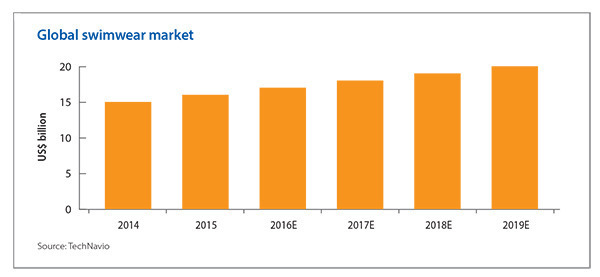

Swimwear was a promising sector from a global standpoint as well; a study in 2015 by Technavio projected revenues for the global swimwear market would rise to $20 billion by 2019, from $15 billion in 2014. The market was also highly fragmented, with the high customer turnover rate meaning that there was no clear worldwide leader.

Knowing these trends, L Capital quickly focused on Seafolly. The brand, originally launched in 1975, had attained a 40% share of the swimwear market in Australia by 2012 but had little overseas presence. The GP felt that with the right changes to management and introductions to a few influential names in the fashion industry, the company could become a global force.

When Thakran put this case to Halas, he found himself pushing at an open door. The CEO had long wished to bring Seafolly into other markets, and had introduced the brand in Singapore and California. However, efforts at further expansion had been frustrated by the limited resources available to the previous owners, and by the company's small management team.

"As a family-run business, it was run very well," Thakran says. "We don't want to change the entrepreneurial nature of the company, but we want to put in more systems so that as and when it becomes a A$250-400 million organization, it is able to cope with that."

Reorganizing Seafolly's structure and senior executive leadership to allow more efficient operations and smoother growth has been a major focus for L Capital in the first two years of its ownership. The company has already made a number of hires, including a new CFO, marketing director and head of retail, and it is currently searching for a head of sourcing.

Bringing in this amount of new talent has been a major investment in financial terms, but L Capital has supported the company's short term expenditures in the name of building greater profits over time. "That's unusual from what I've seen from private equity, where the patience might not be there in the way it was with L Capital," Halas says. "It wasn't about just looking at where can we cut costs and get immediate quick wins on the bottom line; it was really about brand building and positioning the brand for future growth."

Additional behind-the-scenes improvements over the past two years include training for the staff in financial reporting and accounting best practices. These additions are key to the executive team's goal of doubling Seafolly's revenue by the end of next year by helping put the company's operations on a more professional and modern basis.

"In a family business, financial reporting is often a bit on the basic side," says Halas. "They've really put us into the 21st century in terms of the kind of information that we can capture and use to look at our business in a very different way, to really see where we're making money and what areas of business are driving us."

International angle

While the leadership team is working toward increased revenue in Seafolly's existing markets, even more of their efforts are focused on international expansion. L Capital has been a significant influence here as well, helping the company's leadership to tackle markets where it previously lacked resources or connections to compete.

Seafolly's most significant target market has long been the US, which is highly attractive due to its similarity to Australia in terms of culture and the level of outdoor activity. At the time of acquisition Seafolly had some retail exposure in southern California, but had found further expansion difficult in the face of competition from more well-known local brands.

L Capital proved to be a useful icebreaker; now in addition to its success in Australia, Seafolly had the global LVMH empire behind it when it sought to expand its retail presence. "Who am I in America? I'm just a little Aussie family business. But when I go to America and sit with the big landlords, they do look at it very differently knowing our connection to LVMH," says Halas.

Since L Capital's purchase, Seafolly has opened five retail stores in California to test the market, joining the existing two. In addition, it now sells its products through top US retailers including Nordstrom and Amazon, and has increased its presence at the yearly Miami Swimweek fashion show.

The company also has its eye on South America, where it is nearing completion on the acquisition of a major beachwear brand. Here too the backing of L Capital and LVMH have been a major help; Halas had actually been interested in the company for some time prior to 2014, but Seafolly lacked the experience and exposure in the South American market that the GP can provide.

Both Halas and Thakran see the acquisition - which they hope to close by the end of the year - as a game-changer for Seafolly. The company will gain a highly regarded brand with a ready-made retail pipeline in a highly promising market with its own active beachgoing culture. In addition, thanks to free trade agreements between the US and South American countries, the deal could open up additional routes into the US, where the target brand already has a retail presence.

"If that happens it will put Seafolly into another level altogether," says Thakran. "They'll be noticed right away as a company that has two very strong brands, one in the Australia and Asian markets, the other one in America."

L Capital has also been instrumental in helping the company expand its presence in Southeast Asia, where there had traditionally not been a highly active market for Western beachwear. With analysts predicting an expansion in consumer interest across the Asia-Pacific region as a whole, the firm felt that Seafolly had the opportunity to claim a significant portion of the market by entering early.

While Seafolly's leadership was open to an Asia move, both they and L Capital expected this market to be more challenging than the US or other Western countries. The company's existing beachwear designs could be marketed to American consumers with few changes, but differing body shapes and cultural standards among Asian customers would require Seafolly to modify its approach.

Product line changes are under development and Seafolly has already begun to expand its presence in Southeast Asia in expectation of a wider rollout. Starting with its existing retail base in Singapore, which predates L Capital's investment, the company is launching its own stores and partnering with other retailers throughout the region. Talks with major conglomerates are under way.

Seafolly has also been approached by two major retailers in China, with nearly 5,000 stores between them, which were impressed by the brand's performance among Singapore's ethnic Chinese population. As these chains are geared toward fashion rather than beachwear in particular, gaining access to them would give Seafolly a boost into a broader retail market.

Long-term game

Despite this progress, L Capital acknowledges that its plans for Seafolly still have a long way to go. The GP saw the company's EBITDA drop in the most recent financial year - though revenue increased despite a drop in the value of Australia's currency - and attributes this to the investments the company has made in pursuit of its ambitious expansion goals.

"Most private equity players would want the company's EBITDA to keep going up, and would not like any decline at any time, but we saw that we need to invest short term, for the long term destination of the brand," says Thakran. "Even if the currency is falling, we don't want to cut back on initiatives of hiring new talent and launching in America and other markets."

L Capital continues to contribute as Seafolly improves its backend; currently the company is focusing on installing a new customer relationship management (CRM) platform, and the GP is helping it source the most appropriate software for its needs. It is also identifying possible retail partners in Europe and the Middle East, though this expansion is not planned to start until Seafolly has made more progress consolidating its position in Asia and the US.

Halas sees the company's US presence as a particularly gratifying and vital step forward: it justifies his conviction that an Australian brand can do well in the US market given the proper support, which led him to seek a private equity backer in the first place and to decide on L Capital in the end.

"Many Australian businesses have tried to open retail stores in America and failed, but the test stores that we've done in southern California are doing very well," he says. "We're having a lot of wins over there, and a lot of milestones have been reached; I think that there's more of a scope for us to get a good foothold in that market now."

In addition to its geographic expansion, Halas hopes to grow Seafolly into new verticals. He envisions the company becoming more of a comprehensive lifestyle brand, covering such categories as eyewear, accessories and active wear - all areas in which LVMH has long experience and can therefore provide considerable assistance.

For its part, L Capital is focused on putting Seafolly on the strongest possible footing both internally and in market terms so that the company can continue to grow after the GP's exit. This will make it an attractive prospect for acquisition by a rival or another firm.

"Once you break out in a category like swimwear to become a premium player in the market, everything expands. People's focus on you becomes bigger, some of the global majors start looking at you, and your multiple therefore is far better," says Thakran.

Given Seafolly's strong growth potential the GP also sees an IPO as an option that would allow it the freedom to continue to develop independently. Thakran would even welcome a buy-back by Halas, who has already stayed at the company longer than expected due to Seafolly's productive relationship with L Capital and his personal interactions with Thakran.

L Capital itself normally looks for an exit once it believes it can reach a multiple of 2.5x. In the case of Seafolly, however, the firm is prepared to stay longer, given its confidence in both the industry and Halas' leadership. "We don't have to exit in 3-4 years, like we've done with many of our companies; we may have to exit in six years," Thakran says. "If I can make 4x by staying another year and-a-half or longer, I would love to do that."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.