Private debt: Pulling uphill

Selling Asian LPs on private credit strategies remains difficult for the most part, but fund managers are generally confident that interest in the asset class is set to take off

As economists raise cautionary notes about growing debt loads in emerging Asian markets, Robert Petty, managing partner and co-founder of Clearwater Capital Partners, hopes to rally investors to stay calm and keep watch for the prospects that are bound to arise.

"I think the compelling opportunity is absolutely to be contrarian, and we all learned that after the global financial crisis," Petty told the AVCJ Korea Forum last month. "When the US and Europe contracted there was a great vintage in US and European credit. Our time is now. We have $35 trillion of debt in Asia; when you want to invest in credit is counter-cyclically, when credit growth is contracting."

While Asian private debt is seen as an increasingly attractive option for fund managers - most notably in India, where recent reforms meant to help with the country's rise in non-performing loans have attracted a number of foreign and domestic GPs to the space - LPs in the region remain largely reluctant to commit to investors in the sector.

Industry sources acknowledge that lack of familiarity with the asset class among institutional investors plays a role in discouraging them from participation, but this is not the only factor at play; the absence of credible debt investors in the region is also a factor, along with cultural differences between countries. Although managers can find institutional support for private credit strategies, success will depend on focusing their energies on the right type of LPs and proving their capabilities.

Trailing the field

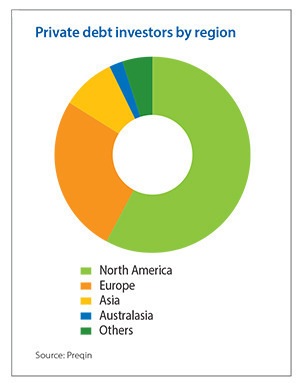

While Asian LPs' appetite for debt investment has so far been shallow, the same cannot be said of their counterparts in other regions. Data from Preqin show that among global institutional investors in private debt, Asia ranks third in regional allocation, making up 9% of the investor base. This compares to 26% for European LPs and 58% for investors based in North America.

It tallies with anecdotal evidence from industry participants, who say that it has been difficult to interest LPs from the region in private debt funds. Investors from other parts of the world, however, actively pursue leading managers.

"It is fair to say that the level of experience of institutional investors in the US is ahead of that for investors in Asia," says Kallan Resnick, managing director at placement agent the Park Hill Group. "But I certainly wouldn't disparage Asian LPs' sophistication. It's just that the PE and private credit programs here are newer and generally less built out than equivalent institutions in the US."

This shortfall in interest among Asian institutions has not kept investors from pursuing credit strategies in the region; many GPs have launched private lending and credit initiatives on their own to pursue the opportunities they see developing in the space. They intend to prove the viability of the market to their LPs and thereby attract institutional support for further investments.

Bain Capital Credit is one such player, though in this case the GP does not have a separate fund for Asia credit, instead investing out of its global credit fund; like many other managers, its credit strategy in Asia encompasses direct lending, mezzanine debt and distressed asset resolution. Barnaby Lyons, managing director and head of Asia, believes the firm's reputation and established relationship with global investors provide the reassurance that its ventures into new asset classes will pay off.

"We generally structure our funds to have a broad remit, whether by geography, strategy or asset class; our LPs recognize this flexibility is a powerful tool in accessing different investment opportunities," he says. "As Bain Capital's investment scope has grown over more than 30 years, I think LPs have drawn comfort from the fact that we build deep experienced teams with local knowledge and that we invest our own capital right alongside theirs."

A large, established GP like Bain, which draws much of its support from outside of Asia, can afford to put in this kind of investment on its own, and Asian institutions have shown willingness to invest in the credit strategies of such GPs. Niklas Amundsson, a partner at Hong Kong-based placement agent Monument Group, says his LP clients in the region gravitate toward larger managers with established track records.

The other side of this preference, however, is that LPs are considerably less likely to consider supporting less well-known firms. Even experienced fund managers outside of the region have difficulty generating interest among Asian institutions. "At the larger end we work with a GP that has about $30 billion assets under management, and they have a private lending fund. That obviously goes very well," says Amundsson. "We also have a small $300 million fund, and it's been very challenging to get Asian investors to look at it."

This tendency is out of step with LPs from outside the region, which devote relatively greater resources overall but tend to make smaller commitments. Preqin records show that among Asian investors that do invest in private debt, 28% commit more than $400 million, compared with 16% for global LPs; 57% of Asian LPs invest $200 million or less in credit, compared to 72% of global investors.

Smaller managers, no matter their origin, will have a difficult time overcoming this tendency. Many in the industry doubt that small credit fund managers will be able to find much traction in the region until Asian LPs have built up their understanding of the space. "In terms of risk appetite, no one ever got fired for buying IBM," Amundsson adds. "So if I'm going to do something in this space, I'm going to be much more comfortable putting the money with a recognized brand name."

North Asian appetites

Of the Asian institutions that do show an interest in private credit, the greatest concentration seems to lie with groups in North Asia, particularly Korea and Japan. This can be partly attributed to the more international focus of these investors compared to others in the region, which gives them more exposure to other LPs' investment strategies; however, industry participants say other significant factors that also play a significant role and could indicate possible directions of development for LPs elsewhere.

One consideration is the type of institutions found in these two countries; Korea and Japan have pension funds and insurance companies that play a similar role in the private investment industry to their counterparts in Western countries. These LPs need reliable returns, and may be looking to exit their fixed income portfolios due to the continued economic weakness of the two countries.

For this type of investor, a stake in a credit-focused fund can offer some advantages over a private equity fund commitment. Chief among these is downside protection, which can be difficult to achieve for a GP holding a minority equity stake in a company; a private lender, though lacking a voting stake in the company, may have more power to hold the borrower accountable as long as the contract has the appropriate protections.

"I think most private equity investors in Asia are looking at minority positions, and trying to protect their position through minority shareholder rights, board seats, voting rights, and so on," says John Redick, managing director at Olympus Capital Asia Credit. "Whereas with private debt your protections really lie in your loan agreement and collateral, and you have numerous things that give you the ability to monitor and enforce your claims against the company."

The contractual nature of private debt is also useful for predicting returns. Investors in a PE fund only realize their commitments at the end of the fund's life cycle, and the size of the return is difficult to predict; with debt, the payments occur according to a set schedule, and their size is guaranteed.

Taehyeong Kim, a senior portfolio manager with Korea Teachers' Pension, offered some insight on this at the AVCJ Korea Forum, noting that major public pension funds are assessed by the government on an annual basis, so there is an emphasis on cash flow. "You cannot ignore the fact that we have our own benchmarks and target returns," he said. "Within a year we have to realize a certain level of returns and that means private debt, whether senior or mezzanine."

This more modest, though guaranteed, return can be valuable for an investor that seeks to balance the higher risk associated with private equity investments that could turn south. "With private debt, more often than not you don't necessarily need the company to hit a home run in terms of growth," Redick says. "To the extent the borrower is stable and able to maintain or reduce leverage ratios, then your probability of getting repaid with all your return is very good."

Along with the investment needs of North Asian LPs, their internal structures may also subtly push them towards debt. Staff at Korean and Japanese institutions typically rotate through positions; a worker will spend three years at the organization's alternative investments desk before moving on to another post at the same company. Some industry players believe this practice subconsciously affects the type of investments that staff members consider. A commitment that requires the organization to wait for a payoff several years away will therefore be less attractive.

"If you're going to be in the role for three years only and you're committing to a 10-year structure, you're never going to reap the rewards of that investment that you've made," Monument's Amundsson says. "You're never going to see whether it was a good investment or not, and probably your successor's never going to see it; it's going to be up to your successor's successor."

While insurance plans and pension funds have yet to achieve the same prominence in other Asian markets that they enjoy in Korea and Japan, credit managers are confident that LPs across the region will show more interest as investment opportunities rise. Slowing growth in China and increased divestment of problem loans by banks in India are expected to fuel activity in the region.

If LPs do turn to credit, it may provide the support that regional debt investors have been lacking. However, managers will still need to convince potential backers that they can meet the individual needs - on which the LPs themselves may not fully agree.

"The nuance is to be a solution provider to these investors, to give them the exposure that they need, allowing them to deploy $200, 300, 500 million in a particular strategy at a particular time, whatever they need in their portfolio," says Mounir Guen, CEO of placement agent MVision. "You have to also think carefully which department is the best fit, or has a need that you can provide a solution for."

Flexibility will also be essential as managers attempt to meet the needs of various institutional investors; not only will GPs need to overcome lingering uncertainty about the asset class, but the LPs that they approach will likely have highly diverse needs.

Getting comfortable?

Though many feel that Asia may never catch up to the US or Europe in terms of investor sophistication, the consensus view is that the gap will at least narrow in the coming years. As LPs in the region become more comfortable with the credit space they should find credit investments closer to home increasingly appealing, since they do not require currency hedging.

"Today the opportunity set in the US is much deeper. But if you looked back in 2000, the number of private equity firms in Asia was very few; now it's roughly 25-30% of Asian investors' portfolios," says Park Hill's Resnick. "So it's probably going to be the same as the credit markets develop out here."

As opportunities in credit grow, however, LPs are likely to remain cautious even in the face of optimistic reports about the sector. Monument's Amundsson notes that recent reports of significant changes to India's distressed debt space bear a striking similarity to claims he heard about the country several years ago - which ended with little to show for the GPs that tried to jump in. This can be attributed to overconfidence as managers committed their own capital without waiting for LP support as well as the expected benefits failing to materialize.

"They were making exactly the same argument in 2012 that they're making today about regulatory changes and how everything is different," he recalls. "But then you look at what happened after 2012 when everyone was trying to raise a mezzanine fund for India and essentially no one was successful. Maybe you can argue AION [ICICI's JV with Apollo] did a good job raising a fund, but no one else managed to raise any capital for the strategy, despite lots of people having tried."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.