Korea exits: Seller central

Foreign buyers and restless chaebols could help deliver more exit opportunities for private equity firms in Korea – provided it is the right asset, at the right price, at the right time

Details emanating from the sale process for Tongyang Magic offer some insights into who is chasing PE-owned assets in Korea, and why. The consumer appliances manufacturer, owned by Glenwood Private Equity and NH Private Equity, is reportedly attracting interest from an assortment of GPs as well as various domestic and foreign strategic investors. This competition is expected to lift the price of the asset, bought in 2015 for KRW280 billion ($250 million), to around KRW600 billion.

It appears to confirm growing investor bullishness on Korea, offering encouragement for a relatively steady but tepid exit market for local PE players. Mixed macroeconomic signals, meanwhile, have been greeted by industry players as signs that new avenues of M&A activity will continue to emerge, adding new dimensions to a market typically characterized by distressed chaebol restructurings.

"I think it is inaccurate to say that because macroeconomic conditions have slowed, strategics are less interested in M&A," says Scott Hahn, CEO of domestic GP Hahn & Co. "In fact, it might be the other way around. If anything, slower growth has meant their decision is to acquire rather than grow organically - they believe it is better to buy than build."

Buy and build is part of the private equity investment thesis, however, and as such will need to be addressed by firms plotting future exits in this evolving environment. The effort will include a re-examination of the potential buyers in different tiers, the industrial changes shaping the local economy, and the unique developmental aspects of Korea's private equity market that make it particularly suited to buyouts.

Big picture

The macro backdrop in Korea has resulted in both a platform for consistent growth in PE activity and overhang in the exit market. Continued weakness in exports, which account for about half of GDP, saw the country fail to meet its economic growth target of 3% in 2015; it is unlikely to better this mark in 2016. Low interest rates have been good for liquidity, however, contributing to improved sentiment among private equity investors.

The country is now host to more than 340 PE funds with some KRW66.3 trillion under management. The managers, together with their international counterparts, invested a record $15.8 billion in 2015, capping a five-year streak of growth. The performance has been attributed to a less interventionist approach by the government as it sought to reinvigorate the economy in the wake of the global financial crisis.

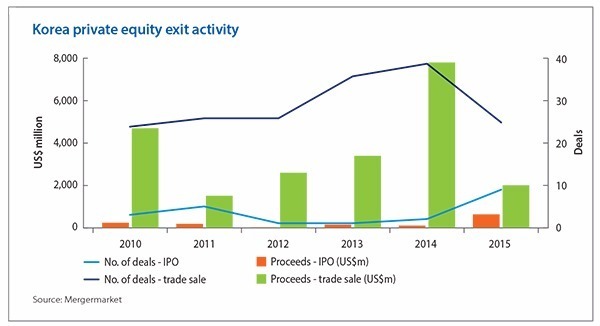

Weakness in exit activity isn't helped by an unreliable domestic IPO market. According to Mergermarket, there were only 21 PE-backed IPO exits, which generated cumulative proceeds of $1.3 billion, between 2010 and 2015, with nine of these listings taking place last year. Trade sales have been more consistent, peaking at a value of $7.9 billion across 39 deals in 2015 as foreign investors seeking Asian exposure began to shy away from China on concerns about economic stability and transparency.

Jaewoo Lee, a partner focusing on cross-border M&A transactions for the Korean office of law firm Ropes & Gray, reports a distinct uptick in interest levels from foreign PE firms during the past two years.

"We've seen a lot more deal action on the surface in the last 12 months, but below the surface there has been a strong upward trend in the level of interest and activity in Korea over the past few years," he says. "A lot of it is driven by the macroeconomic environment in the broader Asian markets and the general perception in Korea toward PE players becoming more favorable. Foreign PE buyers have also become more comfortable about their ability to exit from Korea deals without running afoul of Korean tax or regulatory issues."

As foreign interest in Korean assets picks up among both PE and strategic players, China is expected to be the most aggressive buyer. This is seen as a long-unfolding phenomenon supported by state-owned companies with an agenda to expand global exposure to the renminbi, but for the moment, it remains in tentative beginnings.

"We're seeing more attempts than actual sales being realized through Chinese buyers," says Michael Chung, a managing director at Morgan Stanley Private Equity Asia. "They have become a lot more sophisticated and cautious in terms of how they review a buyout or investment in Korea. Chinese buyers are interested in Korea, but when it comes to sizable deals, they will be cautious and as such many of those sizable deals are still being done domestically."

Secondaries, trade sales

Perhaps the most stirring development in domestic M&A activity in the past few years has been the emergence of secondary transactions. The market took off in 2012 and has remained reasonably robust, with deals worth $764 million announced so far this year. The 2016 total includes VIG Partners' $180 million divestment of Burger King Korea to Affinity Equity Partners.

Nevertheless, the country has yet to see the emergence of a robust secondaries market; there were eight deals in 2015, which is fairly consistent with previous years, out of 70 PE exits overall. A deeper and more mature domestic GP base is necessary for this to happen - at present most secondary buyout opportunities go to pan-regional funds - but it would be problematic in the absence of a broader set of local LPs as well.

"NPS [National Pension Service], Korea Post and Korea Teachers Credit Unions are LPs for most of the local funds, and they don't want the GP to sell to another GP when they are LPs in both funds," says Wonpyo Choi, a partner at Bain & Company. "That's a more serious issue than in other countries because the LP pool is so limited in Korea. Local PE funds definitely need a waiver from NPS or there won't be many deals between local funds."

Meanwhile, investment by local chaebols, is expected to continue providing PE firms with their best opportunities to realize exits. This will be propelled by a relative dynamism among domestic conglomerates. Compared to their Japanese counterparts, for example, chaebol groups are typically characterized as less mature, fluctuating widely in valuation and shaking up M&A strategies.

A particular conglomerate's willingness to buy is largely driven by its broader position - whether there is an ability to diversify into higher growth areas and what those are, and equally whether there is financial or competitive pressure to sell non-core assets. Demand for PE-owned businesses could be impacted by chaebol divestment activity in the same industry.

"Corporates in consumer, retail and services have still good appetite for domestic deals, but corporates in tech or industrial sectors in Korea are more interested in cross-border M&A to fill their gaps in IPs [intellectual property], products and geographical coverage," Choi adds. "Industrials, especially, are a big part of the overall economy in Korea, but now we are seeing overcapacity in shipping, shipbuilding and steel."

Regulatory moves by the government this year are expected to facilitate carve-outs in the commodities-based industries that have been hardest hit by the slowdown. Although, non-core divestments in consumer and technology-related fields are likely to be a part of this process, the assets' inherent exposure to the cyclical industries of their parent companies could limit their appeal and their ability to challenge competing PE portfolios.

Planning for exits by acquiring strategically in niche sectors will need to be approached delicately as Korea continues to tweak its governance policies and anomalous events can have a cooling effect on any particular market. For example, when antitrust regulators blocked the sale of a cable TV asset between CJ Group and SK Telecom, the surprise move brought the local TV market to a virtual standstill.

A question of competition

The Tongyang Magic sale process suggests that sellers, including GPs, can attract a premium for high-quality assets. However, this also complicates prospects for future exits by attracting high levels of competition for companies that might be considered PE mid-market turnaround opportunities, not targets for a broader range of strategic players. In these situations, GPs could come under pressure to bid up for assets, which means operational skills become more important when seeking to add value during the holding period.

"There's always been a strong interest from private equity firms, but when Korean corporates are in an acquisitive cycle, it makes it very difficult for them to compete," says Oliver Stratton, co-head of Asian operations for Alvarez & Marsal (A&M). "With high thresholds in terms of returns, delivering value-add is becoming more and more critical for private equity firms, particularly as the exit market becomes more challenging."

At the same time, competition for assets can vary according to deal size and sector. Finding buyers at the higher end of the value spectrum can be problematic for PE. This was evidenced last year when CJ Corporation, the only domestic strategic to approach MBK Partners regarding water purifier business Coway, walked away from a deal believed to be worth about $1.7 billion.

"It really does depend on the size of the asset because Korea doesn't have a limitless amount of deep pockets," explains Jason Shin, a managing partner at VIG. "When you venture into $1 billion-plus territory, there aren't many buyers in Korea that can write that kind of check."

A&M's director for Korea, Ryong Lee, adds that even as interest in Korean assets increases, the broader economic drivers that are compelling chaebols to sell non-core assets will result in a reduction in domestic M&A activity. Recent examples include Samsung and Doosan selling their respective defense businesses to fellow corporate, Hanwha. This results in companies with relatively weak operational capacity are representing a higher proportion of carve-out companies up for sale and fewer strategics looking for new deals.

For private equity specifically, there is also a need to intensify exploration of alternative exits such as secondaries and IPOs.

These factors may contribute to a difficult exit environment for some private equity firms, but they also underline the fact that quality counts - in the selection and cultivation of assets, as well as strategic positioning ahead of exit. This is certainly the view of T.J. Kono, a partner at Unison Capital, a regional firm focused largely on Japan but with Korean success in the form of mid-cap-level assets such as its Gong Cha bubble tea franchise

"If you have a good asset, now is not a bad time to sell portfolio, but if you don't necessarily have a great asset, low growth is a rather tricky situation because growth low growth plus low profitability equals low valuation. This is a stark contrast to historically high valuations that good assets attract because of the scarcity and availability of cheap capital," he says.

"But just because we are seeing a more polarized market that doesn't mean there's a significant vacuum in fair-valued transactions - it just requires more commitment from the GPs to develop those deals."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.