Cross-border consumer: The Korean wave

Driven by the popularity of music, TV dramas and beauty products, Korea’s cultural cachet has never been stronger. PE and strategic investors want to monetize the phenomenon, for as long as it lasts

The 16-episode military romance "Descendants of the Sun" was the first Korean drama to be released simultaneously in its home market and China, and it has established viewership records in both countries. The last installment, which aired in mid-April, was watched by more than two billion people on video-streaming platform iQiyi, the exclusive online broadcaster in China. It was too hot for the Chinese government to handle: "Watching Korean dramas could be dangerous, and may even lead to legal trouble," the Ministry of Public Security warned on its official Weibo account.

The drama has also spurred interest in cosmetics and fashion products featured in the show. For example, images of lead actor Song Joong-Ki now appear on the packaging of facial masks used in skin treatment, while Laneige has seen rising sales of lipsticks promoted by lead actress Song Hye-Ko, who is also spokes-model for the local cosmetics brand.

Descendants is often compared with "My Love from the Star," a Korean drama from 2014 that saw similar levels of frenetic Chinese interest. The Korean Culture & Tourism Institute estimated that the drama generated about KRW530 billion ($460 million) in tourism receipts as well as overseas sales of the TV series and products featured in it.

The demand rationale is simple - Chinese consumers will not only pay to see their favorite stars, but also flock to the brands these individuals wear or promote - and private equity and strategic players have embraced it as an investment thesis. They see huge potential in monetizing Korea's cross-border cultural appeal, especially in China, but outsize returns will only last as long as the phenomenon itself.

"Media influence is huge - we watch the same shows and listen to the same music simultaneously," says Daniel Shin, a VC investor and senior executive at MCM World, a fashion brand owned by Korean Sungjoo Group. "Whatever creates mass appeal in Korea also works in China almost at the same time. It is beyond what they wear. It also applies to where they spend their time and what they consume in areas ranging from food to leisure travel."

Setting a trend

China became the largest investor in Korean companies last year, according to Korea's Fair Trade Commission, committing more than KRW1.6 trillion ($1.3 billion) last year compared to KRW600 billion in 2014 and KRW40 billion in 2013. The services sector was the forefront, led by media, beauty, and financial services.

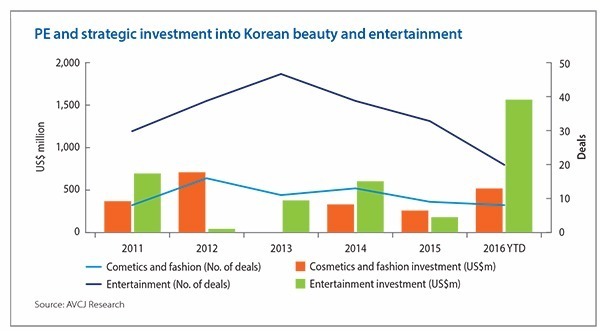

Looking at M&A in its entirety, AVCJ Research's records show more than $519 million was deployed in Korean cosmetics and fashion segments this year, up from $256 million and $329 million in 2015 and 2014, respectively. Meanwhile, more than $1.58 billion has been invested in media content-related businesses - including music labels and movie production houses - so far in 2016, the most in five years.

If private equity investors are most prolific in the fashion and beauty segments, entertainment is the domain of Korean and Chinese strategic investors. The space is primarily populated by $10-20 million deals, driven by Chinese companies looking to acquire to the skills to produce their own content and Korean players looking to diversify their business and then seek partners in order to access China's huge domestic market.

A handful of M&A investments fall towards the larger end of the scale, including two this year that involve private equity firms. In January, Kakao Corp. paid KRW1.87 trillion for a 76.4% stake in Loen Entertainment, which runs Korea's leading music streaming service as well as various music rights ownership, artist management and production businesses, facilitating an exit for previous majority owner Affinity Equity Partners. This came amid speculation that Kakao might bring in a Chinese investor to support expansion into the mainland.

A few months after the Loen deal, Tencent Holdings and Beijing Weiying Times Technology, operator of China's Wepiao online ticketing platform, committed KRW64.8 billion to YG Entertainment, a record label and talent manager backed by L Capital Asia in 2014. The GP followed up with a $50 million investment in Clio Cosmetics, a Korean beauty brand that it wants to help grow in China.

Ravi Thakran, managing partner at L Capital, told AVCJ at the time that he sees media and entertainment and beauty as the most exciting markets in Korea. "From a macro perspective, the Korean beauty sector has achieved unprecedented levels of growth not only domestically but also fueled by demand from other Asian countries," he said.

The Clio deal came just days after Bain Capital and Goldman Sachs paid $350 million for a controlling stake in another beauty player, Carver Korea.

Over the last 10 years, the Korean government has invested billions of dollars with a view to making the country the largest exporter of pop culture to other Asian markets, and even the US. TV dramas, music and reality shows led the charge, and now Gangnam Style, BB Cream and CC Cream are firmly rooted in the cultural milieu of China and beyond. Using the celebrity effect of TV and music stars to raise brand awareness and boost sales is a key part of this strategy.

"Imagine if, before launching a drama, cosmetics firms lined up advertising with broadcasters so every time a TV series cuts to commercial airtime, viewers see the same actress to promote a lipstick brand. If Chinese audiences like the girl in the drama and wants to look like her, they can buy the product immediately online and it is sent direct from Korea to ensure there are no fakes. All of this is a huge business right now," says one GP with an investment in a Korean cosmetics company.

Clio is considering a multi-channel marketing strategy in China by leveraging power bloggers and famous model Gong Hyo-Jin in popular drama "Producer" to attract Chinese eyeballs. Even food and beverage operator Hollys Coffee has leveraged Korea Wave effect when expanding into China. The company portrays itself as an outpost of domestic culture by sponsoring music events and then featuring images of pop stars in its menus and allowing customers to play clips on screens in its restaurants.

"All of this helps position us as a Korean brand," says Joseph Lee, a partner and senior managing director at IMM Private Equity, an investor in Hollys. "Young people in Asia have a positive attitude towards Korean culture. They come into the shops and say ‘It's a Korean brand,' and so they differentiate us from Starbucks or other local brands."

Agency might

A key innovative force at the heart of the Korea Wave phenomenon is the talent agencies. The likes of YG and SM Entertainment have used their industry know-how to develop what is essentially a systematic model for incubating and cultivating stars. The consistency of their track records has given confidence to financial investors.

Domestically-listed YG, which is best known for acts including "Gangnam Style" rapper Psy, selects around 30 out of millions of applicants every year and provide these individuals with all-round training that covers vocals, dancing, song composition and even foreign language study. Every month, these trainees are put through a screening process and the handful that survive this five-year process are released to the public.

Tencent's investment in YG was a response to domestic rival Alibaba Group entering into a partnership with SM, the agency behind groups such as "Girl's Generation" and "Super Junior," which is said to be targeting an IPO in Hong Kong. The company also launched a media-focused fund two years ago with Taiwan's Fubon Group and Hong Kong's Media Asia.

"I don't think Korean companies will make much money from music downloads or streaming in China, because music content is usually free of charge. For Korean companies expanding into China, the way they make money is through concerts and derivative products of the K-pop bands, such as t-shirts and toys," says Tony Park, a partner at LB Investment. The firm recently invested in Bid Kid Entertainment - the agency responsible for "Bangtan Boys" - alongside with China's Legend Capital.

Indeed, YG plans to expand not only into online music, video content and advertising, but also offline concerts. Through its partnership with Tencent and Weiying, the company has a means of feeding its content into distribution and ticketing channels within China. In addition, YG wants to replicate its training system in mainland China and Taiwan, cultivating local bands under different labels. "In China, there is no single player that can develop various activities associated with a comprehensive entertainment company like YG, including concert organizing ability," says Youjin Jung, senior manager of the company's global investment team.

For private equity investors considering the agency space, the question is whether they can get access to the limited number of sizeable players in the market. These companies are already cash-generative and generally careful in selecting partners that complement their expansion agendas.

YG, for example, is branching out into other lifestyle areas including cosmetics and fashion, with a view to leveraging its stars' popular appeal. But building a new brand in a competitive space is not easy, especially when other companies have already launched sophisticated cross-channel campaigns in Korea and China featuring Korean celebrities. L Capital, which is backed by luxury goods giant LVMH Group, is therefore a logical strategic ally.

Being beautiful

One of the most successful cross-channel campaigns came from Innisfree, which was promoting a foundation cushion - a make-up product that encompasses sunscreen, hydration and anti-aging solutions. Known as "Summer Love," the 2015 campaign was built around five videos - featuring Korean actresses and singers Lee Minho and Yoona - on Chinese video platform Youku Tudou. According to research firm L2, there were an average of 181,000 views per video, more than four times the viewing figures for the company's standard spots.

Innisfree has established itself as one of the most popular Korean brands in China, but Youku Tudou was just one part of the strategy. The company also targeted internet, mobile and social networking platforms. Advertising initiatives were supported by omni-channel membership programs that facilitate e-commerce transactions through Alibaba's Tmall and a standalone site that allows users to sign in through Tencent's Weibo and QQ as well as Alibaba's Alipay.

But the traction Korea's beauty industry has gained in other Asian markets relies on the imposition of its own standards as much as the incorporation of local marketing techniques. Although they are by no means the only exponents of this art, Korean companies use the appeal of TV and music stars to project an ideal of "Asian beauty" that differs from the Western model: oval-shaped faces, skinny figures and natural make-up versus tanned skin, full lips and contoured make-up.

At the same time, consumers are told that they can have high-quality products without paying a premium for Western brands. Backed by strong R&D capabilities, Korean cosmetics companies have created innovative products by using natural ingredients such as facial masks made of snails, donkey milk and honey - and pricing them mid-range, which is acceptable to China's mass market.

China was the biggest consumer of cosmetics globally in 2014 with revenue reaching $27 billion, according to Euromonitor International, and this figure does not include cross-border e-commerce and overseas spending. Goldman Sachs did factor in these two additional streams and came up with totals of $40 billion for 2014 and $46 billion in 2015. It estimates the addressable China market for Korean beauty brands will hit $68 billion by 2020.

This cross-border angle has played well for global and regional private equity firms. Many middle-market Korean brands can achieve domestic popularity independently but they have little experience in expanding overseas. Wholesale channels and e-commerce remain the primary China distribution models for these companies.

"If you look at the Japanese cosmetic companies, 20 years ago they were able to build good brands internationally. But over time they have lost market shares, partly because they aren't so competent at running global operations. It's very important for the Korean companies to think about how they can reach every market outside of Korea - obviously they can't rely on the wholesale model any longer," says Joongshik Wang, a corporate finance partner with EY.

Clio entered China for years ago, selling products mainly through intermediaries such as SaSa and Tangsancai. Last year, it entered into a partnership with TMall and has since opened a flagship store. L Capital plans to help the company expand into distribution channels such as Sephora and DFS in Asia, as well as developing a footprint in Europe and the US.

Bain, meanwhile, will focus on getting Carver into China through regular import channels and onto the shelves of third-party specialty and drug stores. There is little interest in opening self-operated physical shops. "The barriers to entry of this kind of business are relatively low. You have a handful of companies which can come up with similar products. However, only a few companies have the ability to offer good products and have an effective market strategy and distribution network," says Jonathan Zhu, managing director at Bain.

Policy uncertainty

Carver has already started the registering its products with the China Food & Drug Administration (CFDA) in response to new regulations announced by the government last month. The changes are intended to tighten up product safety by requiring manufacturers to use less potentially harmful ingredients. As a result, the cost of production will rise and it will become harder for Korean companies to get sales certifications.

To some, these regulations are procedural, but to others they imply a tactical play by China with a view to extracting more value out of the Korean Wave.

"In the short term, there will be fewer Korea-made cosmetic products exported to China directly; there will also be more Korean companies forming joint ventures with Chinese partners. These partners can get access to technology and the Korean companies will be able to continue exports," says Yoon Hyung Chang, a transaction advisory services partner at EY. "We will see a similar trend in the entertainment business as well."

Indeed, there is speculation that the Chinese government will impose restrictions on Korean media content in the country as relations between Beijing and Seoul deteriorate over US plans to deploy a battery of advanced missile defense systems in Korea. It has been reported that China has lengthened the visa application process for certain Korean stars, and asked that several media events be scrapped.

This might turn out to be a short-term obstacle removed through careful diplomacy, but for all the eagerness to satisfy Chinese demand for Korean cultural exports, the biggest issue is still policy uncertainty. "The inconsistencies of Chinese government regulations is the most challenging part for YG's China business expansion," YG's Jung says. "But our local partners have long-standing relationships with the government and they know how to help mitigate these risks."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.