Korea VC: Leaps of faith

Korean e-commerce start-ups have seen breakthroughs in fundraising over the last few years, but investors are already concerned about the future of the industry

To Tae Hea Nahm, managing director of Storm Ventures, the launch of Apple's iPhone in South Korea in 2009 was a milestone in more than just consumer electronics. By giving the country's internet users a truly open platform that it did not control, mobile carrier KT Corp. opened a window that the domestic e-commerce talent wasted no time climbing through.

"By opening up the mobile internet, that allowed companies like Kakao, Come2us, Coupang, anyone in the mobile service sector to really take off," says Nahm. "Before the iPhone, none of those companies could have succeeded in Korea, because KT controlled whatever software goes on the phone."

But now Nahm sees that window closing, thanks to the saturation of the local e-commerce market and the formidable obstacles presented for overseas expansion. While established domestic consumer internet businesses may continue to do well, newcomers to the market will have to deal with the growing power of China's internet players, while start-ups seeking to go overseas face similar challenges building a foreign customer base. In addition, the country's chaebols continue to pose a serious block to smaller companies hoping to tackle the business-to-business (B2B) space.

While not all investors agree with this assessment, many feel that Korean start-ups are facing challenging times. There are still opportunities available for new entrepreneurs and the country's well-developed mobile internet infrastructure and sophisticated consumer base remain a key attraction for e-commerce operators. But the need to focus on increasingly specific customer bases leaves industry players questioning their ability to capture the market share that the country's trailblazers have gained.

The awakening

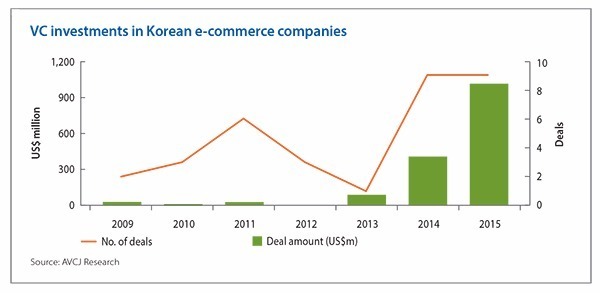

It is hard to deny that the industry has made considerable progress since the introduction of the iPhone, though it took some time for the effects to be seen. AVCJ Research's records show relatively low levels of VC funding for Korean e-commerce start-ups between 2009 and 2012, with $74 million deployed across 14 deals. The really big-ticket transactions started in 2013; in the following three years e-commerce companies received more than $1.5 billion across 19 investments.

While e-commerce start-ups faced a tough climb at first due to skepticism about their ability to compete with the retail operations of chaebol groups, industry participants say the recent breakthroughs in funding should help to negate the conglomerates' advantages. E-commerce players still cannot match the chaebols for scale, but VC support can put them on par in the narrower fields in which they operate.

"The new breed of e-commerce players have gotten hundreds of millions of dollars in funding, so I think it's sort of paved the way for a lot of investors to realize that Korean e-commerce is actually very big," says Han Kim, co-founder and managing director of Altos Ventures. "It's a huge sector, it deserves a lot more funding than it had before, and it could be very lucrative as an investment."

This is not to say that the chaebols are retreating. They have continued to have a strong impact on the shape of the developing e-commerce market, most notably by denying Korean entrepreneurs access to the B2B space due to their dominance of supply chains to their own businesses.

"B2B in Korea has been tough for the domestic-only market, because of the fact that there is a small set of buyers, and they prefer their affiliates," says Nahm of Storm Ventures. "The companies that have done well within the Korea-only market are those that can sell to the broad consumer market by bypassing the chaebol distribution."

In addition, chaebols are unlikely to give up the B2C space easily. While the influx of VC support has helped to level the playing field between conglomerates and start-ups to some degree, chaebols still have much deeper wells than any new entrant, and can draw on their other businesses to help them over the initial hurdles.

The major stumbling block for the chaebols is their roots in the offline world and their established cultures; competing in a fast-moving world like e-commerce will be a major challenge for companies tied to offline distribution channels, as it has been for retailers in other established markets.

"They know the opportunity in the e-commerce market; the problem is that they have an offline legacy, so they are trying to keep that market," says Wonki Yoon, a senior associate at IMM Investment. But, he adds, if the conglomerates are able and willing to implement the needed changes to their corporate cultures, they could become major players in the space.

Yoon identifies Shinsegae as the chaebol posing the biggest threat to e-commerce start-ups. Its online retail branch SSG.com, founded in 2014, offers customers deals from the conglomerate's offline department stores and supermarkets; earlier this year the company started a price war against Coupang, which it sees as eating into the business of its discount store unit E-mart.

However, many industry participants believe this threat in the B2C e-commerce space is likely to be minor. The very size of the conglomerates works against them; with so many business units to coordinate, they cannot afford to focus on a single vertical and give it the attention it needs to succeed, particularly in an untried field. VC investors hope that a company able to tackle a new challenge and build brand recognition quickly can become a formidable enough player that the chaebols concede without a fight.

"A chaebol would never say, ‘We have to go launch our own messaging app,' because it's so basic," says Eric Woo, a principal at VC fund-of-funds Top Tier Capital. "That's where the opportunity is; when the start-up creates something and it takes off and they have a lot of users, there's a lot of loyalty that it's hard for the chaebols to buy."

China incoming

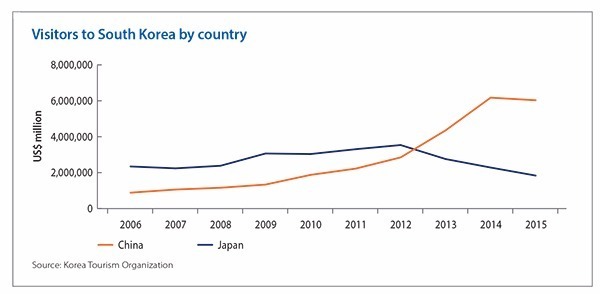

A bigger challenge to Korea's e-commerce players comes in the form of demographics. In the last 10 years, the number of Chinese tourists visiting South Korea each year has exploded, from 897,000 in 2006 to nearly six million in 2015. The boom has made China the country's biggest source of foreign tourists; over the same period onetime leader Japan declined from 2.3 million visitors to 1.8 million.

This influx of visitors has brought a number of positive developments to the country's economy. The growing numbers of middle-class Chinese tourists means new customers for local businesses, with demand ranging from retail to plastic surgery.

However, these visitors are also having a major impact on the orientation of the Korean service sector. Companies have understandably begun to cater to this large group of potential customers, and the parallel growth of China's internet economy means they have been able to connect to them through Chinese online platforms such as WeChat. Adopting Chinese electronic payment options to allow tourists the convenience of familiar tools is the next step.

Industry participants see warning signs in these developments for domestic e-commerce businesses. Chinese social media and payment platforms have the potential to serve as a Trojan Horse, giving their parent companies a way into South Korea's internet industry. Once Alibaba Group and JD.com have a foot in the door, their resources could overwhelm local competitors in the way US giants such as Amazon and eBay have not been able to do.

"The Korean government has done a good job of trying to keep US companies out, and trying to protect the local market," says Nahm of Storm Ventures. "But I just don't think they can do that against the Chinese, because of the fact that there's so many Chinese tourists in Korea, that Korean businesses need to cater to them, and so they're going to start using Alipay and all these other services to support the Chinese tourists."

Others believe the Chinese online giants are not necessarily a threat to the local start-ups. Korean companies can pursue partnerships with their Chinese counterparts, whose customers back home are eager for Korean products and entertainment. Selling to each other's markets could prove equally beneficial for both parties.

"There should be a window for e-commerce players to be approached by Chinese counterparties for equity participation, if not for potential mergers," says Daniel Shin, co-founder and executive director of Kingsbay Capital. "The local sourcing capacity of Korean e-commerce players can still appeal to Chinese counterparties, and how quickly Alibaba, Tencent Holdings and JD can reach out to the much larger customer base in Greater China still amazes me."

Such partnerships could be the way forward for Korea's e-commerce start-ups; it holds the potential for reaching the massive customer base of China, while not requiring the domestic player to compete directly against the Chinese giant.

Into the unknown

Even without major challenges from Chinese competitors or chaebols, industry players still see a tough road ahead for Korea's e-commerce start-ups; not necessarily those currently in the market, but those to come. The country's population, while highly internet-connected and web-savvy, is still a fraction of that in China and India. Investors fear that the market has already reached a saturation point, and that there are few openings left for new local entrepreneurs to enter.

This does not mean that e-commerce is heading for disaster; existing players will continue to do well with domestic consumers, and will continue to raise new rounds of funding. But the small size of the market, and the well-established e-commerce players in other regions, means that Korea's companies will likely face hard limits to their expansion.

Start-ups seen as having the most potential are those that can reach new sets of customers - Memebox, which sells Korean beauty products both domestically and in China and the US, is one example. The company was launched in 2012 in San Francisco before relocating to Seoul the following year. It now sells both third-party brands and its own product lines, with China and the US responsible for more than half of overall revenue.

Having recently closed a $66 million Series C round led by Formation Group, Memebox is identified by several investors as the kind of company most likely to do well in the changing market - though IMM's Yoon also points out that this kind of business does not require any particular originality compared to the pioneering e-commerce players.

"In cosmetics and fashion, there are some meaningful players, but that is not innovation," says Yoon. "It's just marketing to those specific sectors that are showing growth. These are small players reaching the market by reacting to the changes in consumer preference."

Other industry participants, concerned about stagnation, feel a shake-up is to be hoped for, not feared. Such disruption could come from increased Chinese participation, or it could take the form of acquisition activity by the chaebols. Top Tier's Woo points out that chaebols entering the e-commerce industry by acquiring existing start-ups could actually provide a stimulus to VC investment, because there will be greater assurance of the ability to eventually exit one's stake - something that has been lacking in the market so far.

"If that starts happening, and it happens at some scale, it's going to reinvigorate and re-inject more capital and interest into the start-up ecosystem," says Woo. "Because what people always worry about is, the government puts all this money in, but how do investors get their money out? And the only way they can get it out is if it gets acquired by one of the chaebols or it goes to IPO, or if it achieves unicorn status and finds its way over to the US."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.