Venture philanthropy: Change agenda

Well-established in developed and some developing markets, venture philanthropy is still only taking hold in much of Asia. PE firms are figuring out whether they should participate and in what way

Hyderabad's recycling ecosystem starts with 25,000 rag pickers who sift through thousands of tons of waste generated every day for anything with value. Each one might collect 20 kilograms of plastic bottles, tin cans and discarded consumer durables, which is sold on to an estimated 5,000 aggregators located throughout the city. From there, 500 tons of plastic finds its way to small-scale recyclers where it is ground, washed and extruded before reentering the supply chain.

When Mani Vajipey and Rajkiran Madangopal returned to India from the US in 2013 with a bold ambition to solve the country's waste management problems, their initial attempts to work with government agencies floundered. So they decided to focus on the informal sector, specifically the aggregators in Hyderabad. An app was developed to track these people and what they were trading, and Vajipey and Madangopal started sourcing materials from the 50 largest for recycling in their own facility. Banyan Nation was born.

The founders' intention was to formalize the recycling industry and thereby encourage participation from companies that were wary of dealing with informal players. To this end, Banyan's system was sustainable and compliant with labor and environmental regulations. But it was not enough. "We learned after a couple of sales cycles that no one really cared about how noble we were, they just looked at plastics purely from a cost-hedging perspective," Vajipey recalls. "Towards the end of 2014 we were bleeding cash because we were unable to sell our product for a premium."

Banyan needed to up its game to be investment ready and focus on greater value-add. The objective became to provide closed-loop recycling services to customers such as leading automotive and plastics manufacturers, and additional capital - the company had been seeded with $100,000 from friends and family - was needed for the necessary upgrades and expansion. Impact Investment Exchange Asia (IIX) agreed to help raise the money, and this resulted in an introduction to KKR.

The PE firm did not offer money, but expertise. Over the course of several months in 2015, a handful of KKR executives helped Banyan refine its business plan to consider opportunities beyond household plastics, review its financial model and capital needs, and sharpen marketing documents for potential investors. Having initially sought $250,000, the company raised $800,000. "KKR mentored us and put us in front of potential investors and clients, which lent us some legitimacy," Vajipey says. "After this fundraise, and with KKR helping us think about how big we can grow, we are now a bit bolder."

Nascent movement

Banyan Nation represents KKR's third social enterprise assistance project in Asia, following earlier forays into Indonesia and the Philippines. Although private equity professionals throughout the region are active philanthropists, relatively few firms address social issues in a formalized way through the deployment of capital or expertise. To many, it is characteristic of a relatively young industry - or indeed, differing attitudes towards charity in Asia and the West - and change will come with time. However, it remains to be seen how quickly talk about venture philanthropy translates into action.

Asked if she expects to see more private equity activity in the space, Lisa Genasci, CEO of the ADM Capital Foundation (ADMCF), says yes, but adds a caveat: "It's almost as if people want to operate out of two sides of their brain - one side is for the philanthropic giving and the other is for the investment piece. We try and merge the two."

ADM was an early mover, setting up the foundation 10 years ago. The founders of the PE firm, which focuses on special situations and distress investments, covered the core costs personally and they continue to serve as directors of ADMCF, participating in discussions - led by the foundation's independent staff of 13 - on deployment. Concentrating on children at risk and the environment, ADMCF provides early-stage funding and strategic support ranging from accounting to recruitment.

Approaches to venture philanthropy vary according to check size, the maturity of the target geography, the role played by impact investors, and even the characteristics of the enterprises within a particular group's social remit. But ADMCF's underling motivation to fill a perceived gap in the market by helping companies reach agreed goals rather than simply making a donation is shared by others.

Explaining the thinking behind KKR's approach, Steve Okun, the firm's director of public affairs for Asia Pacific, notes that the challenge is not a lack of investors looking to back social enterprises; the impact investor community globally has seen enormous growth over the past decade. But social enterprises struggle to reach the level, in terms of scale or business sophistication, at which they become relevant to investors that are usually seeking a financial return. "We started with the philosophy that the greatest impact we can have from a philanthropic perspective is giving our time and skill as investors," Okun says.

IIX sources deals and performs initial due diligence, establishing that the business is beyond proof of concept and that the entrepreneur has the ability to take advantage of the assistance KKR provides. It then conducts a social return on impact assessment - impact investors want to see projects with measurable social as well as economic returns before they commit - while volunteers from KKR use their time to work on the revenue model, business plan and capital structure.

Social Impact Partners (SIP) was set up in 2014 with a similar rationale, although its operational structure is different. CVC Capital Partners and Baring Private Equity Asia, with some family foundations and high net worth individuals, seeded a $2 million fund for deployment in Hong Kong and they sit on the board of the GP. However, most of the value add comes through the private equity firms' service provider networks, utilized according to the needs of portfolio enterprises. For example, Clifford Chance offers legal support, PwC does the accounting, and Bain & Company provides consulting services.

"One of the core mandates or core ideas for SIP is really to prove that venture philanthropy is an improved way to do philanthropy, whether it's with private equity firms, foundations, or traditional philanthropists," says Lindy Lek, executive director of SIP. She sees the investment process itself as very much aligned with private equity: rigorous due diligence, key performance indicators, and a focus on long-term sustainability and the scaling up of enterprises.

Like KKR, there is a preference for scale-up rather than start-up situations so as to ensure maximum social impact. For example, it took nearly two years of talks and development before SIP made its first commitment to RunOurCity. The enterprise organizes training programs for young people aged 13-20, mostly from difficult backgrounds. After eight weeks, each participant is supposed to be able to run 10 kilometers, and the empowerment that comes from achieving this goal helps them overcome broader motivational and behavioral problems.

The youth-focused program is funded through sponsorship and entry fees for running events open to the entire community; the largest attracts 10,000 participants. RunOurCity held two events in 2014 and five in 2015. By the middle of that year, when SIP became convinced that the business could be sustainable, formal negotiations began. "A lot of deals that come through the door have great programs, but they are run as non-profits with a strong reliance on grant funding, and with little intention or commitment to achieve sustainability," Lek observes.

For Leong Cheung, who left his job as an operating partner at Bain Capital to co-found RunOurCity, a key consideration was identifying an investor that could contribute to the social end, as opposed to just write the largest equity check. One aspect of SIP's value-add was asking Bain & Company to come up with a mechanism for tracking the behavioral change in participants in the RunOurCity program, thereby quantifying the social impact. The enterprise has since received additional capital from the Hong Kong government's Social Innovation and Entrepreneurship Development Fund.

A nod to Europe

SIP's DNA is decidedly European. Douglas Miller co-founded the European Venture Philanthropy Association in 2004 and was instrumental in the launch of its Asian equivalent (AVPN) seven years later. When he subsequently teamed up with CVC and Baring - both founding members of the AVPN - to try and create a model fund for venture philanthropy in the region, there was a ready-made template in Europe: Impetus-PEF, the product of a 2013 merger between the Private Equity Foundation and Impetus Trust.

The organization focuses on enterprises that support disadvantaged children and has a full-time staff of around 30, supplemented by a pro bono network that at last count stretched to 400 people across 60 companies, ranging from GPs to service providers. According to Andrew Ratcliffe, CEO of Impetus-PEF, the model emerged at a time when far fewer private equity firms had their own foundations, but now they often work alongside each other to support particular enterprises. CVC, which set up a foundation in 2011, is among those taking this approach.

"If you are a foundation looking to work on the same issues it is kind of a no-brainer to get behind the charities we work with. Also, they like the fact that we give them a balanced portfolio. They will work with one or two charities themselves but they know that across our 20 charities we are hitting the social problem of disadvantaged young people not getting the chances they deserve," Ratcliffe adds. "It is a way for the industry to achieve more collectively than each organization would on its own."

Alvin Lam, a senior managing director at CVC who represents the foundation on the SIP board, sees Impetus-PEF as an example of what might be achieved in Asia. He describes SIP as "a bit of a leap of faith," at the beginning but has been impressed by advances in the venture philanthropy space since then. The hope is that it won't take 10 years for Asia to reach where Europe is now - maybe five.

However, progress is in part tied to a broader evolution in attitudes towards philanthropy in the region. While there may not be a shortage of capital looking to enter the social sector, it is unclear how many capital providers are willing to invest in social ventures of certain types. Philanthropy in Asia has traditionally been more donation-based, perhaps best characterized by organizations and families putting their names on institutional infrastructure.

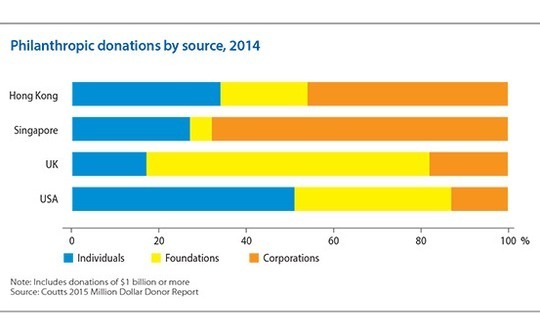

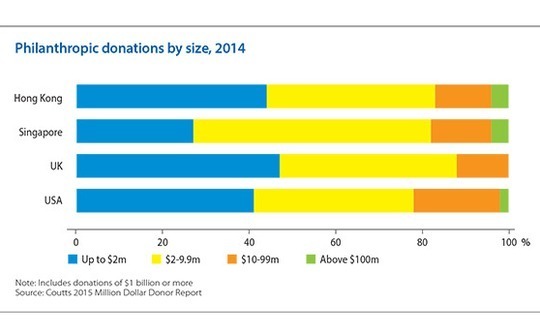

The latest edition of the Coutts Million Dollar Donors Report found evidence of 128 philanthropic donations of $1 million or more in Hong Kong in 2014. Individuals and corporations accounted for approximately $2 billion of the $2.67 billion donated, including: $1.18 billion from Alibaba Group co-founder Joseph Tsai to set up a private philanthropic trust; $350 million from the Morningside Foundation to Harvard School of Public Health; and $167 million from the Hong Kong Jockey Club Charities Trust to the Chinese University of Hong Kong.

In the UK and US there is a more even spread. The UK saw $1.56 billion committed across 298 donations, only 34 of which exceeded $10 million; 240 pledges from US-based philanthropists exceeded $10 million, out of a total of 1,064 across $14.11 billion in donations, and just 2% surpassed $100 million. There is also greater emphasis on individuals and foundations than corporates - in terms of share of overall deal flow, not capital committed.

These data present just a snapshot of activity taking place across the region and there is no breakdown specific to venture philanthropy. But they do offer an insight into prevailing attitudes, as well as perhaps the chances of more private equity firms adopting active philanthropy models and the willingness of other organizations to participate as partners in these endeavors or as follow-on funders.

"It's still suffering from the liability of newness and we need more examples of success," says SIP's Lek. "At the same time, it is a very resource-intensive process - in terms of financial and non-financial resources - and in order to justify it you need to find organizations that have the capacity to fully utilize the resources to achieve measurable social impact."

At the heart of the resource issue is a residual discomfort with a portion of each donation being used to cover the costs of a GP or social enterprise rather than going directly into a program. First, even with a skeleton staff, a fund the size of SIP is likely to have a relatively high percentage allocation for management expenses; essential to those that recognize the additional social impact that professionals pursuing a value-add strategy can bring about, but troublesome to those that do not.

Second, venture philanthropy typically involves backing a social enterprise to grow, which requires investment above the project level. "We often find that as an organization is growing the hardest money to get is the money it needs to build internally. People don't like investing in what they see as overhead, but management allows the organization to be successful in the long term," says Ratcliffe of Impetus-PEF. "The danger with only funding specific programs is it's very difficult for the programs to improve."

The situation is said to be improving in Asia. A number of family offices and foundations already engage in venture philanthropy - one of SIP's backers is a foundation - and others are starting to follow suit. One explanation for this change in mindset is generational transition within family offices. Patriarchs who favored straight donations to institutions are being replaced by younger family members who are more interested in taking an active role. Groups like the Hong Kong Jockey Club are also gradually becoming more strategic and making longer term commitments to social enterprises.

Lasting change?

Private equity is well positioned to provide the non-financial resources that others cannot, whether it is access to financial and business planning skills or putting social enterprises in front of potential investors and customers. Should GPs in Asia want to get more involved, the question is how. ADM, KKR and SIP are similar in ethos but represent different levels of direct participation. On one hand, driving initiatives internally is time-consuming and requires dedicated resources; on the other, finding the right external partners is difficult.

"I think there is a lot of desire, I just feel these guys don't have the right people willing to run it," says Waikay Eik, partner and member of the Greater China PE transaction team at PwC. "They need someone they can trust, who is in it for the right reasons."

Of the PE firms making tentative steps into the space, Southeast Asia-focused Northstar Group makes for an instructive example. The GP's foundation has been active for several years, donating time and money to a variety of causes. Earlier this year, it brought structure to what had previously been a largely ad hoc process with the establishment of an impact committee that leads philanthropic and social investment initiatives. A full-time coordinator for responsible investment is in the process of being hired.

If this approach is most closely aligned to that of ADMCF, it doesn't make the others redundant; as is the case with Impetus-PEF, like-minded organizations want to invest alongside one another. However, while ADMCF's Genasci suggests that "a shared vehicle" for private equity investors in Asia might help, it is debatable whether such a formalized model is appropriate for each market.

Social Ventures Australia was set up in 2002 by several foundations and targets social disadvantage in areas ranging from education and employment to housing and healthcare. Rob Koczkar, a former managing director at Pacific Equity Partners who now serves as the organization's CEO, has yet to see mainstream private equity firms in the country set up similar, SIP-style entities or programs along the lines of KKR's social enterprise assistance initiative. But they still contribute.

"We have benefited from the support from a large number of executives in private equity firms who supported us financially and with time and talent to do various elements of our business," he says. "This involves sitting on investment committees, working with individual portfolio companies. Also, through AVCAL [the Australian Private Equity & Venture Capital Association] our team has access to a series of mentors from within the industry."

If models like SIP therefore represent a contributing part of the developing venture philanthropy ecosystem in much of Asia - a step along the evolutionary curve rather than its end point - the consensus view is there can be no turning back. Several industry participants point to growth in the impact investment space as evidence not only of theses being proven but also the increasing importance LPs attach to social interest as well as financial returns.

This is already bleeding through into the traditional private equity industry globally. Partners Group, for example, set up an employee foundation in 2006, which has since backed 24 social enterprises. Last year the strategy was institutionalized with the creation of a separate but affiliated investment firm that is structured to raise capital from third-party investors.

"Fifteen years ago you had donors and investors and nothing in between, but that is starting to change," says Robert Kraybill, managing director of IIX, which is now raising its own PE-style fund for investments in social enterprises in South and Southeast Asia. "Traditional foundations are saying, ‘Most of what we do is give money away but there is no reason why we can't make investments if that is a better way of addressing a problem.' On the other side, more investors that in the past would target only financial returns are saying, ‘If I can make a positive social impact and generate a return, why not?'"

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.