American dreams: China targets US semiconductor assets

Chinese interest in semiconductor assets has again put the Committee on Foreign Investment in the US under the spotlight. Not all deals get through, but corporate China is generally braver and better informed

While clearly a high-profile deal, Tsinghua Unigroup hoped its investment in America's largest disk drive manufacturer Western Digital (WD) would not fall foul of the regulators. After all, the $3.87 billion price tag would only get the Chinese party a 15% stake and a single board set. But a notification was filed nevertheless, an acknowledgment of the sensitivities surrounding semiconductors.

That was last October. To Unigroup's frustration, the Committee on Foreign Investment in the US (CFIUS) - a body tasked with assessing the national security implications of deals that could result in an overseas entity controlling a domestic business - procrastinated over whether it had jurisdiction over the deal. And in the meantime, the situation took another twist. WD launched a bid for chipmaker SanDisk Corp, going up against Micron Technology, which was supposedly a target for Unigroup.

These prospective related transactions clouded the issue. Unigroup and WD re-filed their notification to CFIUS in order to better address national security concerns, but the regulator decided in February that the deal did in fact warrant attention and launched a review. Unigroup responded by ending its interest in WD, taking advantage of an unusual clause present in their agreement since the outset: either party could terminate the deal if CFIUS claimed jurisdiction.

As Chinese outbound investment has risen to record highs in recent years, companies have become more experienced, better advised, and generally more willing to the run the regulatory gauntlet in pursuit of deals. In this respect, the semiconductor space represents of a perfect storm: strong demand for assets ranging from upstream inter-circuit (IC) design to downstream packaging services from investors with clear Chinese policy support; an industry packed with intellectual property considered of national interest; and an opaque regulatory arguably unaccustomed to this kind of activity.

"CFIUS' mandate is to vet transactions for national security reasons on a case-by-case basis. It was not designed to accommodate serial purchases in a particular industry - such as those that we have seen in recent years in the semiconductor industry - that potentially could have broader implications for the industrial base," says Anne Salladin, special counsel at Stroock & Stroock & Lavan and previously an attorney at the US Treasury Department where she was involved in CFIUS reviews.

The Tsinghua imperative

Unigroup has fast become the best-known serial investor following a string of deals. Owned by Tsinghua Holdings, an investment arm of state-owned Tsinghua University, it is primarily responsible for executing China's strategy to carve out a meaningful market share in global semiconductor manufacturing. The company has set itself a goal to become the world's third-largest chipmaker and pledged to spend RMB300 billion ($47 billion) acquiring relevant assets over the next five years.

Weiguo Zhao, chairman of Unigroup, also a Tsinghua alumnus, outlined his objectives in an interview with Reuters late last year, hinting at another US-based acquisition. The company's spree has already been wide-ranging. It privatized Spreadtrum Communication and RDA Microelectronics in 2013, purchased a majority stake in Hewlett-Packard's China data networking business last May, and five months after that entered the US with the planned WD investment. Taiwan and the UK are other targets.

China consumes about $169 billion worth of microchips every year - more than any other country in the world - which are used domestically and for exports. However, it relies on imports for more than 90% of its ICs. The government has made several attempts over the last decade to build a local semiconductor industry, but with minimal effect.

Nevertheless, targets for upstream IC industry revenue growth and technology improvements in downstream segments are ambitious. Between 2014 and 2020, the IC segment is supposed to register compound annual growth in excess of 20%, China should be able to mass produce the 16/14 nanometer, and packaging and testing technology is expected to reach world-class levels. According to Bernstein Research, the IC industry posted 17% CAGR from 2007-2014, compared to 3% globally.

To achieve these goals, the government has adopted a more market-driven approach to inject capital into the supply chain. First, it set up the RMB10 billion National IC Development Fund to support the foundry segment and also to push industry consolidation domestically and overseas. The vehicle follows a fund-of-funds model, providing seed capital to semiconductor-focused funds managed by professional managers rather than government officials. Unigroup is one of the major recipients of capital.

Several private equity firms have also been established at province or city level, such as E-Town Capital and SummitView Capital in Beijing and Shanghai, respectively. SummitView launched a RMB10 billion fund alongside the Shanghai government. Separate from Unigroup, a Tsinghua Holdings investment team set up Hua Capital alongside China Fortune-Tech Capital. All these firms are backed by the central government or local governments in targeting semiconductor assets overseas.

"No one knows how long this window of opportunity will remain open. Historically, the general pattern is that a window opens for a while and then closes for a while. As such, when it opens, everyone quickly contacts the people they know to try to raise money and do similar things. This is typical of China during periods of relaxed policy - which generally continue unless or until something blows up badly," says Michael Weiss, formerly a partner at domestic cross-border PE firm Sailing Capital.

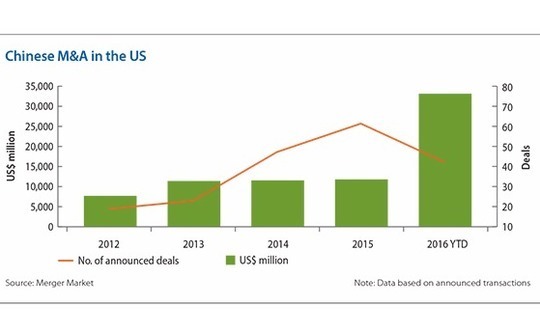

According to Mergermarket, announced M&A deals in the US by Chinese companies stands at $32.8 billion across 42 deals so far in 2016, up from approximately $11.5 billion in each of the three years before that. A handful of large-ticket transactions can make a lot of difference to the headline number, and the semiconductor space is no exception. Eight deals worth a combined $2.29 billion were announced in 2015, the highest on record. This compares to $92 million and $76 million in 2013 and 2014, respectively, and $259 million for 2016 to date.

Regulatory spotlight

China has held top spot for the number of investments reviewed by CFIUS for the three years to 2014. The agency covered 147 deals in 2014 - the greatest number since 2008 - with China accounting for 24 of these, up from 21 in 2013 and 23 in 2012. Nearly three quarters of transactions filed by Chinese investors were in manufacturing, finance, and information and technology, which includes semiconductors. CIFUS is expected to confirm another rise in the yearly China total when its 2015 figures are released.

The filing process is voluntary and it is incumbent on foreign investors to notify the agency about proposed deals that could potentially raise national security concerns. Many err on the side of caution, aware that CIFUS can act retrospectively and review transactions that were not filed voluntarily. In the past, the committee largely focused on reviewing foreign takeover deals involving in the military and defense industry, but its coverage has broadened in recent years, taking in sectors such as consumer.

"With semiconductors, we are in an environment currently where certain targets and buyers may find it challenging to execute a transaction. If you have a Chinese buyer and a target that has US government contracts, or other technology that's deemed to be sensitive, or R&D and special manufacturing capabilities in the US, getting CFIUS clearance might be challenging," says Charles Comey, a partner at Morrison & Foerster.

It is worth noting that most China-related transactions filed with CFIUS are cleared, and not every semiconductor deal has been black flagged. Before Chinese acquisitions had emerged as a significant trend in the space, a consortium known as Uphill Investment completed a takeover of NASDAQ-listed semiconductor maker Integrated Silicon Solution Incorporated (ISSI) and another group of Chinese investors bought OmniVision Technologies.

However, in each case the composition of the investor base still came under scrutiny. Uphill - which was led by SummitView, Hua Capital and Beijing E-Town - was asked to withdraw and re-file its notification before receiving clearance to buy ISSI. This was to allow the regulator enough time to check the background of each Chinese investor and also review the nature the target's business so as to ensure any sensitive issuers were addressed.

Once a deal is filed with CIFUS, it usually takes around 30 days to review, and an additional 45 days can be requested to conduct in-depth due diligence if the deal structure is complicated. Every year, about one third of all transactions require such an extension in the review process. Transactions involving state-owned enterprises usually receive particularly close attention. It has become obvious that, even though private capital features in some of these semiconductor deals, most of the buyers have government backing.

"Processing large numbers of Chinese transactions at one time can present challenges to CFIUS. Typically, these cases require a tremendous amount of due diligence. They can involve more complicated deal structures and, recently, new players like Chinese private equity. Assessing the degree of government ownership and control, which is not always transparent, can also be difficult. At the end of the day, CFIUS needs to know who is calling the shots," says Stoock's Salladin.

Lumileds logjam

The nature of these concerns became apparent during Go Scale Capital's failed attempt to acquire a majority stake in Lumileds - the LED components and automotive lighting unit of Netherlands-based Philips - at a valuation of $3.3 billion. While not a pure semiconductor deal, it involved a considerable amount of intellectual property, with the transfer of more than 600 patents from Philips to Lumileds. There was also a California subsidiary that carried out R&D as well as manufacturing activities, which placed the transaction in CFIUS' orbit.

Go Scale is a Chinese private equity firm sponsored by GSR Ventures and Oak Investment Partners. According to industry participants, the regulator become suspicious about the buyer's intentions because it had never heard of Go Scale and was uncomfortable with the notion of a firm with deep roots in venture capital suddenly turning to buyouts. Philips said last October that completion of the deal was uncertain after CFIUS raised "unforeseen concerns," and Go Scale pulled out in January.

Go Scale said it had been "very transparent about its bona fide commercial and market-oriented interests to invest in technologies" but failed to address government concerns, which the firm did not specify. The two sides reportedly worked on mitigation efforts intended to address concerns about the potential transfer to China of semiconductor technology used in manufacturing LEDs.

"The challenge CFIUS can present for Chinese buyers is not only that it may be unclear whether there will be an issue in gaining clearance, the committee may not fully articulate what its concerns are," says MoFo's Comey. "In the Lumileds case for example, there were apparently concerns regarding the technology and R&D aspects, but lacking details Phillips reached a point in the process where it decided to simply call it and move on." He adds there was a similar pattern in the Unigroup-WD deal.

In addition to thwarting Go Scale's ambitions, the Lumileds situation represented a lot of wasted time and money for Philips; it will be more wary when putting the asset up for auction once again. Fairchild Semiconductor International was of the same mind when rejecting a buyout bid from China Resources Microelectronics and Hua Capital in February. The board said the risk of CFIUS problems was too great, regardless of the size of the offer and the buyer's willingness to pay a $108 million break fee if approval was not forthcoming. It sold to a US firm at a lower valuation as there was more deal certainty.

This risk is increasingly being priced into deals through reverse break-up fees payable by the Chinese buyer if for certain reasons a transaction does not go through. They are particularly prevalent in deals that involve sensitive technology. At the same time, Chinese bidders continue to pay a premium for assets, with valuation multiples exceeding those offered by non-Chinese groups by high single-digit margins. It is not just a reflection of CFIUS uncertainty, but also the possibility that Chinese regulators might nix transactions or financing might fall through.

"US targets often ask for a high termination fee from Chinese buyers. If a Chinese buyer deposits the termination fee [in escrow] when signing the merger agreement, the US counterpart would have a certain level of comfort in doing the deal. Even if the deal can't be completed due to various reasons, at least the target will take away the termination fee," says Ke Geng, a partner at O'Melveny & Myers.

Strategic considerations

The torrent of Chinese outbound investment shows no sign of abating, with the government continuing to relax restrictions and bureaucracy for offshore M&A. It is a response to the slowing economy and a corporate imperative to drive growth by building exposure overseas or by acquiring technologies and expertise that facilitate a business transformation at home. Advanced manufacturing - which goes above and beyond semiconductors - and healthcare are natural areas of interest.

As prospective Chinese acquirers consider investments, the experiences of their counterparts in the semiconductor space should prove instructive in terms of addressing regulatory issues. Clearly, approaches to M&A will continue to evolve and this will have implications for the structure of deals, whether it means spinning out certain assets, starting with minority interests with a view to achieving control over time, or offering more concrete guarantees to counterparties and other stakeholders.

While the spate of semiconductor deals - successful and unsuccessful - serves as a lightning rod for US concerns about Chinese investment, China's CFIUS experience is not necessarily a negative one. Stephen Heifetz, a partner at law firm Steptoe & Johnson who previously contributed to CFIUS reviews while at the Department of Homeland Security, notes that companies have become more sophisticated in addressing the process. There are fewer errors so a high percentage of deals receive regulatory clearance.

"CFIUS has also become much more familiar with Chinese investments over the last five years," Heifetz adds. "They recognize the importance of free trade. Public attention often has focused on the relatively few cases where CFIUS found significant national security risks, but CFIUS clears most cases, allowing trade to flow most of the time."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.