Japan VC: Outbound ambition

Japanese start-ups are looking to address global markets from day one, but few domestic venture capital firms are equipped to support cross-border strategies. Corporate VCs could provide the solution

Whill has an all-direction four-wheel-drive technology that allows users of its electric wheelchairs to make turns even on rough surfaces. The company was founded in Japan five years ago but from the outset wanted to see if its products could have an equally smooth path to commercialization in foreign markets. Within a year of incorporation, co-founder and CEO Satoshi Sugie moved the headquarters to San Francisco and joined US-based 500 Startups' accelerator program.

Now approved by the US Food & Drug Administration, which means its wheelchair can be prescribed by doctors as a medical device, Whill is successfully adapting to its new market. The start-up has also attracted attention from global investors. Eight Roads Ventures recently led a $17.5 million Series B round that will not only drive Whill's marketing efforts in the US but also help it enter Europe.

While Japanese start-ups once emphasized the domestic market, Whill is an example of the new imperative to be global from day one. In this sense, nascent companies are expected to follow in the footsteps of the country's corporate giants, such as Rakuten and SoftBank, and expand overseas early on. The question is whether independent venture capital firms or the captive investment units of domestic companies are willing and able to facilitate this transition.

"VC has a strong local element, it needs GPs on the ground in order to secure good deals and provide hands-on assistance to start-ups. Having said that, our upside is taking portfolio companies overseas," says Shinichi Takamiya, a partner at Japan-focused Globis Capital Partners. "Corporate VCs are the most active players in overseas investments now. A lot of them making the investments as a means to spear head their businesses, whereas financial VCs like us are really leveraging our home establishments to build portfolio company global presence progressively."

Gaining momentum

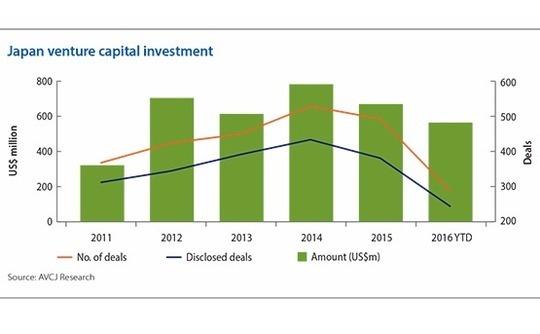

Despite Japan's economic maturity and technological sophistication, its venture capital industry remains relatively small, and in recent years investment has been flat. Commitments to start-ups at all stages amounted to $644 million last year, according to AVCJ Research. This compares to $700 million in 2012, $609 million in 2013 and $775 million in 2014. Corporate venture funds are responsible for most of these deals, and their investments have yet to deliver impressive results, industry players say.

However, there is evidence that the VC ecosystem is improving, with Japanese pension funds and other institutional investors showing greater interest in the new economy. When Globis closed its fifth fund at $150 million in April, the LP base included a handful of corporate pension funds. Only one of investor of this type backed the previous fund and it took Globis 15 year to cultivate that relationship.

Meanwhile, the capital is being put to work in increasingly large rounds. Three years ago, if a start-up raised $3 million, that was considered sizeable; today $10 million rounds happen with greater regularly. The recent JPY8.4 billion ($74 million) raised by Japan flea market-style e-commerce app Mercari represents a significant leap forward, and not only in terms of the size of the round. The investment valued Mercari at more than $1 billion, making it Japan's first pre-IPO tech unicorn.

Much like Whill, Mercari has sought to expand overseas due to the limited size of the domestic market. A US operation was launched two years ago and the company is currently working on customer acquisition for its mobile app. Mercari also approached World Innovation Laboratories (WiL) - a Silicon Valley-based cross-border VC firm that specializes in bringing Japanese start-ups to the US, and vice versa - asking for assistance on hiring staff, finding local partners, and devising a US marketing strategy.

Gen Isayama, co-founder and CEO of WiL, says Mercari's niche customer-to-customer (C2C) business model and the founding team's background - its founder Shintaro Yamada previously set up gaming studio Unoh, which was sold to US-based Zygna - increase the chance of success in overseas markets. At present, there aren't many Japanese start-ups with similar capabilities, but more are likely to emerge in the medium term.

"If you have a management team that only speaks Japanese, going anywhere will be a major challenge. But we are starting to see more young people, who are educated overseas, joining Japanese start-ups, so we hope this will change," says Isayama. "We will see more of these start-ups going overseas in the next 10 years, it is all about timing. I want to be the first to help them enter the US or even Asian and European markets."

The challenges of adapting to a different operating environment are not only relevant to Japan's nascent technology companies; local VC firms also need time to build up their infrastructure in new markets, including hiring local staff, if they are to be of use to portfolio companies looking to make the same move.

Several large Japanese corporations have formed overseas VC units, or investment funds, that back global start-ups. SoftBank has been doing this for years, sponsoring a network of funds that are now either fully or partially independent if not still captive.

Rakuten is also an active investor overseas, with a Singapore-based VC arm that looks for deals in Asia and beyond. Over the last two years, the company has launched global funds targeting financial technology and start-ups generally, with all of the capital believed to come from the parent. Investments - coverage stretches from Singapore mobile advertising platform PocketMath to Chinese discount site Fanli - are supposed to help strengthen Rakuten's e-commerce ecosystem.

"Having their own corporate VC arms, it's kind of a high risk, high return strategy. These principal investments tend to focus on middle to late-stage deals, which link directly to the parent's core business," says Takamiya of Globis. "If they were looking for a lower-risk approach they would diversify their coverage by investing in many independent VC funds to get the maximum amount of information."

Hybrid approach

CyberAgent was among the first Japanese corporations to set up an overseas VC unit, with CyberAgent Ventures launching a China fund in 2005 and a Southeast Asia fund four years later. A South Korea fund was recently added to the portfolio, and the three vehicles manage about $110 million between them. The parent company contributes 20-30% of each fund, with the remainder coming from third-party LPs, predominately other Japanese corporates.

"The reason CyberAgent went into markets outside of Japan wasn't because we were supposed to help Japanese start-ups go outside of Japan; it's because we saw the potential of start-ups in Asian markets to grow into bigger companies," says Nobuaki Kitagawa, managing director at CyberAngent Ventures. "We're sort of corporate VCs, but our money doesn't only come from CyberAgent, but also from third-party LPs, so our ultimate goal is a financial return."

In recent years, more Japanese corporates, particularly those from traditional industries, have begun taking venture capital seriously as they see how disruptive technologies are changing their businesses. Lacking of dedicated resources and VC industry expertise, they tend to participate as LPs in venture capital funds domestically and overseas in order to become more familiar with the technology sector. CyberAgent is an example of this, but so is WiL, which has a dozen Japanese corporates in its current fund.

If the objective is to invest in the best technologies globally, then the interests of these corporate VCs and Japanese start-ups may ultimately converge - the latter have the ambition and business model to enter new markets, and the former see in these companies the potential for rapid growth and strong returns. CyberAgent is willing to support Japanese companies and believes its experience and resources in overseas markets, in addition to its familiarity with Japan, could translate into a unique kind of value-add.

"Right now I don't see Japanese venture capital firms going global very quickly," adds WiL's Isayama. "But I see huge potential for conglomerates coming to the venture space and using their global networks to help start-ups reach different countries. Corporate VCs are well-resourced and multi-lingual, and with their resources the chances of start-ups achieving scale are higher."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.