Japanese LPs: Glacier effect

There is growing interest among Japanese institutional investors for exposure to alternatives. However, this doesn’t mean commitments will come quickly, or go to private equity first

Masatsugu Nagato was speaking for a behemoth that is part of a JPY295.8 trillion ($2.7 trillion) financial conglomerate, so his words made an impact, but the sentiment is shared by many Japanese institutional investors. "Under the current low-interest-rate environment, any investment has been hit," said Nagato, CEO of Japan Post Holdings, adding that the company would increase investments in other areas.

Japan Post Bank, which accounts for the bulk of those assets, has already embarked on an aggressive diversification scheme. Its proportion of government bond holdings has fallen at the expense of higher-return assets, while last year a division was created to explore private equity opportunities. The bank doesn't disclose details of its program but it was expected to start making commitments in 2016.

Japan Post Bank listed last November so an evolution in its investment strategy was expected, but negative interest rates - introduced in a surprise move early in the year following a decade of zero interest rates - has arguably accelerated the process. Around the same time, insurers such as Nippon Life, Dai-ichi Life and Sumitomo Life indicated that they would invest more overseas as well as making larger allocations to higher-return assets, notably alternatives.

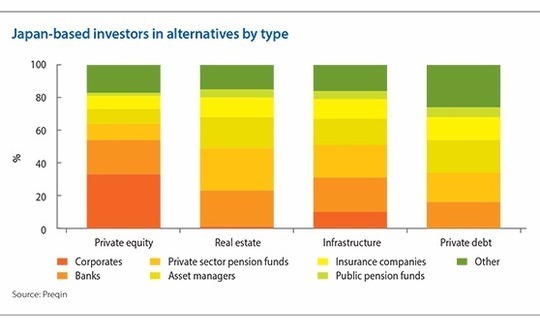

While certainly a long-term positive for private equity, this does not yet represent a panacea. Comments by these institutional investors were punctuated by references to yield - implying they will look first to assets that offer consistent returns, such as infrastructure, private credit and real estate. Institutional investors will devise investment policies according to their specific needs, and certain LPs are clearly more bullish on private equity than before, but for many the onus is currently on studying the asset class.

"They are allocating more to credit, with bank loan funds very popular. This is followed by mezzanine and infrastructure, which offer yield-based returns, and lastly they might allocate a bit more to private equity. It is in that order," says Kazushige Kobayashi, managing director with Capital Dynamics. "Most Japanese institutional investors want returns of 5-6% so private equity is perhaps a bit too risky for them. The j-curve is also a challenge: if they allocate more to PE the return won't come for 4-5 years."

Mixed bag

The bulk of the asset diversification seen so far has been understandably conservative. According to HSBC, major Japanese investors plowed JPY1.5 trillion into overseas bonds in May, up from JPY620 billion the previous month, with North America and Europe the primary destinations. Japan Post Bank, for example, had about 45% of its assets in Japanese government bonds last September and; the switch to higher-return investments likely focuses on offshore debt that can earn a positive yield.

Alternatives exist at the margins and size of appetite hinges on the level of existing exposure. One insurance company investment manager notes that his firm has been active in private equity for more than 15 years, with 60 active GP relationships, three quarters of which involve funds in North America and Europe. There is a preference for low volatility and, yield-generating assets, and a wariness of the j-curve effect, but private equity has performed well and so the current allocation is unlikely to change.

Tuck Furuya, co-founder at domestic placement agent Ark Totan Alternative, adds that some financial institutions are investing more in private equity on an absolute basis, but this is because they are playing catch-up. They missed out on a couple vintages having slowed deployment following the 2011 Great East Japan earthquake and so deployment has speeded up but the overall allocation target is the same. Others are simply responding to strong distributions, particularly from North American portfolios.

"If an investor has a $2 billion private equity portfolio and distributions have been strong in the last two years, then maybe the assets under management have fallen to $1.5 billion. They want to keep it at $2 billion so they have to deploy more. It is a cyclical effect - it's not that they are more upbeat on private equity, they just want to catch up to where they used to be," Furuya says.

For foreign managers targeting Japanese investors, the call sheet tends to be populated by the same cluster of names: Development Bank of Japan (DBJ), the Pension Fund Association (PFA), Norinchukin Bank, Sumitomo Mitsui Banking Corporation (SMBC), and a handful of life insurers. These are the stalwarts in a group of up to 10 LPs that make several new commitments each year. Another 10 are either less consistent or focus on re-ups.

Nevertheless, the amount of capital this clutch of investors has at its disposal is expanding, according to Kallan Resnick, managing director at Park Hill Group. This is a result of distributions being recycled into new investments and also the strengthening yen. "An allocation that used to be $200 million a year might now be $250 million, which is another two managers per year," he says. They tend to be conservative in their choices, with a preference for global brand names or leading upper middle market managers in North America and Europe.

Of the groups in the process of building alternatives programs, Government Pension Investment Fund (GPIF) and Japan Post Bank are viewed most keenly, just by virtue of their size. But obtaining money from them is likely to be a long-term endeavor.

GPIF has teamed up with DBJ and Ontario Municipal Employees Retirement System on an infrastructure investment partnership and made a commitment to International Finance Corporation's latest emerging markets fund-of-funds, but its activity has otherwise been limited. This should remain the case until internal reforms are completed and additional staff are hired. GPIF is said to have five people covering private equity, infrastructure and real estate, while Japan Post Bank has a team of around 10.

Once these institutions are fully active in alternatives, they may still be somewhat thinly staffed. PFA is a useful reference point: it has JPY12.7 trillion in assets, of which around 5% is said to be deployed in private equity; a handful of people are responsible for this allocation and they make investment decisions under advice from Hamilton Lane.

Numerous fund-of-funds and advisory groups have bulked up their presence in Japan but securing a mandate from the likes of GPIF is not necessarily the sole objective. "What has really put Japan on the map in the last couple years is hopes about the whales, without a doubt," says one fund-of-funds executive. "We meet with those guys but I don't have much hope of winning mandates from them; I really want to position us to focus on the tier-two and tier-three guys."

Primary targets

Chief among those targets are corporate pension funds and regional banks. Capital Dynamics recently set up a separate account for a pension fund that wanted to diversify its local private equity portfolio but didn't have sufficient human resources to do so on its own. Kobayashi observes that some groups not only want assistance with offshore investments but also domestic coverage where they want to dip into the lower middle market and are uncomfortable making decisions on smaller managers.

Not all pension funds have large enough allocations to warrant separate accounts, and some are not increasing private equity exposure at all. Indeed, rather than respond to negative interest rates by upping exposure to higher risk, higher return assets, a number of pension fund simply reduced their target returns.

"I am not seeing a lot of activity from pension funds, but I see the potential for activity," Park Hill's Resnick says of demand for offshore private equity. For the government pension funds, much of this potential rests on GPIF. The JPY120 trillion pension fund serves as an allocation model for its smaller counterparts, so when GPIF becomes more active in alternatives the rest will follow.

Japan's regional banks, meanwhile, are becoming more active. Their check sizes tend to be smaller than those of other financial institutions - $5-10 million versus $30-40 million - but there are about 120 nationwide, and a fair number of these are expected to move into the market. Domestic GPs remain the major focus for the regional banks, although greater offshore exposure should come with time.

"I have detected more of an appetite from these regional banks in the last four months than anyone else in the market," says Ark Totan's Furuya. "The early movers are trying to look at foreign opportunities at the same time. I've had calls from regional banks wanting to look US and European investment opportunities."

It was reported last year DBJ had agreed to work with Chiba Bank and Shizuoka Bank on offshore private equity, with each group committing about JPY10 billion for investment in US and Asian funds. DBJ's asset management unit would be responsible for identifying target GPs.

Japanese institutions were among the first in Asia to invest in private equity globally and the country has long been a fixture on the fundraising circuit. As the domestic LP community develops, more GPs come in search of allocations and more advisors will pursue mandates. But no matter how these investors access alternatives, and in what order they address different asset classes, one factor will remain the same: time.

"It is difficult just to go there when fundraising and expect immediate commitments or commitments that come early in a fundraise. You have to invest time and make multiple visits outside of the fundraising process," says Michael Henningson, managing director at First Avenue. "Japanese LPs are already in a number of funds so if you have a stable of domestic investors that are reference points, it becomes easier to raise capital."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.