China micro VC: The micro wave

Micro VC firms are a relatively new segment in China’s venture capital ecosystem, the product of angel investors going institutional. They focus on early stage deals, but as demand grows, will they stay there?

Matt Cheng never intended to become a venture capitalist. Twelve years ago, while applying for an MBA course after leaving his first internet start-up, Cheng's boss from a previous internship recommended him for a position with Taiwan-based VC firm C Square Capital. In early 2005, within six months of joining, he was sent to cover the China market.

The industry was still relatively young and Cheng had to build networks and source deals from scratch, but gradually they came. Now an established super angel, his track record includes being the first backer of China social video platform Tian Ge Interactive - a competitor to YY - which went public in Hong Kong. Cheng went on to establish his own seed-stage fund, Cherubic Ventures, in 2010. First in China and then in the US and other Asian markets, he has backed more than 90 start-ups.

Cherubic raised $8 million for its debut US dollar-denominated fund and $42 million for its second. The third has a target of $120 million and already has $80 million in confirmed commitments from LPs. Cheng classifies Cherubic as a micro VC firm, but it is entering territory beyond the standard definition of fund size below $100 million. A new stratum in the China venture ecosystem appears to be growing in popularity - and rapidly.

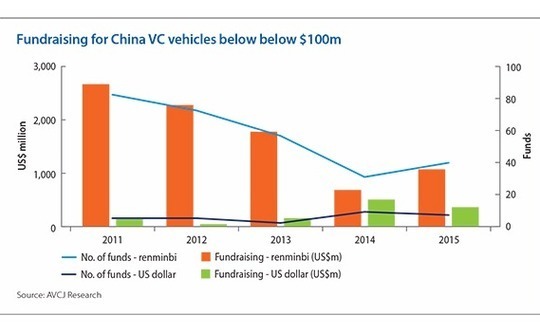

"When angel investors start to emerge, LPs from outside and inside China see an opportunity to grow a micro VC category," says Cheng. "Micro VC funds, in the renminbi and US dollar space, began to emerge after 2011. The US VC industry is probably 20 years ahead of China, but if you look at the micro VC space, China is actually not that far behind the US."

Evolutionary path

The route from angel investment to micro VC is entirely logical: successful entrepreneurs invest their own money in start-ups, enabling a new generation of founders; in due course there are enough opportunities to justify institutionalized, very early-stage funds. While angel investors commit personal resources, micro VC involves third-party capital, traditional fund structures and clear delineations between GP and LP.

The term entered the industry lexicon in the US around 2010; there are now about 200 micro VC funds in the country, compared to about 2,000 angel investors. While fund sizes are generally below $100 million, there are also sub-segments such as micro-cap funds, which are smaller than $50 million. Investors say the definition is fraying, with the line between micro VC and seed investment often unclear.

"It is a bit blurry in the US. Micro VCs typically invest a significant chunk of capital into the seed stages and look for more control," says Rui Ma, Greater China partner at US-based 500 Startups. "Some people call us micro VC but we consider ourselves a regular seed fund. For example, we deploy $100,000 on average for each investment, but micro VCs might put in at least $300,000-400,000 and want a board seat. We don't take active operational involvement in start-ups."

In China, the micro VC trend was kick-started when founders whose companies went public from 2008 put money back into the system. But seed funds were rare before 2010. Xu Xiaoping, co-founder of New Oriental Education, became a full-time angel investor in 2009 after three years doing it in his spare time. In 2011, he launched ZhenFund. Meanwhile, K2VC was the result of a spin-out from VC firm Ceyuan Ventures in 2010 and a partnership with China Renaissance.

"Usually, angels invest for themselves for a few years and then want to make it more like a platform. Three to five years later, they become micro VC fund managers. We have seen a lot more now. There are also a lot of investment professionals who spin out from VC firms and set up their own firms. They probably start small as micro VC," says Anna Fang, CEO of ZhenFund.

Future Capital, the brainchild of serial entrepreneur and angel investor Mingming Wang, is an example of the first model. He co-founded domain navigation site 265.com, sold it to Google, and made angel investments until forming Future Capital in 2014. Source Code Capital falls into the second category, having been created in 2014 by Yi Cao, a former partner at Sequoia Capital.

There are said to be around 15 US dollar micro VC funds, each between $20 and $80 million in size, active in China. The renminbi space is difficult to track given the lack of transparency, but there is a lot of activity because it is easier for these funds to access domestic deals.

"More renminbi funds are being set up than US dollar funds because renminbi is better for early stage founders, they can get the funding quickly and get on with their business. That's why I set up renminbi funds initially. I don't have to use VIE [variable interest entity] structures, which is costly and time-consuming for the founders," says Andrew Teoh, founder and managing partner at early-stage investor Ameba Capital.

Pipeline play

Whichever currency a micro VC operates in, entrepreneurs, technology industry executives and traditional venture funds are an important source of capital, particularly as renminbi fund-of-funds generally will not invest so early. Unicorn Capital Partners, a fund-of-funds launched last year to focus on China VC, is one of the few active institutional US dollar investors in the market. It has backed Cherubic and Future Capital.

"Micro VC fund is the riskiest segment in the venture asset class. I don't see many institutional LPs wit the appetite for micro VC funds in China given it very early stage risk; we are probably the only institutional LP actively investing in this space," says Tommy Yip, co-founder at Unicorn. "This segment comes with higher risk, but it also means higher returns. These managers have a better chance and higher potential to deliver 10x or above fund-level returns given their smaller fund sizes and low entry valuations."

The future of micro VC is to a certain extent dependent on the traditional venture space. In recent years managers have raised ever larger funds - the further they go past the $300 million mark, the less likely they are to consider seed stage deals of $1-3 million. Instead, they will commit small amounts - either at fund level or from managers' personal resources - to micro VC funds to stay abreast of early-stage deal flow.

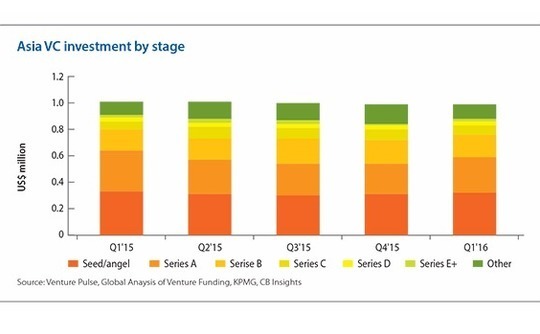

"About 100 Chinese start-ups are able to raise Series C rounds every year, whereas in the Series A and pre-Series A space, people joke that more than 30,000 companies get funded. The number of follow-on investments has dropped significantly," says Harry Wang, co-founder of micro VC firm Linear Ventures. "By investing in micro VC funds, traditional VCs can broaden their coverage and get to know start-ups before investing later-on. Sometimes they can get into proprietary deals early on at lower valuations."

However, most LPs don't want established GPs making passive investments in other VC funds - there is an extra layer of fees and returns are unlikely to match those of direct deals. Therefore, GPs must convince LPs that participating in a third-party fund as a strategic investor will help generate deal flow. In some cases, GPs waive a portion of the fees and carry charged to the LP.

Sequoia, for example, has made fund level investments in vehicles managed by ZhenFund, Future Capital and Source Code. It is unclear where the capital is coming from, although the firm has a fund-of-funds to invest in early-stage funds. GGV Capital is also a Cherubic LP. Industry participants see this as a natural evolution of the VC ecosystem - entrepreneurs, seed funds and matured VC funds supporting each other.

"Traditional VC investors can enjoy our investment returns through investing in our funds," says one micro VC player. "We also work closely with other angel funds to cover more early-stage deals. There might be some potential conflicts of interest, but we believe they can be addressed through sensible management. A professional GP is responsible for delivering the best results it can to all LPs in its funds."

Expansion plans

ZhenFund must also manage many different interests. The firm has four US dollar funds and three renminbi vehicles. Xu and Sequoia were the sole LPs in the first two of each kind; then the LP base grew to include other international investors, including family offices and VC fund-of-funds Horsely Bridge Partners. Tencent Holdings and Gopher Asset Management are LPs in the latest renminbi vehicle. ZhenFund does not award co-investment rights to Sequoia.

"The early stage investment space is becoming more competitive. But I think all the angel funds - including ourselves - will try to open up to all investors, although everyone will have closer relationships with their initial partners," says ZhenFund's Fang. "We don't want to have a signaling risk for the start-ups getting into Series A rounds [whereby a company suffers from negative perception because a seed investor doesn't re-up for the Series A]. We have to make sure we engage everyone fairly."

Due to capital constraints, micro VC firms often struggle to participate in future rounds at higher valuations for their most promising portfolio companies. ZhenFund has set aside $40 million for pro rata commitments from its latest $150 million US dollar fund. It is also considering using special purpose vehicles (SPV) to back specific companies to the Series C and D rounds, and has invited friends and LPs to participate.

Source Code and Ameba also plan sidecar funds for follow-on deals beyond Series A. With fund sizes over $100 million and eager to raise capital for later-stage deals, these firms arguably are no longer in the micro VC category, though pre-Series A and Series A remain their core focus.

This stretching of remits is apparent in other VC strata, notably GGV, which raised $1.2 billion in 2016 for multiple strategies: in addition to the main fund and top-up vehicle, the GP received $250 million in commitments to GGV Discovery I, which seeks earlier-stage transactions, with Series A and pre-Series A rounds of particular interest.

Given this strategic shift, GGV is less likely to re-up in Cherubic. But despite the dedicated early-stage vehicle, Cheng sees the firm as a cooperator, not a competitor. And he has no plans to move in the opposite direction and raise larger funds for growth-stage deals. The preferred approach is to refer portfolio companies to GGV as potential targets for the GP's bigger ticket venture and top-up entities.

"In the US and China all the micro VCs have been established by former entrepreneurs, not financial investors," Cheng says. "Today the cost of forming a start-up is falling and competition is intensifying - that's why micro VC funds emerge; the investors know how to grow a company to 1,200 people and go for an IPO. Entrepreneurs are getting smarter and want to work with people like us who can really add value, not angel investors who just provide capital and come back every quarter asking for a financial report."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.