Australian agriculture: Investor stampede

Australia’s politically charged beef industry has attracted a wave of new investment, much of it driven by overseas buyers. As this interest elevates valuations and emotions, PE firms must capture value with care

Statistically minor foreign investment segments generate a disproportionate amount of buzz when 2.5% of the targeted country's landmass can go on the block in a single deal. When the owner of cattle rancher S. Kidman & Co. put this amount of Australian agricultural property up for sale, it highlighted both the skyrocketing potential of the local beef industry and the inherent difficulties of exploiting assets so intimately connected to national pride.

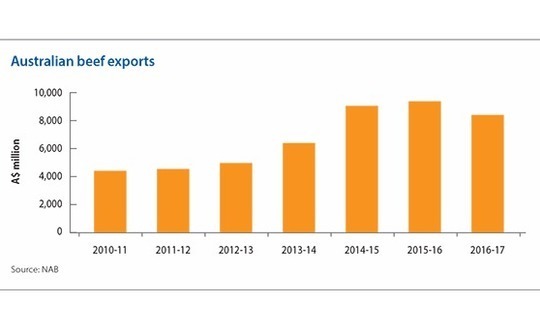

The 100,000-square-kilometre Kidman property attracted more than 30 serious international bidders, with a dominant showing by Chinese firms. This flood of attention punctuated a doubling in foreign demand for Australian beef during the prior five years to an export value of about A$9 billion ($6.5 billion), according to National Australia Bank (NAB).

Shanghai Pengxin Group eventually emerged as the preferred buyer with a A$379 million offer which was set to be the largest cattle station portfolio purchase in Australia since UK private equity group Terra Firma bought 5,000 square kilometres from Consolidated Pastoral in 2009 for about A$400 million.

Australian government data indicate that agriculture receives only around A$1 billion of foreign direct investment (FDI) annually - compared to typical totals of A$200 billion and A$80 billion for mining and manufacturing. Future PE involvement along the lines of Terra Firma, however, hinges on finding the right investment model and handling the protectionist backlash due to agriculture's role as the bedrock Australia's cultural identity. Indeed, this tendency toward populist politics has been widely interpreted as unravelling the Kidman deal.

"One of the main issues in this country at the moment is around foreign investment review, we need some more certainty. Remember that we're two months short of an election, so these things tend to get bogged down," observes Andrew Gill, a partner at Australian law firm MinterEllison.

Unwelcome investors?

Last month, Australian Treasurer Scott Morrison snuffed the Kidman deal saying that the sale of such a sizable portfolio was contrary to the national interest. This assessment came despite the land's leasehold status and a concessionary move by the bidders to exclude a station in sensitive proximity to a weapons testing range. Even with the involvement of a local partner, Australian Rural Capital, Pengxin was sufficiently discouraged and withdraw.

"The Chinese read into the Kidman outcome maybe that the largest transactions are in fact not going to be approved," says Doug Ferguson, head of Asian business and a deals advisory partner at KPMG in Australia "In the eyes of the Chinese, there's a perception that they're not welcome in primary beef production in Australia ¬-¬ and that's not the reality with vendors here."

The imperative to address this Chinese public relations problem is driven largely by the risk of Australian beef becoming marginalized as other global suppliers rise to meet the growing demand. "We have been so busy sending so much to our traditional market in the US that competitors like Uruguay and Brazil have increasingly been able to capture that Chinese market," says Phin Ziebell, an agribusiness economist at NAB. "The medium-term story is that we're under increasing pressure from South America."

This context is rendered all the more precarious by the fledgling nature of China's embrace of Australian beef. KPMG charted 2015 as the first year Chinese agribusiness investment showed substantial growth in the country, with A$375 million of commitments across 12 deals almost tripling the prior year's results in both volume and value. This upswing doesn't simply represent an increased appetite for traditional meat sources like pork and poultry - it is driven by a lifestyle shift toward more expensive, high-end protein, particularly beef.

Other tailwinds in the latest boon to Australia's international beef business include an encouraging new free trade agreement with China as well as export incentives based on a depreciated local currency and weather-driven fluctuations in herd populations. More broadly, Australia benefits from advantages in quality reputation, regulatory certainty, economically viable station sizes and scalability.

These factors have attracted considerable interest from Canadian and European pension funds and sovereign wealth funds with food security interests. Most investments, however, have been realised by strategic players aiming to geographically hedge animal disease risks and use Australia as a skipping stone to access the Chinese market.

Brazilian meat giant JBS has been a leader in this regard, completing five major Australian acquisitions since 2008. This spate was capped last year with the A$1.4 billion purchase of Primo Group, a household name in cured pork that also controls a beef processing facility. Affinity Equity Partners was the seller, having bought the business in 2011 with a view to increasing supply into Asia.

Recent domestic activity includes QIC's acquisition of an 80% stake in North Australian Pastoral Company at a valuation of A$400 million earlier this month. The Queensland government-controlled investor bought UK-based Pension Protection Fund into the deal, as well as superannuation fund money.

"Asia is going to account for 47% of global beef imports by 2024. The supply chains to get fresh product up into Asia haven't been built yet and that's part of the investment thesis - that we and others can help grow these supply chains so we can get fresh beef in particular to where the demand is, whether that is Japan, the US or China," says Marcus Simpson, head of global private equity at QIC.

This outlook has also inspired state-owned entities in Asia to secure links to markets back home by targeting the swaths of freehold land that epitomize the world's most sparsely populated country. David Williams, managing director at Australian agribusiness-focused advisory firm Kidder Williams, sees this demand as outstripping supply by such a margin that cashed up foreign investors are essentially pricing private equity out of the market.

"There have been quite a number of properties sold in the last year that were on the market for 3-4 years and weren't able to find a buyer," he says. "Now you're finding Chinese buyers who are paying massive prices - sometimes way over what the asking price was - and sometimes without having done due diligence. You just can't compete with that if you're private equity. However, if private equity is patient some of those properties will be back on the market in less than 10 years at significant discounts to their sale prices."

The escalation in Australian beef asset valuations has been exacerbated by a trend of property amalgamation to improve economies of scale. This development has propelled a well-publicized evolution toward a more US-style, corporate-run agricultural sector, where large-scale beef production portfolios are positioned as part of a centrally controlled paddock-to-plate supply chain.

The rapid emergence of an internationally owned patchwork of mega-farms is considered unlikely to occur, however, as consolidation become more difficult to achieve. This is because combining fragmented cattle stations can only be realized by physically circulating in outback communities and convincing stakeholders to take the plunge.

Although the average family station is often helmed by a patriarch nearing 60 with uncertain succession prospects, and annual incomes typically come in at less than A$100,000, the generational change to corporate ranching is likely to be gradual and characterized by smaller deals. Minter Ellison's Gill says the social challenges related to land amalgamation strategies will limit opportunities for deals valuing more than A$100 million.

"It's hard to put a string of those properties together because the bulk of them are held in family operations that have an emotional tie to the property," he explains. "There's a massive demand for that kind of asset but there's that fundamental block as these properties being held so tightly. Given the sheer size and often the sheer remoteness of them, it's not an easy task. These are people's homes as well as their businesses."

Unsuitable owners?

While the tightening supply-demand dynamic created by these influences has largely blocked private equity from approaching primary cattle land assets, the exclusion may ultimately be irrelevant. The investment thesis for these properties is based on returns that are unlikely to fit the targets or time horizons of typical PE models. Practical short-term betterment strategies, meanwhile, offer incentives that fail to match the level of risk.

It may well be the natural instinct for GPs to vertically integrate a business down to its rawest materials, but firms attempting to penetrate agriculture will need to calculate at which point of the value chain they are comfortable doing business. Private equity is traditionally more comfortable a few steps downstream from the primary production source - in areas such as processing and distribution - due to the respective levels of risk involved.

Risks include exposure to commodity prices, complications due to disease, and in the case of drought-prone Australia, erratic availability of grass complicating the two-year growth cycle of new calves. In this context, even longer infrastructure-style fund models or sale-and-leaseback transactions will still only capture internal return rates in the range of 3-8%.

Improvements in irrigation technology, drone usage or novel breeding techniques can be used to grow herd sizes substantially, but these efforts have not yet been proven to deliver sizeable returns from primary agricultural land. PE firms can likewise professionalize a ranch's management and bookkeeping, but a switch from family to institutional ownership will also bring with it additional regulatory compliance obligations including new occupational health and safety costs.

"There are not many examples where you can show that a private equity fund has been able to generate a better operating return out of a farm than an owner-operator," says Tony McKenna, managing director for Lempriere Capital Partners, an Australian investment manager with a history in agribusiness consulting.

Primary cattle land assets can, in certain circumstances, be strategic for PE firms looking to control the economics of entire markets by dominating supply. Terra Firma's 2009 investment, for example, has angled to achieve this by making the GP Australia's second biggest beef producer. But in the country's ever more expensive beef game, the strategy is becoming increasingly implausible for new entrants.

"At the moment, we're looking for investments that are capital light and can get a broad exposure across Australian agriculture production," McKenna adds. "There is a place in portfolios for farmland, but not if you're trying to generate a 20% return."

PE firms seeking to leverage the China-Australia beef equation without being held to ransom by primary production risk factors must approach the cattle trade as an environment in which acquisitions are managed with a strong focus on maintaining partnerships. This will involve transactions with built-in foreign offtake connections and synergistic agreements with domestic cattle suppliers.

Chinese PE firm Hosen Capital adopted this philosophy with its 2013 purchase of Kilcoy Pastoral, a leading grain-fed beef processor and exporter in Queensland which benefits from stable relations with regional feedlot operators. The GP has since made a critical priority of supporting these primary producers, but has stopped short of the financially and politically risky move of actually buying the feedlots.

"Too many investors are looking at land acquisition, which in any country would be subject to regulatory and emotional political pressure, and it's a single-digit yield generation investment," says Alex Zhang, a founding partner at Hosen. "But if you have a supply chain approach, you can acquire pretty good assets and bring value to the table. For us, Australia hasn't been challenging at all. In fact, it's been quite a friendly environment."

The Hosen plan has focused on building value chain coordination through participation in export, distribution and branding operations. Specifically, this included the acquisition of WeiDao a major beef supplier to Yum Brands and a number of Chinese food companies. The PE firm has also made direct customer connections a core value-add policy by packaging Kilcoy beef in cuts and recipes that appeal to the Chinese palate.

"This allows you to protect the market, extend the margin at Kilcoy and get consistent quality supply on this end to Chinese customers," Zhang adds. "Our investment thesis is not cattle - it's the consumption upgrade of the Chinese middle class. That's the fundamental driver."

Pursuit of value on the post-farm gate end of the supply chain has not only been a ploy of foreign investors. Last year, cattle farming giant Australian Agricultural Company (AACo) marked a 42% year-on-year increase in revenue from packaged beef, cementing the group's transition into a food supplier after almost two centuries of strictly pastoral operations.

The company controls feedlots and live cattle farms representing about 1% of the continent's landmass, yet it derived more than three-fourths of its income from boxed beef as of early 2015. "Building our brands is the next stage of transforming and growing our business," says Jason Strong, AACo's managing director.

The way forward

AACo's metamorphosis into a grocery supplier is a dramatic reminder of both the emerging gravity of the Chinese market and the potential advantages of partnering with a locally experienced player. A disconnect has manifested, however, between Asian investors and Australian ranchers as anecdotal evidence accumulates around perceptions that cross-border transactions have a tendency to fizzle in the 11th hour.

Broken deals are often attributed to the inexperience of Asian first-timers seeking to take advantage of a hot new market or a lack of local understanding about foreign investors' financing models. For private equity, the miscommunication has been interpreted a chance to get a place at the agribusiness negotiating table by flexing its strengths in transaction execution and investment management.

In the fallout from the Kidman deal any such inroads by GPs could be helpful in restoring the Australian beef industry's dented reputation for openness to foreign investment. Private capital providers in Asia will play their role in this process, but the onus will remain on local players and government entities that are not only politically acceptable owners but also have investment models that fit primary production's steady but long turnover timeframes.

"QIC, as a government-owned institution, is uniquely able to partner with overseas investors on buying these sorts of assets," Simpson adds. "We have close relationships within the region and can connect overseas and domestic investors to these attractive and innovative investment opportunities."

Taking a longer term view, there are positives to be drawn from the gradual consolidation of primary assets. This will in turn deliver more clarity over land ownership, greater application of technology and science and the opening up of financing markets that support growth in primary food production.

"Global macro demand for beef and protein is compelling and international investors will continue to see it that way, but we have to decide as a country how we want to participate," says KPMG's Ferguson. "We can continue to be a largely family-based grazing business, or with Asian partners we create large-scale integrated beef production businesses that are linked to processing and transportation infrastructure. That's where we want to be."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.