The Blackstone Group

Blackstone may take over Morgan Stanley's Japan real estate assets

Leading global private equity firm the Blackstone Group is said to be near to finalizing a deal to purchase Morgan Stanley’s holdings of Japan CMBs with a face value of around JPY100 billion ($1.14 billion).

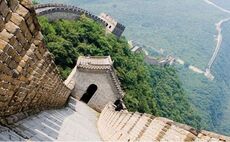

"End of an era" for China

China's release of its official GDP growth figures for 2Q10 last week showed the economy heading for the soft landing sought by policymakers, with National Bureau of Statistics estimates citing 10.3% growth, down from 11.9% the previous quarter, and giving...

Carlyle, TPG pick up Healthscope for $1.73 billion

The Carlyle Group and TPG Capital have won out in a bidding contest for Australian private hospitals and pathology services operator Healthscope Ltd., with an A$1.99 billion ($1.73 billion) all-cash offer that has already been unanimously recommended...

MBK CNS process could jumpstart Taiwan deals

North Asia-focused buyout firm MBK Partners has started the formal sale process for its Taiwanese cable TV/broadband asset China Network Systems (CNS) with the first bidding round, forecast to fetch up to $2.5 billion in a deal shaping up to be one of...

Final Healthscope bids confirmed by Carlyle, TPG as Blackstone withdraws

The Jul 16th deadline for bids on Australian private hospital and pathology operator Healthscope saw the Carlyle Group and TPG Capital confirm that they had submitted bids for the asset, despite the withdrawal of Blackstone Group from their consortium...

Allied Medical talks complicate Healthscope situation

The $1.6 billion takeover bid for Australian private hospital and pathology operator Healthscope by a consortium of the Blackstone Group, the Carlyle Group, and TPG Capital, with a rival bid from Kohlberg Kravis Roberts & Co., has been complicated by...

Blackstone to take over BofA real estate portfolio in Asia

US private equity firm the Blackstone Group will pick up opportunities in Asian real estate deals by taking over management of a portfolio of regional real estate investments from Bank of America Merrill Lynch, according to reports.

Carlyle to take 13.6% stake in China Fishery

Singapore-listed China Fishery Group – which began operations as a North Pacific trawling business in 2001 – has announced it will issue new ordinary shares and warrants in a conditional private placement to the Carlyle Group, for a total consideration...

Korean government delays Woori sale

The Korean government has delayed the public announcement of its privatization plans for Woori Financial Group, owner of No. 3 Korean lender Woori Bank, likely looking to increase the value of the sale.

Blackstone takes EMOBILE stake in Japan

The Blackstone Group has purchased a stake of around 5.98% in EMOBILE Ltd., a Tokyo-based mobile broadband transmission provider, for JPY16 billion ($182 million) through a third-party allotment.

Blackstone takes China Animal stake

The Blackstone Group has made a commitment giving it exposure to China's foods and agriculture and healthcare sectors, by leading a significant minority investment in Singapore-listed China Animal Healthcare, a maker of animal drugs and vaccines, for...

Blackstone completes Monnet deal

The Blackstone Group has executed its plans, first publicized in March this year, to invest around $60 million for 12.5% of Monnet Power Co. Ltd., an Indian independent power producer currently developing at 1050MW coal-fired power plant in Orissa state....

Korean government delays Woori sale

The Korean government has announced a delay to the publication of its privatization plans for Woori Finance Holdings, owner of Number Three Korean lender Woori Bank, which has attracted the attention of the Blackstone Group among others, seeking to maximize...

Blackstone gets RMB fund backing from Shanghai Ace

The Blackstone Group will receive RMB300 million ($44.1 million) for its renminbi-denominated fund, The Blackstone Zhonghua Development Investment Fund, from listed Shanghai Ace Co., a Shanghai-based investment firm.

Reliance/GTL deal may involve Saudi Telecom, ADIA, PE players

The $11 billion merger of Reliance Infratel, the cellular transmission tower arm of India's Reliance Anil Dhirubhai Ambani Group, into Indian independent telecoms player GTL Infrastructure may include investment by Saudi Telecom Co., the Abu Dhabi Investment...

KKR nixes CVC partnership on Healthscope

Kohlberg Kravis Roberts & Co. has said that CVC Capital Partners will not be participating in a bid for Australia's Healthscope, estimated at potentially up to A$1.84 billion ($1.56 billion), with KKR continuing on the bid by itself.

Blackstone may join Woori process

The Blackstone Group has been in discussions with Korea's Woori Financial Group over possible participation in the state-backed $6 billion auction of the government's 57% stake in the country's third largest banking group, at some $10.6 billion market...

Reliance sells India towers

The Blackstone Group, the Carlyle Group and TPG Capital are all in talks with number two Indian cellular provider Reliance Communications, part of India’s Reliance Anil Dhirubhai Ambani Group, over the spinout of the company’s cellular transmission tower...

Blackstone could exit Emcure

The Blackstone Group may be on the verge of exiting its first investment in India, Emcure Pharmaceuticals, following earlier reports that Kohlberg Kravis Roberts & Co. may be about to commit $50 million to the company - the same amount as Blackstone's...

Blackstone may invest Reliance towers

The Blackstone Group has formed a consortium with US cellular tower operator Crown Castle International to bid for Reliance Infratel, the tower division of Reliance Communications, Indian's Number Two cellular provider, backed by billionaire Anil Ambani....

Tenet backs out of Healthscope, citing disclosure

US hospitals group Tenet Healthcare Corp. has announced its withdrawal from bidding for Australian hospitals and pathology business Healthscope Ltd., leaving the two rival private equity consortia - Kohlberg Kravis Roberts & Co. and CVC Capital Partners...

Location, location, location

Hong Kong and Singapore residents have long been used to the competition between the two regional centers in terms of quality of life, friendliness to business, and just about every other metric going.

KKR, others cited for Healthscope

Kohlberg Kravis Roberts & Co. and an unnamed strategic bidder have been cited as the latest contenders for Australia's Healthscope Ltd., entering bids of around A$1.84 billion ($1.56 billion), marginally above the A$1.8 billion ($1.5 billion) already...

KKR may invest India's Emcure

Kohlberg Kravis Roberts & Co. may be on the point of committing around $50 million into India's Emcure Pharmaceuticals, which until recently was also in discussions with the Blackstone Group, according to Indian sources.