Softbank China Venture Capital

SoftBank China invests in P2P lending site Yooli.com

Chinese peer-to-peer financing platform Yooli.com has received $10 million in Series A funding from Softbank China Capital. The platform launched in February but already has nearly 100,000 registered users and has transacted more than RMB264 million ($43...

Hony, Suning to take controlling stake in China's PPTV for $420m

Hony Capital and home appliance retailer Suning Commerce - also one of the PE firm's portfolio companies - will buy a controlling interest in Chinese online TV provider PPTV for $420 million. The deal, which values PPTV at approximately $568 million,...

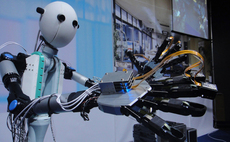

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

Two more PE firms win QFLP approval in Shanghai

SB China Venture Capital and Shanghai Guosheng CLSA Venture Capital have won approval from the Shanghai government to participate in the Qualified Foreign Limited Partners (QFLP) initiative. They join The Carlyle Group, Blackstone and DT Capital Partners,...

Tencent to take shares in Huayi Brothers Media

China’s internet giant Tencent will reportedly make a strategic investment in Huayi Brothers Media, a Shenzhen-listed film distributor and TV produce based in Beijing and Hong Kong.

Venture-backed Easou receives further VC funds

Easou, a Chinese mobile search service provider, has reportedly raised $20.48 million worth of financing from a venture capital investment group that includes Softbank China Venture Capital and Shanda Capital, the venture arm of Nasdaq-listed online media...

Qiming Ventures leads $18 million round of financing for LanzaTech

Qiming Ventures has led an $18 million Series B round of funding for New Zealand clean tech firm LanzaTech, while Softbank China Venture Capital and two of LanzaTech’s existing investors from its Series A round - US-based Khosla Ventures and K1W1 from...

Softbank China Venture helps Henghui dental play

Softbank China Venture Capital (SBCVC) has signed a strategic cooperation agreement with Henghui Technologies Co., Ltd., a company engaged in R&D and industrialization of digital oral cavity technology in China.