Region

Japan divestments still strong despite 'double-edged sword' of Abenomics

Corporate divestments continue to be a strong source of buyout deal flow in Japan, regardless of the impact of recently introduced economic reforms, according to Richard Folsom, co-founder and CEO of domestic GP Advantage Partners.

Carlyle-backed New Century REIT targets $254m HK IPO – report

China’s New Century Group, a portfolio company of the Carlyle Group, is seeking to raise as much as $254 million through an IPO offering by a real estate investment trust (REIT) in Hong Kong.

China's Dalian Wanda buys PE-backed yachtmaker Sunseeker

Dalian Wanda Group has sealed a deal to acquire a 91.81% stake in Britain’s largest luxury yachtmaker Sunseeker – backed by Irish private equity firm FL partners - for GBP320 million ($495 million). The deal is expected to close by mid-August.

Hawkesbridge seeks Australian bottled water company exit

Hawkesbridge Capital is seeking a potential buyer for Noble Beverages, the Australian company behind the bottled water brand Pureau.The Sydney-based private equity firm made a succession play for the family-owned company back in 2004, acquiring a majority...

GIC to sell Springer Science+Business

GIC Special Investments, the PE arm of the Government of Singapore Investment Corporation, and EQT will sell global publisher Springer Science+Business Media to London-based BC Partners for a total enterprise value of around EUR 3.3 billion ($4.4 billion),...

Omnivore invests in Indian agri-tech startup Barrix

VC investors Omnivore Partners has made a seed stage investment into Bangalore-based Barrix Agro Sciences, which develops pest control products that can reduce the use of chemical insecticides. Financial details of the transaction were not disclosed....

Tencent leads $150m financing round for Fab.com

Chinese internet group Tencent has led a $150m round of investment for US online design store Fab.com, in a fourth round of financing which is yet to close. The deal values the company at $1 billion, not including new capital raised.

Carlyle to exit Yashili stake to China Mengniu Dairy

The Carlyle Group has agreed to sell its 24% stake in Yashili International to domestic rival China Mengniu Dairy for about HK$3 billion ($387 million). This is part of a Mengniu bid for a majority interest in Yashili - its second lateral investment...

Yageo shareholders block private equity deal

Shareholders of Taiwanese electronic components manufacturer Yageo Corporation have blocked a $1.65 billion private equity deal put forward by company management.

AlpInvest's Hong Kong secondaries head steps down

AlpInvest has confirmed that the head of its secondaries team in Hong Kong, Neal Costello, has left the company after less than a year in the role.

Fidelity leads Series B round for India's Cloudbyte

Fidelity Growth Partners India has led a $4 million Series B round of investment in Cloudbyte, a company which provides cloud-storage solutions for online applications. Existing investors Nexus Venture Partners and Kae Capital also participated.

Asian Healthcare Fund invests in Wellspring clinic chain

Delhi-based Asian Healthcare Fund (AHF) has invested in Wellspring Healthcare, which runs eight primary care clinics in Mumbai under the Healthspring Community Medical Centres brand. Financial details of the deal were not disclosed.

Singapore's Temasek establishes UK presence

Temasek Holdings has set up a unit in the UK that will focus on investments in Europe. It is the Singaporean sovereign wealth fund’s 10th overseas office or affiliate.

JLL reaches first close on debut India real estate fund

Jones Lang LaSalle’s (JLL) Segregated Funds Group has reached a first close of INR1 billion ($17.2 million) on its Residential Opportunities Fund I. The vehicle launched last year and has a final target of INR3 billion ($51.2 million)

Australia's M.H. Carnegie, Vivant Ventures launch accelerator

M.H. Carnegie & Co, the venture capital firm set up by Australian investor Mark Carnegie, has launched an A$80 million ($76 million) accelerator fund for emerging technology companies. It will be run in collaboration with Vivant Ventures, an Australia-based...

Shogun diplomacy: Corporate management in Japan

History shows that Japan's corporate elites rarely take kindly to private equity knocking down their door. How can the outside investor best woo potential partners?

All smiles in Tokyo?

The timing of last year's AVCJ Japan Forum was perhaps fortuitous - a matter of days before the event Unison Capital announced that it agreed to sell sushi chain Akindo Sushiro to Permira for $1 billion.

Giant maintenance: PE and corporate Japan

Restructuring is a compelling story in Japanese private equity, but deal access is constrained by perception issues and government-linked competition. Will the there be anything left for foreign players?

Japan fundraising: Sink or swim?

Investor sentiment is gradually turning on Japan. The big buyout funds must convince LPs there is sufficient deal flow in their portion of the market; the smaller players must figure out how to talk to foreign LPs

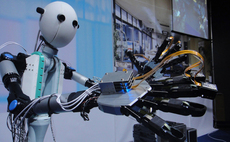

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

TriVeda Capital launches $500m real estate vehicle

India-focused TriVeda Capital has launched a $500 million real estate asset management platform, initially comprising five residential and mixed-used projects located in Bangalore. It plans to invest in structured property transactions in tier-one cities....

CITIC Capital raises $683m China retail property fund

CITIC Capital has reached a final close of $683 million on its China Retail Properties Investment Fund, exceeding the original target of $600 million.

PE-owned Dutch waste company sells subsidiary to Cheung Kong Infrastructure

A Dutch waste management provider owned by CVC Capital Partners and KKR has exited its energy-from-waste (EfW) subsidiary to a consortium led by Cheung Kong Infrastructure (CKI) for EUR940 million ($1.27 billion). It is the Hong Kong-based company’s second...

China's GSR leads restructuring round for Mirabilis Medica

China-focused GSR Ventures is leading a $7 million restructuring round for Mirabilis Medica with a view to helping the company expand its footprint outside the US.