Funds

Investors commit $100m to another Rocket Internet Asia retail start-up

Southeast Asian online retailer Lazada has raised $100 million through a new round of funding led by Verlinvest, a Beglium-based investment firm set up by the founding families of Anheuser-Busch InBev. Existing investors Holtzbrinck Ventures, Kinnevik...

KKR-backed GenesisCare taps US debt markets

GenesisCare, a healthcare business controlled by KKR, has become the latest Australian PE-backed company to refinance its debt via the US high-yield market. A string of corporates are taking advantage of strong liquidity in the US leveraged market, where...

Tsinghua University investment arm makes buyout offer for Spreadtrum

Spreadtrum Communications, a Chinese mobile chip manufacturer backed by NEA, has received a buyout offer from a unit of Tsinghua Holdings, an investment entity controlled by Beijing-based Tsinghua University. The offer values Spreadtrum at $1.35 billion....

J-Star promotes Satoru Arakawa to partner

Japanese mid-cap buyout firm J-Star has promoted Satoru Arakawa to the position of partner.

Carlyle, Seven to retain ownership of Australia's Coates Hire

The Carlyle Group and Seven Group Holdings have decided against pursuing an exit from Australian equipment-leasing business Coates Hire following a strategic review. The co-owners said they remain fully committed to growing the business.

Korea's Castling gets first LP commitment, targets fund-of-funds

Castling Investment Group, a start-up alternatives investment advisory firm based in South Korea, has received its first external LP commitment – totaling $80 million – from a local museum foundation. The capital will be placed into a separate account...

Japanese, Chinese VCs provide $4.4m round for social site Muzy

The Silicon Valley-based venture capital arm of Japanese telecoms giant NTT Docomo, Docomo Capital, and Recruit Strategic Partners - the corporate VC arm of Japanese internet company Recruit Holdings - have teamed up with Chinese entrepreneurs to invest...

Indian pharma firm Cipla launches VC unit

Cipla, an India-based generic drug maker, has set up a VC arm – Cipla Ventures – to invest in biotechnology, medical devices and new chemical entities.

Carlyle-backed New Century REIT targets $254m HK IPO – report

China’s New Century Group, a portfolio company of the Carlyle Group, is seeking to raise as much as $254 million through an IPO offering by a real estate investment trust (REIT) in Hong Kong.

Omnivore invests in Indian agri-tech startup Barrix

VC investors Omnivore Partners has made a seed stage investment into Bangalore-based Barrix Agro Sciences, which develops pest control products that can reduce the use of chemical insecticides. Financial details of the transaction were not disclosed....

Tencent leads $150m financing round for Fab.com

Chinese internet group Tencent has led a $150m round of investment for US online design store Fab.com, in a fourth round of financing which is yet to close. The deal values the company at $1 billion, not including new capital raised.

AlpInvest's Hong Kong secondaries head steps down

AlpInvest has confirmed that the head of its secondaries team in Hong Kong, Neal Costello, has left the company after less than a year in the role.

Fidelity leads Series B round for India's Cloudbyte

Fidelity Growth Partners India has led a $4 million Series B round of investment in Cloudbyte, a company which provides cloud-storage solutions for online applications. Existing investors Nexus Venture Partners and Kae Capital also participated.

JLL reaches first close on debut India real estate fund

Jones Lang LaSalle’s (JLL) Segregated Funds Group has reached a first close of INR1 billion ($17.2 million) on its Residential Opportunities Fund I. The vehicle launched last year and has a final target of INR3 billion ($51.2 million)

Australia's M.H. Carnegie, Vivant Ventures launch accelerator

M.H. Carnegie & Co, the venture capital firm set up by Australian investor Mark Carnegie, has launched an A$80 million ($76 million) accelerator fund for emerging technology companies. It will be run in collaboration with Vivant Ventures, an Australia-based...

Shogun diplomacy: Corporate management in Japan

History shows that Japan's corporate elites rarely take kindly to private equity knocking down their door. How can the outside investor best woo potential partners?

All smiles in Tokyo?

The timing of last year's AVCJ Japan Forum was perhaps fortuitous - a matter of days before the event Unison Capital announced that it agreed to sell sushi chain Akindo Sushiro to Permira for $1 billion.

Japan fundraising: Sink or swim?

Investor sentiment is gradually turning on Japan. The big buyout funds must convince LPs there is sufficient deal flow in their portion of the market; the smaller players must figure out how to talk to foreign LPs

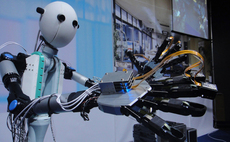

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

TriVeda Capital launches $500m real estate vehicle

India-focused TriVeda Capital has launched a $500 million real estate asset management platform, initially comprising five residential and mixed-used projects located in Bangalore. It plans to invest in structured property transactions in tier-one cities....

CITIC Capital raises $683m China retail property fund

CITIC Capital has reached a final close of $683 million on its China Retail Properties Investment Fund, exceeding the original target of $600 million.

KKR, Blackstone, Carlyle among bidders for SingTel Australia unit - report

KKR, The Blackstone Group and The Carlyle Group are said to have submitted first-round bids for Optus Satellite, the Australian satellite unit of Singapore Telecommunications (SingTel).

ICICI Prudential exits Indian residential investment

ICICI Prudential AMC, a joint venture between India’s ICICI Bank and Eastspring Investments, has exited investments in two Shriram Properties residential projects in Bangalore with returns upwards of 20%.

CHAMP, Headland seek to oust Miclyn directors

Headland Capital Partners and CHAMP Private Equity, majority shareholders of Miclyn Express Offshore, are looking to jettison two of the company's independent directors, saying the move would be in the interests of shareholders.