Articles by Mirzaan Jamwal

Ironbridge targets full buyout of Australia's Bravura

Ironbridge Capital has made an offer to acquire a further one-third stake in listed Australian life insurance and wealth management provider Bravura Solutions. The offer values the company at A$172.7 million ($158.3 million).

Blackstone set for partial exit as Emcure Pharma files for IPO

The Blackstone Group will make a partial exit from its 2006 investment in India's Emcure Pharmaceuticals as the company targets a INR3 billion ($50.4 million) IPO.

3i Debt hires Lisa Johnson as Asian investor relations director

3i Debt Management (3iDM) has appointed Lisa Johnson as director of investor relations in Asia. Based in Singapore, Johnson will help 3iDM expand its business in the region and develop its client relationships.

Global Environment Fund promotes Sridhar Narayan to MD

Global Environment Fund (GEF), a private equity firm that targets energy, resources and environment-related assets, has promoted Sridhar Narayan to managing director within its India team.

Gray Matters invests in social banker Unitus Capital

Bangalore-based social investment bank Unitus Capital (UC) has received an undisclosed commitment from Gray Matters Capital (GMC)-owned First Light Ventures fund. The vehicle acts as an incubator and investment partner to seed-stage, for-profit social...

PE-backed NBFC Magma to apply for India banking license

Non-bank financing company (NBFC) Magma Fincorp, which has several private equity investors, will apply to the Reserve Bank of India (RBI) for a new banking license. IDFC, Religare Enterprises, Reliance Capital and the Aditya Birla Group also plan to...

Abraaj teams up with USAID to launch $100m Pakistan PE funds

The US Agency for International Development (USAID), The Abraaj Group and JS Private Equity Management (JSPE) will launch two private equity funds focused on Pakistani small- and medium-sized enterprises (SMEs).

Indian regulator opens up new channel for SME exits

The Securities and Exchange Board of India (SEBI) will allow start-ups and small- and medium-sized enterprises (SMEs) to list without an IPO in a move to facilitate exits. The regulator has also brought angel funds under the alternative investments funds...

Warburg Pincus-backed India coal washery firm re-files for IPO

Warburg Pincus is set for a partial exit from ACB, a provider of coal beneficiation services, after the company re-filed a draft red herring prospectus (DRHP) for an IPO. It hopes to raise INR4.15 billion ($69.4 million).

India secondaries: Plan B?

India’s PE industry is expected to see an increase in secondary deals as funds approach maturity and GPs look for alternatives to difficult public market exits. But is the talking translating into transactions?

India's IL&FS, IDFC see 2.6x return on gas distributor exit

IDFC Private Equity, the Asian Development Bank (ADB) and a subsidiary of IL&FS Investment Managers have sold their stake in Central UP Gas (CUGL) in a strategic sale to Indraprastha Gas. The investment generated a gross IRR of 17% and a money multiple...

ChrysCap exits Ahmednagar Forgings, buys Sequoia's Infotech stake

ChrysCapital Partners has exited Ahmednagar Forgings (AFL), a manufacturer of automotive components, for INR363 million ($6.07 million) through a series of bulk deals on the open market. The firm originally bought the stake for INR295 million in 2008....

ChrysCapital-backed Intas Pharma files for IPO

ChrysCapital Partners will exit the 10.16% stake held by Fund III in Ahmedabad-based formulations maker Intas Pharmaceuticals via an upcoming IPO. Another 6.25% stake will continue to be held by the PE firm's fifth fund.

Tencent-Naspers JV ibibo buys India ticketing firm redBus

Delhi-based ibibo Group has acquired VC-backed Indian bus ticketing company redBus.in, allowing Helion Venture Partners, Inventus Capital Partners and Seedfund to exit their investment. Financial terms of the transaction were not disclosed.

GIC to sell Springer Science+Business

GIC Special Investments, the PE arm of the Government of Singapore Investment Corporation, and EQT will sell global publisher Springer Science+Business Media to London-based BC Partners for a total enterprise value of around EUR 3.3 billion ($4.4 billion),...

Omnivore invests in Indian agri-tech startup Barrix

VC investors Omnivore Partners has made a seed stage investment into Bangalore-based Barrix Agro Sciences, which develops pest control products that can reduce the use of chemical insecticides. Financial details of the transaction were not disclosed....

Asian Healthcare Fund invests in Wellspring clinic chain

Delhi-based Asian Healthcare Fund (AHF) has invested in Wellspring Healthcare, which runs eight primary care clinics in Mumbai under the Healthspring Community Medical Centres brand. Financial details of the deal were not disclosed.

JLL reaches first close on debut India real estate fund

Jones Lang LaSalle’s (JLL) Segregated Funds Group has reached a first close of INR1 billion ($17.2 million) on its Residential Opportunities Fund I. The vehicle launched last year and has a final target of INR3 billion ($51.2 million)

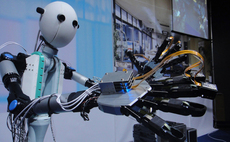

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

Avenue Venture invests $9.5m in Chennai residential project

Avenue Venture Partners has invested INR250 million ($4.3 million) in a Chennai luxury residential project being developed by Casa Grande. The firm plans to commit a total of INR550 million ($9.5 million) in the project.

ICICI Prudential exits Indian residential investment

ICICI Prudential AMC, a joint venture between India’s ICICI Bank and Eastspring Investments, has exited investments in two Shriram Properties residential projects in Bangalore with returns upwards of 20%.

Motilal Oswal hires Sharad Mittal to head real estate

Motilal Oswal Private Equity (MOPE) has appointed Sharad Mittal as head of its real estate business. The firm is expected to launch an INR6 billion ($104 million) India real estate fund later this year.

India should simplify foreign investment rules, open more sectors to VC - committee

India should encourage investment by foreign portfolio investors by scaling back the regulatory apparatus used to register and monitor inbound capital flows, according to a high-level committee. It also recommended expanding the number of sector open...

Oaktree Cap invests $20m Indian pharma packager

Oaktree Capital Management has bought a 60% stake in Cogent Glass for around INR1.2 billion ($20.6 million). As part of the deal, Cogent has signed an agreement with Oaktree portfolio company SGD for technology sharing as well as marketing and management...