Articles by Paul Mackintosh

Summer daze

AVCJ is taking a well-earned break, but astute readers will already have noticed that summer is a’coming in on anything but a quiet note.

Palamon, Morgan Stanley, AlpInvest get Oz cards spinout exit

Palamon Capital Partners, Morgan Stanley Alternative Investment Partners and AlpInvest Partners have picked up A$353 million ($319 million) from the sale of the Australian operations of their joint investee Retail Decisions, a card payment-processing...

WuXi Pharma exit to Charles River nixed

VC-invested PRC pharmaceutical major WuXi PharmaTech has seen its $1.6 billion sale to US peer Charles River Laboratories fail over opposition from major shareholders in Massachusetts-based Charles River, including Neuberger Berman and hedge fund Jana...

Baring India, Matrix back Muthoot Finance

Baring Private Equity Partners India and Matrix Partners India have jointly committed some INR157 crore ($33.6 million) to Muthoot Finance Ltd., a leading Indian non-bank financial company, in its first institutional funding round.

JS Pakistan fund gets OPIC backing

JS Private Equity Fund II, the fund launched by Pakistan's JS Private Equity that targets $150 million, has received a $50 million commitment from US policy investor the Overseas Private Investment Corporation (OPIC).

H&QAP claims 11x return on Fabrinet after IPO

Long-established regional private equity firm H&Q Asia Pacific (H&QAP) has claimed an 11x return on its 1999 investment in Thailand-headquartered optical and electronic components foundry company Fabrinet, after the latter's IPO on the NYSE earlier in...

Soros seeks Dubai's BSE stake

Soros Fund Management, the investment vehicle of iconic investor George Soros, is looking to buy the 3.92% stake in the Bombay Stock Exchange held by Dubai Holdings, for around $40 million, according to reports.

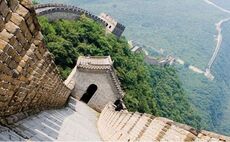

Hands hands on for China

Guy Hands, high-profile chairman of UK buyout leader Terra Firma Capital Partners, has publicly said that his firm is looking for partners to enter the China market.

It's a wrap

In the course of several unrelated discussions on secondaries last week, I was reminded of one of the more curious byways of private equity fund investment: the wrap.

ANZ back in KEB frame?

After a stop-and-go involvement in the auction of Lone Star Funds' 51% stake in Korea Exchange Bank, which included a statement earlier this month that it was not considering any deals at all, Australia and New Zealand Banking Group (ANZ) may now be about...

Industry Q&A: Hu Zhanghong, CEO, CCB International

AVCJ spoke to Hu Zhanghong, CEO of CCB International, the asset management and private equity arm of the major PRC banking group, who discussed opportunities in Greater China and the role of RMB funds

Gung-ho for Kyobo as buyout firms assess stake

Potential private equity buyers, specifically Affinity Equity Partners and the Carlyle Group, are doing due diligence on a potential 24% significant minority stake opportunity in Kyobo Life Insurance Co., Korea’s third-largest insurer and second-largest...

The dynamics of secondaries

The coverage of the state of the Asia Pacific secondaries market earlier this month in AVCJ naturally leads one to consideration of how secondaries work, and what they can do for investors in the region – whether for local buyers or sellers, or outsiders...

Khazanah wins Parkway

Malaysian SWF Khazanah Nasional has reportedly won the battle with Fortis Healthcare for control of Singapore hospital asset Parkway Holdings, after the latter opted to sell its entire 25.37% stake to Khazanah, as the SWF launched a $2.56 billion general...

BofA secondaries may go to Asia

Bank of America Corp. is seeking to sell up to $1.2 billion of secondary positions in Warburg Pincus funds, with the China Investment Corporation (CIC) cited as one of the most likely buyers, according to reports.

Carlyle completing Kbro exit to Tsais

The Carlyle Group has reportedly finalized the exit of its Taiwanese cable TV investment Kbro to the Tsai business family, owners of Taiwan Mobile, the company that Carlyle originally planned to exit the asset to.

Unitas, OTPP ready NZ Yellow Pages for sale

Offering up the asset that launched NZ's much-praised "yellow tree house" ad campaign, regional buyout firm Unitas Capital and its co-investor Ontario Teachers Private Capital have kicked off the exit process from boom-era Antipodean telecoms investment...

PE-backed Ambow files for NYSE IPO

Ambow Education Holding Ltd. - a PRC education and career development service provider backed by Actis, CStar Investment, EdVenture, JAFCO Asia Technology Fund and Macquarie - has filed for an IPO on the New York Stock Exchange, planning to raise nearly...

Evolvence launches second India f-o-f

Evolvence Capital, the Dubai-headquartered MENA and India investment group, is launching its second fund of funds and third India fund, the Evolvence India Fund II, targeting $400 million.

Navis VI nears $1.2 billion close

Leading Kuala Lumpur-headquartered regional investor Navis Capital Partners is approaching a $1.2 billion final close on its latest vehicle, Navis Asia Fund VI.

"End of an era" for China

China's release of its official GDP growth figures for 2Q10 last week showed the economy heading for the soft landing sought by policymakers, with National Bureau of Statistics estimates citing 10.3% growth, down from 11.9% the previous quarter, and giving...

CPPIB on the road again in Oz with Intoll

The Canada Pension Plan Investment Board (CPPIB) has returned to its pursuit of Australia-headquartered toll road groups with an A$3.4 billion ($3.05 billion) privatization proposal for Australian road toll operator Intoll Group – a cash offer at a 38%...

Carlyle, TPG pick up Healthscope for $1.73 billion

The Carlyle Group and TPG Capital have won out in a bidding contest for Australian private hospitals and pathology services operator Healthscope Ltd., with an A$1.99 billion ($1.73 billion) all-cash offer that has already been unanimously recommended...

Chindia, more Chindia

With the volume of China hype across the region, it’s good to receive a timely reminder of the other great growth market in the region: India.