Articles by Justin Niessner

LP interview: Australia’s QIC

As QIC’s PE programme tilts toward earlier stages, legacy assets have counterbalanced macro turbulence in tech. More direct investment is desired, but funds are still of interest, especially in Europe

Aramaco backs Singapore clean energy certificates player

Aramaco Ventures, a VC unit of Saudi oil giant Aramaco, has led a USD 10m Series A round for Singapore’s Redex, an early mover regionally in renewable energy certificates (RECs).

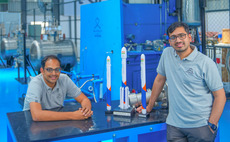

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

KKR commits $400m to Malaysia's OMS Group

KKR has agreed to invest USD 400m in Malaysian telecoms infrastructure and subsea cable services company OMS Group.

Mandiri, Investible launch climate tech fund

Mandiri Capital, the venture arm of Indonesia’s Bank Mandiri, and Australia-based VC firm Investible have launched a climate technology fund of unspecified size.

Korea Investment Partners raises $60m SE Asia fund

Korea Investment Partners (KIP) has raised USD 60m for a Southeast Asia venture fund from institutional investors in Korea, Hong Kong, and Singapore.

Flourish Ventures secures $350m in new funding

Flourish Ventures, a US-based emerging markets financial technology investor with a strong Asia focus, has secured USD 350m for future deployments from its sole LP, eBay founder Pierre Omidyar.

SparkLabs launches Korea deep tech fund

Early-stage VC investor and accelerator SparkLabs Korea has achieved a first close of USD 15m on a deep tech fund. That target corpus has not been confirmed.

Lightspeed leads $50m round for Singapore's YouTrip

Lightspeed Venture Partners has led a USD 50m Series B investment in Singapore-based travel wallet and currency exchange app YouTrip.

Saudi fund invests $100m in China's Pony.ai

Saudi Arabia’s Neom Investment Fund, a strategic venture vehicle for the planned smart city of Neom, has made a USD 100m commitment to Chinese autonomous driving player Pony.ai.

Navegar leads Series C for Singapore's Inteluck

Philippines private equity firm Navegar has led a USD 34m Series C round for Singapore-based supply chain technology provider Inteluck with support from East Ventures.

Husk Power raises $43m for Asia, Africa mini-grid strategy

India, US, and Nigeria-based renewable energy developer Husk Power has raised USD 43m in Series D funding from global VC investors for a South Asia and sub-Saharan Africa mini-grid rollout.

Schroders, Thailand's KBank launch renminbi PE fund

Schroders Singapore and KBank Private Banking, a unit of Thailand’s Kasikornbank, have jointly launched a Thailand-based renminbi-denominated China private equity fund of undisclosed size.

Asia distress: Landslides on hold?

Investors are witnessing an uptick in turnaround opportunities based on delayed pandemic effects and a poor macro outlook. The trend remains anecdotal, but some markets could see a surge

Bain, DNE launch $250m China advanced manufacturing platform

Bain Capital and Chinese industrial infrastructure developer DNE Group have jointly launched a USD 250m advanced manufacturing investment platform.

Faering invests $30m in India's Vastu, Multiples exits

Faering Capital has invested USD 30m in India’s Vastu Housing Finance, facilitating an exit for Multiples Alternate Asset Management.

PayPal backs Quona, Sweef impact funds

PayPal has confirmed LP commitments of undisclosed size to funds managed by financial inclusion-focused Quona Capital and women-led businesses specialist Sweef Capital.

East targets $30m for Indonesia healthcare VC fund

East Ventures has launched a dedicated Indonesia healthcare innovation fund with a target of USD 30m.

Blackbird, Airtree back $18m round for Australia's Darwinium

Blackbird Ventures and Airtree Ventures have participated in a USD 18m Series A round for Darwinium, an Australian digital security start-up that moved its headquarters to the US in April.

Quadria hits $500m first close on third healthcare fund

Singapore-based healthcare specialist Quadria Capital has reached a first close of USD 500m on its third flagship fund. The target is USD 800m.

Q&A: BII’s Holger Rothenbusch

Holger Rothenbusch, head of infrastructure and climate at British International Investment, unpacks the opportunities and challenges of a significant new credit programme for developing Asia

Korea's STIC to exit biofuels player to PE-backed consortium

Korea’s STIC Investments has agreed to sell biofuels producer Daekyung Oil & Transportation to a consortium backed by SK Group, Korea Development Bank (KDB), and Eugene Private Equity.

Deal focus: Minnow finds favour in crowded Indonesia vertical

Indonesia’s Luna, a seed-stage contender in a competitive retail digitalisation landscape, continues to collect VC backers as a patient, diversified gameplan comes into focus