China's JW Therapeutics trades up after $300m Hong Kong IPO

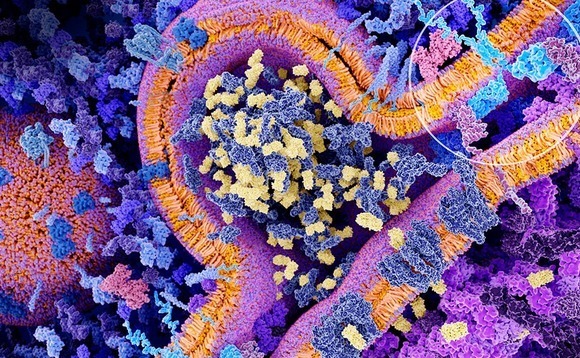

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

The company sold 97.7 million shares for HK$12.80 apiece, according to a prospectus. Ten cornerstone investors, including Rock Springs Capital, Hillhouse Capital, Loyal Valley Capital, and Temasek Holdings, covered 50% of the offering, assuming the over-allotment option isn't exercised.

The stock debuted on November 3, opening at HK$24.90 and falling back to close at HK$21.20. It ended November 4 at HK$21.00, which equates to a market capitalization of HK$7.9 billion.

JW was established in 2016 by Bristol Myers Squibb-owned Juno Therapeutics and China's WuXi AppTec, with a view to leveraging the former's expertise in cell therapy technologies and the latter's capabilities in contract drug development and manufacturing services. Juno holds a post-IPO stake of 19.91%, while WuXi AppTec has 10.16%.

Temasek owns 6.03%, having led the company's Series A alongside Sequoia Capital China and Yuan Ming Capital, and having participated in the Series B. When announced in 2018, the Series A was $80 million. However, the prospectus indicates JW raised $168 million across two tranches. Oriza Holdings, Arch Venture Partners, Loyal Valley, and AVICT Global Holdings also took part.

The $100 million Series B earlier this year was led by CPE – formerly CITIC Private Equity – and Mirae Asset. Additional commitments came from Oriza, CR-CP Life Science Fund, Loyal Valley, Temasek, Sequoia, and Arch. CPE and Mirae Asset now own 5.2% and 3.64%, respectively. No other external investor holds more than 3%.

JW's most advanced treatment is Relma-cel, a CAR-T therapy for lymphoma that has reappeared after a period of remission or is not responding to other treatments. The drug – which specifically targets the CD19 antigen, one of the most common proteins in white blood cells – was submitted to Chinese regulators for new drug application (NDA) approval in June. It is expected to be the first CAR-T therapy released in China as a category-one biologics product.

JW has six other treatments in its pipeline, of which only one has reached phase-one clinical trials. The IPO proceeds will be used to develop more drug candidates, as well as to take Relma-cel to monetization.

According to Frost & Sullivan, the market for CAR-T therapies in China is expected to be worth RMB24.3 billion ($3.6 billion) in 2030, up from RMB600 million in 2021. Several other companies are targeting the space, with Loyal Valley leading a $186 million Series C round for CARsgen Therapeutics this week. Another recent deal saw Gracell Biotechnologies – which is working on products intended to make CAR-T cell drug development cheaper and faster – raise $100 million in Series C funding.

JW has yet to generate any revenue and is listing under provisions that allow pre-revenue biotech companies to go public in Hong Kong. Its net loss for 2019 was RMB633.3 million, up from RMB272.6 million a year earlier, largely due to R&D spending.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.