Indonesia foreign investment: Negative no more

Changes to Indonesia’s “negative list” are expected to open up the country to more foreign investment, but private equity players will have to remember to tread cautiously

Perhaps it's fitting that one of the highest profile deals in Indonesia's nascent technology sector was made possible by a technicality. When e-commerce marketplace Tokopedia received $100 million from SoftBank and Sequoia Capital in 2014, foreign ownership of Indonesian e-commerce groups was completely off limits.

The transaction went through thanks to Tokopedia's official classification as a "web portal" used for customer-to-customer contacts rather than a straight online retailer. While this may be a reasonable business model distinction, the episode helps illustrate the fact that much of Indonesia's modest amount of foreign investment so far has depended on either legal semantics or, in many other cases, complex proxy ownership schemes.

However, the notoriously restrictive foreign investment "negative list" that has necessitated such convolutions appears set for a major overhaul as the government's latest economic policy revision rolls out this month. But with some of the stimulus package's more dramatic recommendations likely to inspire a rush of new PE entrants into this often complicated legal jurisdiction, the call for thorough due diligence has taken on an increased gravity.

"Even the sophisticated domestic investors [in Indonesia] get spooked by foreign investment, so it's a really positive sign to have this come out in a space of 6-9 months compared to a 2-3 years for the 2014 list," says David East, head of transaction services for KPMG in Indonesia. "Now it all depends what actual business fields they fit under it, which isn't always so clear."

Practical implications

The face of the new policy has been Trade Minister Thomas Lembong, who was plucked last year by President Joko Widodo from the leadership of private equity firm Quvat Management to revitalize a sputtering economic reform process. He has been credited with introducing the latest policy revamp with an efficiency and speed uncommon in Indonesia's decidedly sluggish bureaucracy.

The changes to the negative list, which stipulates which industries are open to foreign investment and to what degree, were announced in an economic stimulus package in February. Liberalizations are expected in 35 industries on the list, including a number of consumer-focused segments of particular interest to private equity - e-commerce, healthcare, food service and entertainment.

From a practical standpoint, KPMG's East describes the new negative list as an important stroke in ending two years of incessant changing of rules, regulations and decrees - some delivered through ministries without consultation with the president or the foreign investment coordination board, BKPM. However, even a stirring move like the opening of e-commerce to foreign investment remains inherently vague as to what specific businesses models will be able to benefit.

As a result of this lack of clarity, there will need to be a heightened focus from foreign investors on due diligence in both the newly opened sectors and any support industries which may remain restricted. While the Tokopedia investment demonstrated a favorable twist in the reading of a sector's definition, other businesses may find that the new e-commerce liberalizations don't apply to their particular brand of online business.

This uncertainty is rooted in memories of a disappointing 2014 negative list review. Coming on the back of the commodities boom, it was largely characterized by reforms to bulk logistics, minerals and energy, spurring little enthusiasm among private equity investors.

"The 2014 version of the list was insular and too protectionist in design," says Brian Gordon, a partner in the Singapore office of law firm Holman Fenwick Willan. "As a result of a lack of inward investment, they've taken the chance to make changes [with this year's list]. A lot of industrialized countries are never warm to that kind of attitude so it's refreshing to see the largest economy in Southeast Asia taking this on."

The reforms underline a broader transition in Indonesia over the past few years in which weak commodity prices have forced the diversification of a resources-focused economy into services, technology and consumer-related fields. They also reflect a more concerted effort from the government to address longstanding concerns that domestic consumption can no longer be the driver of economic growth.

The specifics

Under the new rules, e-commerce ¬- still completely closed to foreign investment - could be opened up as much as 100% for foreign companies investing in increments of IDR100 billion ($7.6 million) and above. Restaurants, bars and the film industry - including production, distribution and cinemas - are also slated to go 100%.

Meanwhile, consulting services, construction and the medical equipment sector could each be opened to 67% foreign ownership. Other areas expected to be opened up to majority offshore control include job training, travel bureaus, golf course development, certain museums and telecom services.

KPMG broadly flagged important upside in the film industry - where the group has already tracked new interest from a global PE firm - and the warehousing and distribution sector, which is currently limited to only 33% foreign ownership. "If you can open that up, it creates a lot of opportunities for PEs and strategic corporates in terms of buying a business and having control over the distribution process," East says.

The relaxing of restrictions on healthcare industry, however, could deliver some of the more interesting opportunities of the overall package. Indonesia is considered precariously dependent on imported medical supplies, with some estimates finding that 90% of medical raw materials are brought in from outside the country. With the rupiah remaining weak against many international currencies, these skewed terms of trade suggest a push for more domestic healthcare operations could be on the near-term horizon.

"We continuously have clients and private equity investors asking how they can invest in Indonesian hospitals, so there seems to be a genuine appetite and a genuine need," says Oene Marseille, foreign counsel for Indonesian law firm ABNR. "Indonesian patients are travelling to Thailand and Singapore for their health services, so if you can bring that into Indonesia, that's interesting for everybody, including investors."

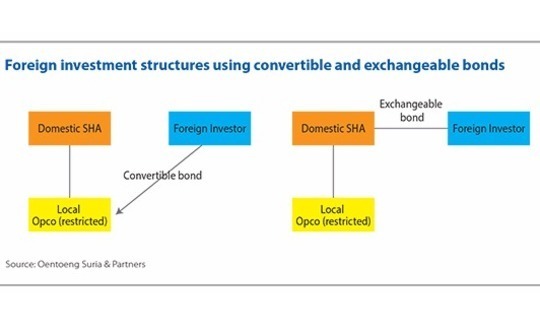

The structural changes to foreign ownership will be fundamental rather than technical re-workings. For industries that are fully opening up, the cumbersome convertible debt instruments that characterize most cross-border ownership schemes in Indonesia will become obsolete, allowing investors to convert their stakes into traditional equity holdings immediately.

In industries where only partial ownership is permitted, the currently employed convertible options and debt arrangements will remain intact, although foreign investors will pursue their maximum threshold allowances through conventional share acquisitions.

"I don't necessarily expect to see new structures; I expect an implementation of the existing structures," Marseille says. "The more positive sentiment would be that certain sectors are indeed opening up, which hopefully will attract large investments in the country."

Other foreign ownership techniques such as the "nominee" method of offering a loan to a local holding company as well as a structure that specially grants foreign control rights in venture companies are likely to persist as well. But due to the increased level of regulatory scrutiny and reduced necessity, these more inventive workarounds will likely remain of marginal relevance to private equity.

New structures based on the proposed regulatory changes are difficult to predict since the lawyers who advise on cross-border schemes will likely lean toward proven systems during any transition period.

Holman's Gordon says the convertible debt structures that have been demonstrated to work for years, although awkward, are the ones foreign investors will continue to use after implementation of the new negative list. Indeed, these structures are likely to be used in greater numbers as more investors enter the market and as part of a movement toward a more imaginative contractual environment that offers increased legal comfort.

"There are always grumblings in Indonesia regarding the certainty of contracts and you're seeing a greater emphasis on those ownership structures with arbitration clauses that take neutral Asian locations, principally Singapore, as a theater in which to address disputes outside of what can be a less confident legal environment," he says. "You'll see more of those bilateral contracts that contain protections that allow them to deal with the situation outside of Indonesia."

Subversive obstacles

The influx of outside investment interest set to take advantage of these developments will be attracted to improved exiting prospects related to accelerated growth and de-risked control frameworks. But new entrants into this space will have to contend with a host of more subversive obstacles associated with Indonesia's comparatively weak legal infrastructure and ongoing concerns in capital market regulations.

Private equity players chasing opportunities in the new negative list environment are perhaps most likely to face unexpected pitfalls in the difficulties related to acquiring a business license in growth-stage service or customer-oriented businesses. This is because BKPM requires all companies to commit at least IDR10 billion in Indonesia during the early stages of investment regardless of the target sector's size or investment profile.

Due diligence concerns around employment, immigration and customs are also expected to parallel increased PE activity as these policy areas are often in direct conflict with the essence of the PE investment model. Even in a 100% ownership scenario, stringent rules for issuing work permits to foreigners in Indonesia remain at odds with GP imperatives to maintain a presence on the ground.

"That is as much a burden as what the old negative list was," Gordon adds. "Those floor issues create the backdoor nationalism that the negative list doesn't really have a say on. Everybody's thought of the much bigger issues, but they haven't thought of the minutia that can have a detrimental effect, particularly where private equity is involved."

In the final weeks before the new negative list's expected endorsement, stakeholders from government and business will continue to lobby either for or against changes in the industries where the rules are expected to change. This process was the cause of the disappointment in 2014 and has been most prominent so far this year in the country's crumb rubber sector, where a proposal to open up 100% to foreign investment has sparked a highly visible protest from local industry representatives.

In this way, the success of the new negative list, as with any economic progress in Indonesia, inevitably comes back to the country's unique cultural challenges in achieving the practical rollout of new policies.

"It's all positive in terms of talk, but like that overused term goes, Indonesia has to walk the talk," KPMG's East says. "We're seeing some Ministry of Trade regulations being cleaned up, but I don't think we've got a lot of traction yet in terms of implementation and execution in some of the other areas. It'll be a disappointment if we're still talking about this in a year's time because this is where they've got a chance to make up for two years of lost time."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.