Placement agents: Perfect partners?

Once a private equity firm selects a placement agent, they might be working hand in glove on a fundraise for the next two years. A strong mutual understanding increases the chances of a favorable outcome

For one placement agent, the secret weapon is a Snickers bar. When a North American fund manager's roster of LP meetings stretches deep into the Beijing afternoon, and low blood sugar threatens to impede his pitching performance, chocolate serves as a restorative and a reminder of home. It is one of many small acts that can keep the placement agent-GP relationship on an even keel during protracted fundraising processes.

"The smaller the issue, the bigger the irritation for many GPs. Is the car waiting for you in the right spot when you've finished the meeting or is it parked around the corner? Was there a better flight that could have been booked? Is the hotel satisfactory? Is the breakfast good?" the agent explains. "It's never just one problem, more a bunch of smaller things – that aren't directly related to fundraising – nagging away."

Facilitating a private equity fundraise can be a thankless task. If it goes badly, the placement agent is a natural scapegoat; if it goes well, the manager tends to claim all the credit. Whatever the outcome, there might be some residual bitterness on the part of the GP as to how much the agent gets paid.

Tensions are avoidable and most mandates are completed in a professional manner. Yet with Asia's less institutional managers, there is sometimes a misperception as to how the agency model works and what it can deliver. This might manifest itself in a reluctance to listen to hard truths, a failure to appreciate when, how, and to whom a strategy should be pitched, and frustration when commitments are not immediately forthcoming.

Agents must be careful in managing expectations. Equally, private equity firms should take time to understand the personalities, capabilities and resources of the people sitting on the other side of the table; it helps them look beyond the marketing pitch and identify the group best suited to their needs. Above all, there must be a recognition that a placement agent can do no more than influence outcomes. They may add substance and sparkle to a fundraise; they cannot perform magic.

"If a placement agent pitches on the quality of their LP relationships, a GP that doesn't understand institutional fundraising might believe they are going to meet the decision maker, he's going to listen and as long as they meet some basic criteria, there's going to be an investment," says Chris Lerner, head of Asia at Eaton Partners. "In China, including in renminbi fundraising, relationships are everything, but in Western institutional markets no one invests because of relationships."

Another agent, taking advantage of the veil of anonymity, is more blunt: "A lot of people come to me because they think I can click my fingers and say, ‘Okay, Japan Post Bank, HKMA [Hong Kong Monetary Authority], and GIC Private are now your investors.' I can't."

Mixture of mandates

It is estimated that more than two dozen placement agents are active in Asia with US dollar-denominated fund mandates, ranging from affiliates of global investment banks to one-man independent shops. Not all of them have an office in the region. About half are regarded as part of the global mainstream. To ask industry participants to slice and dice the market is to invite a series of often conflicting analyses that may consider size, revenue, geographic scope, style, and philosophical outlook.

A few broad statements about the market ring true: an established large-cap manager would probably opt for a platform with strong global distribution like Credit Suisse; a break-out China GP looking to build out an institutional LP base might gravitate towards Eaton; a complex small to mid-cap Southeast Asia strategy could go to Monument Group.

At the same time, some agents are working on a wide variety of mandates. In the past few weeks, Lazard has closed CITIC Capital's fourth China buyout fund at $2.8 billion and Xiang He Capital's second venture vehicle at $425 million. Atlantic Pacific Capital helped Panacea raise $180 million for its debut China healthcare fund and is now working on IMM Private Equity's latest Korea offering, which has a $1.5 billion target. UBS is raising a pan-Asian infrastructure fund and a China food and agriculture fund.

Everyone claims to offer comprehensive strategic advice to clients – helping them generate buzz and scarcity value – rather than take on large, easy-to-sell mandates for flat project management fees. And the basic fundraising process is uniform: due diligence, awarding of mandate, preparatory work, launch, road show, LP due diligence. However, there are nuances in terms of mindset, internal structure, and compensation policies that could feasibly impact a fundraise. GPs should take note.

"Bigger agents tend to pride themselves on working on a limited number of mandates and being very focused. Others target earlier parts of the market and I think the way they structure things, it's more quantity over quality," one Asia-based manager observes. "But no one is perfect."

Lines of inquiry

The standard opening questions put by the GP to the agent concerns track record and resources – how much they have raised before, whether it was for relevant mandates, which LPs are likely to be interested in the GP's strategy, and what can be done to reach them. This might feed into a discussion about potential conflicts with other mandates an agent is working on, but the exchange doesn't necessarily go in that direction.

"A lot of China managers want to know what other China funds you have raised, but geography might have nothing to do with relevance. Were these large or small funds? First time or high numeral funds? What sorts of investors were participating?" says Niklas Amundsson, a partner with Monument. "There tend to be a lot of high-level questions. For example, they ask us which LPs we know best when in fact they should ask which LPs are most relevant to their strategy."

It is also worth getting specific on which person from the agent would be working on a mandate. There are plenty of stories about big hitters flying in from New York to help close a mandate and then never being seen again by the manager until the closing dinner. Moreover, some agents have separate teams working on origination, project management and distribution. Problems can arise if the originator, who is compensated on the amount of new business he brings in, is more enthusiastic about a mandate than colleagues whose remuneration is linked to its successful execution.

This disconnect become more profound in situations where the agent is working on multiple projects and doesn't have the bandwidth to give them all equal attention. "If you are working across different funds, it is human nature to gravitate towards the easier ones," observes one agent.

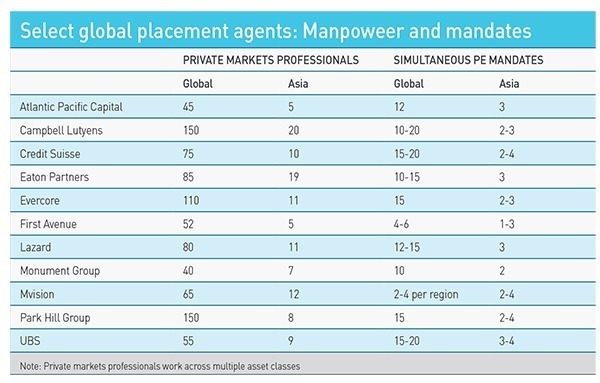

As a result, considerable attention is paid to the number of mandates an agent takes on relative to the size of the team – although that alone is not indicative of service quality. Team sizes can be deceptive, given coverage extends from private equity into real estate, infrastructure, and credit and agents might be more active in some areas than others. Park Hill, for example, has nearly 150 people for private markets globally – including hedge funds – of which 40 do PE.

Campbell Lutyens claims to have the largest presence globally and in Asia, with 150 and 20 professionals, respectively. It is followed by Eaton with 19 out of 85 and MVision with 12 out of 65. Moving toward the smaller end of the mainstream, Monument has 40 people globally of which about half a dozen sit in Asia. Consequently, it works on no more than 10 private equity mandates at any one time, typically with two in Asia.

No agent AVCJ spoke to claims to have more than four Asian funds on the go, with most citing a range of between two and four. This is vociferously disputed by some industry participants, who claim that one agent was working on approximately 10 projects simultaneously in 2018. Regardless of size, the projects in a portfolio are typically at different stages of advancement, with some funds entering the launch phase while others are nearing completion.

On a global basis, the likes of Credit Suisse and UBS say they tend to have 15-20 concurrent live fundraising mandates. The routine criticism of large capacity platforms is that complicated or far-flung mandates get pushed to the back of the queue by distribution teams in the US. It is often not just a matter of compensation and convenience, but also retaining credibility in the eyes of LPs. They would not try and push 20 mandates on the same investor.

The counterargument is these firms have large enough sales teams and strong enough internal systems – provided the project management team has the clout to get things moving – that these concerns can be addressed. It is also worth noting that a smaller agent that takes on more mandates than it has the manpower to handle is just as likely to lose focus on fundraising processes that prove difficult. Still, prospective GP clients are advised to seek clarity.

"You want to have the right advice, you want to have the right level of attention, you want to be important to your advisor and to have an open, trusted relationship with them," says Thomas Swain, a director with Credit Suisse's private funds group. "You also want to have the right global resources and feel comfortable with the breadth of their market coverage. As such, meeting with the global leadership is important to understand how they run the business and how they ensure people are doing their day jobs. I would ask the question as to exactly what role the people at the pitch meeting are going to play on a day-to-day basis."

In addition to vetting his placement agent's project management executives, one executive with an Asia-based GP spoke to each of the regional distribution teams to get an idea of their capabilities. Personal relationships can also lead to a better understanding of the product. He adds that placement agents "have not been as stable as we would like" because of staff turnover, with the departure of key rainmakers weakening coverage in certain geographies. Some managers respond to this by inserting key person clauses in placement contracts.

Common interests

Alignment on fees is another area where it helps to be transparent upfront. Every mandate is bespoke. Where compensation is based on success, an agent might be paid on all money brought in but with a higher percentage for new commitments than re-ups; only new money; new money, excluding certain names the GP is familiar with; new money, but subject to approval of the LP by the GP; or re-ups from existing LPs where the relationship with the GP is weak.

Red lines are robustly negotiated, but disputes over who played what role in sourcing certain commitments are not uncommon – even when the agent has brought in an anchor investor that makes a fundraise possible. These tensions might be minimized if there is an alignment of interest to the end of the fundraise. An agent would object if a manager sets an aggressive target and proposes a severe cut in the placement fee if they fall short of an 80% threshold. Conversely, a GP may question an agent that offers to cap its fees once the same threshold is crossed.

Several industry participants observe that paying a 2% performance fee on an entire fund only works when there is trust between GP and agent. A worst-case scenario might see the fund stuck $200 million short of its $500 million target – and with no end in sight – because the manager was overoptimistic about existing LPs coming back in or the agent has failed to deliver new money. With the agent set to receive a 2% cut regardless, ill feeling is inevitable.

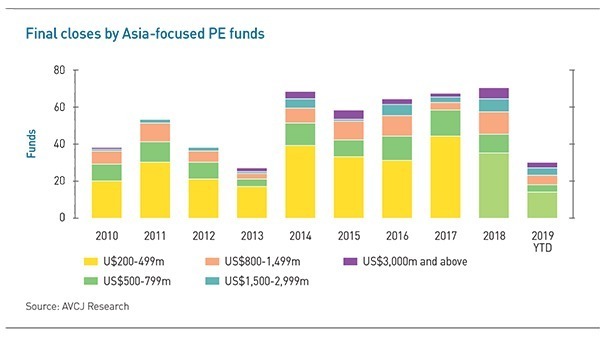

There are all kinds of reasons why a fundraise might fail to gain traction, some beyond an agent's control. The impact of macro factors has been evident in Asia over the last 12 months as investor confidence has dwindled, prompting LPs to reevaluate how and where they put money in the region. Alternatively, it could be a micro phenomenon as public market instability forces a GP to delay a couple of anticipated exits, while eroding the valuations of the entire portfolio.

Early indications of an agent is coming up short emerge during the preparatory phase, such as documentation that is of dubious quality or not delivered on time and target LP lists that are out of date. But relations with the GP are most likely to fracture during the marketing process. "You might set up a road show and there aren't enough meetings, you are seeing the wrong people, you get the logistics wrong, and there's not enough post-meeting feedback – all are potential problem areas and cause for friction," says Vincent Ng, a partner at Atlantic Pacific.

A lot of dissatisfaction arises from inappropriate LP meetings. Targeting an investor with no interest in the fund based on geography, strategy or numeral is an obvious error, but pitch dynamics also come into it. Some LPs like structured meetings where they work through tick sheets and ask questions; others want to hear a story and have a proper dialogue. The agent should brief the GP on what to expect, analyze the discussion and understand how to close that LP.

A single poorly planned or executed meeting won't necessarily cause a rift. Rather it is an accumulation of missteps that undermines a manager's confidence and leaves him feeling isolated and uninformed. In some cases, that's when minor irritations around transport and hotels escalate into major affronts. Better fundraisers – typically those that keep their fingers on the pulse by talking regularly to LPs – find it easier to regroup.

When a fundraise loses momentum, it is incredibly difficult to revive. One course of action is postponing until re-ups come in and a first close is imminent, but this might create friction with existing clients and limit a manager's options in terms of attracting new money with a recalibrated narrative and some more distributions or turnarounds in the existing portfolio. At the same time, going back to LPs that have already said no might do little to cultivate commitments or goodwill. Indeed, getting back on an investor's agenda has arguably never been harder.

"The market is deeper, and LPs are getting dragged in different directions by co-investment and secondaries. They might say they are interested in an opportunity, but they don't have the bandwidth to address it immediately. At the same time, investors are getting more aggressive about planning forward pipeline. If you haven't had a dialogue ahead of time, it's hard to break into that pipeline," says Michael Henningsen, a partner with First Avenue.

Listening to both sides of a struggling fundraise offers insights into the blame game. The manager recognized there would be turnover in the LP base, thought it could reach $1.5 billion on its own and wanted help getting an additional $1 billion. The agent claims the manager said existing demand could run to $2 billion, but in fact it was 25% of that. With $1.5 billion in commitments, and neither side happy, they agreed to part ways. The sense of frustration, from manager and agent alike, at trying to climb out of a pit that becomes seemingly deeper by the day is palpable.

Time on your hands

The chances of mid-process loss of momentum can be reduced by recognizing and addressing problems before launch. The goal of most agent due diligence is to understand a prospective client as well as any LP. Information gleaned from reference calls – with current and former LPs, ex-employees, service providers – track record analysis and internal document review bleeds into the fund preparation process itself. In one instance, the translated transcripts of 55 reference calls conducted in Japanese were placed in the data room for prospective LPs to read.

A two-month due diligence effort might be followed by upwards of six months on strategic positioning, preparing documentation, mapping out target LPs, and working with the manager on presentation. Meanwhile, the agent is constantly sounding out the market. "The premarketing element, the strategy around building competitive tension in a fundraising is really important," says one agent. "Six to nine months of premarketing is critical to getting momentum."

An established GP might be battle-ready in a shorter timeframe but Mounir Guen, CEO of MVision, prefers a mandate for a first-time manager to begin 12 months before launch. First, a group that hasn't raised institutional capital before may need help writing its operating policies as well as its pitchbook. Second, the operational due diligence burden has increased to the point that a manager that goes to market without a proper governance structure – ranging from tax planning to cash flow approvals – may have difficulty getting traction.

Private equity firms in Asia have been known to reach out to placement agents, ask them who they can raise money from and how much it will cost, and want to finalize a mandate in two weeks and launch a fund shortly thereafter. Much depends on their objectives, but such haste seldom results in positive outcomes. Of all the advice that gets thrown around during a fundraise, perhaps the one that should be heeded above all others is: don't go too fast.

"A rush to get in the market is an urge to be resisted," says Swain of Credit Suisse. "You can change the pricing of an IPO or flex the coupon on a bond offering, however, once you've launched a fundraising there is very little you can do that will immediately change the attractiveness of the offering. The story is the story once you've sent it out, so getting it right before you launch is more important than launching quickly."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.