India secondaries: Mixed signals

India has skirted around an expected boom in secondaries activity for the past couple of years, but investors haven’t lost faith in the narrative’s eventual unfolding. The devil will be in the details

Investors in Indian secondaries have long championed a disconnect between their opportunity set and real deal flow that is logically convincing but difficult to reconcile with the lack of traction to date. At a national level, they report under-potential progress, citing the relative smallness and complexity of the market. Anticipation around a breakthrough periodically peaks with the odd deal, but due to the countercyclical nature of many of the inputs and the need for specialized brokering skills, the unspoken understanding is that any significant groundswell of activity is likely to happen under the radar.

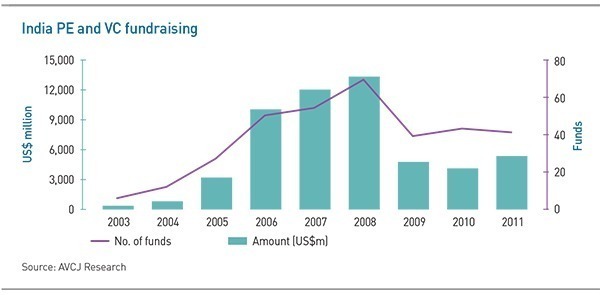

Undercurrents of this kind, by their very nature, are difficult to detect in statistical or even anecdotal terms. But for those who have been patient believers in the drivers of a larger Indian secondaries market, the dots are beginning to connect. First and foremost, these drivers include an anomalous lift in fundraising activity around 2006-2008. Commitments to India-focused private equity and venture capital funds during this period totaled $35.2 billion, compared to $4.4 billion for the preceding three-year period and $14.2 billion for the three years that followed.

There is concern that this window of opportunity to realize more exits through secondaries is overripe and therefore unlikely to deliver the implied deal flow. Yet even after multiple holding period extensions, up to half of the relevant portfolios are said to remain un-exited, leaving a discreet door for those who know how to exploit it. Coller Capital and CDC Group recently offered a case in point with the launch of a $300 million program focused on Indian PE secondaries that has closed its first transaction in the form of a $98 million GP-led transaction with a 2008-vintage India-focused fund.

"We're starting to see some of these secondary opportunities come to market and get resolved in India," says William Yea, a principal at Coller. "Ten-year funds reaching the end of their lives have already given rise to some deal flow, and there is now an increasing number of funds whose lives have been extended well beyond their scheduled terms. Liquidity solutions are clearly going to be needed – but that doesn't mean the market is going to be inundated with deal flow in the next two years. India's secondaries market is far more nuanced than that. Every situation is different, and as a secondary investor you have to look under the hood of each opportunity."

Unusual opportunities?

Coller's mandate reflects the diverse and evolving nature of the secondaries opportunity. The firm looks at a mix of LP positions and direct deals, including GP-led secondaries, and to a lesser extent, single-asset transactions. This strategy echoes industry expectations that GP-led deal growth will outpace the growth of other kinds of transactions at a faster rate in India than it does elsewhere. The rationale for this view is tied to the strong presence of both global and local investors in the largest late-cycle funds, which heightens the importance of the GP as a driver of solutions at the center of a sprawling LP base.

Single-asset deals are expected to continue representing the bulk of this activity, however, especially in financial services, which has arguably been the most heavily invested sector in recent years. Healthcare is likewise considered prospective for increased deal flow although its longer natural gestation periods and less predictability around IPO sentiment have complicated outlooks. More broadly, single-asset transactions may also be kept in check by a local tendency for relatively diversified shareholder capitalization tables.

India captures many of the universal complexities of secondaries that stymie deal flow such as difficulties of achieving alignment in multilateral negotiations or price agreement in a market with few historical reference points. This is compounded locally by a volatile period in regulatory changes and a paucity of sector specialist funds, which intensifies due diligence requirements by essentially obliging investors to underwrite each sector in a given portfolio. Meanwhile, complexities stemming from the country's relatively fragmented and diversified shareholdings cuts across the market from single-asset deals, where dozens of angel investors can gum up a sale, to more intricately structured, fund-level transactions.

NewQuest Capital Partners, which is currently seeking $850 million for its fourth dedicated Asia secondaries fund, demonstrated this point last year in a deal that included the creation of a new fund for Singapore's Basil Partners that brought an unwieldy Indian portfolio including 30 counterparties under one controlling interest. For Amit Gupta, a founding partner at NewQuest, the highly customized transaction is unlikely to be repeated in its finer details, but it hints that complex GP-led transactions could represent up to 50% of India's overall secondary deal flow in the next few years.

"The Basil transaction was an exceptional case, but overall, we have seen that deals are more complex in India than in other geographies, given the shareholding cap tables, shareholding rights, the holding structures of the funds, and where the various entities are based," says Gupta. "So having local knowledge of the stakeholders and regulations involved is very important. A lot of the issues are similar to those in a primary deal, but you have to be on top of them in India. Often things are not as black and white as in the US."

Envisioning an uptick

NewQuest focuses on directs and splits its deal flow about 65-70% in single-asset and 30-35% in GP-led transactions. GP-led transactions are thought to represent as much as 45% of deal flow in value terms, however. The firm's Mumbai office, which opened in mid-2017 to monitor a local portfolio of some $200 million of investments at the time, has reported a strong increase in deal flow in the past two years. Most of this activity has involved significant minority stakes, and in two cases, controlling stakes.

This momentum reflects how the specters of negative sentiment for secondaries are dissipating in India and how 2006-2008 vintages are subtly making themselves available to harvest via creative deal-making. But it also raises the question of how far the market can go in a context largely characterized by minority stakes. If building up underdeveloped portfolios is the name of the game in Indian secondaries, a field of non-control interests will do little to entice investors with a value-add agenda.

Concerns around control do not necessarily suggest a lack of faith in portfolio quality. NewQuest, among others, reports signs of portfolio strengths such as an uptick in late-stage tech investment opportunities. Likewise, there is a sense that many investments from 2006-2008 benefited from relatively favorable rupee-US dollar exchange rates at the time, which has unfairly impacted perceived performance down the track. In these cases, funds may have to extend horizons multiple times due to difficulty finding buyers, despite continued competitiveness in the underlying companies.

Still, agreeing on a price for these assets remains difficult, especially in an environment where rapid macro growth leads to varying expectations around expansion prospects and therefore valuations. Meanwhile, a lack of control options continues to dent the logic of approaching the fixer-uppers of the unrealized 2006-2008 vintages. As one investor puts it: "The reason it hasn't played out so far is that these are minority positions and many have underperformed for a decade. If these companies need to be cleaned up and turned around, why would anyone buy into them?"

Optimism for an uptick in secondaries around 2020-2021 persists, however, not because sellers are likely to compromise on pricing en masse, but because an overall maturation process for the PE space is coinciding with the emergence of major opportunity sets such as the maturity of the 2006-2008 vintages. Peepul Capital, for example, began investing in a mix of control and minority stakes in the early-2000s but has effectively transitioned to a control-only mandate. If more GPs express their growth in experience through this kind of ambition, it could result in a stronger secondaries market.

Sandeep Reddy, a managing director and co-founder at Peepul, estimates his firm has realized 6-8 single-asset secondaries, all with a control agenda. The acquisitions have typically been multi-stage processes, such as with snack food maker Unibic. Peepul initially acquired a majority stake in the company from Lazard Australia Private Equity and went on to consolidate its position with another secondary with minority shareholder Lighthouse Funds.

"Finding companies is just part of the challenge. The bigger challenge is executing in a marketplace and growing a business to its full potential because, fundamentally, India is still a very fragmented market," says Reddy. "The macro is obviously attractive, and there is a pipeline of opportunities, which for control deals would be narrower. But the key question is, how confident are you to be able to execute given the state of that platform."

An issue of liquidity

Embracing this market either at the portfolio or single-asset level will require an on-the-ground presence, especially given expectations that growth trajectories in India will be anything but linear in the years to come. The thinking here is that India is going through a particularly dynamic phase in its regulatory environment, with the financial services sector, for example, experiencing some of its biggest overhauls in recent memory. These include a banknote demonetization initiative in 2016 and a new goods and services tax regime the following year.

Importantly, the government that implemented these measures secured a new mandate with a convincing majority in the recent general elections. This is seen as setting the stage for even bolder reforms in the coming years. Already, business sector expectations around the likelihood of a supportive new policy environment are finding their way into valuation negotiations and the public markets. Some investors have interpreted the enhanced exit potential in this scenario as a possible inhibitor of secondaries, but caution at the crossroads of such fickle variables remains the prevailing mantra.

"We foresee that, for the next year or so, IPO windows will continue to exist, but they will be shorter, more volatile and harder to predict," says Norbert Fernandes, vice president and head of India at TR Capital. "Indian stock markets are not cheap right now because there is a lot of confidence that the government is going to make all the right moves to increase investment and consumption. But arguably the markets have priced in too much good news. Index performance has not been a slam dunk since the elections. It's been flat, and it's completely possible this will continue for the next year."

A lack of timeliness in traditional exits is ultimately the main driver of secondaries, but while these channels have proven vulnerable to macro shocks, they generally appear to be growing in reliability. Total proceeds generated by PE-backed IPOs, for example, increased 2,000% during the three years to 2017, peaking at about $1.2 billion that year, according to AVCJ Research. Despite events such as the loss of confidence in non-banking financial companies and a string of payment defaults by infrastructure lending stalwart IL&FS, the record figure fell only 43% during 2018 to $690 million.

Trade sale exits appear to be on a roll as well, with TR helping exemplify the trend with its 3.4x net return on an investment in e-commerce player Flipkart, which was acquired by Walmart in 2017. The fact that TR used the exit to announce the opening of its Mumbai office perhaps offers a clue to secondaries investors' comfort with competition from strategics and warming IPO markets. If competition implies industry maturity, which in turn implies improved prospects for secondaries, then the more the merrier.

"People can frame improved exit options as competition for secondaries, but it would be tough for us to get comfortable investing if those options weren't available," say Coller's Yea. "What we're seeing is the market developing. More international money is coming in and being applied in different ways. Some of the larger assets are getting passed up the chain – that's good for the liquidity of the system. Secondaries investors solve for particular types of illiquidity, so having more exit options at the underlying company level is generally a good thing."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.