GP due diligence: Stones unturned

The expansion of private equity activity in developing markets is translating into greater due diligence pressure on LPs seeking reliable fund managers. Solutions are intuitive but difficult

The transparency of a GP can be determined to some extent with a binary compliance standard: has the requested information been provided or not. This suggests that one of LPs' most indispensable criteria for fund manager professionalism can be systematically quantified. Alas, it doesn't really work like that.

Diligence around transparency is, ironically, one of the murkiest pursuits in private equity, and it could be set to get murkier as the asset class continues its pivot toward developing Asia. Data in these regions is scant, and although PE has proliferated rapidly in recent years, final assessments by global LPs about what constitutes an above-board GP continue to hinge to a significant degree on unfamiliar social variables and assumptions about the wisdom of the players that have more intimate access.

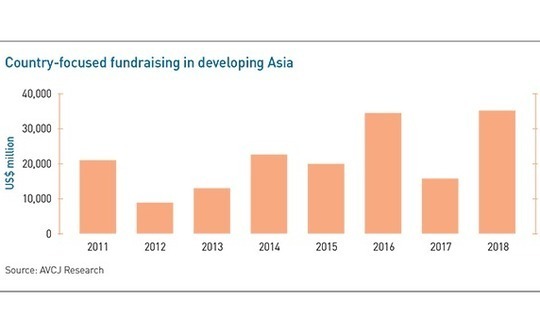

The issue is being exacerbated by an influx of capital that hints global investors increasingly see themselves as under-allocated in these markets. According to AVCJ Research, PE and VC fundraising for vehicles primarily targeting China has climbed from about $44 billion during 2011-2014, excluding renminbi-denominated vehicles, to $71 billion during 2015-2018. South Asia-mandated fundraising has followed a similar curve, albeit from a lower base.

"I think GPs are becoming less candid," says Eric Marchand, an investment director at Unigestion. "More up-and-coming fund managers have a better sense of what is expected of them and will make sure they seem much more institutional than they did before – but that's actually smoke and mirrors. If the improvement opportunities are not glaring, and as an LP you cannot help the GP, then you're exposing yourself to bigger risk. If you have just one hesitation, walk away. There are so many talented people in this industry in Asia, no one should be afraid to walk."

Lessons learned

The elephant in the room with this line of thinking is The Abraaj Group, which over the course of 2018 became the world's largest insolvent developing markets PE firm due to a still-unfolding drama around allegations of misuse of funds and unpaid debt. Industry participants have described the meltdown largely as a matter of LPs being seduced by the opportunity set and the charm of people around the firm, while ignoring risks mostly related to character profiles and transparency.

By most accounts, there were no gross lapses in diligence, and Abraaj was defined as one of the most institutional set-ups in the developing world on legitimate track record merits. Perceived mistakes mostly revolved around insufficient investigation of the sources of wealth and a concentrated management structure that left poor access to only a handful of decision-makers. Compounding the effect was the credibility implied by early support from reputable names the likes of Bill Gates and stringent DFIs including the International Finance Corporation (IFC), DEG, FMO, CDC Group, and Proparco.

"With very well-established managers, it all seems structured and professionally done particularly with the support of fund administrators and head of investors relations, but we have to look beyond that by being in a position to challenge the documents produced and have the capacity to audit big managers the same way we would with less experienced ones," says Jean-Nicolas Béasse, an investment officer at Proparco. "Sometimes, commercial LPs plan to invest substantial amounts but dedicate only a limited time to the field due diligence - one or two days and few questions asked post due diligence."

Béasse added that as a DFI, his firm prioritizes patience with references checks and developing a level of trust capable of underpinning long-term partnerships. Proparco currently invests about $40 million a year in Asia, half of which is in fund commitments. India has been the primary market to date, although Vietnam, Indonesia, and the Philippines are now considered mature enough for increased activity. This push is being partly directed by the lessons of Abraaj, with a greater emphasis on business integrity and single country funds, which are seen as more credible ground-level operators.

The industry consensus is that while outright corruption and blatant negligence may be relatively subdued themes, LPs are investing in an increasingly buyer-beware environment as fast-growing but traditionally opaque governance environments gain popularity. Anecdotal evidence includes observations that lavish AGMs have fallen out of favor in the past couple of years and that operational capacity has begun to trump market dynamics as a core due diligence consideration.

This evolution in priorities sees LPs paying greater attention to the back office, focusing less on meeting the investment team, and pressing more for engagements with the CFO or COO. When an information request is presented, the interest is now less about the details of what the manager says in the reply versus the way the query is handled logistically inside the firm.

Background research

CDC has adopted much of this philosophy, partly because it is among those that see accurate character assessments as a growing challenge. Its solution in recent years has been intensified reference checks, even with experienced firms. This includes visiting both successful and failed portfolio companies, without the manager, to get confidential perspective on what value-add was provided and how relationships were built. The DFI, which focuses significantly on India, speaks with 30-40 people as part of this process, including ex-employees and intermediaries.

"Ten years ago, there were a lot more first-time fund managers which made it much more difficult to evaluate track records. So that aspect of due diligence has become a lot easier, but there are new challenges now," explains Alagappan Murugappan, a managing director at CDC. "Team cohesion and retention has become a major issue, so funds tend to be dominated by one or two personalities, and there's no general partnership culture. That's why we always have to do extensive referencing, even if it's a third or fourth fund."

According to a survey published last September by US enterprise technology provider Intralinks, 56% of LPs still prefer to undertake this work on their own, but 32% are now incorporating the services of external consultants, and 12% favor fully outsourced approaches. These figures could shift further with the uptake of more forensic diligence methods such as artificial intelligence-enabled screening and psychiatric reviews aimed at picking up a willingness to deceive.

There is, however, a prevailing sense of caution around the adoption of tech-based diligence that is based on industry dogma about the virtues of gut instinct and the notion that there will always be undetectable ways to be subversive. Time is still considered the only reliable revealer of a cheat.

Other diligence trends focus on negotiation points such as insisting on having an advisory committee seat, where feasible, or being able to validate claims through existing LPs that may have special insights or simply the necessary language skills to get the needed background. Most tactics boil down to partner pedigree, however, and the intangibles around team chemistry that can make or break of fund over its planned horizon.

"The best way to evaluate the track record of a new GP in a developing market is to look at whether or not the individual team members will be able to stick together for at least 10 years," says Jorrit Dingemans, a manager focused on private equity at FMO. "At the partner level, teams usually consist of people who worked in the industry in developed markets and then came back to their home country. They bring strong individual track records but not always in the targeted geography, and not with the other people they've brought together."

For most LPs, detailed background checks of this kind can only be pursued after an initial canvassing process including a manager questionnaire on key issues such as alignment of interest, accounting procedures, legal norms and, increasingly, environmental, social, and governance (ESG) practices.

The Institutional Limited Partners Association (ILPA) has issued various templates of this device since 2013, with the latest iteration emphasizing staff diversify. Uptake has been gradual, but there are signs that critical mass as an industry standard could be on the horizon. Intralinks found that 90% of global LPs had either increased or maintained the depth and breadth of their use of ILPA-style questionnaires over the previous 12 months.

With greater reliance on questionnaires, LPs are advised to remember that although standardization of the manager evaluation is the main objective, an overly formulaic approach can backfire. The most revealing questions will vary from GP to GP and market to market. Likewise, technology-related developments in the broader business world are highlighting the growing importance of widely overlooked categories of investigation, including GP protocols in cybersecurity and data storage.

"The majority of investors ask different questions in meetings depending on geography, fund numeral, and strategy, but quite often, we see that questionnaires, and RFPs [request for proposal] in particular, haven't been adapted to the reality of the fund or its approach," says Niklas Amundsson, a partner at placement agent Monument Group. "A lot of the gatekeepers take that cookie-cutter approach with very onerous information requests. But there's always going to be a judgment call in terms of how little information you can get away with having if you need to make a decision in a timely manner."

Regional variations

The idea that LPs must make judgments about when to compromise in a due diligence process suggests a tendency to look the other way when developing market GPs show gaps in institutional quality. But such a double standard is difficult to demonstrate. Even with the flexibility of a fund dedicated to post-conflict regions, CDC spent two years negotiating a successful but highly conditional commitment in Afghanistan. The firm went on to spend another year reviewing a GP in Bangladesh – where it already had two fund commitments – only to decide it wasn't worth the risk.

"If you don't know the markets well enough and a multi-market manager puts on a good show, then it's a lot more difficult for the LPs to figure out what the GP is doing in each market," says CDC's Murugappan. "We therefore focus primarily on country funds where we have networks and it's easier for us to suss these things out. But in the smaller markets like Bangladesh and Pakistan, everyone knows each other, so it can be more difficult to go deep."

Geography has proven a considerable variable in LP views on due diligence as developing market strategies come to the fore. Among the main schools of thought is the idea that country funds give greater comfort around local rules that may not be well understood to the uninitiated, but their restricted mandate increases pressure to deploy imprudently. Regional funds, while seen as having a diversification advantage, may lack sufficiently precise market savvy to be competitive.

The geographic profile of the existing LP base in a given fund is also under review. Although the presence of non-local investors in a fund is seen as a sign of good governance, markets characterized by predominantly local LP support are often known for detailed contracts and long processing times that echo a level of strictness usually associated with DFIs. China, for example, is routinely cited as the most difficult environment for information gathering and navigating local regulation, but this informality should not be confused with a lack of rigor.

"Today's investors don't really invest as much with x-factor individuals anymore. They want very institutional structures, even in emerging markets. That's why the first question they always ask is who the anchor or the other first-close investors are," says Mounir Guen, CEO of placement agent MVision. "In markets with a significant local investor presence, those anchor investors may follow a diligence template that differs from the international LPs, but just because the local regulatory and legal structures are different, it doesn't mean it's a weaker standard. In some local markets, GPs can go to jail, not just face penalties."

This point helps refocus concerns about overreliance on local investors, existing brand-name backers, or any other LPs presumed to have done their homework with a more complete set of data. The "beauty contest" method of GP selection, while not believed to be as pronounced as in years past, has remained a distinct part of the frontier markets diligence toolkit for better or worse. The risk is greatest with new investors in popular funds, where little time is afforded to standard questionnaires and assumptions have to be made to participate.

"Private equity is a people business, so you have to get to know the investors and they have to trust your institution," Guen adds. "Sometimes, a new LP in a hot fund has a very short period of time to do that, so they lean on other investors they are close to. Personally, I believe investors should take their time to make a commitment and make sure that they are fully comfortable that all their own boxes were checked to make a fair investment decision."

Art versus science

The people factor in PE not only complicates diligence through the assumptions that come with leaning on the investment rationale of peers, it also encourages achieving comfort based on personal rather than professional interactions. Deals can't be made without trust, which inevitably entails at least some level of emotion-based decision-making. But for many investors, one of the biggest takeaways of the Abraaj affair is that LPs have a fiduciary responsibility to remain guarded even when they have a chummy rapport with a manager.

At the same time, a nimble reliance on "feel" will be essential to effective diligence in the rapidly changing socioeconomic contexts that define Asia's developing markets. Indeed, subjective character appraisals are the crux of the deep-dive individual background explorations that are considered critical track record checks for newly assembled teams. The sticking point will be in the reviewer's ability to manage natural bias. Red flags for hubris might easily be interpreted as justified confidence, and culturally-rooted defensiveness about transparency matters could be wrongly viewed as an ethics issue.

The gaps in institutional quality discovered during this work will not necessarily be deal-breakers, so long as they are recognized by the fund manager and targeted as projects for long-term improvement. If effect, this approach exposes LPs to the potential and risk of a controlled compromise. As part of the process, developing markets will see GPs preoccupied with fundraising and making investments give way to those geared more toward maintaining consistency in team and culture.

"What you want to be focusing on is whether this is a GP that really wants to build an institutional-grade firm, or does it just want to be a wheeler and dealer," says Unigestion's Marchand. "If the gaps you identified in the first fund are not solved when it's time to raise another fund, you should probably no longer compromise with the objective of helping the manager improve. Even if you're comforted by the fact that there's a group of smart LPs involved, and you don't smell anything else is wrong, that unwillingness to bridge the gap is a great way to understand where the GP's mind lies."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.