Worlds apart: Virtual and augmented reality

Virtual reality is closer to mainstream acceptance than ever before, while augmented reality presents considerable potential – but financial returns will not come quickly and investors must show patience

Jason Wong was getting into the wrong industry, and he knew it. He had a great idea - a tool to let real estate developers turn their blueprints into a three-dimensional model that buyers could explore in a virtual reality (VR) environment, or examine from a bird's-eye view in augmented reality (AR). But the Hong Kong-based former investment banker had no practical programming experience to make it happen.

However, Wong's lack of technical background has been less of a liability in the nascent VR and AR communities, where many developers are still feeling their way forward. The company he founded, Parallax Technologies, has gained backing from the Hong Kong Science & Technology Parks Corporation (HKSTP) and won last year's MIPIM competition for real estate-focused start-ups in Hong Kong, giving it the right to compete in the global finals.

"Everyone's quite open and collaborating at this point, because we're not really stepping on anyone's toes yet. Everyone's trying just to get VR out there, and get people to understand what VR is and its applications," says Wong.

But the newness that makes VR and AR a receptive environment for risky ideas also represents a considerable challenge for investors. While several PE and VC funds are active in the space, many are still cautious, feeling that the industry has yet to prove itself commercially and skeptical about jumping in before a market standard has been established. Those who do participate must be sure they know what they are getting into and can give investee companies the required support.

Small beginnings

The last two years have seen a significant jump in private equity investment in Asian VR and AR start-ups. AVCJ Research records just two deals in 2013; since then the count has roughly doubled every year, with five deals in 2014 and 11 in 2015. This year looks set to be even bigger, with 20 deals in the first six months alone.

The vast majority of those 20 transactions have been in China; four were in Japan and three were in India. Additionally, most have involved small sums, reflecting the early stage of many developers in the sector. The biggest investment recorded so far was a RMB230 million ($35 million) commitment earlier this year led by CITIC Capital for Chinese VR equipment developer Baofeng Mojing Science, with SAIF Partners' RMB101 million commitment to VR-focused information technology developer Shanghai Graphic Design Information in second place. Only one other deal this year has surpassed $7 million, and at least six were for less than $1 million.

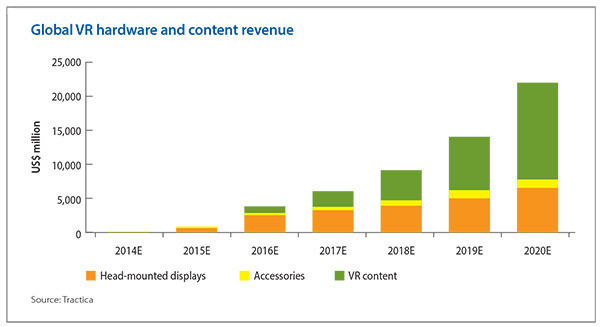

Increasing investor interest has been fueled by expectations of similarly explosive growth in the industry worldwide. In a 2015 report, technology market research firm Tractica predicted that revenues for VR hardware - including headsets and accessories - and content will reach $21.8 billion by 2020; earlier this year International Data Corporation (IDC) projected shipments of VR hardware to grow from 9.6 million units in 2016 to 64.8 million in 2020, and AR hardware shipments to grow from 400,000 units to 45.6 million over the same period. IDC expects both categories to see compound annual growth of more than 180% over the next five years.

Industry watchers base their high expectations for the industry on a number of factors, both technological and cultural, that they see as preparing the way for VR and AR to finally achieve the broad acceptance and enthusiasm that futurists have pursued for decades.

On the technology side, VR especially has made great strides. Advances in processor speed and efficiency, display technology and environmental sensors have allowed developers to liberate users from the bulky headsets and limited controls that held back technology in the 1980s and 1990s. Early virtual reality implementations simply did not have the power to create convincing virtual worlds.

"Things like latency [the time required for a display to respond to user input], peripheral vision, lighting, shading, all have to be within a range of what you'd expect from the real world, and that requires a tremendous amount of processing speed, a tremendous amount of storage," says Vini Letteri, a director at KKR, which joined Kleiner Perkins and Google in 2014 to invest $542 million in US-based VR goggle developer Magic Leap.

The ubiquity of smart phones is playing a key role in spreading VR technology to a broader market. These devices combine high resolution displays, relatively powerful processors and gyroscopes that can detect the phone's orientation - on paper, all the technology needed for VR. With a cheap phone mount such as Google Cardboard users can turn nearly any recently released smart phone into a VR headset.

Cardboard and similar low-end devices are not without their limitations, of course - smart phone processors are nowhere near the capabilities of a computer's dedicated graphics chips, and interaction is restricted since users must use their hands to hold the device to their eyes. Nevertheless, even the basic VR experiences available through these implementations are enough to stimulate the creativity of developers.

In the case of Parallax, for example, the company's home-exploration software is currently available through an Android app - with an iOS app planned for the near future - to be used with Google Cardboard or similar devices. The company has no desire to develop for higher-end VR devices such as the Oculus Rift and HTC Vive, both of which were released earlier this year; while those devices allow more realistic experiences, the company's target audience of developers and real estate agents are unlikely to invest in them just to use the app.

Trading up

This is not to say that the future of VR lies solely with low-end devices, but rather that industry players see this approach as a necessary component of the overall ecosystem. Consumers that are reluctant to spend the kind of money needed for a full VR system - including both the headset and a computer powerful enough to run it - may pick up a Cardboard headset mount as an impulse buy, and end up enjoying it enough to take the plunge for the full VR experience.

"Before the user decides to spend $600 to buy a Vive, or more for an Oculus, can you educate them in that experience?" says Jenny Lee, managing director at GGV Capital. "You can use a Cardboard-type device, and then experience it with your existing phone content, the VR content that you have for games, or for museum tours."

Industry watchers consider smart phones to be crucial to the acceptance of AR as well. Since the advent of the iPhone consumers have become used to broadcasting and receiving a constant stream of information. Modern smart phones, with high-resolution cameras and screens and information stored online, can create highly convincing illusions, such as objects, animals or people that seem to exist within the environment, albeit only on the phone's screen.

In fact, despite the excitement around VR, many believe that AR will prove easier in the long run to develop, as it mainly makes use of existing technology. Parallax's Wong says implementing the company's AR application - which calls up a 3D model of a house when it scans a floor plan - was as simple as creating a link on a website, since the app merely accesses an existing model stored in an online database.

"Once we developed the VR, we just needed one or two more steps to create the AR," says Wong. "Because we built the model, and you're walking around inside the model, we just have to slim it down, make it less memory intensive so that it's in sync when you move the camera around."

However, despite the growth potential for these technologies, investors have so far been slow to take advantage of them, chiefly because adoption by consumers is not guaranteed. Fragmentation of the market is another potential problem: currently there is no dominant player in the VR industry, and with so many competing technologies it will take time for the sector to coalesce around one or two platforms that are acceptable for both users and content creators, as happened in the smart phone space.

The youth of the VR and AR ecosystems also means that investors are unlikely to see returns on their capital for some time. Financial investors thus are often unwilling to commit funds. Even technology-focused funds - though many say they are curious and hopeful about the industry - have made few investments.

Most support has therefore come from players motivated by other than financial factors. HKSTP has supported a number of start-ups in the VR and AR space through its incubation programs, most notably Parallax and Realmax, which develops AR applications for enterprise users and creates tools to help other developers.

"Applications for VR and AR are still a relatively untapped market with huge potential and enough room to accommodate SMEs and start-ups," says Peter Mok, head of incubation programs at HKSTP. "AR technology is now primarily used in the gaming industry, but start-ups can explore more potential applications for AR tech."

Taiwanese hardware developer HTC is also supporting the ecosystem through an incubator of its own. The Vive X program, created earlier this year and based in Beijing, Taipei and San Francisco, aims to stimulate development for the Vive, HTC's proprietary high-end headset. HTC has said that additional VC investors are participating, but did not identify them.

Patience pays off?

Despite the support of incubators such as these, the VR and AR industries will ultimately need more support in order to realize their potential. Industry players worry that financial investors, especially in Asia, lack the patience to appreciate the amount of research that is still needed. Those who look to jump in to a hot sector for quick returns may not understand that companies often need to explore multiple avenues of development before reaching the best approach.

"No one can guarantee the future, we just analyze the trends and do the research and development here," says Shuyan Lu, business development manager at Realmax. "I think in Hong Kong we need investors to be more patient for that, and to give us enough space to do the R&D. Of course we think if the direction is correct, we will get returns, but we just need time to do the right things."

The research that is needed focuses on several technological barriers that still need to be overcome, particularly in the VR sector. Current VR, even on the high end, still presents usability barriers: most users experience disorientation after 20 minutes, and many cannot use existing systems at all because they are not realistic enough, causing unacceptable discomfort.

These issues could lead to regulatory difficulties as well. Fears of VR's effect on children's nervous systems may result in restrictions on marketing the devices, as could concerns over disorientation arising from prolonged use.

Industry watchers believe these difficulties are not insurmountable: upcoming smart phone processors are expected to allow more realistic environments, while new screens will permit higher frame rates and smoother movement. However, these will take time to implement, and investors may not be willing to wait.

In this context, many feel that there is considerably more potential for widespread acceptance of AR. While users may find VR exciting, they are far more likely to actually use AR - it is less obtrusive and less isolating, requiring no headsets that close users off from the world around them. Though there are still social barriers to overcome, it is thought that AR has potential to rival or even overtake the smart phone in popularity and usefulness.

"I can envision a world where the smart phone goes away altogether, and all that exists is augmented reality," says KKR's Letteri. "Everybody in the world's wearing AR glasses or AR contact lenses around, and the need for a phone goes away. Everything you need is contained either in the glasses or in the contact lens in terms of communication, data, voice and others. And if that's the case, I think everybody in the world having access to the technology will be of paramount importance."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.