Korean culture plays: Sitting pretty?

Private equity is riding the 'Korean wave' by investing in cultural assets - from music to TV dramas to beauty products – that have international appeal. Success hinges on execution as much as macro trends

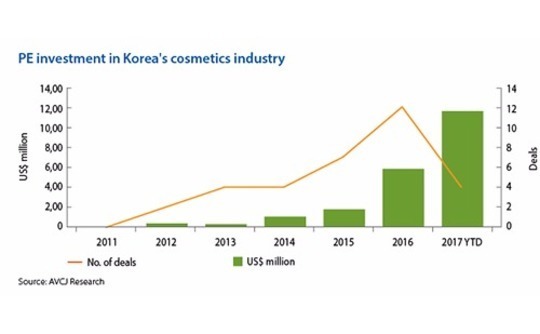

As recently as three years ago, private equity investment in South Korea's cosmetics industry was minimal. AVCJ Research has records of three deals between 2006 and 2011, all of them venture capital transactions. Investment hit $31 million the following year and $100 million in 2014. Then last year the industry exploded, with the amount of capital deployed reached $575 million. Five months into 2017, the total stands at $334 million.

It isn't hard to see why. The country has left a firm cultural imprint on Asia as reflected in the popularity of its contemporary music and television dramas. Korean celebrities have become part of a zeitgeist, and so too have the fashions and cosmetics they showcase. The combination of star exposure plus product quality and affordability – Korea is credited with various global innovations within cosmetics, while its products are competitively priced compared to global brands – clearly sells.

Investment has taken off in the past two years not so much because the number of deals is rising (although it is), but because check sizes are becoming bigger. Bain Capital teamed up with Goldman Sachs to buy a majority stake in Carver Korea last year for KRW400 billion ($350 million) and followed up in April with a KRW927 billion solo deal to acquire botox and facial treatments manufacturer Hugel (not a cosmetics play in the traditional sense, but it follows a similar theme).

Last week, IMM Investment completed a tender offer that secured it a majority stake in Able C&C, having already agreed to buy a minority interest from the founder. For a commitment of $330 million across the two legs of the transaction, IMM has gained control of Korea's third-largest cosmetics company by sales. The plan is to shore up Able C&C's already substantial domestic operation and accelerate expansion in Asia. China is an obvious target, most likely through wholesale arrangements.

Goldman Sachs put cosmetics sales in China at $46 billion in 2015 and it expects the addressable market to hit $68 billion in 2020. For private equity firms that see the Chinese market as part of their investment thesis – using their relationship networks in the country to help Korean brands get their products on more shop shelves – there are success stories to which they can point. Domestic market leader AmorePacific has established several of its brands in China, in part through mobile marketing initiatives featuring Korean celebrities.

The challenge is execution. While the underlying trends are clear, do these companies have the right products at the right price points for Asian markets, and are they pitching them in the most effective ways? None of these companies are looking to build stores in China, so they must rely on third-party distributors. The thesis plays out as long as their products – and the broader phenomenon of the Korean cultural export – stay relevant.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.