Corporate carve-outs: Who's selling?

Certain markets in Asia represent a target-rich environment for corporate carve-outs, but private equity firms must be patient in waiting for deals to emerge

The Longreach Group secured its second Japanese corporate carve-out earlier this month, with an agreement to buy Nippon Outsourcing Corporation, a business process outsourcing unit of Olympus Corporation. The first, in June, saw the GP acquire a majority stake in hamburger restaurant chain Wendy's Japan and combine it with First Kitchen, a non-core subsidiary of Suntory Holdings.

Longreach has a proven track record in picking up divested assets. However, its activities make little imprint on headline PE investment numbers. Not only are the firm's check sizes relatively small - equity commitments have ranged from $30-200 million, but most fall towards the bottom end of that scale - but they also rarely become public knowledge. Longreach has announced four carve-outs since 2013; none came with a disclosed valuation.

While KKR's acquisition of a majority stake in Panasonic Healthcare remains the recent high point in terms of private equity acquisitions from corporate Japan, the bulk of activity is smaller and quieter. Much the same can be said of Korea, where there have been numerous divestments, but the eye-catching ones have been made by multinationals rather than domestic groups.

Henry McVey, KKR's head of global macro and asset allocation, thinks this deal flow could proliferate, driven by conglomerates that have over-diversified across industries or overestimated the opportunity within an industry. "In our view, complexity of story appears cheap on a relative basis in today's low rate, slower growth environment. Nowhere is this investment set more intriguing right now than in Japan, in our view... Moreover, rates are low, banks need to lend, and many firms require the requisite expertise to help them expand abroad," he said in a recent note.

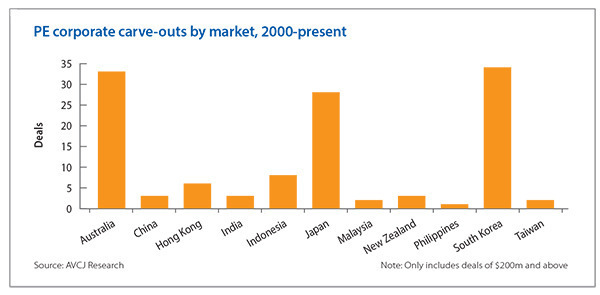

Korea and Australia are also seen as target rich environments, and this is confirmed by data from AVCJ Research. Of the 123 PE corporate carve-outs of $200 million or more that have taken place in Asia since 2000, Australia, Japan and Korea each account for around 30. And there has been a pick-up in these larger deals, with 14 announced in 2015 and 17 the year before that, both record highs. The running total for 2016 is seven, with Korea and Hong Kong the main actors.

At the same time, these trends are notoriously difficult to predict. The Korea carve-out opportunity, for example, has been a topic in private equity circles for years. It remains to be seen whether corporates will respond to pressure from the banks to resolve their debts and pressure from the government to reduce their labyrinthine empires, resulting in deal flow rising substantially above current levels. Similarly, Japan's governance drive, intended to make companies focus more on issues such as transparency and return on equity could lead to more divestments. Or equally it may not.

In the less mature Asian markets, carve-outs are even more of a rarity as most domestic companies remain firmly in acquisition mode, although at some point they will surely retreat from markets in which they are less competitive. In short, there is logic to the Asian divestment opportunity, but private equity investors must be patient.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.