Australian PE: Under the spotlight

The rapid descent of Dick Smith Electronics from a $500 million valuation to bankruptcy has led to sharp criticism of private equity. Once again, the industry must explain why it isn’t the bad guy

The groups meet about once a month, typically in Canberra, Melbourne or Sydney, to learn about the financial mechanics that enabled their preferred skin cream or sportswear line to come to market. For public sector employees, tax authority officials and representatives of the Department of Treasury alike it can be an eye-opening experience - finding out which brand names are owned by private equity.

This is a snapshot of the Australian Private Equity & Venture Capital Association's (AVCAL) PE101 seminar series, intended to educate key stakeholders about the asset class, and perhaps knock down some preconceptions along the way. It is one facet of a broad-based outreach initiative, something that is perhaps more necessary in Australia than other Asian markets.

"We have invested a lot of time in informing the market, being more engaged and participating in public policy debate to ensure that new reforms deliver the right outcome in the marketplace," says Yasser El-Ansary, AVCAL's CEO. "Had we not built relationships with the likes of policy makers, MPs and regulators to the extent we have, perhaps a situation like the one we are confronting now would have been significantly more problematic for us."

That situation involves Dick Smith Electronics, which Anchorage Capital Partners bought in 2012 for A$20 million ($14 million) plus a share of any upside resulting from an exit. Having turned around the distressed asset, the GP listed it in late 2013 at a valuation of A$520.3 million. In January, just over one year after Anchorage sold the last of its shares, Dick Smith entered receivership.

The swift demise prompted a public outcry: How could Dick Smith fall so far, so fast? A senate inquiry has been asked to find an answer. It will investigate the causes and consequences of the collapse of listed retailers in Australia, although some expect politicians to use it as a public platform from which to attack private equity. Once again, the industry could be held up to scrutiny, tasked with explaining why it does not pose a systemic threat to listed companies.

"I think it is politically opportunistic," says one local LP. "It does look like an opportunity to have a crack at Dick Smith and the role of private equity within it, which is in some respects shortsighted. Many other people play a role stewarding a company through a public offering process. It can be hard to pin everything back on what someone did several years earlier in a private equity context."

A question of context

AVCAL would like to participate in a wide-ranging inquiry that allows the senate committee to develop a better understanding of PE. There are two reasons for this. First, the same committee, albeit with different members, conducted a thorough inquiry into private equity specifically in 2007 and concluded that the asset class makes a positive contribution to the economy. Second, and more importantly, Dick Smith is still under the control of administrators and it is up to them to determine what went wrong.

The most detailed and frequently repeated third-party critique of Anchorage's behavior, put out by Forager Funds Management in late October, claims the GP engaged in accounting trickery to dress up Dick Smith for an IPO at the expense of long-term sustainability. Anchorage has refuted these claims. Opinion within the PE community is mixed, although most acknowledge that retail presents a challenge.

Changes in the dynamics that govern discretionary spending, high fixed costs and tight inventory management can make things "get pretty dangerous pretty quickly," as one manager observes. This is not solely a private equity issue - indeed, Australia has seen numerous blow-ups of non-PE backed businesses, in and outside of retail - but by the same token, as a turnaround investment in a high-risk sector, Dick Smith is not representative of the private equity mainstream.

It remains to be seen what prognosis the senate committee, the administrator or the securities regulator deliver. But for most LPs - aware that private equity in Australia gets its share of negative publicity and not reading too much into it - the pressing question is what impact the Dick Smith situation will have on investor confidence in PE-backed IPOs.

"There is always a concern as to who is going to be the pariah, who is going to take a portfolio company public that doesn't do well," says Jonathan English, managing director at Portfolio Advisors. "There was some concern during the last window of IPO issuance in Australia as to when a newly listed company would underperform and disrupt the momentum. The opportunity for PE-backed IPOs is highly sensitive to negative press which may close the window for a prolonged period of time, resulting in a lack of near term liquidity."

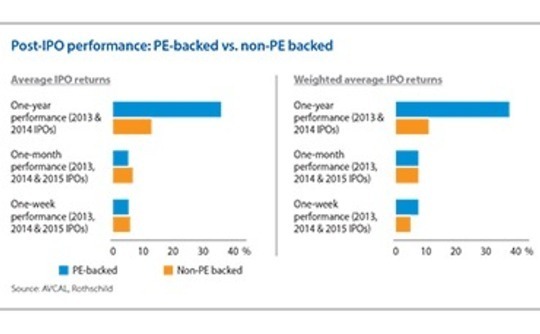

It is worth noting that private equity-backed IPOs generally perform well compared to the wider market. AVCAL and Rothschild track the performance of 67 PE-backed and non-PE backed companies that have listed in Australia since 2013 with a minimum offer size of A$100 million. The PE-backed contingent have generated an average return of 40.9%, versus 25.5% for non-PE backed, and account for eight of the top 10 performing offerings during this period. Meanwhile, Dick Smith is the only blow-up.

According to a separate analysis by Goldman Sachs, three quarters of the 25 largest PE-backed IPOs since 2013 have outperformed the ASX200 Index. Seven of these have bettered the index by more than 100%.

This generally strong stock performance up to three years after IPO appears to defy characterizations of private equity as a carpetbagger that doesn't consider the health of businesses beyond the end of its holding period. It also offers an interesting perspective on calls for those holding periods to be lengthened with a view to reassuring public market investors that their interests are aligned with those of a company's PE backers.

Time to sell?

While retaining a portion of the stock post-offering is commonplace in the US and the UK, in Australia it has taken time to become the norm. The counter-argument that the overhang effect - weaker post-offering performance due to the presence of a substantial stake that investors know will dilute the stock when exited - still carries weight with buy-side investors in certain situations. For example, in 2013, Crescent Capital Partners was encouraged to sell its entire stake in LifeHealthcare's IPO.

Industry participants place the origins of the shift from full to partial exit in 2009 and 2011, when first Myer and then Collins Foods swiftly dropped below their offering prices. The PE investors were not there to share in the pain.

"These offerings were the catalyst for investors to change their minds. They said, ‘We can deal with the overhang and would prefer to have an alignment of interest where there is enough money still on the table for PE to be concerned that it needs to hit the forecasts and not have a reputational issue.' People are now setting strong forecasts but also leaving a few dollars on the table because they want to hit those targets and be trading to the upside," says David Willis, head of Australia private equity at KPMG.

As a general rule, a private equity owner is expected to retain around 30% of a portfolio company for up to 18 months after the offering. This timing is linked to the earnings forecast periods set out in the IPO prospectus; once these have expired the PE investor is free to complete its exit, although if certain targets are met ahead of schedule there might be an early reprieve.

For example, Pacific Equity Partners (PEP) took cleaning and catering contractor Spotless Group public in May 2014. The private equity firm and its co-investors retained about 40% of the business and this position was exited across three block trades between December 2014 and August 2015. By the time the last share was sold, Spotless had bettered its EBITDA projections for the 2014 and 2015 financial years.

However, as a result of slower new business growth, Spotless announced last December that EBITDA would be flat in 2016 while net profit is expected to fall year-on-year. The stock duly fell by half and remains below the IPO price. In terms of revenue, profit and margins, Spotless is said to be in a stronger position than it was on listing, but the announcement coincided with Dick Smith's downward spiral. It was cited alongside the electronics retailer in news reports as an example of the damage PE can do.

Anchorage cut its stake in Dick Smith from 98% to 20% through the IPO in December 2013 and the GP completed its exit in September 2014. The earnings forecast for 2014 had been exceeded and the company posted year-on-year improvements for the 12 months ended June 2015. Up until mid-August, the stock was still trading close to its IPO price.

In his presentation at the annual general meeting in October, Dick Smith CEO Nick Abboud highlighted store openings, online expansion, growth in sales of private label products, and cost controls. He also announced a reduction in projected profit for 2016, and the stock dropped 30%. It turned out to be the beginning of the end.

The longer hold

If these investors' post-IPO holding periods lengthen, how long is long enough? While LPs would like to see the industry behaving as a good corporate citizen, they also expect a return commensurate with the risk being taken. "A three-year lock-up seems a little overdone, but if there could be some sort of system based on hitting certain targets and exiting in tranches to give public market investors piece of mind I'm open to that," one LP observes.

In this respect, GPs have to balance the desire to avoid reputational risk arising from short hold and a sharp post-exit drop with their fiduciary responsibilities. A five-year escrow period, for example, is not a good fit for a fund with a 10-year life that starts considering realizations from around year four. Furthermore, the PE model is based on the premise that private ownership is a superior way to build businesses; if a company is public for half the holding period this could be seen to undermine the original rationale.

Quadrant waited two years to sell the last of its shares in New Zealand retirement village operator Summerset, having taking the business public in November 2011. This was due to limited liquidity in the local market, but the PE firm knew what it was getting into and retained a majority stake. The thinking was that if the holding period was going to be longer than usual, Quadrant should be in control for longer than usual; otherwise the GP would be working contrary to its typical approach and returns might suffer.

"We want to set companies up for 3-4 years but that isn't directly linked to how long we retain the stock post-IPO," says Marcus Darville, a managing partner at Quadrant. "Even if it's a very good business, our investors aren't paying private equity fees for us to hold on to it. We retain shares because it's part of the exit process, and sometimes we will hold them for longer than we are obliged to hold them. I'm not certain that holding for, say, three years is necessary when it is a well-established and mature business."

Numerous industry participants, while accepting that the chances of a full exit on IPO are slimmer than before, believe that holding until the prospectus forecasts have been met is appropriate. Several also observe that PE firms are not the sole actor in IPO processes. While the portfolio company board is ultimately responsible for the accuracy of disclosed information, various third parties play a role in vetting it, and then public market investors ultimately decided whether or not to buy.

"Apart from a couple of relatively minor circumstances there has not been a lot of action against companies for defective prospectuses," says Robert Pick, a partner at Allens who specializes in capital markets. "More often than not, investors might not understand a business or they are mesmerized by the attraction of certain parts of the business without understanding the full risks."

Neither is it in the interests of private equity investors to see companies falter, even after exit. Quadrant has been involved in five IPOs since 2013, PEP has done four, Crescent three and Anchorage two. It remains to be seen how long a shadow Dick Smith casts over the private equity industry, but a sponsor that leaves its fingerprints on a string of failures is less likely to win over investors next time around.

"When we get into a business we are looking at it with a 10-year mindset," says Tim Martin, a partner at Crescent. "Even if you exit after 4-5 years you still have to be thinking about the story 4-5 years beyond that. We have to ask about the long-term risks and opportunities because when we exit, having done the first phase of that you still need that next level of the growth story ahead."

This attitude is apparent, for example, in approaches to staff retention. There is a phenomenon in Australian private equity of the repeat CEO - an executive who is familiar with PE investors and likes the professional challenge, financial incentives and clear goals that are part and parcel of a turnaround or rapid growth play. These individuals are not always interested in staying on once the goals have been achieved and a company is public.

It is possible to shape contracts so they commit key management team members to a certain length of post-IPO tenure, but equally private equity firms must look at succession planning. When the CEO of LifeHealthcare departed two years after the company went public his successor was ready and waiting, having spent the last three years with the company as a general manager.

This brings the issue back to whether the public perception of private equity tallies with the reality. Most industry participants do not expect the inquiry to result in a crackdown on the asset class, noting the broadening of the terms of reference to include several questions about consumer protection that do not relate to PE as evidence of wiser heads prevailing over an initial knee-jerk response.

They also point to part of the conclusion to the report from the 2007 inquiry: "The committee views private equity as an opportunity to reinvigorate underperforming public companies, which will subsequently benefit Australian consumers, shareholders and workers."

At the same time, an appreciation of the need for private equity to communicate more consistently and effectively with stakeholders is tempered by a feeling among GPs that the prevailing view in certain constituencies might never be fully swayed.

"Making the connection points across our industry more visible to people - explaining the role of superannuation funds as investors in PE funds that deploy capital into Australian businesses - that task will never be complete," adds AVCAL's El-Ansary. "When we are sick of saying it there are people on the other end of our message that are only just starting to hear it."

SIDEBAR: Risk factors - PE and retail

It should come as little surprise that Anchorage Capital's acquisition of Dick Smith Electronics constituted a turnaround deal. AVCJ Research has records of fewer than 20 private equity buyouts in Australia's retail sector since 2012. Half of these were wholesalers. Of the handful that involved genuine high street retailers, several have required some kind of triage.

The issues these businesses have faced vary enormously, from fall-outs between investment partners over the best way to achieve growth to GPs providing capital to companies with existing PE backers at times when getting fresh funding is difficult. However, their collective travails and the hesitancy of investors to get new exposure underline the challenges presented by the industry.

"Australia has a very high cost base for traditional retail. We have high concentration of ownership amongst the landlords, which translates into high rents compared to similar places around the world, and we have a highly unionized workforce, which translates into high hourly rates," says Peter Wiggs, CEO at Archer Capital. "Then you throw in the fact that technology makes it easier for people not to leave their homes if they want to shop. I am happy the current retailers are sorting through these issues before we dive back in."

Archer's last retail investment was Rebel Sports in 2004, which was sold to a trade buyer seven years later. The thesis was supported by a consolidation strategy specific to sports retail that changed the dynamic between the company and its suppliers, leading to increased profit.

If particular angles or general market trends do not work in a retailer's favor, difficulties can escalate rapidly. Several PE-backed retailers went under in the wake of the global financial crisis when nervous consumers increased their savings ratios from 2% of household income to 12% in the space of nine months. Revenues retracted and companies could no longer service their debts.

In December 2009, REDGroup Retail - a Pacific Equity Partners portfolio company that owned the local master franchiser for Angus & Robertson and Borders - was said to be among the most profitable bookstore chains in the world. Four months later profit had slumped to zero and the business went into administration in 2011. According to a source familiar with the situation, a 15% reduction in REDGroup's revenue ate into what was a 50% gross margin and a 7% net margin.

"In retail you have large fixed costs and long operating leverage. Everyday businesses with low discretion are distinctly different, but the ones with high margins are a death trap if you get any tremor at all in the discretionary spending Geiger counter," the source adds.

REDGroup wasn't helped by a swing in the exchange rate. It was legally obliged to source books in Australia, but suddenly consumers could buy them more cheaply overseas. That inability to choose lower cost suppliers compounded the company's difficulties because it couldn't adapt to narrowing gross margins by altering costs.

Speed and agility are often highlighted by Brian Harris, a managing director at Alvarez & Marsal, when advising retailers on supply chain management. These qualities are particularly relevant to retail segments such as apparel and consumer electronics because the latest products are superseded by the next season. Consumer electronics was also among the first to be overwhelmed by digital channels, which sway purchasing decisions towards price and availability.

"Most groups you see fall from a place of margin stability are either missing the market with their assortment strategy, being forced to match prices of lower cost competitors, or allocating inventory sub-optimally, resulting in too much inventory in the wrong places," says Harris. "If it's the latter, a retailer has no choice but to cut prices and clear inventory, which is painful from a margins perspective. If you can't move this season's winter sweaters, you can't hold on to them and sell them next year - the lifecycle of merchandise is accelerating so quickly."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.