2017 in review: Peak of the cycle?

Large-cap buyouts take private equity investment to record high; KKR leads the way in fundraising, but renminbi vehicles still distort the market; IPOs flourish amid global public markets boom

INVESTMENT: UNCHARTED TERRITORY

With more capital at their disposal, GPs get bigger and bolder in their Asia buyout endeavors

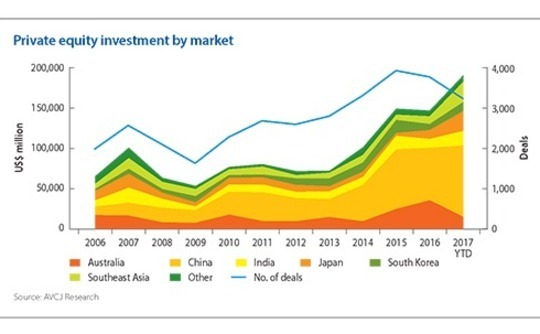

Three years ago, private equity investment in Asia topped $100 billion for only the second time, finally inching past the previous record high set in 2007. That total could be doubled in 2017, with $191.7 billion deployed as of early December, according to provisional data from AVCJ Research. Buyout deal flow alone is nearing three times the 2014 figure.

Of course, this stellar year is underpinned by a string of mega-transactions, including the largest Asia has ever seen: the $17.8 billion acquisition of Toshiba Memory Corporation (TMC) by a Bain Capital Private Equity-led consortium, which won shareholder approval in October. (AVCJ Research deducts the capital that Toshiba is reinvesting in the asset and puts the total at $14.7 billion.)

The deal might be seen as vindication for those who have spent years trying to persuade Japanese companies to divest their most prized assets. It offers hope that there will be more such large-cap divestments as governance reforms and an emphasis on return on equity and maintaining competitiveness are forcing conglomerates to prioritize efficiency over size.

On one hand, the TMC transaction is unusual: while most divestments are strategically motivated and involve non-core assets, Toshiba is offloading a very large business that in other circumstances would never have been put on the block. On the other hand, the fact that a foreign GP – supported by a string of foreign corporates – has been able to participate suggests a growing acceptance among Japanese corporates that private equity can be an effective partner and custodian.

Innovation Network Corporation of Japan (INCJ) is a feature of this deal, having also led a group of domestic conglomerates in a bailout of Renesas Technologies five years ago, effectively thwarting private equity efforts to buy that business. However, in this instance, INCJ is actively working with Bain, which says much about the change in mindset.

Japan should end 2017 as Asia's second-largest PE investment destination, a position it has occupied only once in the last decade. TMC is one of five deals of $1 billion or more announced in 2017, compared to six during the six years to September 2016. Four of the five are corporate carve-outs: TMC, KKR's purchases of Hitachi Koki and Hitachi Kokusai Electric (the latter also features Japan Industrial Partners), and GSR Capital's acquisition of Nissan Motor and NEC's electric battery business.

Japan is an exciting investment theme for global and pan-regional managers, but large-cap deals are proliferating across Asia. A total of 32 $1 billion-plus transactions have been disclosed so far this year, compared to 19 in 2016 and 25 in 2015. They account for 61% of the overall amount deployed in the region. It is not just a case of corporate rationalization in markets like Japan. Twelve are in China – the same as the last two years – while five are in India, a country that delivered six in the previous 10 years.

Eight of the 32 mega deals are take-privates – often, but not always, the result of GPs approaching companies that are not necessarily for sale – including four of the six largest by enterprise valuation: TMC, Global Logistics Properties (GLP) at $11.5 billion, and Belle International at $6.8 billion, and Nord Anglia Education at $4.3 billion. Nord Anglia is also unusual in that the buyers, Baring Private Equity Asia and Canada Pension Plan Investment Board, took out positions held by two earlier Baring funds.

Each of these transactions has a strong China theme, even though GLP is based in Singapore, which is partly why private equity deal flow in Southeast Asia has reached a record $25.2 billion in 2017. Global Infrastructure Partners' purchase of a renewable energy portfolio (incorporated in Singapore but with assets across the region) from Equis Funds Group and Silver Lake's support a proposed takeover of Qualcomm by Broadcom (formerly Avago Technologies) were other key contributors.

It is worth noting that last year China and Australia – primarily growth-stage technology transactions in the former and infrastructure privatizations in the latter – accounted for 68% of Asia private equity investment on a dollar basis. In 2015, it was 66%. For 2017 to date, while Australia has shrunk to 8% from 24%, Japan and Southeast Asia have doubled their shares, with each now on 13%. India remains on around 9% but it is close to surpassing its all-time high investment figure of $18.9 billion set in 2007.

Needless to say, China is holding steady on 47%. There are new flavors to the country's investment story, notably multinationals divesting their local businesses, a course of action unheard of as recently as five years ago. CITIC Capital has participated in two of these deals, working with CITIC Group and The Carlyle Group on the $2.1 billion purchase of the McDonald's franchise in mainland China and Hong Kong and partnering Baring in the carve-out of Pearson's Wall Street English division.

At the same time, much remains unchanged. Substantial sums of money continue to be plowed into China's late-stage technology space. Alongside a $21.8 billion commitment to semiconductor specialist Tsinghua Unigroup by two government-linked investors, these transactions soaked up most of the $56.8 billion in growth capital put to work this year.

There is evidence of greater selectivity in certain segments. Didi Chuxing and Meituan-Dianping both raised multi-billion-dollar rounds with investors appearing to accept that they will remain the dominant forces in ride-hailing and online-to-offline services, respectively. Perhaps the same can now also be said of news reading app provider Toutiao, which has reportedly raised a $2 billion. Demand is strong for these players, as evidenced by SoftBank's willingness to cover $5 billion of Didi's $5.5 billion round.

Elsewhere the battle is far from won. The approximately 50 China growth deals of $100-999 million that involve internet-related business models include a variety of bike-sharing, automobile trading and services, education and cloud computing companies. Meanwhile, artificial intelligence, robotics and autonomous driving are emerging trends, but ones on which investors are prepared to make large bets.

India displays similar characteristics to China in terms of late-stage technology deals. Three of the five private equity investments of $1 billion or more fall into this category, with Paytm, Flipkart and Ola all receiving further capital. However, the latter two raised money at lower valuations to previous rounds, implying a reduction in investor fervor and perhaps a recognition that these companies won't have everything their own way.

While growth capital investment in Asia as a whole is up 45% year-on-year at $78.8 billion, early-stage activity has been more muted. With $15.8 billion committed, it could well eclipse the 2015 full-year total of $17.7 billion, but not in the same barnstorming fashion as other categories.

FUNDRAISING: KKR AND THE REST

KKR takes seven months to raise Asia's largest PE fund as renminbi vehicles lurk in the background

KKR Asia Fund III is very much a sign of the times. It is by some distance the largest pool of private equity capital raised for deployment across Asia – coming in 50% larger than KKR's previous fund – and closed in May at the hard cap of $9.3 billion after approximately seven months in the market. Some LPs say their allocations were cut back by 50% to accommodate the level of demand.

Appetite for the fund speaks volumes for the way in which investors are addressing Asia. More capital is entering the asset class, but many LPs are looking to consolidate their GP relationships, committing more capital to a smaller collection of managers. The increase in minimum check size means smaller funds cannot be considered. In addition, while many LPs believe they are underweight on Asia and want to increase allocations, a relative lack of familiarity with the region means they stick with familiar brand names.

It should therefore come as little surprise that the $500 million and $200 million commitments KKR received from New York State Common Retirement Fund and New York State Teachers' Retirement System were the largest they have ever made to an Asian fund; or that Minnesota State Board of Investment's $150 million commitment represents its first to a pan-Asian vehicle.

No other US dollar-denominated final close in 2017 is anywhere near the KKR vehicle, but others are in the pipeline. Having reached a first close of $4.5 billion on its latest Asia buyout fund in October, Carlyle has set a hard cap of $6.5 billion, which if hit would result in a corpus 66% larger than its predecessor. Meanwhile, Affinity Equity Partners is said to be on course to close on least $5 billion by year end. The debate about whether the amount of capital available at the top end of the market is in danger of exceeding the investment opportunity will surely continue.

Despite being the largest pan-regional fund on record, KKR Asian Fund III does not represent the largest single close of 2017. That honor goes to the State-Owned Enterprises China Innovation Fund, a vehicle with a remit to reform the country's industrial laggards that was launched with a target of RMB150 billion ($22.6 billion) and had accumulated RMB114 billion as of May.

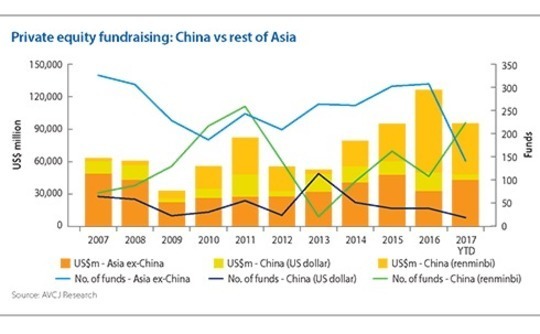

It continues a trend established last year by Chinese governments – central and provincial – effectively distorting headline fundraising numbers by launching successive private sector vehicles to bankroll their policy objectives. In 2016, a record $127.2 billion was committed to PE funds in Asia, with renminbi-denominated vehicles accounting for $0.60 of every $1 raised. Three large state-backed funds accounted for about one-third of the overall pool on their own.

For 2017, there are just two of these behemoths: the aforementioned Innovation Fund and the Reform Central Enterprise Operation Investment Fund, which reached a first close of RMB50 billion towards a target of RMB150 billion. As such, the renminbi impact on overall fundraising is more muted, representing 50% of the total, and the chances of another record year are slim. Just over $95 billion has been raised for vehicles across the region.

It is worth noting that more than 220 Chinese local currency funds have achieved partial or final closes, the most since 2011, and more than twice the 2016 total. This suggests the renminbi space is filling out once again, although it is unclear to what extent the growth reflects an influx of quality managers.

Certainly, domestic GPs with established reputations on the US dollar side are still looking to maximize their flexibility by raising renminbi as well. Banyan Capital, Source Code Capital, and Lyfe Capital have closed VC funds in both currencies over the past year, Among the PE players, CDH Investments closed its debut mid-market fund with dollar and renminbi pools, and CITIC Capital is doing the same for its flagship vehicle.

Japan is no exception in terms of the importance of team and track record, but fundraising by domestic GPs in 2017 has still been exceptional. Eight mid-market buyout funds have achieved final closes – in other words, most of the incumbent GPs in the market – over the course of the year. Six came in April, which also marks the start of Japan's financial year, thereby enabling domestic LPs to push their commitments into the next 12-month period.

Tokio Marine Capital is the only one to have raised capital from local investors only, but all apart from J-Star and CLSA Capital Partners relied on domestic LPs for a majority of commitments. Much like their global peers, these LPs – which include insurance companies, mega banks and regional banks – are prepared to go further in search of returns in a low (or negative) interest rate environment.

GPs say they are seeing more middle-market deal flow, but it remains to be seen whether this new capital will lead to more competition and increased entry multiples, putting more pressure on value creation capabilities. The same questions are being asked of the pan-regional players at the top end of Asia's buyout market.

EXITS: IPO REAWAKENING

Private equity firms pursue public-market exits on the back of a global equities boom

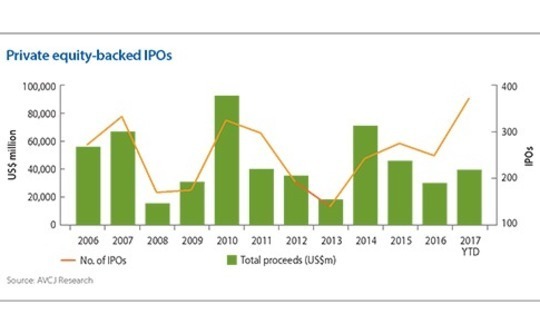

The Hong Kong Stock Exchange (HKEx) will end 2017 with at least 13 private equity-backed listings, roughly the same as the previous year, but well short of the five-year average. However, the three largest offerings in the class of 2017 involve companies that didn't exist as recently as four years ago.

Hong Kong has traditionally been a bourse of old economy stalwarts in the financial services and consumer sectors. But the successful IPOs of Zhong An Insurance, China Literature and Yixin – an insurance business, a book supplier, and an auto dealership, though each one with a business model that is more online than offline – suggest that PE and VC investors now have an additional source of liquidity for companies that a part of China's new economy.

These listings, which were oversubscribed and raised $3.86 billion between them, continue the momentum established by photo and community app operator Meitu at the tail-end of 2016, which completed Hong Kong's biggest internet IPO since Tencent Holdings in 2004.

Opting for HKEx means opting out of the dual-class share structure that allows founders to retain control despite being diluted by multiple funding rounds. But then Zhong An, China Literature and Yixin are still controlled by the corporate parents from which they were spun out, while Meitu achieved critical mass without much capital burn, so there was no need for significant external funding.

For the rest, the US remains an attractive offshore option, with NASDAQ and the New York Stock Exchange seeing 10 private equity-backed Chinese listings this year so far, the most since the infectious fervor around Alibaba Group and JD.com in 2014. Financial services and education have been the most popular themes, with the likes of Qudian, PPDai, Jianpu Technology, Rise Education and RYB Education.

Meanwhile, China's domestic bourses have enjoyed their busiest year on record for private equity portfolio companies: 246 listings across the Shanghai and Shenzhen A-share markets and Chinext. This is not far off the combined total for 2014-2016.

None of this should be all that surprising. The Shanghai and Shenzhen markets have continued their steady appreciation over the course of 2017 – and they are the relatively conservative exception. Indexes in virtually every other market globally that is relevant to Asian listing candidates is at or close to record highs: Hong Kong, the US, Japan, Korea, India.

The total proceeds from private equity-backed IPOs are $39.1 billion year-to-date, which isn't particularly high in historical terms, but the number of offerings stands at 369, already considerably more than the 12-month record.

Australia is the only major market to disappoint in terms of IPOs. Having seen 44 companies raise more than $10 billion over the previous three years, investors have just $83 million from five offerings in 2017. Several companies have tested the market and found demand lacking and others have quietly converted dual-track processes to trade sales.

What this dynamic has underlined is Asian, and particularly Chinese, demand for Australia businesses. The $3.1 billion sale of Alinta Energy to Hong Kong's Chow Tai Fook Enterprises represents the largest trade sale in the country this year. In second and third place are the $773 million exits of Icon Group and Real Pet Food. In each case, Quadrant Private Equity sold to a consortium that includes Chinese financial or strategic investors keen on exploiting the Asian growth angle.

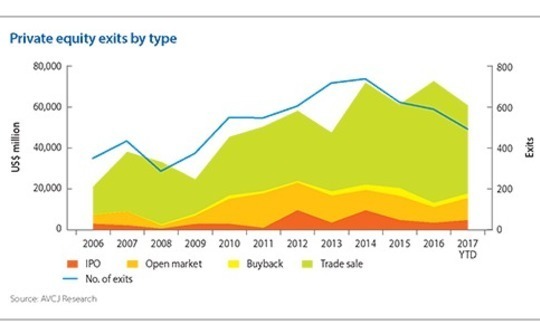

Trade sales remain the lifeblood of PE exits in Asia: they were largely responsible for total exit proceeds crossing the $70 billion threshold in 2014 and they are the main reason why proceeds haven't fallen below $60 billion since then.

Nevertheless, with $61.1 billion generated across all exits so far in 2017, last year's record high of $73.1 billion is unlikely to be surpassed. The 28% year-on-year fall in trade sale activity to $43.5 billion has been influential, with Asia seeing relatively few of the bumper deals that traditionally move the needle. Trade sales of $1 billion or more number eight, half the 2016 total.

GIC Private's sale of its 36.8% stake in GLP as part of a $11.5 billion privatization tops the list, followed by Alinta, Bain Capital and Goldman Sachs' exit from Carver Korea at a $2.7 billion valuation, Comcast NBCUniversal buying out the remaining PE interest in Universal Studios Japan for $2.3 billion, and a Goldman-led consortium selling Daesung Industrial Gases for $1.7 billion.

Daesung, Icon Group, and Real Pet Food are among a growing number of secondary transactions that appear in the ranks of Asia's trade sales – and pricing is often not disclosed so the full impact isn't apparent in the bottom line. AVCJ Research has records of nearly 60 agreed this year, about half of which are full buyouts.

The transfer of assets between GPs of similar size happens, but not to the same extent as in developed markets. Indeed, the developing theme is mid-size private equity firms selling out to larger counterparts once a portfolio company reaches a certain scale and has different requirements. TPG Capital, for example, has been involved in two such transactions, picking up Vietnam Australia International School from Mekong Capital among others and Australia's Novotech from Mercury Capital.

Japan is also seeing increasing activity of this nature, but that is not why it and Singapore are the only two major jurisdictions in Asia to see a substantial year-on-year jump in exit value. While Singapore has GLP, Japan has a community of private equity investors who have played the public markets very well.

Exit proceeds for 2017 are currently $12.1 billion, up from $4.7 billion the previous year. The contribution from open market sales has risen from $533 million to $5.1 billion as GPs cashed in on the likes of sushi chain Sushiro Global Holdings, restaurant operator Skylark, coffee shop chain Komeda Holdings, and retailer Joyful Honda.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.